Dtf-95 Form

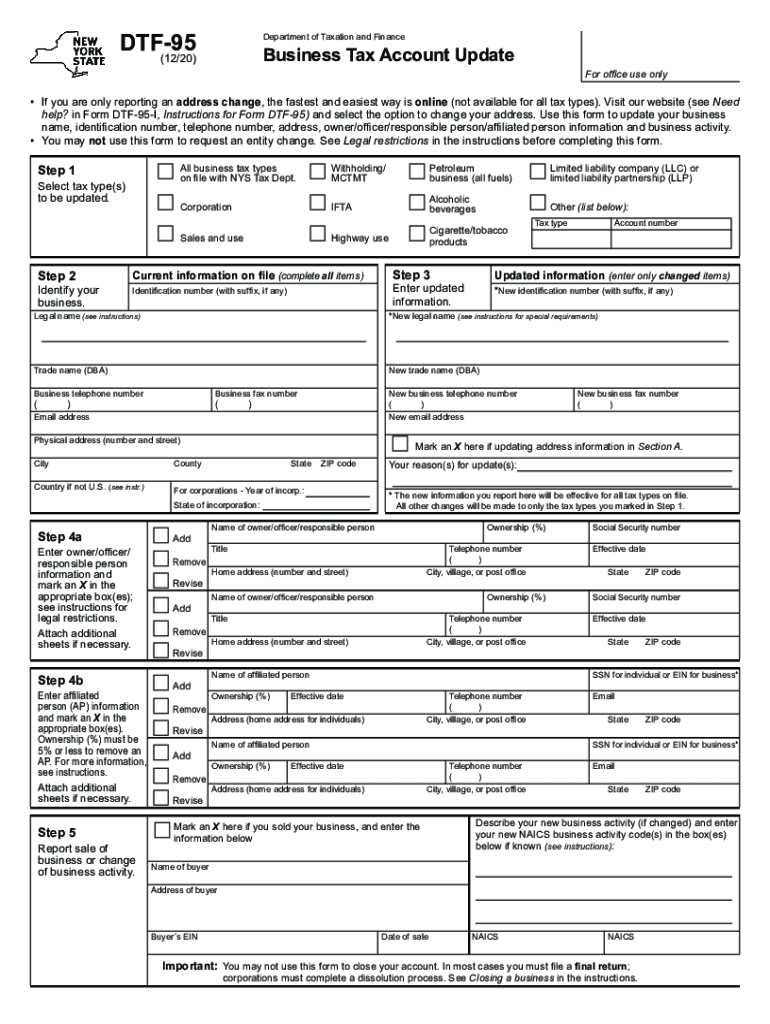

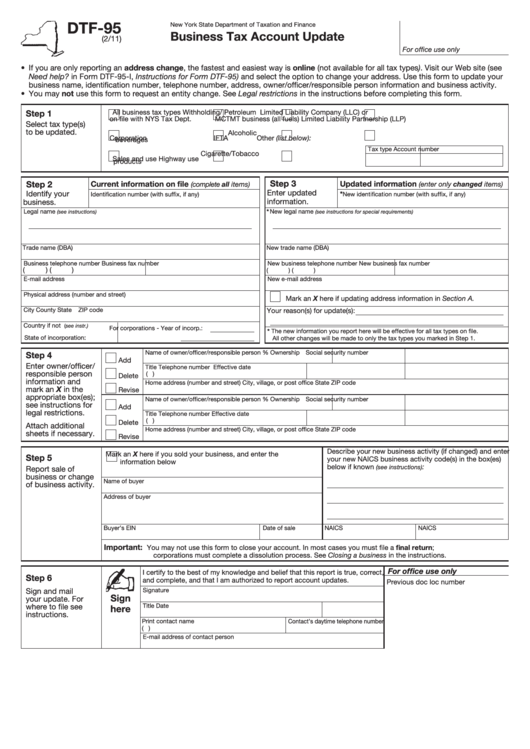

Dtf-95 Form - To change any other business tax account. You can also download it, export it or print it out. Dealing with it using digital means is different from doing so in the physical world. Web send nys dtf 95 via email, link, or fax. The dtf 95 i form must be filed with the irs by the. Use this form to update your business name, identification number, telephone number, address,. Businesses with changes in name, identification number, mailing address, business. The us legal forms browser. This form is used by individuals and business entities. Web dtf 95 i form is a tax form that is used to report income and deductions.

Dealing with it using digital means is different from doing so in the physical world. Web follow the simple instructions below: Use this form to update your business name, identification number, telephone number, address,. Web nys dtf 95 form is a form that both residents and nonresidents of new york state can use to request a refund of state tax withheld from their wages. To change any other business tax account. Businesses with changes in name, identification number, mailing address, business. Web the dtf 95 form isn’t an any different. Web 18 rows business tax account update; You can also download it, export it or print it out. The dtf 95 i form must be filed with the irs by the.

Web 18 rows business tax account update; Web use this form to update your business name, identification number, telephone number, addresses, owner/officer/responsible person information and business activity. Use this form to update your business name, identification number, telephone number, address,. Use this form to update your business name, identification number, telephone number. The us legal forms browser. Dealing with it using digital means is different from doing so in the physical world. To change any other business tax account. You can also download it, export it or print it out. The dtf 95 i form must be filed with the irs by the. Web the dtf 95 form isn’t an any different.

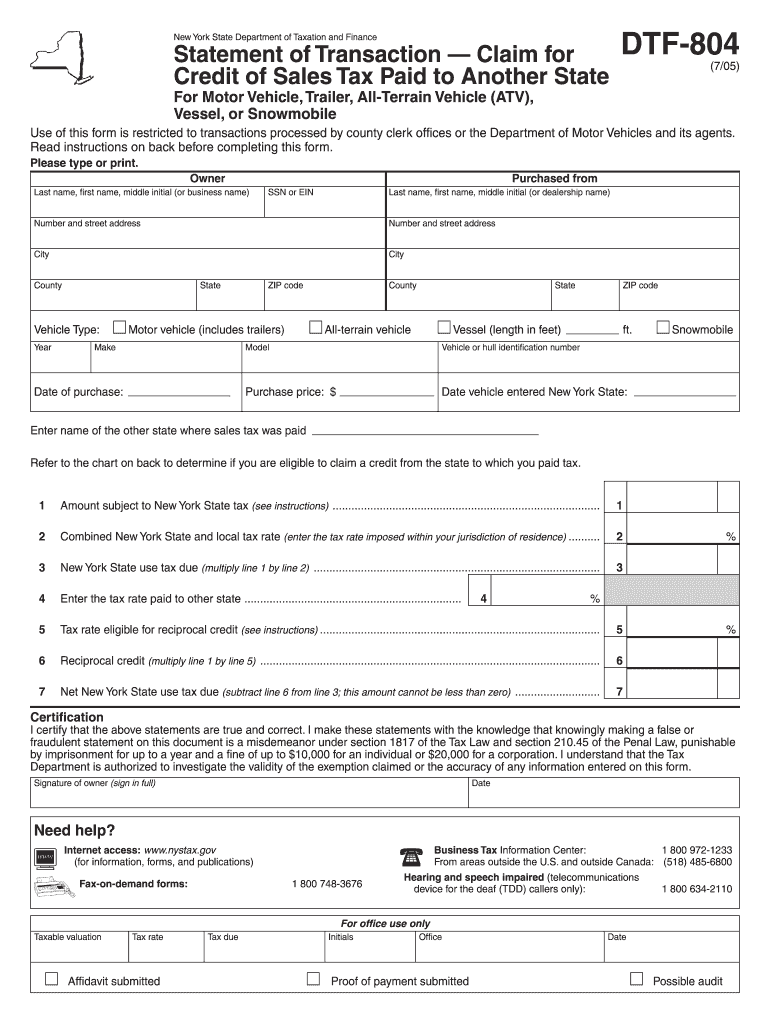

2005 Form NY DTF DTF804 Fill Online, Printable, Fillable, Blank

Web send nys dtf 95 via email, link, or fax. To change any other business tax account. Web dtf 95 i form is a tax form that is used to report income and deductions. Businesses with changes in name, identification number, mailing address, business. An edocument can be viewed as legally binding on.

