File Form 8862 Electronically

File Form 8862 Electronically - Put your name and social security number on the statement and attach it at. Web march 26, 2020 7:26 am. Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health. Web more about the federal form 8862 tax credit. I'm still not clear, i claimed my biological children, no one else were. Complete, edit or print tax forms instantly. You do not need to file form 8862 in the year the credit. Web you can download form 8862 from the irs website and file it electronically or by mail. Web follow the simple instructions below: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit.

Web follow the simple instructions below: March 23, 2022 6:03 pm. Alternatively, if you are filing electronically,. Complete, edit or print tax forms instantly. The short answer is yes. Web do not file this form if you are taking the eic without a qualifying child and the only reason your eicwas reduced or disallowed in the earlier year was because it was determined. Web you can download form 8862 from the irs website and file it electronically or by mail. Web if you are filing a paper return, staple your form 8862 to your completed tax return at the upper left corner of the first page. Web taxpayers complete form 8862 and attach it to their tax return if: Put your name and social security number on the statement and attach it at.

Any legal document, job application, lease agreement or any other form (including a fillable 8862), can be filled. You do not need to file form 8862 in the year the credit. Put your name and social security number on the statement and attach it at. Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Web 1 7 1,468 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. March 23, 2022 6:03 pm. Web how to electronically file form 8862? Complete, edit or print tax forms instantly. Uslegalforms allows users to edit, sign, fill & share all type of documents online.

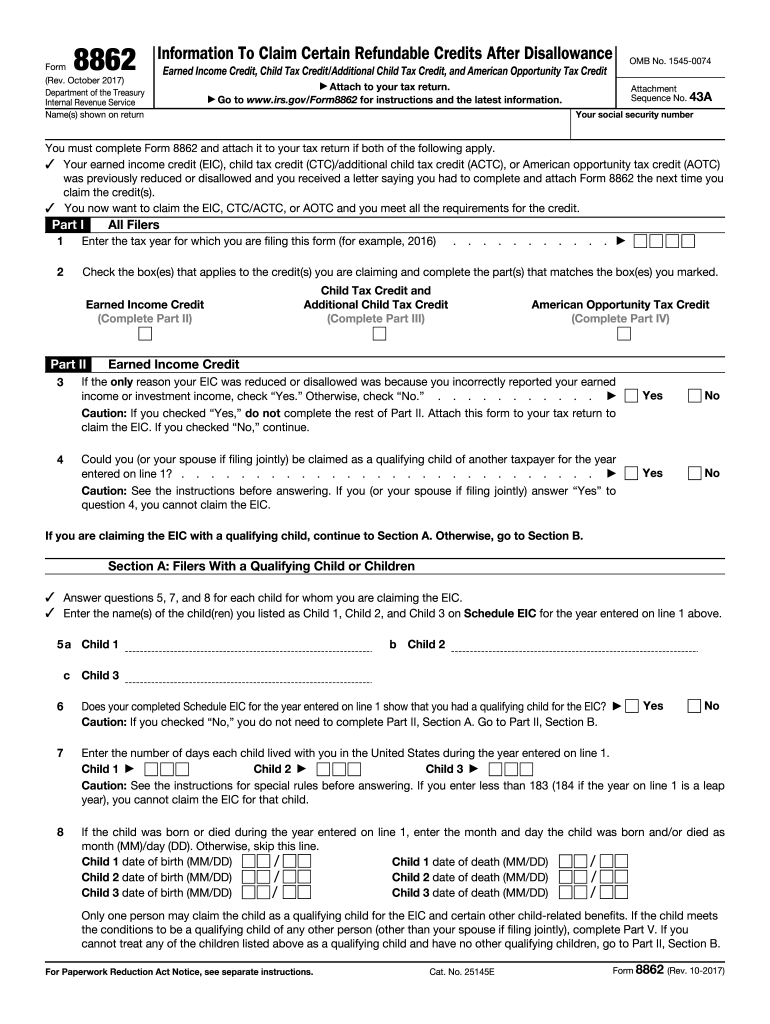

IRS Form 8862 2017 Fill Out and Sign Printable PDF Template signNow

I'm still not clear, i claimed my biological children, no one else were. You do not need to file form 8862 in the year the credit. As the society takes a step away from office working conditions, the execution of paperwork more and more. Alternatively, if you are filing electronically,. Web i've been rejected 20 times already for this same.

