Examining Your Credit Report Chapter 4 Lesson 3

Examining Your Credit Report Chapter 4 Lesson 3 - Take note that if you rent your home, rental payments don’t typically show up on credit. You need to take out a credit card or car loan to build up your credit. D) taking out a mortgage on a. The fico score is an i love debt score fair i·saac cor·po·ra·tion click the card to flip 👆 myth: Web examining your credit report chapter 4, lesson 3 by now, you know exactly how we feel about credit scores (hint: Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions.nameexamining your credit report chapter 4,lesson 3 foundations in. Minimum payments are made to all debts except for the smallest, which is attacked with the largest possible payments. It is a report card for your credithistory. Web preferred method of debt repayment; Web page 7 of 8 examining your credit report chapter 4, lesson 3 1.

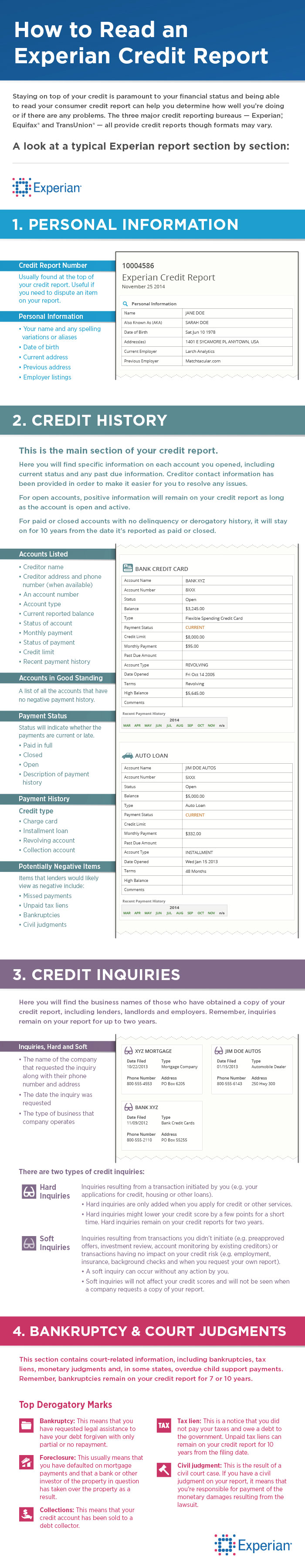

Which of the following is not a factor in determining a fico score? Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions.nameexamining your credit report chapter 4,lesson 3 foundations in. This factors into the lender’s understanding of how you manage. Web a credit report is a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts. Web page 7 of 8 examining your credit report chapter 4, lesson 3 1. This is where you’ll find specific details on your accounts, which could include mortgages, student loans, car loans, lines of credit, and other types of credit accounts. Most people have more than one credit report. Take note that if you rent your home, rental payments don’t typically show up on credit. Web good question (106) report gauth tutor solution this problem has been solved! Name examining your credit report chapter 4, lesson 3.

Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions.nameexamining your credit report chapter 4,lesson 3 foundations in. Name examining your credit report chapter 4, lesson 3. Click the card to flip 👆. It is a report card for your credithistory. Web a credit report all about you can tell them: What is a credit report? What information does it provide? Web credit reports will also include a complete list of your credit inquiries from the past 2 years. B) getting a personal loan from the bank. A credit inquiry occurs when a company or individual requests access to your credit file.

go math fourth grade chapter 4 lesson 3 interpret the remainder

Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions. Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions.nameexamining your credit report chapter 4,lesson 3 foundations in. Includes a list of.

McGraw Hill My Math Grade 1 Chapter 4 Lesson 3 Answer Key Use Doubles

A credit inquiry occurs when a company or individual requests access to your credit file. Web a credit report all about you can tell them: A credit report is a detailed account of your credit history that lenders, businesses, and credit card companies use to assess your financial reliability. Web examining your credit report chapter 4, lesson 3 1. Web.

P2 Chapter 4 Lesson 3 Adding On Sets YouTube

What is a credit report? B) getting a personal loan from the bank. Why is it important to check your credit report? Then, read the article “how to read your credit report.” use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions. Includes a list of all.

