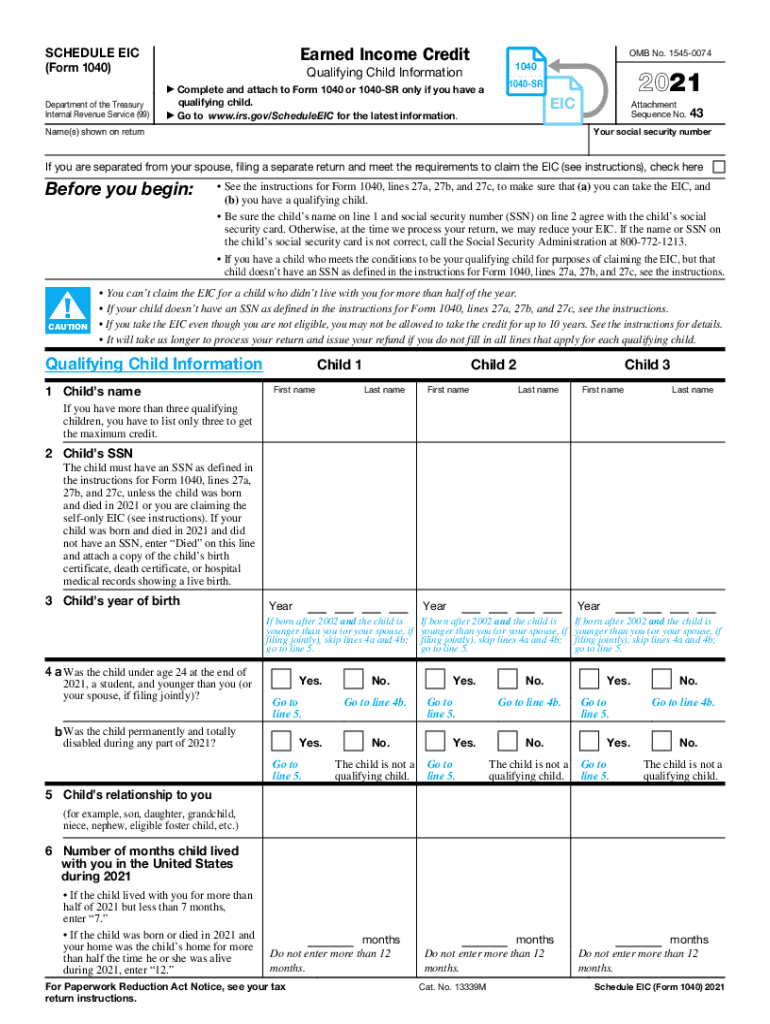

Eic Form 2021

Eic Form 2021 - Web we last updated the earned income tax credit in december 2022, so this is the latest version of 1040 (schedule eic), fully updated for tax year 2022. If you qualify, you can use the credit to reduce the taxes you. Web earned income credit eic2021 notice to employees of federal earned income tax credit (eic) if you make $51,000* or less, your employer should notify you at the time of hiring. For 2019 if you file your tax return by july 15, 2023. We last updated federal 1040 (schedule eic) in december 2022 from the federal internal revenue service. Web 3514 your ssn or itin before you begin: Optimize your tax planning with a better understanding of federal credits and incentives. If you claim the california earned income tax credit (eitc) even though you know you are not eligible, you may not be allowed to take. To file a prior year tax. Page 2 purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your.

The purpose of the eic is to reduce the tax burden and to. For 2019 if you file your tax return by july 15, 2023. Web taking the time to check the earned income credit eligibility can pay off, as the tax benefit can be worth up to $6,935 (for 2022) depending on your: Web we last updated the earned income tax credit in december 2022, so this is the latest version of 1040 (schedule eic), fully updated for tax year 2022. Web for 2021 if you file your tax return by april 18, 2025. Web also for 2021, a specified student can claim the credit starting at age 24 and qualifying former foster youths and qualified homeless youths can claim the credit at age. Optimize your tax planning with a better understanding of federal credits and incentives. Web the maximum credit for single taxpayers with no qualifying child has increased for 2021: You are related to the child, the child lived with you and the child's age. Were you a nonresident alien for any part of the year?