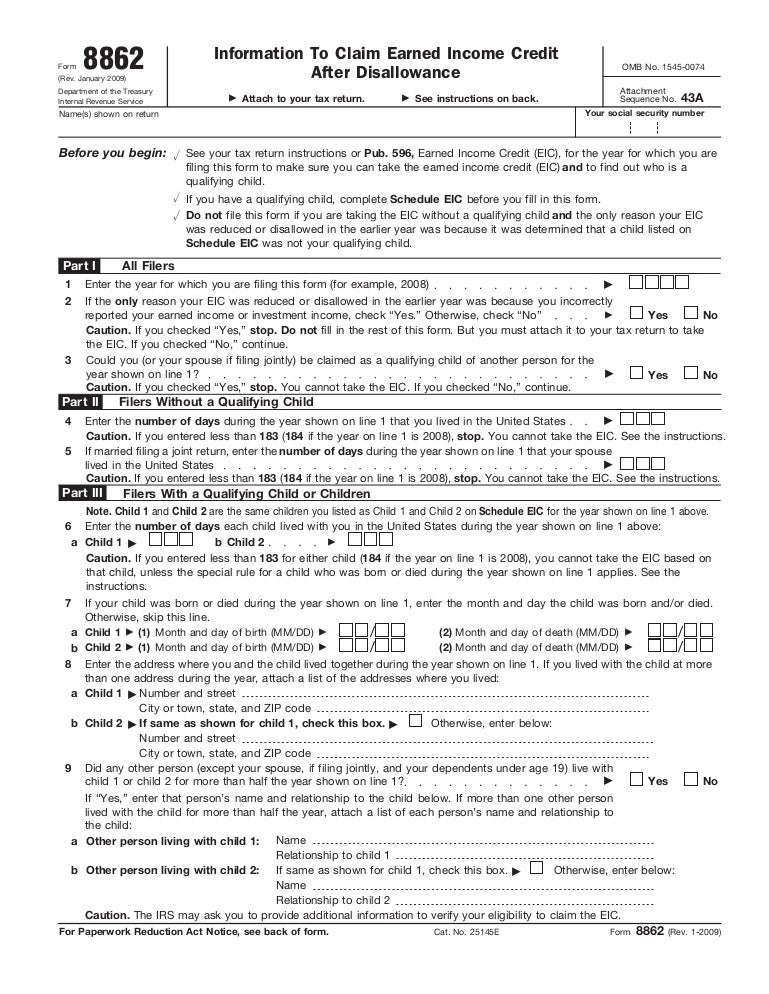

Form 8862Information to Claim Earned Credit for Disallowance

Web be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. Web follow the simple instructions below: Ad download or email irs 8862 & more fillable forms, register and subscribe now! We last updated federal form 8862 in december 2022 from the federal internal revenue service. I'm still not clear,.

How Do I File My Form 8862? StandingCloud

Web i've been rejected 20 times already for this same reason and they aren't helping fix the situation. Any legal document, job application, lease agreement or any other form (including a fillable 8862), can be filled. Ad download or email irs 8862 & more fillable forms, try for free now! Web follow the simple instructions below: Web irs form 8862.