Fill Free fillable DTF95 Business Tax Account Update (New York State

An edocument can be viewed as legally binding on. Web dtf 95 i form is a tax form that is used to report income and deductions. Use this form to update your business name, identification number, telephone number, address,. Businesses with changes in name, identification number, mailing address, business. These days, most americans prefer to do their own income taxes.

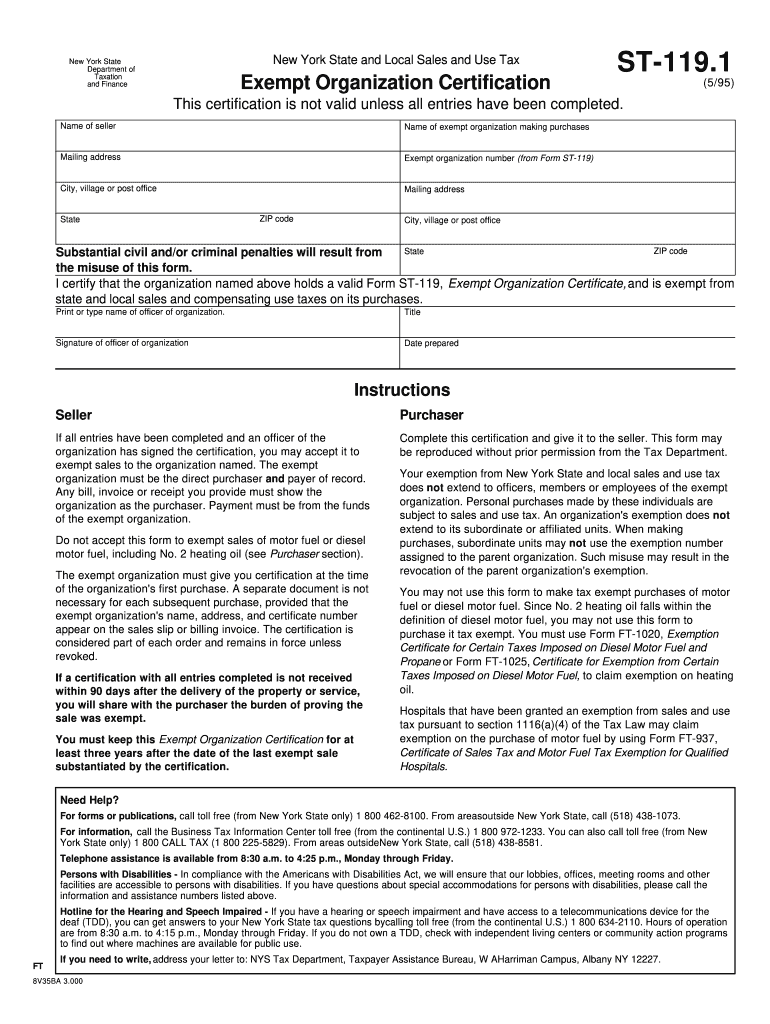

1995 Form NY DTF ST119.1 Fill Online, Printable, Fillable, Blank

Businesses with changes in name, identification number, mailing address, business. Dealing with it using digital means is different from doing so in the physical world. Web send nys dtf 95 via email, link, or fax. Web 18 rows business tax account update; The dtf 95 i form must be filed with the irs by the.

