Delaware Form 1100S Instructions 2022

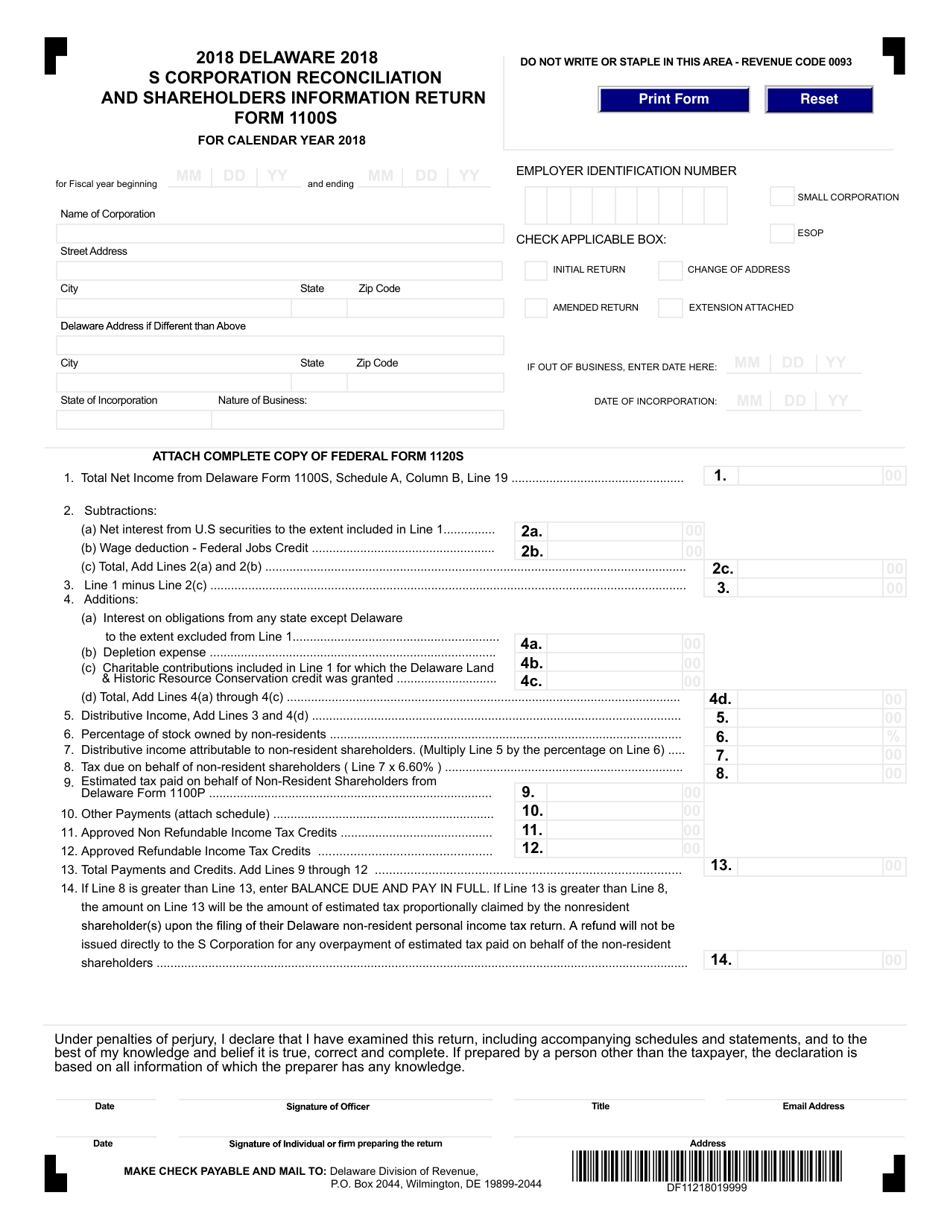

Delaware Form 1100S Instructions 2022 - A request for an automatic extensionof six months to the internal revenue. Web step by step instructions for completing the delaware s corporation reconciliation and shareholders information return are provided in this booklet. Every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902 (b), title 30, delaware code, is required to file a corporate. Also enter the amount on line 17 of the delaware individual resident. The division of revenue is. Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year. Web more about the delaware form 1100sa1 corporate income tax ty 2022. Web this form is used by corporations to request for an extension on reporting their earnings for the year. Web delaware form 1100s, line 4(c) multiplied by the percentage of stock owned by each shareholder. Web see more about delaware government.