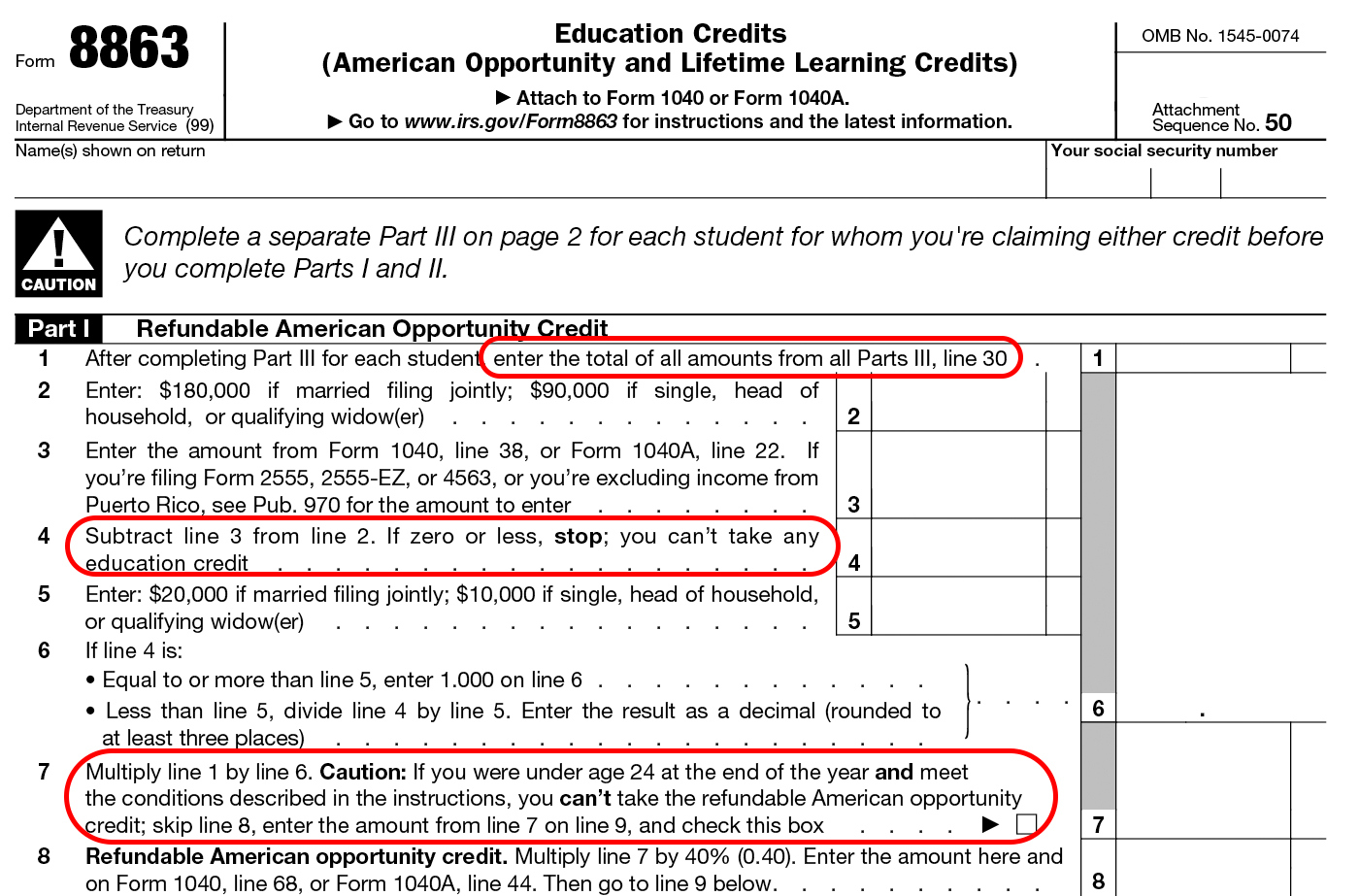

Form 8863 Instructions Information On The Education 1040 Form Printable

Click view complete forms list. Number each entry on the statement to correspond with the line number on form 8862. Web follow the simple instructions below: Ask an expert tax questions how to electronically file form 8862? Put your name and social security number on the statement and attach it at.