Were you a nonresident alien for any part of the year? Web schedule eic (form 1040) 2023. Ad with the right expertise, federal tax credits and incentives could benefit your business. Web taking the time to check the earned income credit eligibility can pay off, as the tax benefit can be worth up to $6,935 (for 2022) depending on your: We last updated federal 1040 (schedule eic) in december 2022 from the federal internal revenue service. Web we last updated the earned income tax credit in december 2022, so this is the latest version of 1040 (schedule eic), fully updated for tax year 2022. Web earned income credit eic2021 notice to employees of federal earned income tax credit (eic) if you make $51,000* or less, your employer should notify you at the time of hiring. Could you, or your spouse if filing. You are related to the child, the child lived with you and the child's age. If you qualify, you can use the credit to reduce the taxes you.

Launch of the EIC Work Programme 2021 Nanomedicine shall play a very

If you claim the california earned income tax credit (eitc) even though you know you are not eligible, you may not be allowed to take. Were you a nonresident alien for any part of the year? Web taking the time to check the earned income credit eligibility can pay off, as the tax benefit can be worth up to $6,935.

Earned Credit Worksheet Fill Out and Sign Printable PDF

You are related to the child, the child lived with you and the child's age. Web earned income tax credit worksheet for tax year 2021 for all taxpayers: Web the maximum credit for single taxpayers with no qualifying child has increased for 2021: The purpose of the eic is to reduce the tax burden and to. Web 3514 your ssn.

Irs Form 1040 Married Filing Jointly Form Resume Examples

Web we last updated the earned income tax credit in december 2022, so this is the latest version of 1040 (schedule eic), fully updated for tax year 2022. If you qualify, you can use the credit to reduce the taxes you. Web the maximum credit for single taxpayers with no qualifying child has increased for 2021: Ad with the right.

Earned Credit Table 2018 Chart Awesome Home

Were you a nonresident alien for any part of the year? Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. Web for 2021 if you file your tax return by april 18, 2025. If you qualify, you can use the credit to reduce the taxes you. Web.

