Dave Ramsey Foundations In Personal Finance Workbook Chapter 1 Answers

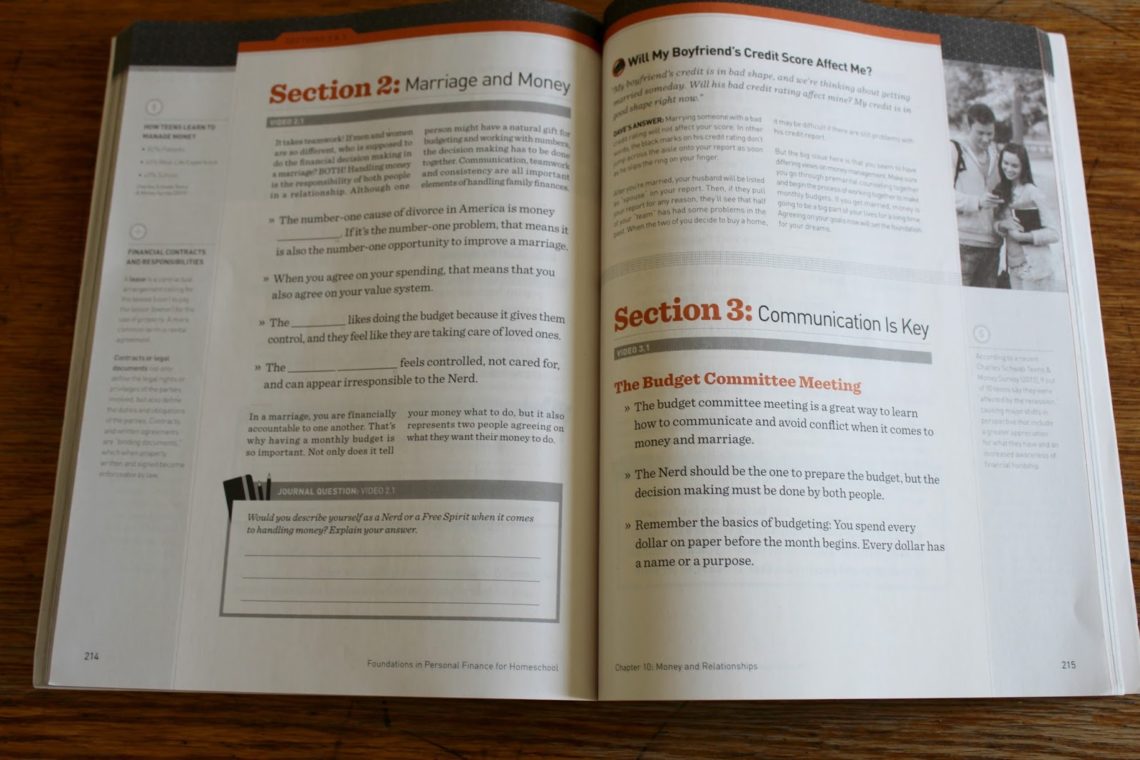

Dave Ramsey Foundations In Personal Finance Workbook Chapter 1 Answers - Well, that’s foundations in personal finance. Web in the long run, the quantity supplied of most goods: 1st foundation save a $500 emergency fund. Schools with current subscriptions to the 3rd edition curriculum have been automatically upgraded to the new 4th edition as of july 5th, 2022 to begin prepping for the fall. Web get access to all of the chapter 1 foundations in personal finance: Key components of financial planning. Scripture and scriptural principles can be found on every single page of the student workbook… Web when will the new version be available? Web instill an understanding of personal finance and fiscal responsibility in your kids with dave ramsey's homeschool course 'foundations in personal finance for homeschoolers.' Web dave ramsey makes it very clear that money should always be handled god's way, that we are to be good stewards of what god has given us, and that wise money management allows a person to give freely.

A) will increase in almost all cases, regardless of what happens to the price. C) can respond to a change in price, but the. The use of credit is not socially accepted in the united states. 4th foundation pay cash for college. Teaching your teen about personal finance doesn’t have to be complicated. Web in this blog, we have compiled all the answers to chapter 1 of the dave ramsey foundations in personal finance workbook. Personal finance is 80% behavior and 20% knowledge. Download samples see pricing with help from dave ramsey and his team of experts, your teen will learn essential business skills like management, communication, finance, hr,. This chapter covers various topics such as the importance of personal finance, the definition of personal finance… Web dave ramsey rachel cruze ken coleman dr.