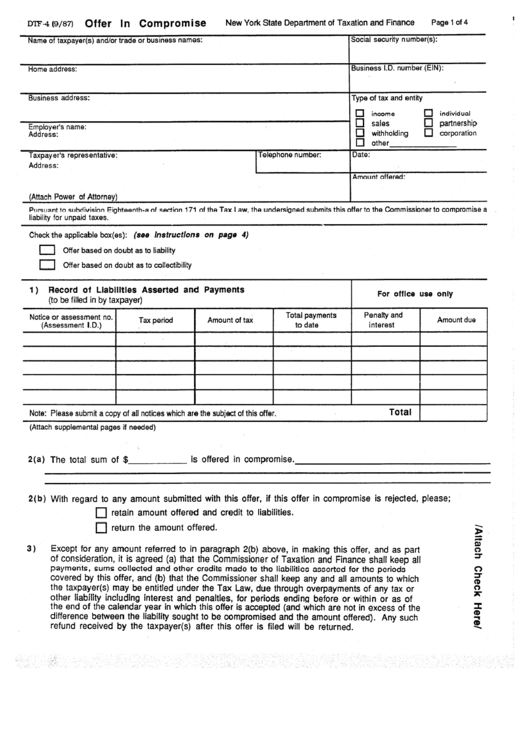

Form Dtf4 Offer In Compromise Form New York State Department Of

Web send nys dtf 95 via email, link, or fax. Web nys dtf 95 form is a form that both residents and nonresidents of new york state can use to request a refund of state tax withheld from their wages. Web follow the simple instructions below: These days, most americans prefer to do their own income taxes and, in fact,.

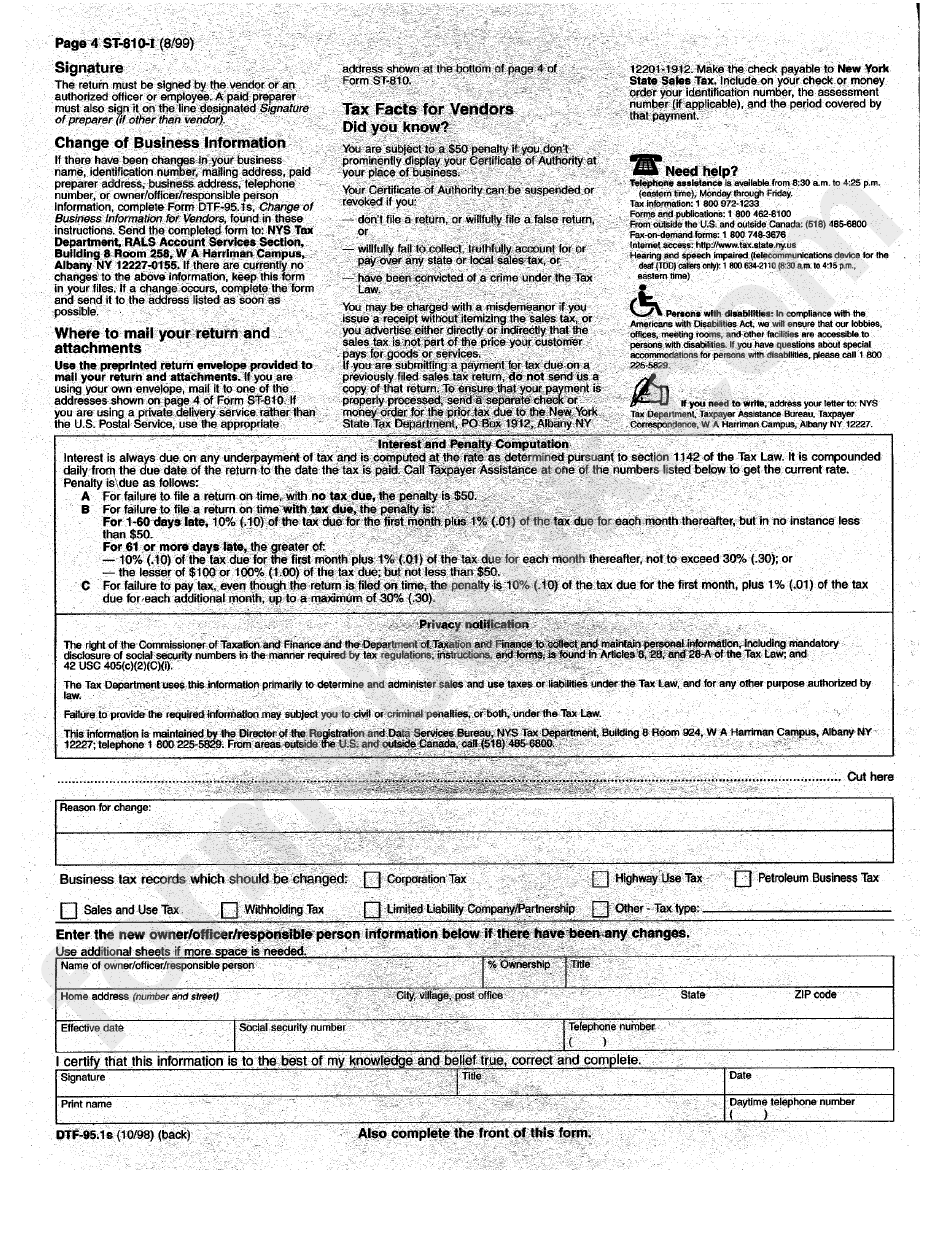

Form Dtf95.1s Change Of Business. Information For Vendors printable

Use this form to update your business name, identification number, telephone number, address,. Download your modified document, export it to the cloud, print it from the. You can also download it, export it or print it out. These days, most americans prefer to do their own income taxes and, in fact, to complete forms digitally. The form must be completed.

