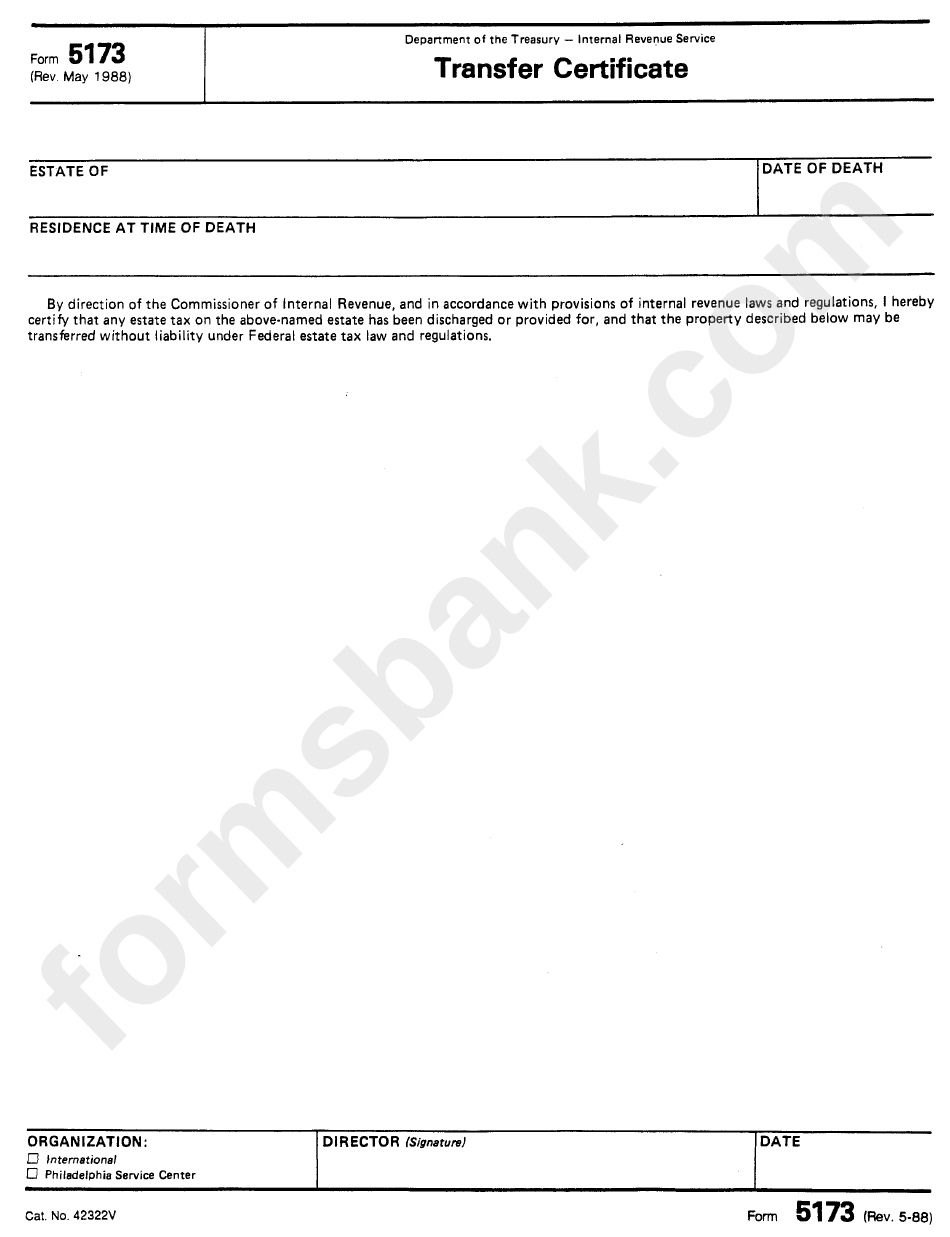

Federal Transfer Certificate Irs Form 5173

Federal Transfer Certificate Irs Form 5173 - Int is post, we discuss the mechanicians of form 5173. Web form 5173 is required when a deceased nonresident has u.s. We be give you instructions and plus show you some tips also tricks as you can receive the form as quickly as possible. Web in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. Web federal transfer certificate requirements. What is the requirement for a federal transfer certificate? Web a transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. (form 706na and form 5173)for more details, please check this article: Web a transfer certificate is not required for property administered by an executor or administrator appointed, qualified and acting within the united states. The assets are only u.s.