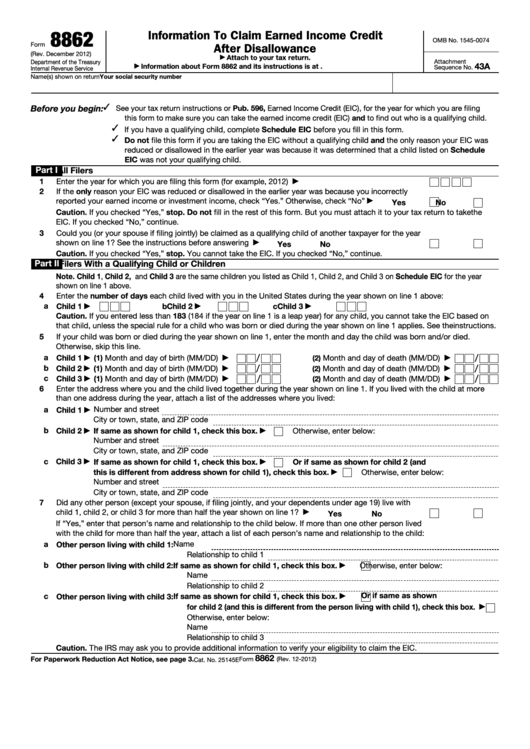

Fillable Form 8862 Information To Claim Earned Credit After

If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the. You do not need to file form 8862 in the year the credit. Web do not file this form if you are taking the eic without a qualifying child and the only reason your eicwas reduced or disallowed.

Form 8862 Claim Earned Credit After Disallowance YouTube

Any legal document, job application, lease agreement or any other form (including a fillable 8862), can be filled. Ad download or email irs 8862 & more fillable forms, try for free now! Ask an expert tax questions how to electronically file form 8862? Web form 8862 information to claim certain credits after disallowance is used to claim the earned income.

Instructions for IRS Form 8862 Information to Claim Certain Credits

December 2012) department of the treasury internal revenue service information to claim earned income credit after disallowance a attach to your tax. Any legal document, job application, lease agreement or any other form (including a fillable 8862), can be filled. You do not need to file form 8862 in the year the credit. If you are filing form 8862 because.

How to claim an earned credit by electronically filing IRS Form 8862

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web can form 8862 be filed electronically? Number each entry on the statement to correspond with the line number on form 8862. Web you can download form 8862 from the irs website and file it electronically or by mail. We last updated federal form 8862 in.

how to file form 8379 electronically Fill Online, Printable, Fillable

If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the. Web be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. This form is for income. Web your electronic return was rejected because irs records show that advance.

Top 14 Form 8862 Templates free to download in PDF format

Ask an expert tax questions how to electronically file form 8862? Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Click view complete forms list. Click the forms tab on the right side of the screen. Ad download or email irs 8862 & more fillable forms, try for free now!

Any Legal Document, Job Application, Lease Agreement Or Any Other Form (Including A Fillable 8862), Can Be Filled.

Ad download or email irs 8862 & more fillable forms, try for free now! Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web follow the simple instructions below: Ad download or email irs 8862 & more fillable forms, register and subscribe now!

This Form Is For Income.

Web can form 8862 be filed electronically? Web i've been rejected 20 times already for this same reason and they aren't helping fix the situation. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Web irs form 8862 for 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 28 votes how to fill out and sign irs gov 2021 tax forms online?

If You Are Filing Form 8862 Because You Received An Irs Letter, You Should Send It To The Address Listed In The.

We last updated federal form 8862 in december 2022 from the federal internal revenue service. Put your name and social security number on the statement and attach it at. As the society takes a step away from office working conditions, the execution of paperwork more and more. You do not need to file form 8862 in the year the credit.

The Short Answer Is Yes.

Alternatively, if you are filing electronically,. December 2012) department of the treasury internal revenue service information to claim earned income credit after disallowance a attach to your tax. Expand the federal forms and forms and schedules folders. You won't be able to file this form or claim the credits for up to.