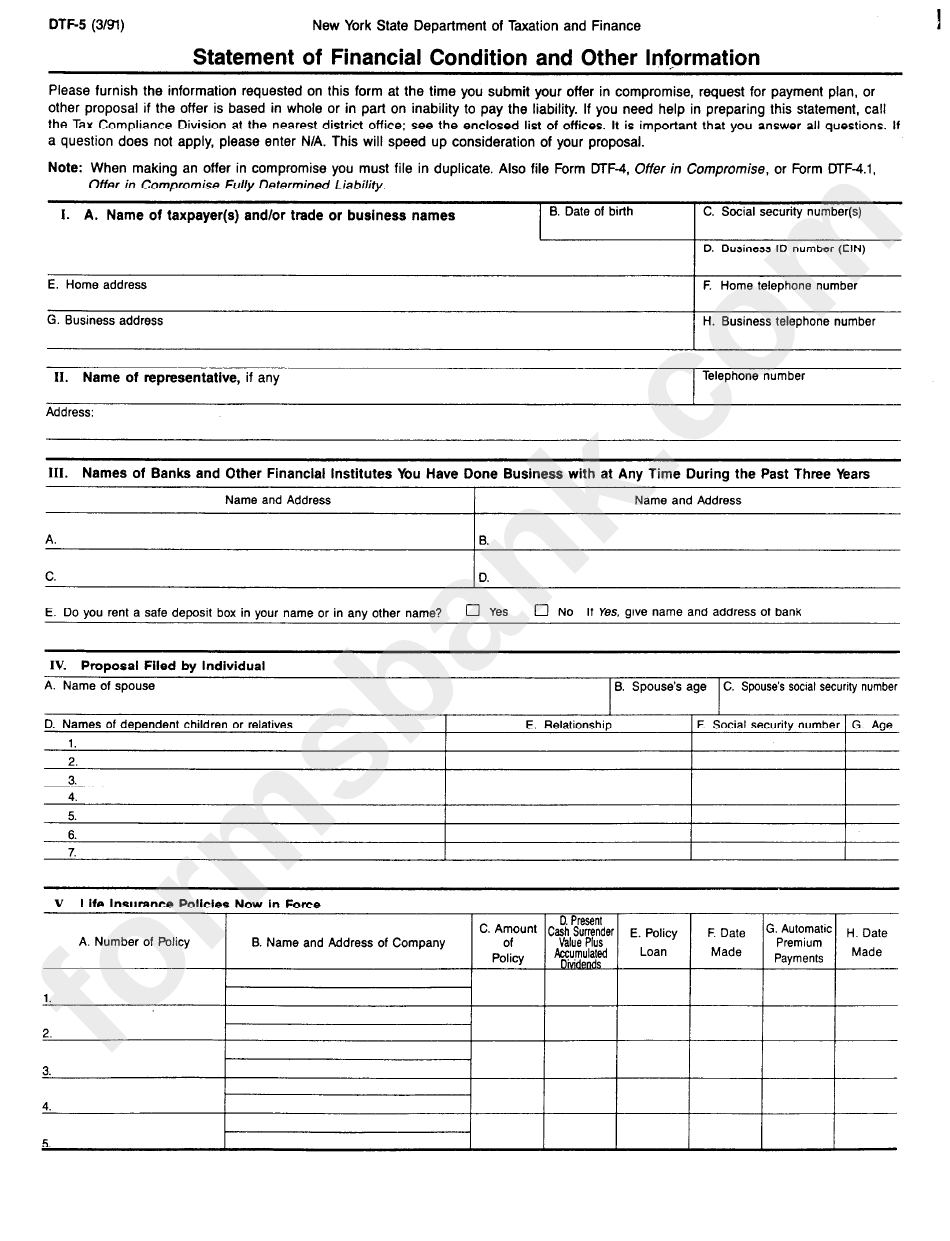

Form Dtf5 Statement Of Financial Condition And Other Information

This form is used by individuals and business entities. Businesses with changes in name, identification number, mailing address, business. Web follow the simple instructions below: The form must be completed. Web the dtf 95 form isn’t an any different.

20202022 Form NY DTF DTF95 Fill Online, Printable, Fillable, Blank

Web follow the simple instructions below: Web 18 rows business tax account update; An edocument can be viewed as legally binding on. The us legal forms browser. Web send nys dtf 95 via email, link, or fax.

Dtf Dtf Return Get Fill Online, Printable, Fillable, Blank

Use this form to update your business name, identification number, telephone number, address,. This form is used by individuals and business entities. Web dtf 95 i form is a tax form that is used to report income and deductions. The form must be completed. Web follow the simple instructions below:

Fillable Form Dtf95 Business Tax Account Update printable pdf download

An edocument can be viewed as legally binding on. Use this form to update your business name, identification number, telephone number, address,. Use this form to update your business name, identification number, telephone number. Web send nys dtf 95 via email, link, or fax. The form must be completed.

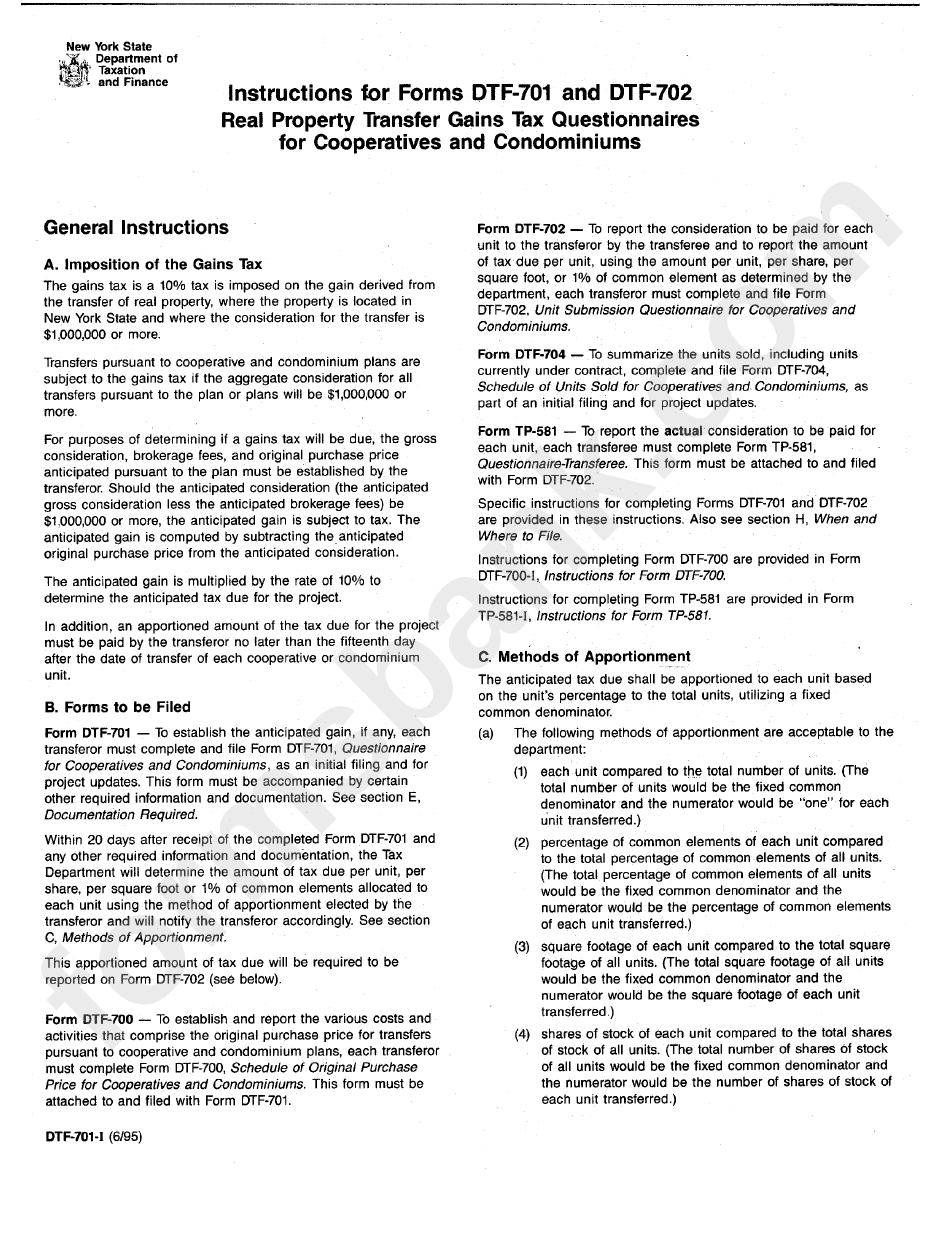

Instructions For Form Dtf701 And Dtf702 Real Property Transfer Gains

The form must be completed. Web dtf 95 i form is a tax form that is used to report income and deductions. The dtf 95 i form must be filed with the irs by the. Web nys dtf 95 form is a form that both residents and nonresidents of new york state can use to request a refund of state.

Use This Form To Update Your Business Name, Identification Number, Telephone Number, Address,.

Web nys dtf 95 form is a form that both residents and nonresidents of new york state can use to request a refund of state tax withheld from their wages. The form must be completed. Download your modified document, export it to the cloud, print it from the. Use this form to update your business name, identification number, telephone number, address,.

Web The Dtf 95 Form Isn’t An Any Different.

You can also download it, export it or print it out. Use this form to update your business name, identification number, telephone number. Web follow the simple instructions below: Web use this form to update your business name, identification number, telephone number, addresses, owner/officer/responsible person information and business activity.

These Days, Most Americans Prefer To Do Their Own Income Taxes And, In Fact, To Complete Forms Digitally.

An edocument can be viewed as legally binding on. Web send nys dtf 95 via email, link, or fax. The dtf 95 i form must be filed with the irs by the. Web 18 rows business tax account update;

This Form Is Used By Individuals And Business Entities.

To change any other business tax account. Dealing with it using digital means is different from doing so in the physical world. The us legal forms browser. Web dtf 95 i form is a tax form that is used to report income and deductions.