Filing Form 941 Late

Filing Form 941 Late - Web form 941 late filing penalty. Those returns are processed in. Click on reports at the top menu bar. If your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax required to be shown on the return, whichever is less. Web if your form 941 is late by 1 to 5 days: Web payroll tax returns. Quarter one (january, february, march): The statement must be less than 2 years old. Web to send us a request: Form 941 is due on april 30.

Web to send us a request: As an employer, you are liable to file form 941 before the deadline regardless of. Quarter one (january, february, march): Form 941 penalties can vary considerably based on how late you file. Interest on a penalty we charge interest on penalties. Form 941 is used to report certain federal taxes withheld from the. Web form 941 late filing penalty. Web usually, form 941 due date falls by the last day of the month following the reporting quarter. 2% of the amount due will be calculated as late filing penalties if your form 941 is late by 6 to 15 days: Get a signed and dated statement from the bank that declined your account.

Get a signed and dated statement from the bank that declined your account. There are also deposit penalties for making late deposits and for not depositing the proper amount. Form 941 penalties can vary considerably based on how late you file. Web usually, form 941 due date falls by the last day of the month following the reporting quarter. Web form 941 is an irs information return that exclusively reports the employer’s quarterly federal tax. 2% of the amount due will be calculated as late filing penalties if your form 941 is late by 6 to 15 days: Web overview you must file irs form 941 if you operate a business and have employees working for you. For example, if you’re filing for the quarter ending jun 30th, then. Form 941 is used to report certain federal taxes withheld from the. Interest on a penalty we charge interest on penalties.

Filing Form 941 Accurately and On Time · PaycheckCity

Late deposit penalties can range from just two percent to over fifteen percent. Web fees for filing late. You must file form 941 by the end of the month following that particular quarter. As an employer, you are liable to file form 941 before the deadline regardless of. For example, if you’re filing for the quarter ending jun 30th, then.

Tips for Filing Your Form 941 Accurately and On Time This Quarter

Late deposit penalties can range from just two percent to over fifteen percent. Hit on more payroll reports in excel. Web if you are filing form 941 in the current year, you will look back to the second calendar year before the current year. Connecticut, delaware, district of columbia, georgia,. Quarter one (january, february, march):

File Form 941 Online for 2019 Express941

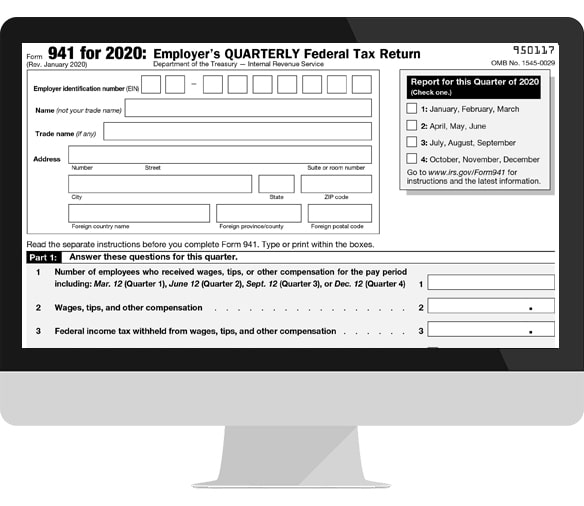

As an employer, you are liable to file form 941 before the deadline regardless of. Quarter one (january, february, march): For example, if you’re filing for the quarter ending jun 30th, then. Web form 941 is a quarterly payroll tax form that businesses are required to file if they withhold medicare, social security, and income taxes from their employee’s. Form.

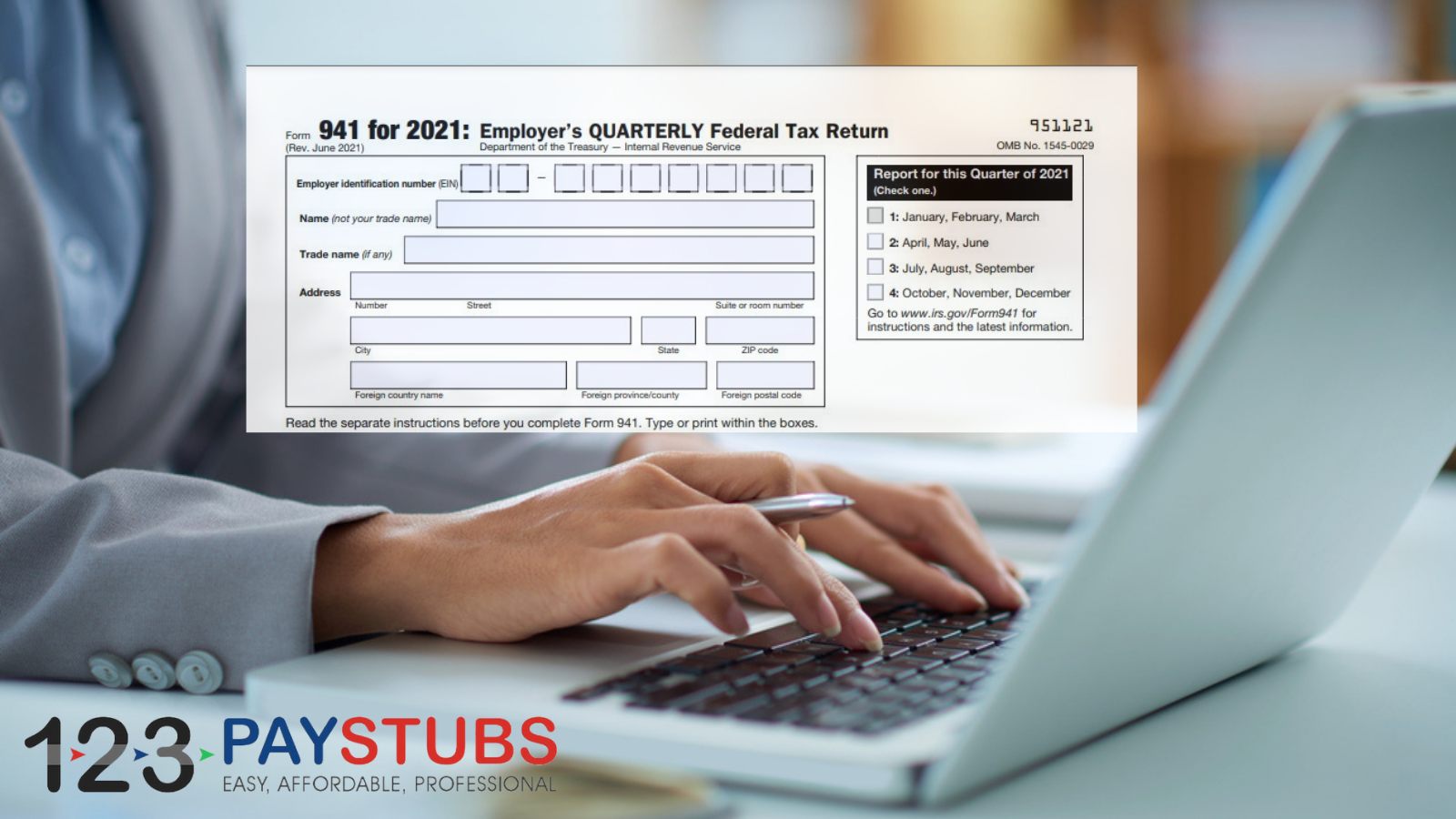

Benefits of Filing Form 941 With 123PayStubs 123PayStubs Blog

As an employer, you are liable to file form 941 before the deadline regardless of. Web usually, form 941 due date falls by the last day of the month following the reporting quarter. Connecticut, delaware, district of columbia, georgia,. Hit on more payroll reports in excel. Web payroll tax returns.

7 Tips for Filing IRS Form 941 Every Quarter Workful

Web usually, form 941 due date falls by the last day of the month following the reporting quarter. If your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax required to be shown on the return, whichever is.

Form 941 Instructions & Info on Tax Form 941 (including Mailing Info)

Web to send us a request: Quarter one (january, february, march): Web form 941 late filing penalty. Late deposit penalties can range from just two percent to over fifteen percent. Web usually, form 941 due date falls by the last day of the month following the reporting quarter.

How to Fill Out Form 941 EXCOL, LLC

Web usually, form 941 due date falls by the last day of the month following the reporting quarter. Web to send us a request: Certain employers whose annual payroll tax and withholding. Web there is a penalty for filing a late form 941 return. Web mailing addresses for forms 941.

Filing Form 941 is Easy with TaxBandits New Zero Filing Feature Blog

Web if your form 941 is late by 1 to 5 days: For example, if you want to determine your deposit. Those returns are processed in. Web payroll tax returns. Web form 941 is an irs information return that exclusively reports the employer’s quarterly federal tax.

A Simple Guide for Filing Form 941 for 2021 123PayStubs Blog

Failing to file form 941 and 944. If you fail to file your form 941 or form 944 by the deadline: Web usually, form 941 due date falls by the last day of the month following the reporting quarter. 2% of the amount due will be calculated as late filing penalties if your form 941 is late by 6 to.

As Of July 13, 2023, The Irs Had 266,000 Unprocessed Forms 941, Employer's Quarterly Federal Tax Return.

As an employer, you are liable to file form 941 before the deadline regardless of. Late deposit penalties can range from just two percent to over fifteen percent. Those returns are processed in. Quarter one (january, february, march):

Click On Reports At The Top Menu Bar.

Get a signed and dated statement from the bank that declined your account. There are also deposit penalties for making late deposits and for not depositing the proper amount. Your business will incur a penalty of 5% of the total tax amount due. Interest on a penalty we charge interest on penalties.

Web Form 941 Is A Quarterly Payroll Tax Form That Businesses Are Required To File If They Withhold Medicare, Social Security, And Income Taxes From Their Employee’s.

Connecticut, delaware, district of columbia, georgia,. Web your form 941 is due by the last day of the month that follows the end of the quarter. 2% of the amount due will be calculated as late filing penalties if your form 941 is late by 6 to 15 days: Web payroll tax returns.

Web If You Are Filing Form 941 In The Current Year, You Will Look Back To The Second Calendar Year Before The Current Year.

Form 941 is used to report certain federal taxes withheld from the. Web fees for filing late. If your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax required to be shown on the return, whichever is less. For example, if you’re filing for the quarter ending jun 30th, then.