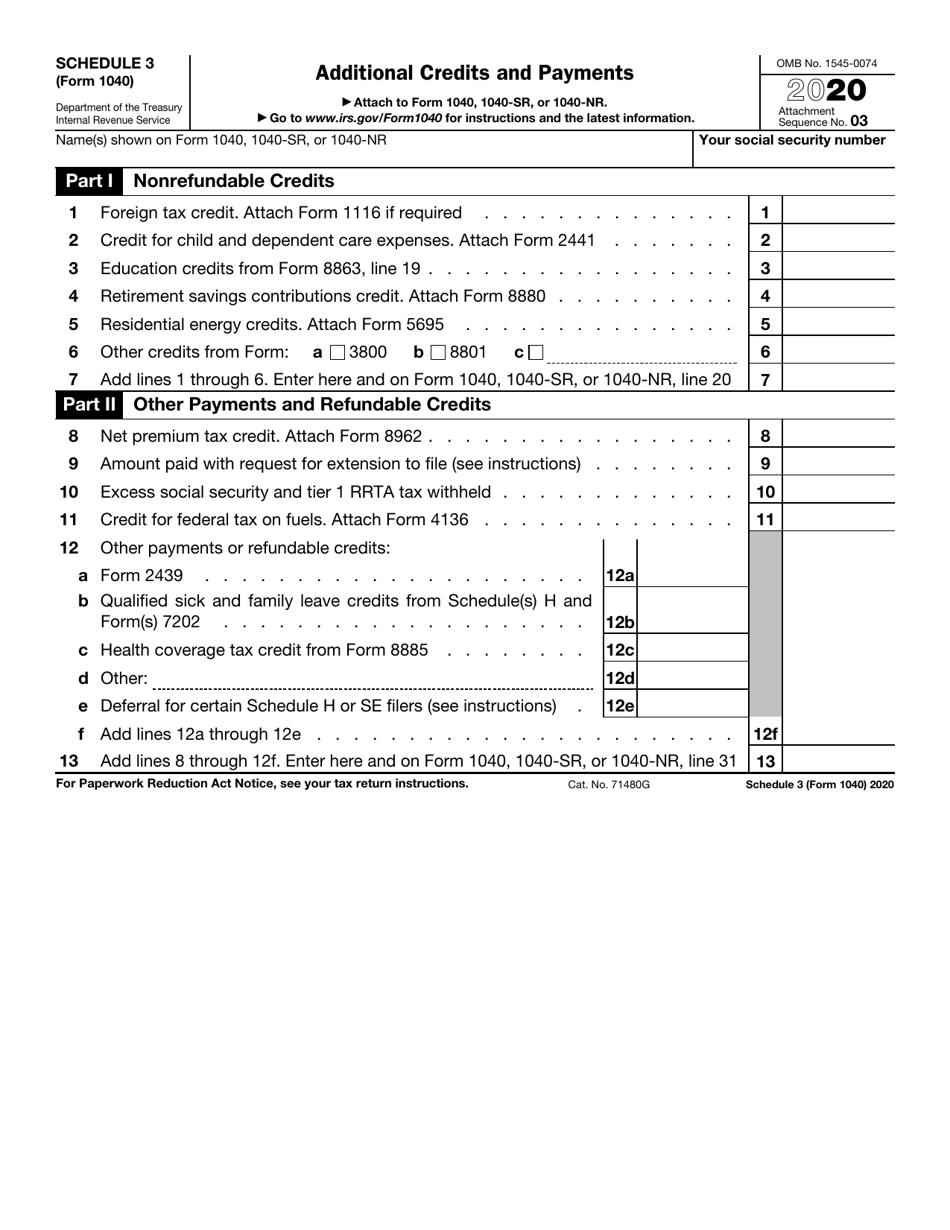

IRS Form 1040 Schedule 3 Download Fillable PDF or Fill Online

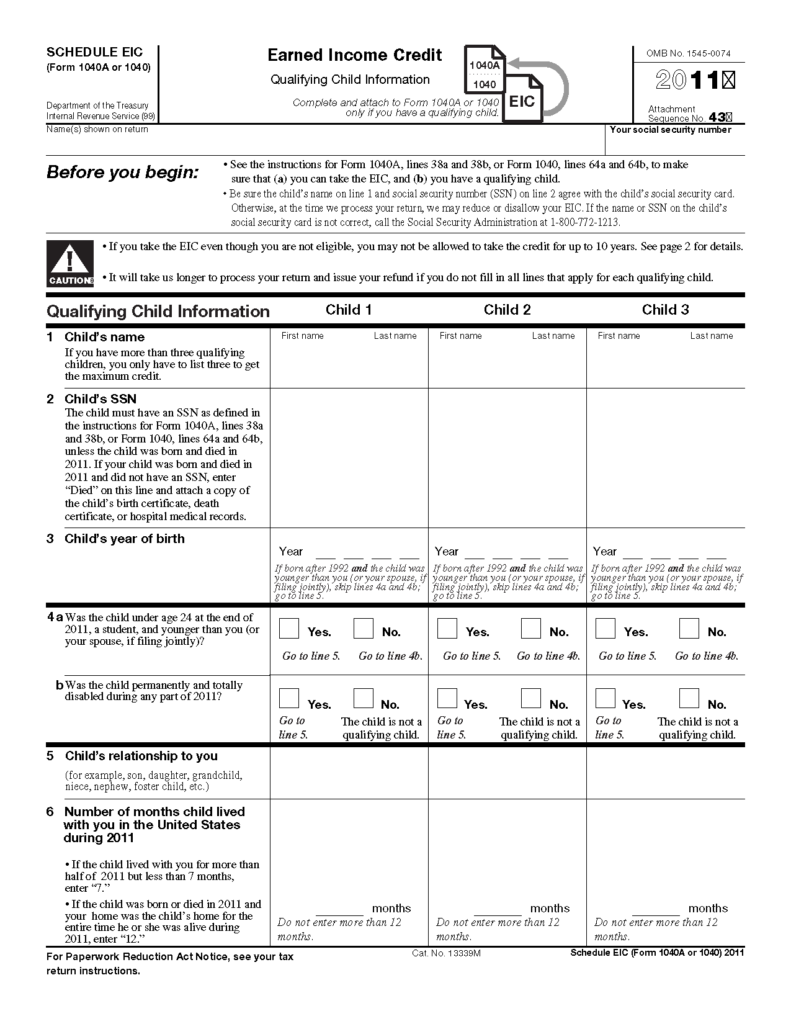

We last updated federal 1040 (schedule eic) in december 2022 from the federal internal revenue service. Web for 2021 if you file your tax return by april 18, 2025. Web up to $40 cash back earned income credit schedule eic form 1040 department of the treasury internal revenue service omb no. You are related to the child, the child lived.

