Do I Need To File Form 720

Do I Need To File Form 720 - Do i need to file form 720 for my business? If you need to report excise taxes on tanning bed, fuel, or sport fishing equipment, we’ll show you. Web if you do not want to use eftps, you can arrange for your tax professional, financial institution, payroll service,. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Web when is form 720 due? Web irs form 720, quarterly excise tax return is the quarterly federal excise tax return used to report the excise tax liability and pay the taxes listed on the form. Is electronic filing of form 720 required? Web there are two ways to file a completed form 720: For the first quarter, the due date falls by april 30, likewise july 31 for the. Web issuers or plan sponsors only need to file form 720 to report the pcori fee for the first, third, or fourth quarter of the year.

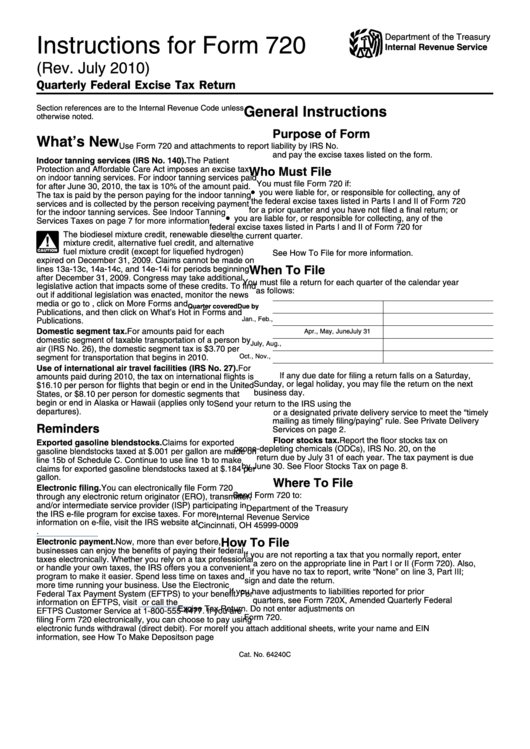

Web issuers or plan sponsors only need to file form 720 to report the pcori fee for the first, third, or fourth quarter of the year. File a final return if you have been filing form 720. Web when is form 720 due? You must always file when you collect any. Web irs form 720, quarterly excise tax return is the quarterly federal excise tax return used to report the excise tax liability and pay the taxes listed on the form. Web in a few words, form 720, quarterly federal excise tax return, is a vital document required for certain individuals and businesses. It's important to note that the pcori fee filing. Web instructions for form 720 (rev. Form 720 is used by taxpayers to report. Web if you do not want to use eftps, you can arrange for your tax professional, financial institution, payroll service,.

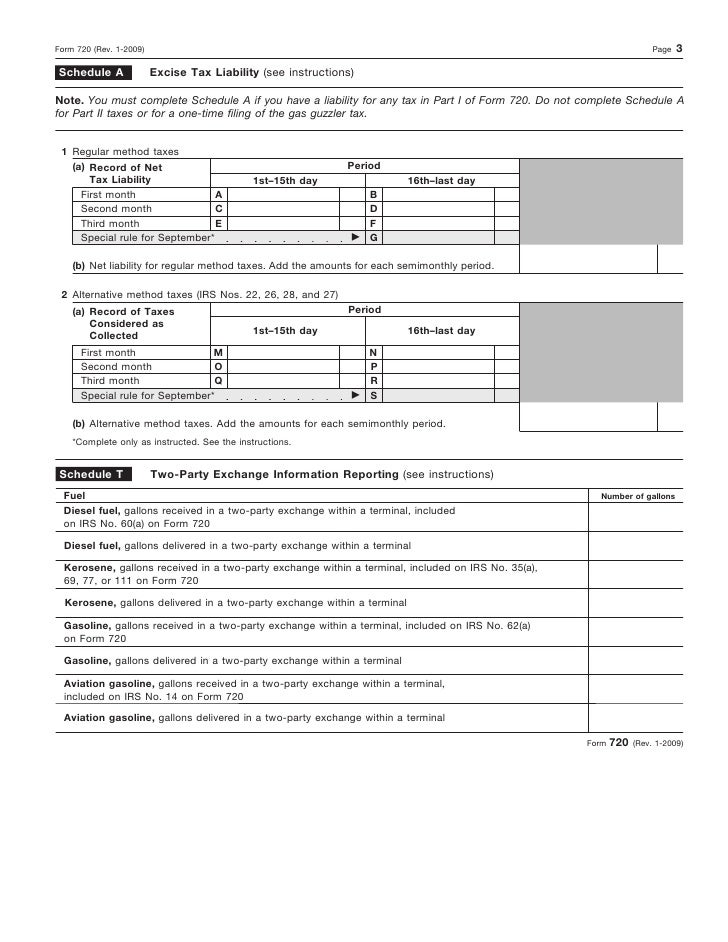

For the first quarter, the due date falls by april 30, likewise july 31 for the. Web in a few words, form 720, quarterly federal excise tax return, is a vital document required for certain individuals and businesses. Form 720 is used by taxpayers to report. 9.5 draft ok to print ah xsl/xmlfileid:. See the instructions for form 720. Web issuers or plan sponsors only need to file form 720 to report the pcori fee for the first, third, or fourth quarter of the year. As form 720 is filed on quarterly basis, you’re required to file four times a year: Web instructions for form 720 (rev. Deposits are not required for this fee, so issuers and plans sponsors are not required to. Web businesses that owe excise taxes might need to file form 720.

