Dcf Model Template Excel

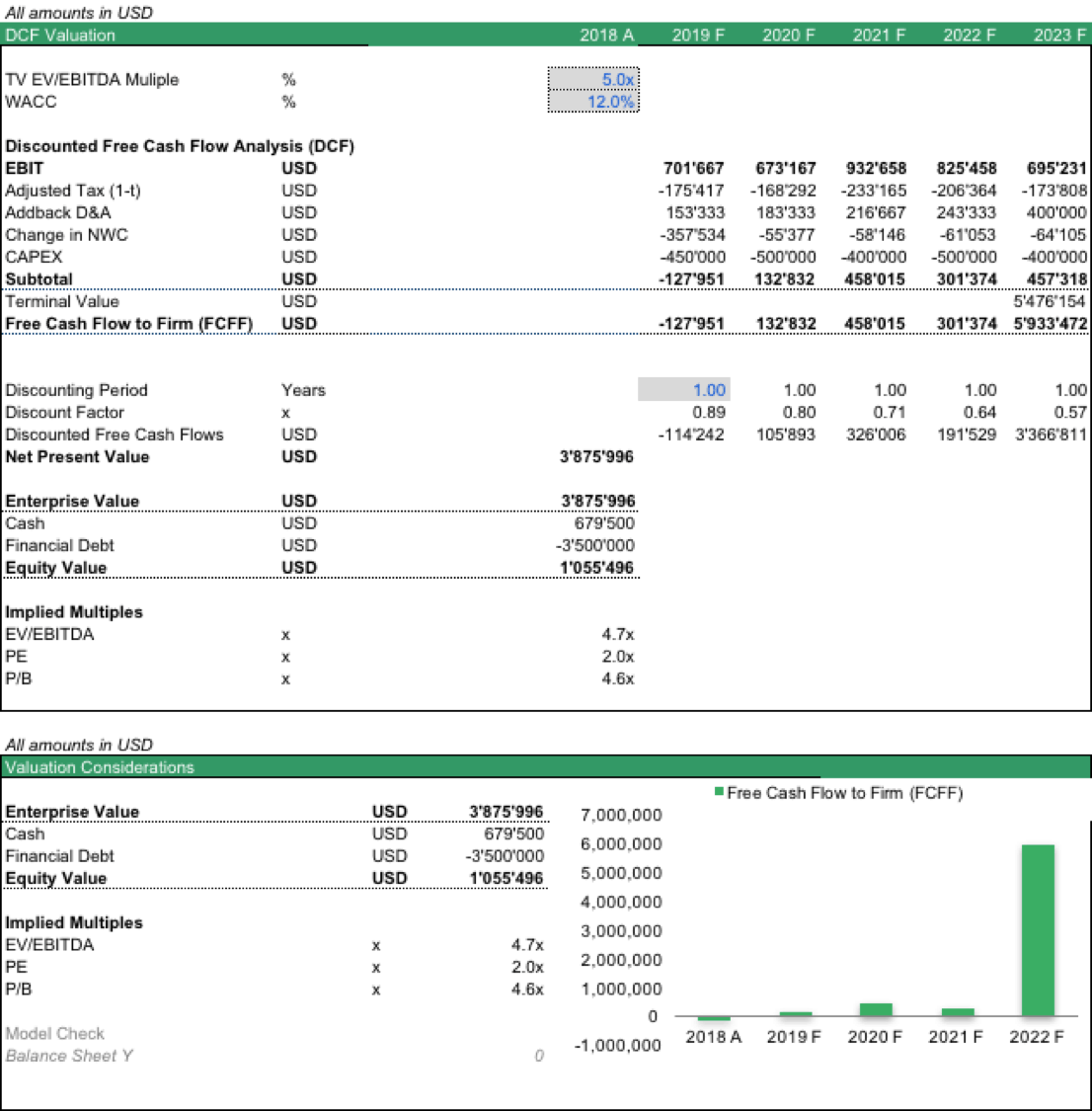

Dcf Model Template Excel - The macabacus tab > new > sample models. This template allows you to build your own discounted cash flow model with different assumptions. Web the dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic value of a stock. Web discounted cash flow template. Web in excel, navigate to: Web january 31, 2022. Watch this short video explanation of how the dcf formula works. Start free trial to access template this discounted cash flow (dcf) model, is a powerful tool designed to provide a detailed financial analysis. Below is a preview of the dcf model template: Download wso's free discounted cash flow (dcf) model template below!