The division of revenue is. Also enter the amount on line 17 of the delaware individual resident. Web home business tax forms 2020 listen please select the type of business from the list below. Web every s corporation deriving income from sources within delaware is required to file an s corporation reconciliation and shareholders information return (form 1100s). Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year. Web delaware form 1100s, line 4(c) multiplied by the percentage of stock owned by each shareholder. Complete, edit or print tax forms instantly. Web we last updated the corporate income tax return in january 2023, so this is the latest version of form 1100, fully updated for tax year 2022. You can download or print current. Every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902 (b), title 30, delaware code, is required to file a corporate.

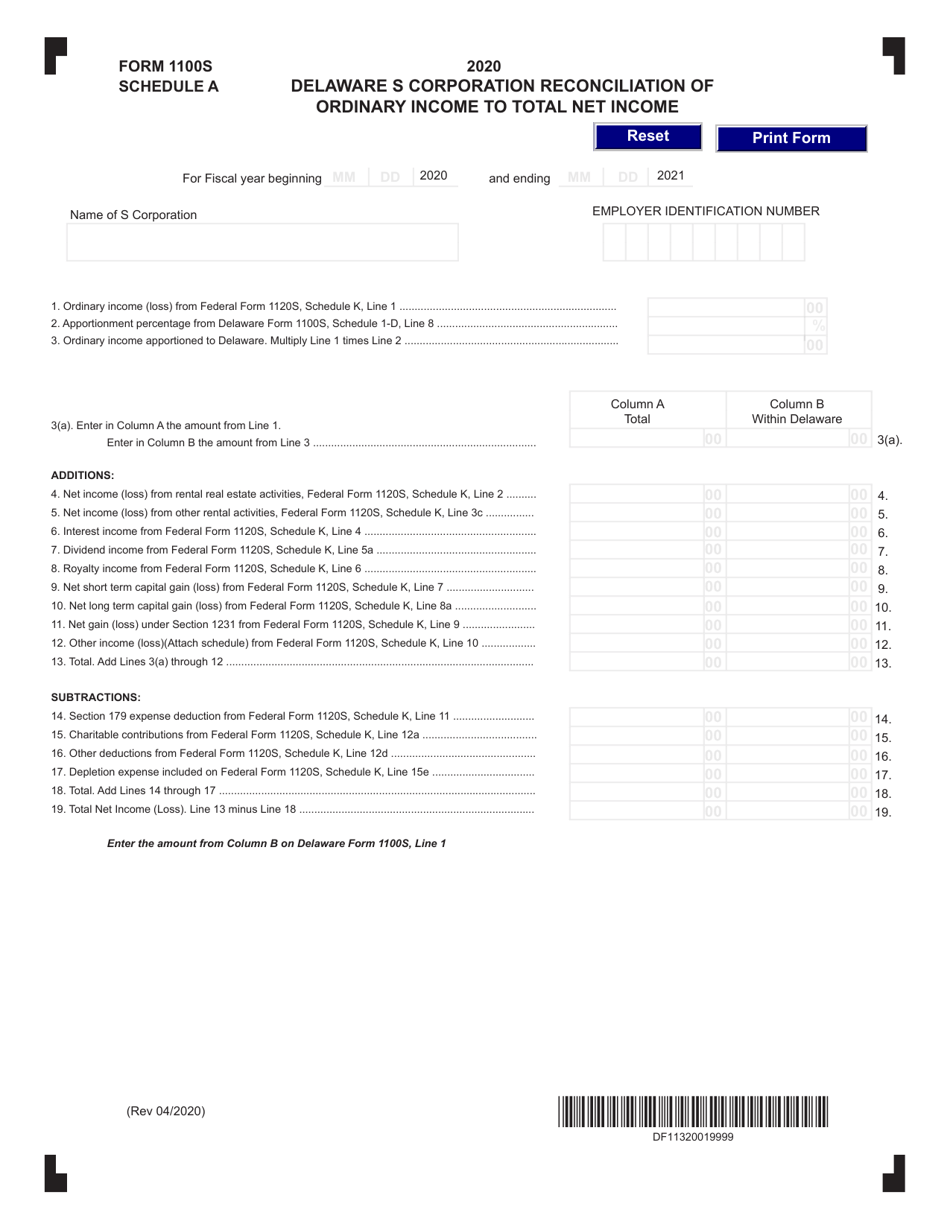

Interest from any state except delaware from delaware form 1100s, line 4(a). Web report error it appears you don't have a pdf plugin for this browser. A request for an automatic extensionof six months to the internal revenue. Web are required to file a corporate income tax return (regardless of the amount, if any, of gross or taxable income) using delaware corporate income tax return form 1100 or. The division of revenue is. Every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902 (b), title 30, delaware code, is required to file a corporate. You can download or print current. Web home business tax forms 2020 listen please select the type of business from the list below. Web we last updated the corporate income tax return in january 2023, so this is the latest version of form 1100, fully updated for tax year 2022. Web step by step instructions for completing the delaware s corporation reconciliation and shareholders information return are provided in this booklet.

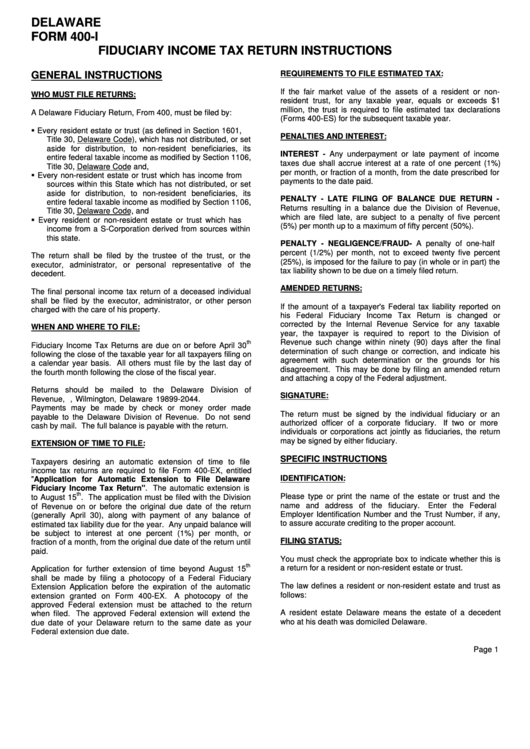

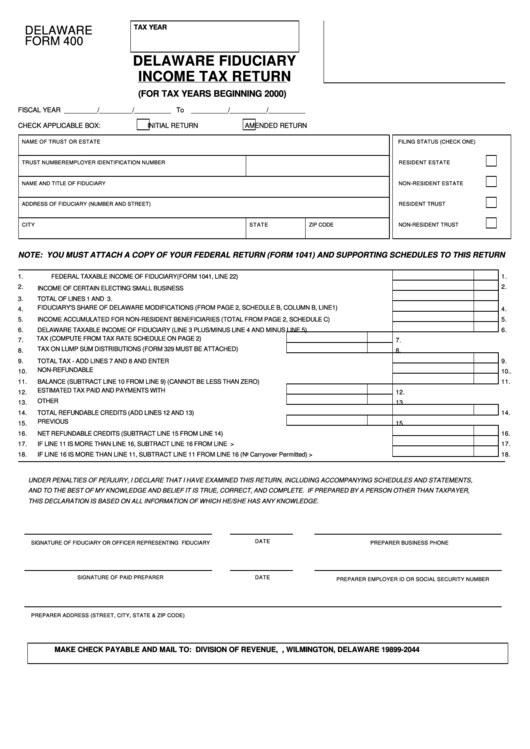

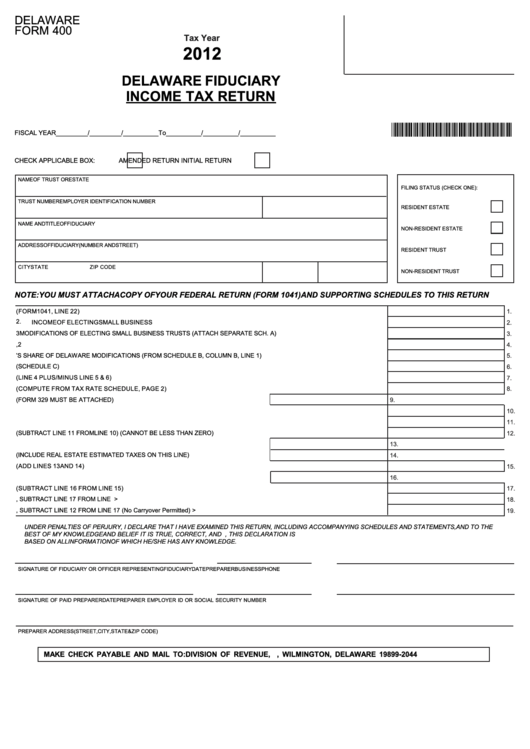

Instructions For Delaware Form 400I Fiduciary Tax Return

Web report error it appears you don't have a pdf plugin for this browser. Every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902 (b), title 30, delaware code, is required to file a corporate. Also enter the amount on line 17 of the delaware individual resident. Web step by step instructions for completing the.