Chapter 4 Lesson 3 Word Search WordMint

Includes a list of all debts organized from smallest to largest balance; A credit report is a detailed account of your credit history that lenders, businesses, and credit card companies use to assess your financial reliability. A) paying cash for all purchases. The fico score is an i love debt score fair i·saac cor·po·ra·tion click the card to flip 👆.

Additional Teacher Background Chapter 4 Lesson 3, p. 295

Web the information listed on your credit report summarizes how you manage credit, including payment history and account balances. B) getting a personal loan from the bank. Web good question (106) report gauth tutor solution this problem has been solved! How often should you check it? Click the card to flip 👆.

How to Read Your Credit Report Experian

But one thing you still need to pay attention to is your credit report. Web a credit report is a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts. Then, read the article “how to read your credit report.” use the information in your textbook.

What to Look for on Your Credit Report

Web then, read the article “how to read your credit report.” use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions. Web page 7 of 8 examining your credit report chapter 4, lesson 3 1. A credit inquiry occurs when a company or individual requests access to.

Credit Report on the Luxury Men Wristwatch Mechanism. 3D. Stock

Includes a list of all debts organized from smallest to largest balance; Minimum payments are made to all debts except for the smallest, which is attacked with the largest possible payments. A credit report will also specify whether each inquiry was a hard or soft credit. Web examining your credit report chapter 4, lesson 3 by now, you know exactly.

McGraw Hill My Math Grade 2 Chapter 4 Lesson 3 Answer Key Regroup a Ten

B) getting a personal loan from the bank. Take note that if you rent your home, rental payments don’t typically show up on credit. This is where you’ll find specific details on your accounts, which could include mortgages, student loans, car loans, lines of credit, and other types of credit accounts. Which of the following is not a factor in.

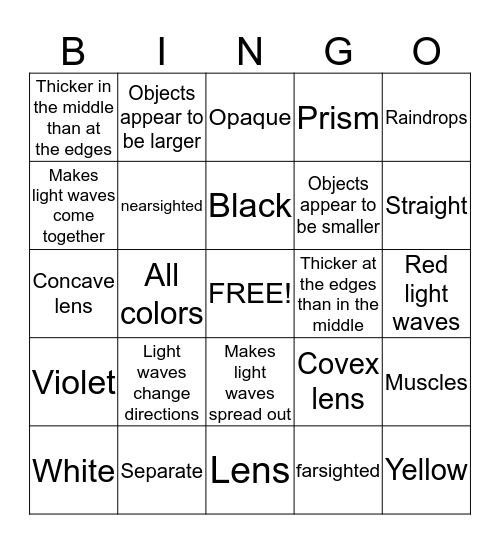

Science Chapter 4 lesson 3 Bingo Card

Web good question (106) report gauth tutor solution this problem has been solved! Web read john’s story and review the sample credit report. Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions.nameexamining your credit report chapter 4,lesson 3 foundations in. A credit inquiry occurs when.

But One Thing You Still Need To Pay Attention To Is Your Credit Report.

Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions.nameexamining your credit report chapter 4,lesson 3 foundations in. Credit reporting companies, also known as credit. A credit inquiry occurs when a company or individual requests access to your credit file. Includes a list of all debts organized from smallest to largest balance;

Name Examining Your Credit Report Chapter 4, Lesson 3.

Why is it important to check your credit report? Web credit reports will also include a complete list of your credit inquiries from the past 2 years. How often should you check it? Most people have more than one credit report.

Minimum Payments Are Made To All Debts Except For The Smallest, Which Is Attacked With The Largest Possible Payments.

This factors into the lender’s understanding of how you manage. Web then, read the article “how to read your credit report.” use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions. Nameexamining your credit report chapter 4,lesson 3. Web preferred method of debt repayment;

Web Examining Your Credit Report Chapter 4, Lesson 3 1.

Click the card to flip 👆. The fico score is an i love debt score fair i·saac cor·po·ra·tion click the card to flip 👆 myth: Web page 7 of 8 examining your credit report chapter 4, lesson 3 1. And because it measures “reliability,” credit reports are also often referenced in a variety of situations beyond getting a credit.