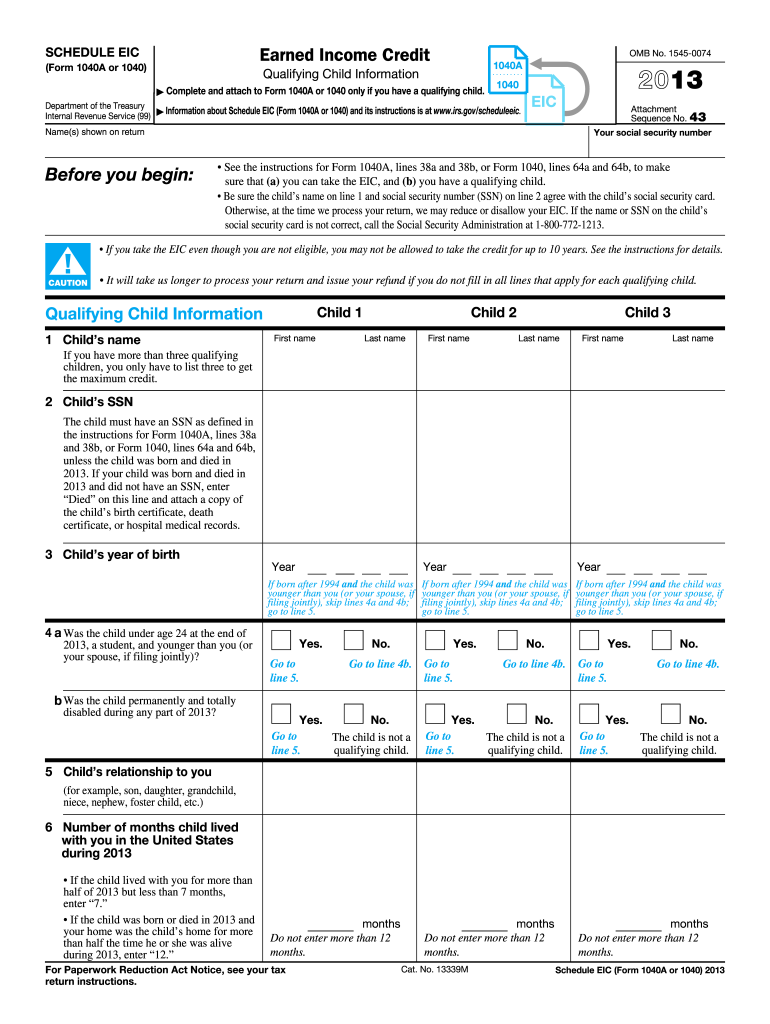

2013 Form IRS 1040 Schedule EIC Fill Online, Printable, Fillable

Web the maximum credit for single taxpayers with no qualifying child has increased for 2021: Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. Web also for 2021, a specified student can claim the credit starting at age 24 and qualifying former foster youths and qualified homeless.

Child Tax Credit 2021 Monthly Payment Calculator / Storage Unit Size

Optimize your tax planning with a better understanding of federal credits and incentives. Web 3514 your ssn or itin before you begin: Page 2 purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your. Web more about the federal 1040 (schedule eic) tax credit. Web for 2021 if.

IRS releases drafts of 2021 Form 1040 and schedules Don't Mess With Taxes

If you qualify, you can use the credit to reduce the taxes you. Ad complete irs tax forms online or print government tax documents. Web earned income credit eic2021 notice to employees of federal earned income tax credit (eic) if you make $51,000* or less, your employer should notify you at the time of hiring. If you claim the california.

Form 1040 Schedule EIC Earned Credit 2021 Tax Forms 1040 Printable

Web how to file when to file where to file update my information popular get your economic impact payment status coronavirus tax relief get your tax record get an identity. Ad with the right expertise, federal tax credits and incentives could benefit your business. If you claim the california earned income tax credit (eitc) even though you know you are.

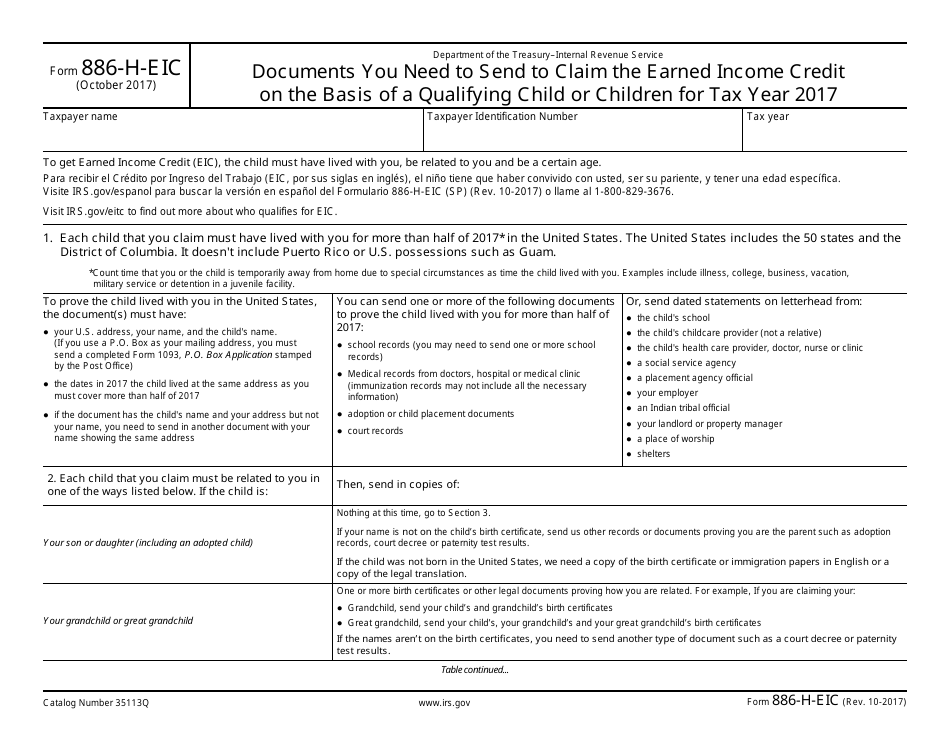

IRS Form 886HEIC Download Fillable PDF or Fill Online Documents You

Web earned income tax credit worksheet for tax year 2021 for all taxpayers: Web earned income credit eic2021 notice to employees of federal earned income tax credit (eic) if you make $51,000* or less, your employer should notify you at the time of hiring. Ad complete irs tax forms online or print government tax documents. Could you, or your spouse.

Ad With The Right Expertise, Federal Tax Credits And Incentives Could Benefit Your Business.

Web we last updated the earned income tax credit in december 2022, so this is the latest version of 1040 (schedule eic), fully updated for tax year 2022. Web up to $40 cash back earned income credit schedule eic form 1040 department of the treasury internal revenue service omb no. Page 2 purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your. If you claim the california earned income tax credit (eitc) even though you know you are not eligible, you may not be allowed to take.

Were You A Nonresident Alien For Any Part Of The Year?

Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. Web schedule eic (form 1040) 2023. To file a prior year tax. Complete, edit or print tax forms instantly.

Web The Maximum Credit For Single Taxpayers With No Qualifying Child Has Increased For 2021:

For 2019 if you file your tax return by july 15, 2023. Web earned income tax credit worksheet for tax year 2021 for all taxpayers: Ad complete irs tax forms online or print government tax documents. Web how to file when to file where to file update my information popular get your economic impact payment status coronavirus tax relief get your tax record get an identity.

Web 3514 Your Ssn Or Itin Before You Begin:

Could you, or your spouse if filing. Web more about the federal 1040 (schedule eic) tax credit. Web taking the time to check the earned income credit eligibility can pay off, as the tax benefit can be worth up to $6,935 (for 2022) depending on your: We last updated federal 1040 (schedule eic) in december 2022 from the federal internal revenue service.

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png)