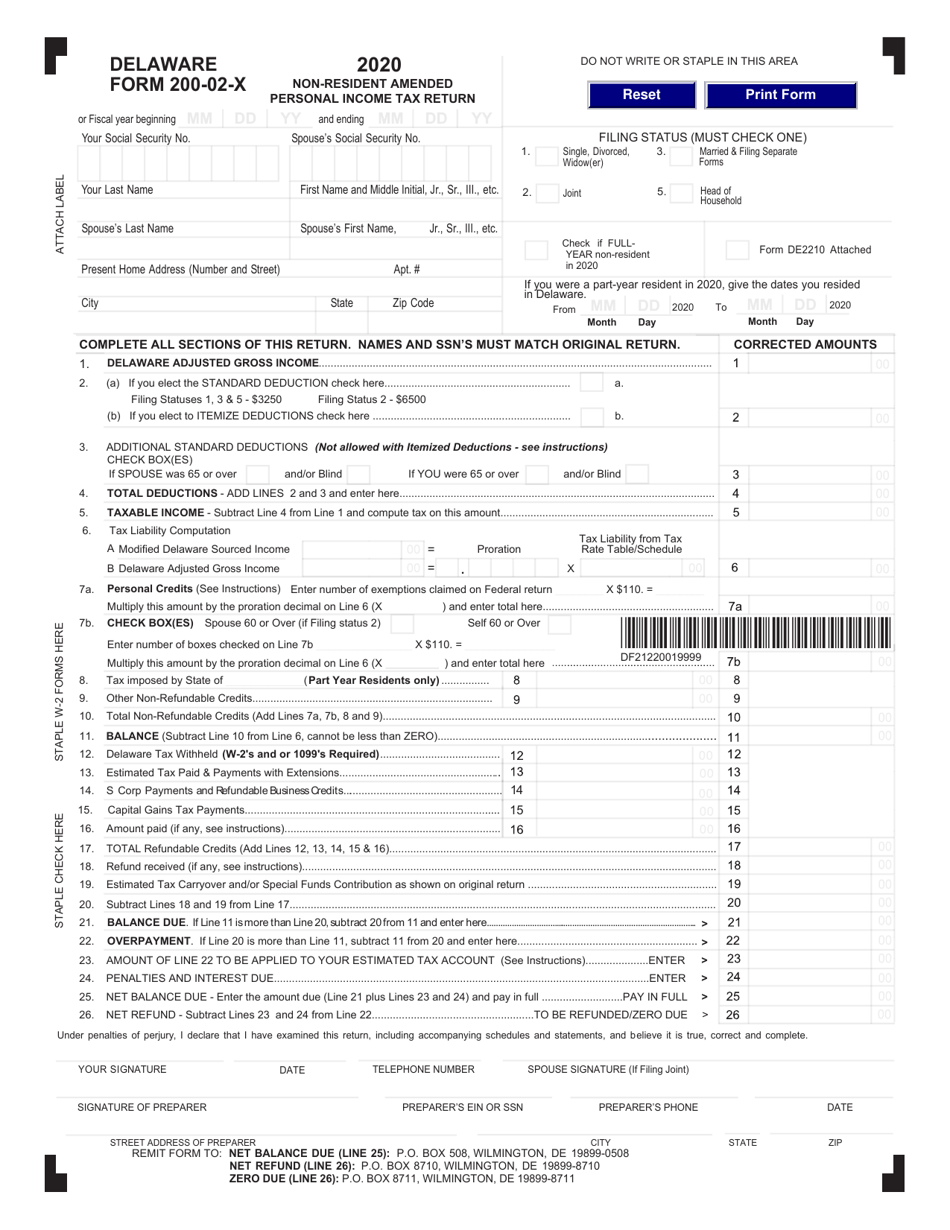

Form 20002X Download Fillable PDF or Fill Online Nonresident Amended

Web see more about delaware government. The division of revenue is. Web step by step instructions for completing the delaware s corporation reconciliation and shareholders information return are provided in this booklet. Web every s corporation deriving income from sources within delaware is required to file an s corporation reconciliation and shareholders information return (form 1100s). Web report error it.

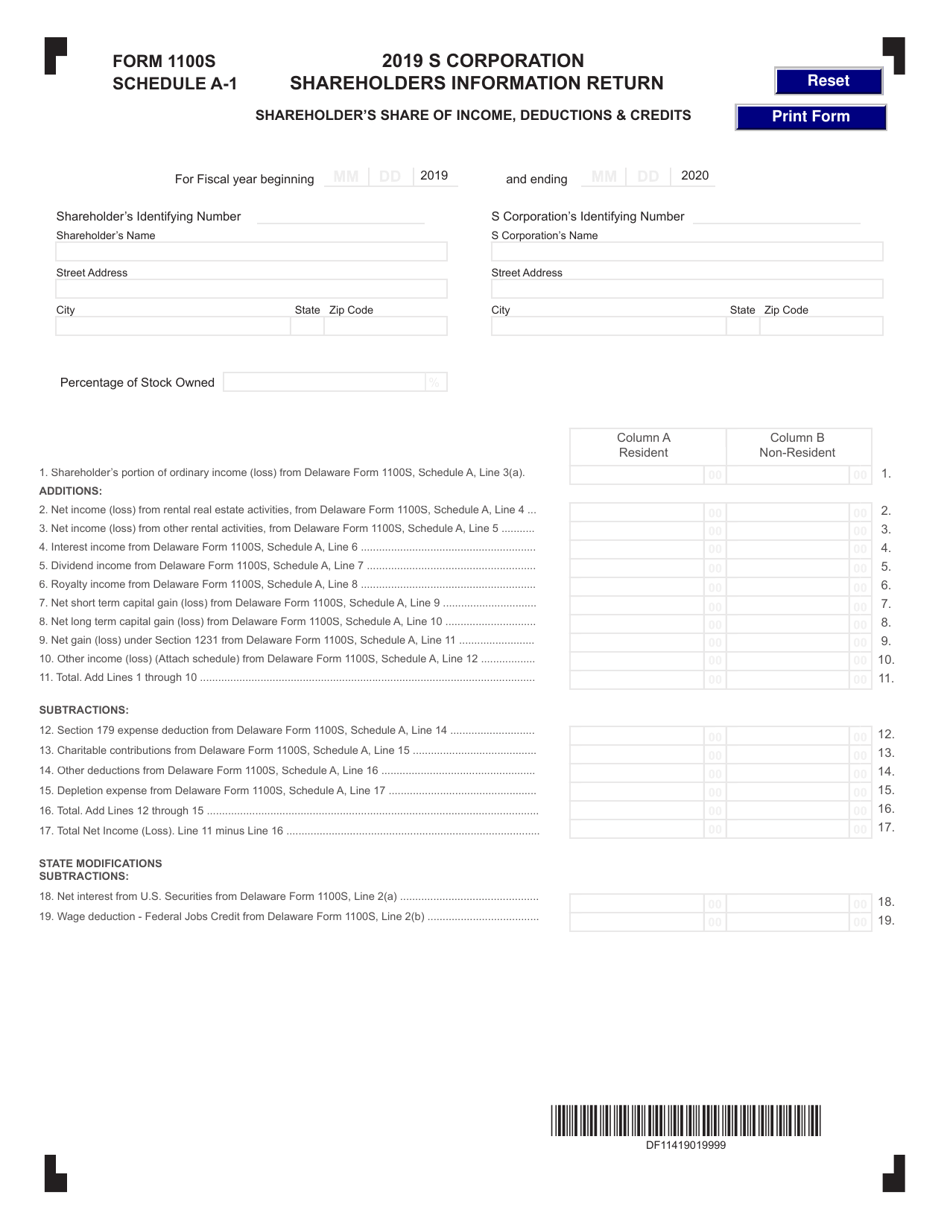

Form 1100S Schedule A1 Download Fillable PDF or Fill Online

The division of revenue is. Complete, edit or print tax forms instantly. Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year. Web report error it appears you don't have a pdf plugin for this browser. Web see more about delaware government.

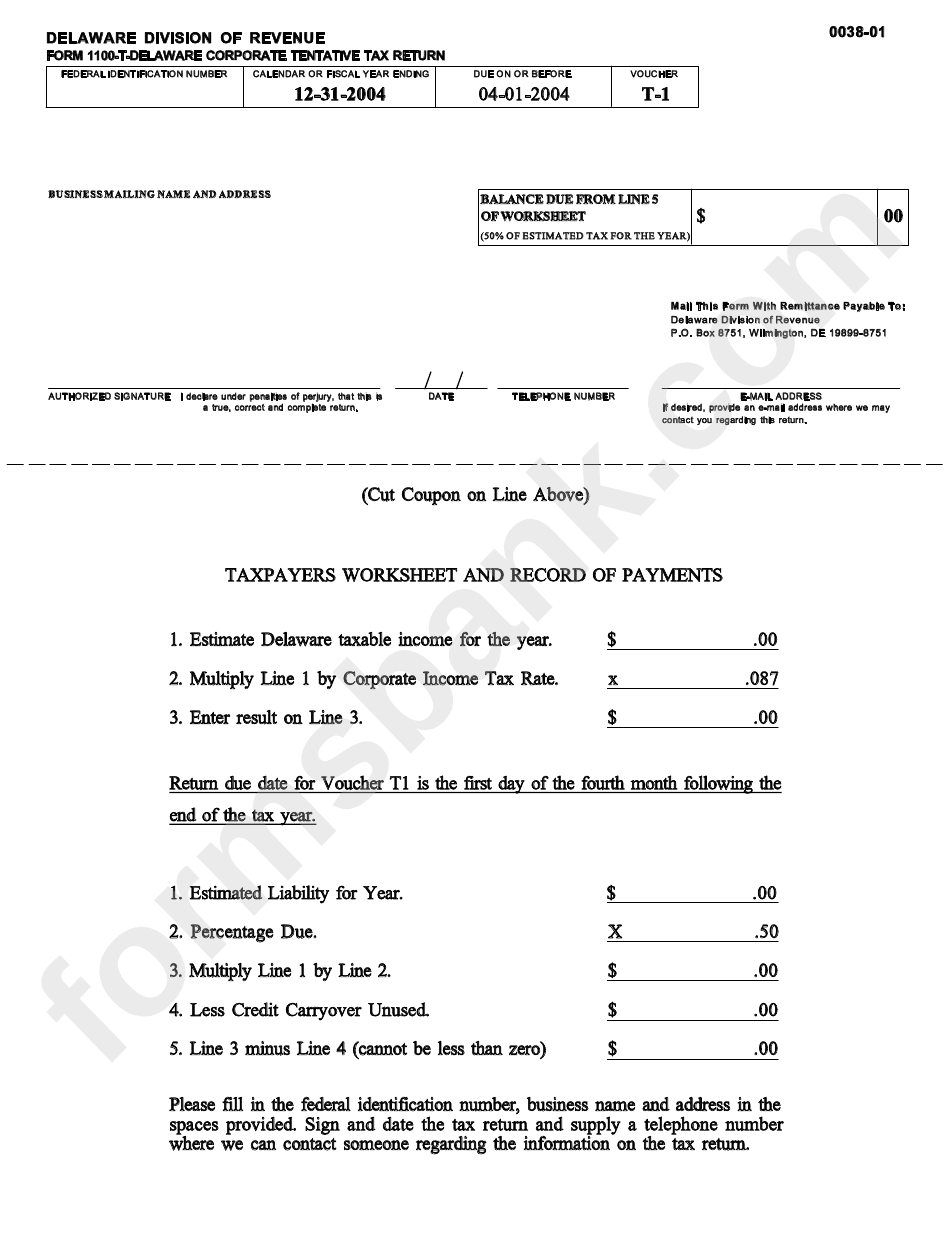

Form 1100T Delaware Corporate Tentative Tax Return 2004 printable

Calendar year 2022 and fiscal. Web step by step instructions for completing the delaware s corporation reconciliation and shareholders information return are provided in this booklet. Web report error it appears you don't have a pdf plugin for this browser. Every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902 (b), title 30, delaware code,.

Form 1100S Download Fillable PDF or Fill Online S Corporation

A request for an automatic extensionof six months to the internal revenue. Web more about the delaware form 1100sa1 corporate income tax ty 2022. Web every s corporation deriving income from sources within delaware is required to file an s corporation reconciliation and shareholders information return (form 1100s). Web we last updated the corporate income tax return in january 2023,.

Form 1100S Schedule A Download Fillable PDF or Fill Online Delaware S

Web see more about delaware government. Web more about the delaware form 1100sa1 corporate income tax ty 2022. Calendar year 2022 and fiscal. Web are required to file a corporate income tax return (regardless of the amount, if any, of gross or taxable income) using delaware corporate income tax return form 1100 or. Web step by step instructions for completing.

Form 400 Delaware Fiduciary Tax Return printable pdf download

Calendar year 2022 and fiscal. Web every s corporation deriving income from sources within delaware is required to file an s corporation reconciliation and shareholders information return (form 1100s). Every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902 (b), title 30, delaware code, is required to file a corporate. Web file form 1100 on.

Delaware Form 400 Fiduciary Tax Return 2012 printable pdf

Web this form is used by corporations to request for an extension on reporting their earnings for the year. Web are required to file a corporate income tax return (regardless of the amount, if any, of gross or taxable income) using delaware corporate income tax return form 1100 or. Alcoholic beverages business licenses business tax credits cigarette/tobacco. Web every s.

Delaware Form 5403 2020 Fill and Sign Printable Template Online US

Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year. Web this form is used by corporations to request for an extension on reporting their earnings for the year. Every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902 (b), title 30, delaware code,.

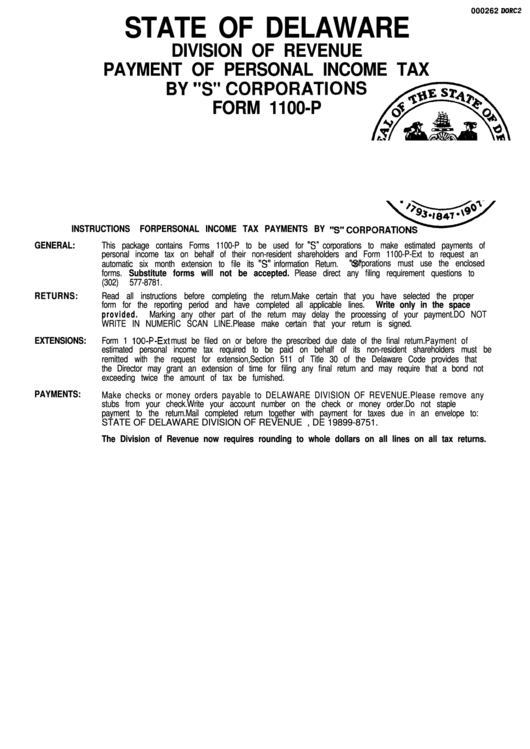

Form 1100P Instructions For Personal Tax Payments By "S

Web are required to file a corporate income tax return (regardless of the amount, if any, of gross or taxable income) using delaware corporate income tax return form 1100 or. Web more about the delaware form 1100sa1 corporate income tax ty 2022. Alcoholic beverages business licenses business tax credits cigarette/tobacco. Also enter the amount on line 17 of the delaware.

Web More About The Delaware Form 1100Sa1 Corporate Income Tax Ty 2022.

Alcoholic beverages business licenses business tax credits cigarette/tobacco. Web every s corporation deriving income from sources within delaware is required to file an s corporation reconciliation and shareholders information return (form 1100s). You can download or print current. Web report error it appears you don't have a pdf plugin for this browser.

Web We Last Updated The Corporate Income Tax Return In January 2023, So This Is The Latest Version Of Form 1100, Fully Updated For Tax Year 2022.

Web 3 rows we last updated the s corporation reconciliation and shareholders return in january 2023, so this is. Web home business tax forms 2020 listen please select the type of business from the list below. Web this form is used by corporations to request for an extension on reporting their earnings for the year. Web are required to file a corporate income tax return (regardless of the amount, if any, of gross or taxable income) using delaware corporate income tax return form 1100 or.

The Division Of Revenue Is.

Also enter the amount on line 17 of the delaware individual resident. Every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902 (b), title 30, delaware code, is required to file a corporate. Web see more about delaware government. Web delaware form 1100s, line 4(c) multiplied by the percentage of stock owned by each shareholder.

Web Step By Step Instructions For Completing The Delaware S Corporation Reconciliation And Shareholders Information Return Are Provided In This Booklet.

Complete, edit or print tax forms instantly. Calendar year 2022 and fiscal. Web file form 1100 on or before the fifteenth day of the fourth month following the close of the taxable year. Interest from any state except delaware from delaware form 1100s, line 4(a).