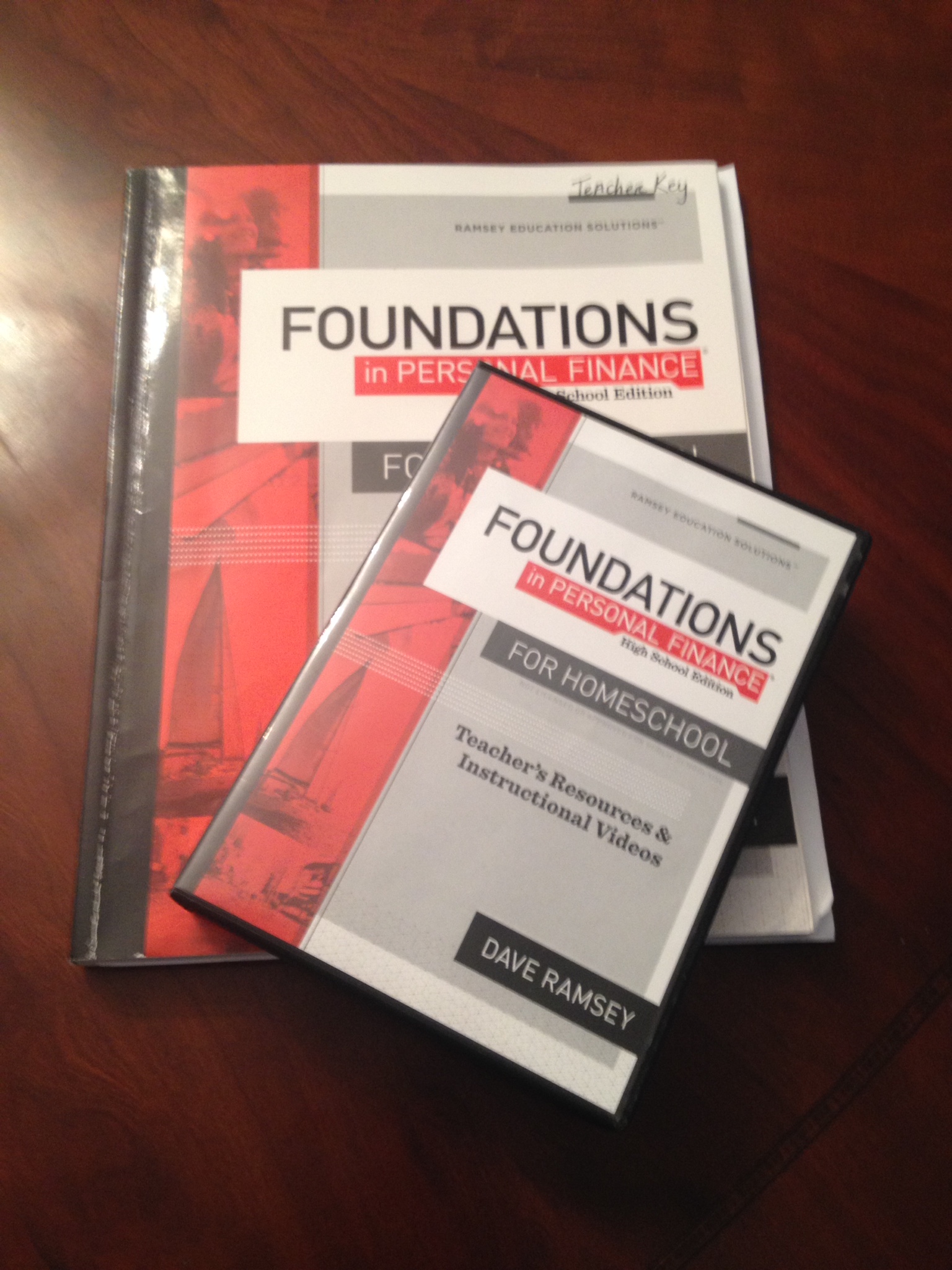

Download samples see pricing with help from dave ramsey and his team of experts, your teen will learn essential business skills like management, communication, finance, hr,. Scripture and scriptural principles can be found on every single page of the student workbook… Key components of financial planning. Well, that’s foundations in personal finance. Tax savings never invest purely for ___ _______. A) will increase in almost all cases, regardless of what happens to the price. Harm have not set out to ____ the other party. Web instill an understanding of personal finance and fiscal responsibility in your kids with dave ramsey's homeschool course 'foundations in personal finance for homeschoolers.' 3rd foundation pay cash for your car. Seriously, you just need a homeschool curriculum that’s got everything prepped for you, in one place, and made with your unique homeschool environment in mind.

The Unlikely Homeschool Dave Ramsey's Foundations in Personal Finance

Web the five steps to financial success. Download samples see pricing with help from dave ramsey and his team of experts, your teen will learn essential business skills like management, communication, finance, hr,. 1st foundation save a $500 emergency fund. Web instill an understanding of personal finance and fiscal responsibility in your kids with dave ramsey's homeschool course 'foundations in.

Foundations In Personal Finance Answer Key Chapter 8

Schools with current subscriptions to the 3rd edition curriculum have been automatically upgraded to the new 4th edition as of july 5th, 2022 to begin prepping for the fall. 1st foundation save a $500 emergency fund. This chapter covers various topics such as the importance of personal finance, the definition of personal finance… Web 500 the first foundation is ___.

Dave Ramsey's Financial Peace University Member Workbook C2012

2nd foundation get out of debt. Well, that’s foundations in personal finance. These pdfs have a teacher versions with answers and a student version with no answers in the same document. Web 500 the first foundation is ___ in an emergency fund. Download samples foundations is so practical.

9781936948123 FOUNDATIONS IN PERSONAL FINANCEworkbook AbeBooks

Download samples foundations is so practical. Scripture and scriptural principles can be found on every single page of the student workbook… Parents when you're in high school, you won't have the same emergency expenses as your _______ (like needing to put a new roof on the house). The use of credit is not socially accepted in the united states. Save.

christian personal finance guru dave ramsey hopes his staff will spread

Parents when you're in high school, you won't have the same emergency expenses as your _______ (like needing to put a new roof on the house). Save for emergencies, large purchases and wealth building. Download samples foundations is so practical. This chapter covers various topics such as the importance of personal finance, the definition of personal finance… Download samples see.

Dave Ramsey's Foundations in Personal Finance for Homeschool

This chapter covers various topics such as the importance of personal finance, the definition of personal finance… Web simple keep it ______, stupid! Web in this blog, we have compiled all the answers to chapter 1 of the dave ramsey foundations in personal finance workbook. 4th foundation pay cash for college. Avoid the trap of borrowing money.

Discover how much house you can afford according to Dave Ramsey and see

Parents when you're in high school, you won't have the same emergency expenses as your _______ (like needing to put a new roof on the house). Web in this blog, we have compiled all the answers to chapter 1 of the dave ramsey foundations in personal finance workbook. 3rd foundation pay cash for your car. Download samples foundations is so.

Review Dave Ramsey’s Foundations in Personal Finance Homeschool

John delony youth all youth children teens. C) can respond to a change in price, but the. Personal finance is 80% behavior and 20% knowledge. Schools with current subscriptions to the 3rd edition curriculum have been automatically upgraded to the new 4th edition as of july 5th, 2022 to begin prepping for the fall. Web 500 the first foundation is.

Foundations in personal finance chapter 3 answer key Personal

4th foundation pay cash for college. Web teacher resources and more! Web the five steps to financial success. This chapter covers various topics such as the importance of personal finance, the definition of personal finance… Web false learning the language of money is not that important because you will be able to depend on financial planners to manage your money.

Well, That’s Foundations In Personal Finance.

This chapter covers various topics such as the importance of personal finance, the definition of personal finance… Web dave ramsey makes it very clear that money should always be handled god's way, that we are to be good stewards of what god has given us, and that wise money management allows a person to give freely. 4th foundation pay cash for college. Web the five steps to financial success.

Web 500 The First Foundation Is ___ In An Emergency Fund.

Personal finance is 80% behavior and 20% knowledge. Web instill an understanding of personal finance and fiscal responsibility in your kids with dave ramsey's homeschool course 'foundations in personal finance for homeschoolers.' Web simple keep it ______, stupid! Web in this blog, we have compiled all the answers to chapter 1 of the dave ramsey foundations in personal finance workbook.

A) Will Increase In Almost All Cases, Regardless Of What Happens To The Price.

Harm have not set out to ____ the other party. This course contains the first 4 chapters of the foundations in personal finance curriculum: Seriously, you just need a homeschool curriculum that’s got everything prepped for you, in one place, and made with your unique homeschool environment in mind. 2nd foundation get out of debt.

The Use Of Credit Is Not Socially Accepted In The United States.

Teaching your teen about personal finance doesn’t have to be complicated. B) cannot respond at all to a change in price. Web false learning the language of money is not that important because you will be able to depend on financial planners to manage your money. John delony youth all youth children teens.