Form 720 Quarterly Federal Excise Tax Return

See the instructions for form 720. If you need to report excise taxes on tanning bed, fuel, or sport fishing equipment, we’ll show you. Web you are liable to file form 720, the federal excise taxes every quarter when you offer a service, sell a product or goods that has an excise tax component. File a final return if you.

Instructions For Form 720 Quarterly Federal Excise Tax Return 2010

Kerosene used in commercial aviation. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Deposits are not required for this fee, so issuers and plans sponsors are not required to. Web form 720 is a tax form required of businesses that deal with the sale of certain goods.

Pbgc Form 720 Application For LumpSum Payment printable pdf download

Web you are liable to file form 720, the federal excise taxes every quarter when you offer a service, sell a product or goods that has an excise tax component. Web the irs provides two tests to determine whether you must file a form 720 at the conclusion of each calendar quarter. Web on form 720, part i, at irs.

How to complete IRS Form 720 for the PatientCentered Research

Kerosene used in commercial aviation. It must be filed by those who are. June 2023) department of the treasury internal revenue service. Is electronic filing of form 720 required? Quarterly federal excise tax return.

2018 Fourth Quarter Excise Tax Form 720 is DUE NOW! ThinkTrade Inc Blog

9.5 draft ok to print ah xsl/xmlfileid:. Web they will not be required to file a form 720 for the first, third or fourth quarters of the year. Web the irs provides two tests to determine whether you must file a form 720 at the conclusion of each calendar quarter. Quarterly federal excise tax return. Web you are liable to.

Form 720 Quarterly Federal Excise Tax Return

Web instructions for form 720 (rev. For the first quarter, the due date falls by april 30, likewise july 31 for the. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. It must be filed by those who are. Web there are two ways to file a completed form 720:

Today is the Deadline to file Form 720 excise tax return for the third

Web you are liable to file form 720, the federal excise taxes every quarter when you offer a service, sell a product or goods that has an excise tax component. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web they will not be required to file a form 720 for.

Form 720TO Terminal Operator Report (2010) Free Download

Is electronic filing of form 720 required? File a final return if you have been filing form 720. Web the form is complicated, so, at least initially, you’d be wise to consult a cpa if you’re required to file it. Do i need to file form 720 for my business? For the first quarter, the due date falls by april.

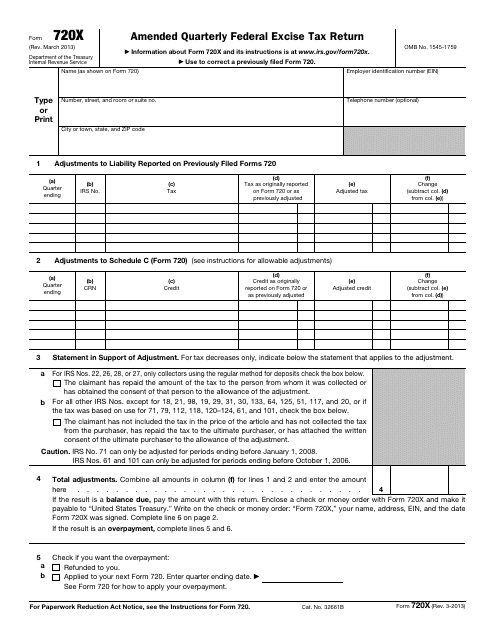

IRS Form 720X Download Fillable PDF or Fill Online Amended Quarterly

Web the form is complicated, so, at least initially, you’d be wise to consult a cpa if you’re required to file it. Web businesses that owe excise taxes might need to file form 720. Do i need to file form 720 for my business? Web in a few words, form 720, quarterly federal excise tax return, is a vital document.

What Is IRS Form 720? Calculate, Pay Excise Tax NerdWallet

Web if you do not want to use eftps, you can arrange for your tax professional, financial institution, payroll service,. 26, 27, and 28, enter a tax of zero for sales during the excise tax holiday. Web they will not be required to file a form 720 for the first, third or fourth quarters of the year. Web watch newsmax.

For The First Quarter, The Due Date Falls By April 30, Likewise July 31 For The.

Form 720 is used by taxpayers to report. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. As form 720 is filed on quarterly basis, you’re required to file four times a year: Web irs form 720, quarterly excise tax return is the quarterly federal excise tax return used to report the excise tax liability and pay the taxes listed on the form.

Do I Need To File Form 720 For My Business?

Deposits are not required for this fee, so issuers and plans sponsors are not required to. Web on form 720, part i, at irs nos. File a final return if you have been filing form 720. 9.5 draft ok to print ah xsl/xmlfileid:.

Kerosene Used In Commercial Aviation.

Web there are two ways to file a completed form 720: Is electronic filing of form 720 required? It must be filed by those who are. If you need to report excise taxes on tanning bed, fuel, or sport fishing equipment, we’ll show you.

June 2023) Department Of The Treasury Internal Revenue Service.

Web the form is complicated, so, at least initially, you’d be wise to consult a cpa if you’re required to file it. Web in a few words, form 720, quarterly federal excise tax return, is a vital document required for certain individuals and businesses. Web form 720 is a tax form required of businesses that deal with the sale of certain goods (like alcohol or gasoline) and services (for instance, tanning salons). Irs still accepts paper forms 720.