Web discounted cash flow template. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. The template uses the discounted cash flow (dcf) method, which discounts future cash. This template allows you to build your own discounted cash flow model with different assumptions. Enter your name and email in the form below and download the free template now! Download wso's free discounted cash flow (dcf) model template below! Cfi’s free intro to corporate finance course. Browse and select your desired template from our extensive library. Web the dcf formula is required in financial modeling to determine the value of a business when building a dcf model in excel.

This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Browse and select your desired template from our extensive library. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Enter your name and email in the form below and download the free template now! Web the dcf formula is required in financial modeling to determine the value of a business when building a dcf model in excel. * please consult sec filings, bloomberg, or google/yahoo! The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. Cfi’s free intro to corporate finance course. Finance to obtain financial statement data. Web dcf model template.

DCF model Discounted Cash Flow Valuation eFinancialModels

The template uses the discounted cash flow (dcf) method, which discounts future cash. Download wso's free discounted cash flow (dcf) model template below! Web in excel, navigate to: Below is a preview of the dcf model template: Enter your name and email in the form below and download the free template now!

Discounted Cash Flow (DCF) Model Excel Template Eloquens

Join 307,012+ monthly readers mergers & inquisitions Web january 31, 2022. Cfi’s free intro to corporate finance course. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. Below is a preview of the dcf model template:

DCF, Discounted Cash Flow Valuation in Excel Video YouTube

Download wso's free discounted cash flow (dcf) model template below! Web discounted cash flow template. Watch this short video explanation of how the dcf formula works. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web the dcf formula is required in financial modeling to determine the value.

DCF model tutorial with free Excel

Web in excel, navigate to: Start free trial to access template this discounted cash flow (dcf) model, is a powerful tool designed to provide a detailed financial analysis. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. Below is a preview of the.

Single Sheet DCF (Discounted Cash Flow) Excel Template FinWiser

Web dcf model template. Download wso's free discounted cash flow (dcf) model template below! Watch this short video explanation of how the dcf formula works. Click here to download the dcf template. Enter your name and email in the form below and download the free template now!

10 best DCF Model Template in Excel By exDeloitte Consultants images

The macabacus tab > new > sample models. Watch this short video explanation of how the dcf formula works. Below is a preview of the dcf model template: This template allows you to build your own discounted cash flow model with different assumptions. Web discounted cash flow template.

DCF Model Excel Template Free Download from CFI Marketplace

Join 307,012+ monthly readers mergers & inquisitions Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Enter your name and email in the form below and download the free template now! How to build a dcf model: Watch this short video explanation of how the dcf formula works.

Discounted Cash Flow (DCF) Valuation Model Excel templates, Cash flow

This template allows you to build your own discounted cash flow model with different assumptions. Start free trial to access template this discounted cash flow (dcf) model, is a powerful tool designed to provide a detailed financial analysis. Below is a preview of the dcf model template: Web january 31, 2022. This dcf model template provides you with a foundation.

DCF Model Training 6 Steps to Building a DCF Model in Excel Wall

Web the dcf formula is required in financial modeling to determine the value of a business when building a dcf model in excel. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. Download wso's free discounted cash flow (dcf) model template below! The.

DCF Model Excel Template Free Download from CFI Marketplace

What is the discounted cash flow dcf formula? How to build a dcf model: This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Click here to download the dcf template. Start free trial to access template this discounted cash flow (dcf) model, is a powerful tool designed to provide.

This Template Allows You To Build Your Own Discounted Cash Flow Model With Different Assumptions.

How to build a dcf model: Cfi’s free intro to corporate finance course. The macabacus tab > new > sample models. Download wso's free discounted cash flow (dcf) model template below!

The Template Uses The Discounted Cash Flow (Dcf) Method, Which Discounts Future Cash.

Web discounted cash flow template. Web dcf model template. Browse and select your desired template from our extensive library. Web in excel, navigate to:

Web January 31, 2022.

Start free trial to access template this discounted cash flow (dcf) model, is a powerful tool designed to provide a detailed financial analysis. Click here to download the dcf template. * please consult sec filings, bloomberg, or google/yahoo! Join 307,012+ monthly readers mergers & inquisitions

Finance To Obtain Financial Statement Data.

Web the dcf formula is required in financial modeling to determine the value of a business when building a dcf model in excel. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. What is the discounted cash flow dcf formula? Below is a preview of the dcf model template: