Direct Deposit Form Intuit

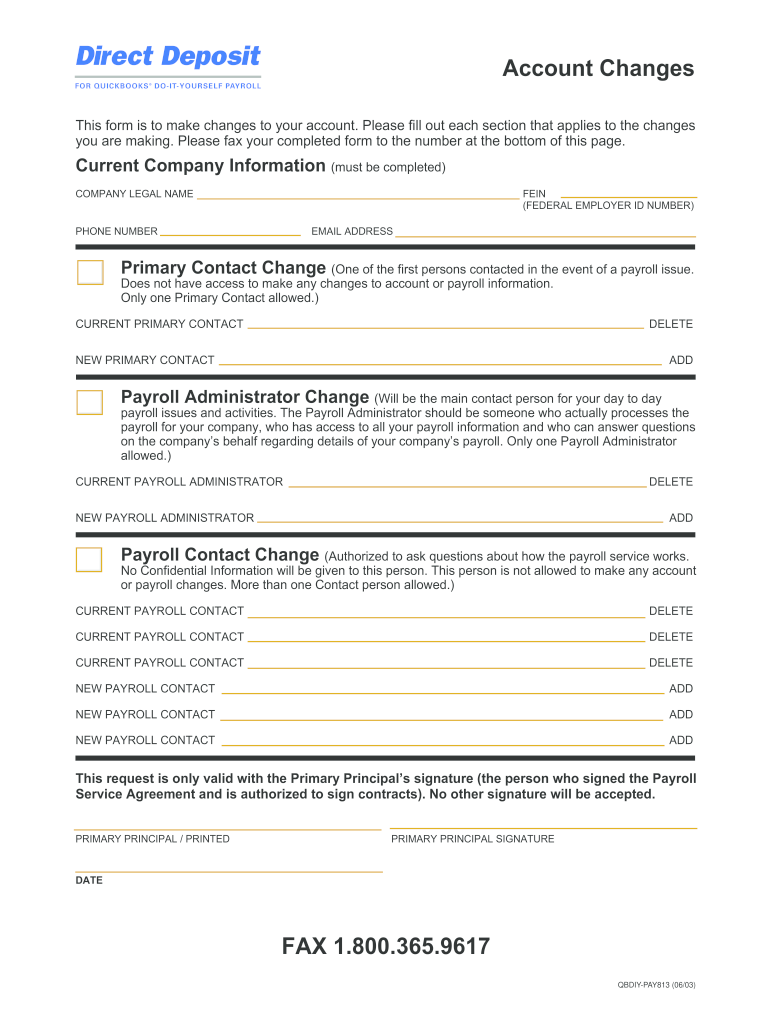

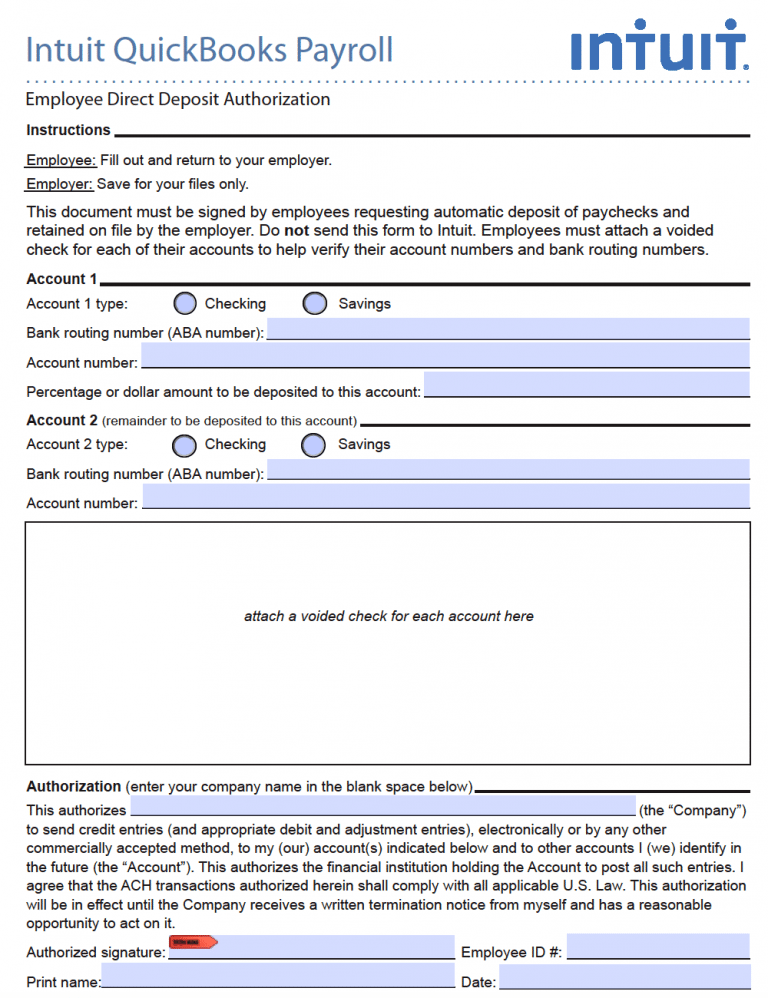

Direct Deposit Form Intuit - Choose the small pencil icon beside of pay. This part of the deduction formula gets complicated. Web if you’re trying to access the direct deposit authorization form for your employees, just visit the payroll tax section in quickbooks online (qbo). Select bank verification, then view and print. Account 1 account 1 type: This way, your employees can start to fill out and sign. Get a direct deposit authorization form have your employees fill out, sign, and date a direct deposit authorization form and attach a voided check from the employee’s bank account (not a deposit slip). In section #5, select direct deposit from the list of options for payment. Web you need your filing status, your social security number and the exact amount (line 35a of your 2021 form 1040) of your federal refund to track your federal refund: You will need to decide which account or accounts you wish your payment to be deposited to then report the information defining the target account (s).

Here's some important information to know before submitting that direct deposit reversal form. Web here are some forms commonly printed for new employees (pdf): Choose the small pencil icon beside of pay. The intuit (quickbooks) payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit. Select the employee from the list you'd like to enter direct deposit info for. In section #5, select direct deposit from the list of options for payment. Do not send this form to intuit. To track your state refund: Go to taxes and select payroll tax. Click the workers tab, then select employees.

It is not guaranteed that the funds will be fully recovered, and it could take up to 5 days. The intuit (quickbooks) payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit. Select the employee from the list you'd like to enter direct deposit info for. You will need to decide which account or accounts you wish your payment to be deposited to then report the information defining the target account (s). Click the workers tab, then select employees. Web if you’re trying to access the direct deposit authorization form for your employees, just visit the payroll tax section in quickbooks online (qbo). In section #5, select direct deposit from the list of options for payment. Select bank verification, then view and print. Do not send this form to intuit. To track your state refund:

5+ Intuit Direct Deposit Authorization Form Free Download!!

It is not guaranteed that the funds will be fully recovered, and it could take up to 5 days. The intuit (quickbooks) payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit. Then enter the bank account information. Web if you’re trying to access the direct deposit authorization form.

10+ Quickbooks Direct Deposit Form Intuit Direct Deposit [DOWNLOAD]

The intuit (quickbooks) payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit. Here's some important information to know before submitting that direct deposit reversal form. Account 1 account 1 type: In section #5, select direct deposit from the list of options for payment. To track your state refund:

10+ Intuit Direct Deposit Form Word, PDF, Excel Download!

This way, your employees can start to fill out and sign. This part of the deduction formula gets complicated. You will need to decide which account or accounts you wish your payment to be deposited to then report the information defining the target account (s). Click the workers tab, then select employees. Employees must attach a voided check for each.

8 Quickbooks Check Template Pdf Template Monster

Get a direct deposit authorization form have your employees fill out, sign, and date a direct deposit authorization form and attach a voided check from the employee’s bank account (not a deposit slip). Set up your company payroll for direct deposit see set up your company payroll for direct deposit for detailed steps. Go to taxes and select payroll tax..

Free Intuit / Quickbooks Direct Deposit Authorization Form PDF

Web you need your filing status, your social security number and the exact amount (line 35a of your 2021 form 1040) of your federal refund to track your federal refund: This feature is only available to quickbooks full service payroll customers. Do not send this form to intuit. Set up your company payroll for direct deposit see set up your.

7+ Quickbooks Direct Deposit Form Free Download [Word, PDF]

Go to taxes and select payroll tax. Web if you’re trying to access the direct deposit authorization form for your employees, just visit the payroll tax section in quickbooks online (qbo). Then enter the bank account information. Do not send this form to intuit. Web here are some forms commonly printed for new employees (pdf):

10+ Quickbooks Direct Deposit Form Intuit Direct Deposit [DOWNLOAD]

You will need to decide which account or accounts you wish your payment to be deposited to then report the information defining the target account (s). Select the employee from the list you'd like to enter direct deposit info for. Employees must attach a voided check for each of their accounts to help verify their account numbers and bank routing.

10+ Quickbooks Direct Deposit Form Intuit Direct Deposit [DOWNLOAD]

Then enter the bank account information. It is not guaranteed that the funds will be fully recovered, and it could take up to 5 days. Here's some important information to know before submitting that direct deposit reversal form. Choose the small pencil icon beside of pay. This way, your employees can start to fill out and sign.

Affiliate Direct Deposit Authorization Fill and Sign Printable

Choose the small pencil icon beside of pay. Select bank verification, then view and print. Click the workers tab, then select employees. You will need to decide which account or accounts you wish your payment to be deposited to then report the information defining the target account (s). Web you need your filing status, your social security number and the.

Intuit Direct Deposit Form Fill Out and Sign Printable PDF Template

Web you need your filing status, your social security number and the exact amount (line 35a of your 2021 form 1040) of your federal refund to track your federal refund: It is not guaranteed that the funds will be fully recovered, and it could take up to 5 days. Do not send this form to intuit. Web if you’re trying.

Web Here Are Some Forms Commonly Printed For New Employees (Pdf):

In section #5, select direct deposit from the list of options for payment. Web you need your filing status, your social security number and the exact amount (line 35a of your 2021 form 1040) of your federal refund to track your federal refund: Select bank verification, then view and print. You will need to decide which account or accounts you wish your payment to be deposited to then report the information defining the target account (s).

Go To Taxes And Select Payroll Tax.

Account 1 account 1 type: Get a direct deposit authorization form have your employees fill out, sign, and date a direct deposit authorization form and attach a voided check from the employee’s bank account (not a deposit slip). Web this document must be signed by employees requesting automatic deposit of paychecks and retained on file by the employer. Do not send this form to intuit.

It Is Not Guaranteed That The Funds Will Be Fully Recovered, And It Could Take Up To 5 Days.

This part of the deduction formula gets complicated. This feature is only available to quickbooks full service payroll customers. Set up your company payroll for direct deposit see set up your company payroll for direct deposit for detailed steps. Choose the small pencil icon beside of pay.

Employees Must Attach A Voided Check For Each Of Their Accounts To Help Verify Their Account Numbers And Bank Routing Numbers.

This way, your employees can start to fill out and sign. Click the workers tab, then select employees. Then enter the bank account information. Web if you’re trying to access the direct deposit authorization form for your employees, just visit the payroll tax section in quickbooks online (qbo).

![10+ Quickbooks Direct Deposit Form Intuit Direct Deposit [DOWNLOAD]](https://i0.wp.com/www.printabletemplateslab.com/wp-content/uploads/2017/10/5-6.jpg?resize=600%2C730)

![7+ Quickbooks Direct Deposit Form Free Download [Word, PDF]](https://www.opensourcetext.org/wp-content/uploads/2020/09/ddf-6.png)

![10+ Quickbooks Direct Deposit Form Intuit Direct Deposit [DOWNLOAD]](https://i0.wp.com/www.elseviersocialsciences.com/wp-content/uploads/2017/10/3-4.png?resize=640%2C828)

![10+ Quickbooks Direct Deposit Form Intuit Direct Deposit [DOWNLOAD]](https://i0.wp.com/www.printabletemplateslab.com/wp-content/uploads/2017/10/5-5.jpg?w=806)