(form 706na and form 5173)for more details, please check this article: The tax will be considered fully discharged for purposes of the issuance of a transfer certificate when investigation has been completed and payment of the tax, including any deficiency. This can be a lengthy process. Real estate, tangible property, and u.s. Web how do i get an irs transfer certificate? Web form 5173 is required when a deceased nonresident has u.s. Int is post, we discuss the mechanicians of form 5173. Custodian in order for them to release the. What is the requirement for a federal transfer certificate? Web in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases.

Web how do i get an irs transfer certificate? The tax will be considered fully discharged for purposes of the issuance of a transfer certificate when investigation has been completed and payment of the tax, including any deficiency. Web in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. Web a transfer certificate is not required for property administered by an executor or administrator appointed, qualified and acting within the united states. The executor of the person's estate must provide form 5173 to a u.s. What is the requirement for a federal transfer certificate? (form 706na and form 5173)for more details, please check this article: Web this remains certainly this case using irs form 5173 (often called an irs transfer certificate). Real estate, tangible property, and u.s. Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets held in the estate are exempt from inheritance tax in the usa.

IRS Publication 936 2010 Fill and Sign Printable Template Online US

This can be a lengthy process. Int is post, we discuss the mechanicians of form 5173. Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets held in the estate are exempt from inheritance tax in the usa. Web a transfer certificate is.

11Transfer certificate front page

Web what is a form 5173? The tax will be considered fully discharged for purposes of the issuance of a transfer certificate when investigation has been completed and payment of the tax, including any deficiency. Web form 5173 is required when a deceased nonresident has u.s. Transfer certificate filing requirements for the estates of nonresident citizens of the united states.

Form 5173 Transfer Certificate printable pdf download

Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets held in the estate are exempt from inheritance tax in the usa. This can be a lengthy process. The tax will be considered fully discharged for purposes of the issuance of a transfer.

IRS Form 8038GC Download Fillable PDF or Fill Online Information

Web a transfer certificate is not required for property administered by an executor or administrator appointed, qualified and acting within the united states. Web in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance.

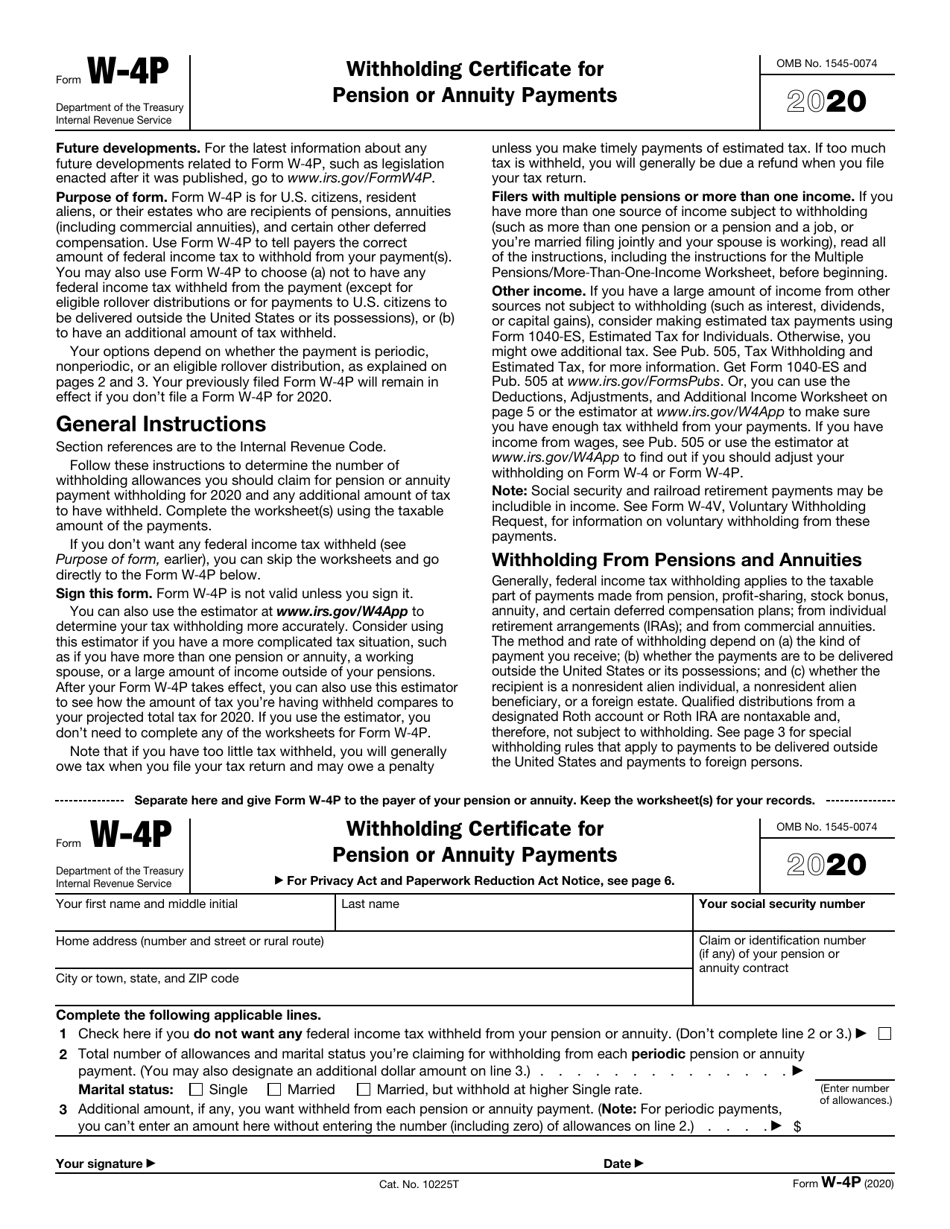

IRS Form W4P Download Fillable PDF or Fill Online Withholding

The tax will be considered fully discharged for purposes of the issuance of a transfer certificate when investigation has been completed and payment of the tax, including any deficiency. Web in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. Transfer certificate filing requirements for the estates of.

What is the IRS Form 5173 Tax Clearance Certificate YouTube

The tax will be considered fully discharged for purposes of the issuance of a transfer certificate when investigation has been completed and payment of the tax, including any deficiency. Web a federal transfer certificate is used to authorize the transfer of property located in the us and is required before most institutions will begin to distribute any assets, therefore if.

What is the IRS Form 5173 Tax Clearance Certificate

This can be a lengthy process. Web a federal transfer certificate is used to authorize the transfer of property located in the us and is required before most institutions will begin to distribute any assets, therefore if you are the executor of an estate outside of the united states which holds us assets with a value of over $60,000 at.

IRS Letter of Tax Exempt Status

Web how do i get an irs transfer certificate? We be give you instructions and plus show you some tips also tricks as you can receive the form as quickly as possible. The executor of the person's estate must provide form 5173 to a u.s. Web federal transfer certificate requirements. Web a transfer certificate is not required for property administered.

EDGAR Filing Documents for 000119312516456864

Web what is a form 5173? Real estate, tangible property, and u.s. Web form 5173 is required when a deceased nonresident has u.s. Int is post, we discuss the mechanicians of form 5173. (form 706na and form 5173)for more details, please check this article:

form 5173 Fill Online, Printable, Fillable Blank form706

The executor of the person's estate must provide form 5173 to a u.s. The assets are only u.s. Web a transfer certificate is not required for property administered by an executor or administrator appointed, qualified and acting within the united states. Web this remains certainly this case using irs form 5173 (often called an irs transfer certificate). What is the.

The Executor Of The Person's Estate Must Provide Form 5173 To A U.s.

Web this remains certainly this case using irs form 5173 (often called an irs transfer certificate). What is the requirement for a federal transfer certificate? The assets are only u.s. Web a transfer certificate is not required for property administered by an executor or administrator appointed, qualified and acting within the united states.

Web A Transfer Certificate Will Be Issued By The Service When Satisfied That The Tax Imposed Upon The Estate, If Any, Has Been Fully Discharged Or Provided For.

Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets held in the estate are exempt from inheritance tax in the usa. (form 706na and form 5173)for more details, please check this article: Web what is a form 5173? The tax will be considered fully discharged for purposes of the issuance of a transfer certificate when investigation has been completed and payment of the tax, including any deficiency.

Web How Do I Get An Irs Transfer Certificate?

Transfer certificate filing requirements for the estates of nonresident citizens of the united states | internal revenue service Int is post, we discuss the mechanicians of form 5173. Web in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. This can be a lengthy process.

Web Form 5173 Is Required When A Deceased Nonresident Has U.s.

We be give you instructions and plus show you some tips also tricks as you can receive the form as quickly as possible. Real estate, tangible property, and u.s. Web federal transfer certificate requirements. Web a federal transfer certificate is used to authorize the transfer of property located in the us and is required before most institutions will begin to distribute any assets, therefore if you are the executor of an estate outside of the united states which holds us assets with a value of over $60,000 at the date of death, applying for irs clearanc.