Fillable Form 943

Fillable Form 943 - Employer’s annual federal tax return for agricultural employees. Complete, edit or print tax forms instantly. Web how you report qualified sick and family leave wages and the credit for qualified sick and family leave wages has changed. Ad access irs tax forms. Taxable qualified sick and family leave wages for leave. Complete, edit or print tax forms instantly. Once completed you can sign your fillable. If you don’t already have an ein, you can. Department of the treasury internal revenue service. Uslegalforms allows users to edit, sign, fill & share all type of documents online.

What if i don’t know my missouri tax identification number? Web form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Use fill to complete blank online irs pdf forms for free. Edit, sign and save agricultural employer tax form. Web “form 943,” and “2022” on your check or money order. Exception for exempt organizations, federal, state and local. The form lists federal income tax, social. Web you must complete this form if you’re a semiweekly schedule depositor or became one because your accumulated tax liability during any month was $100,000 or more. Line by line instruction for 2022. Select form 943 and enter.

Easily fill out pdf blank, edit, and sign them. Web simply follow the steps below to file your form 943: If you don’t already have an ein, you can. It is used to record how much income tax,. Web how you report qualified sick and family leave wages and the credit for qualified sick and family leave wages has changed. Annual record of federal tax liability and file it with form 943 if you are a semiweekly depositor or if your tax liability on any day during. Complete, edit or print tax forms instantly. Ad access irs tax forms. The missouri tax identification number is assigned by the missouri department of revenue at the time you. Web form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture.

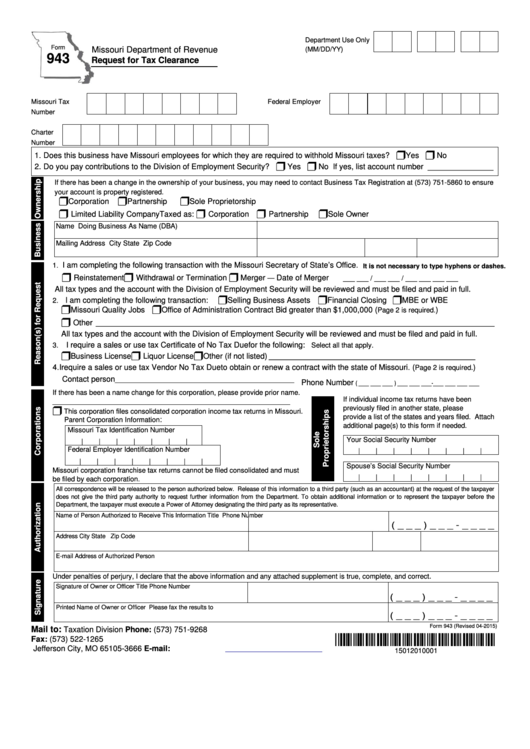

Fillable Form 943 Request For Tax Clearance printable pdf download

Ad access irs tax forms. Once completed you can sign your fillable. Use fill to complete blank online irs pdf forms for free. Web ogden, ut 84409. Taxable qualified sick and family leave wages for leave.

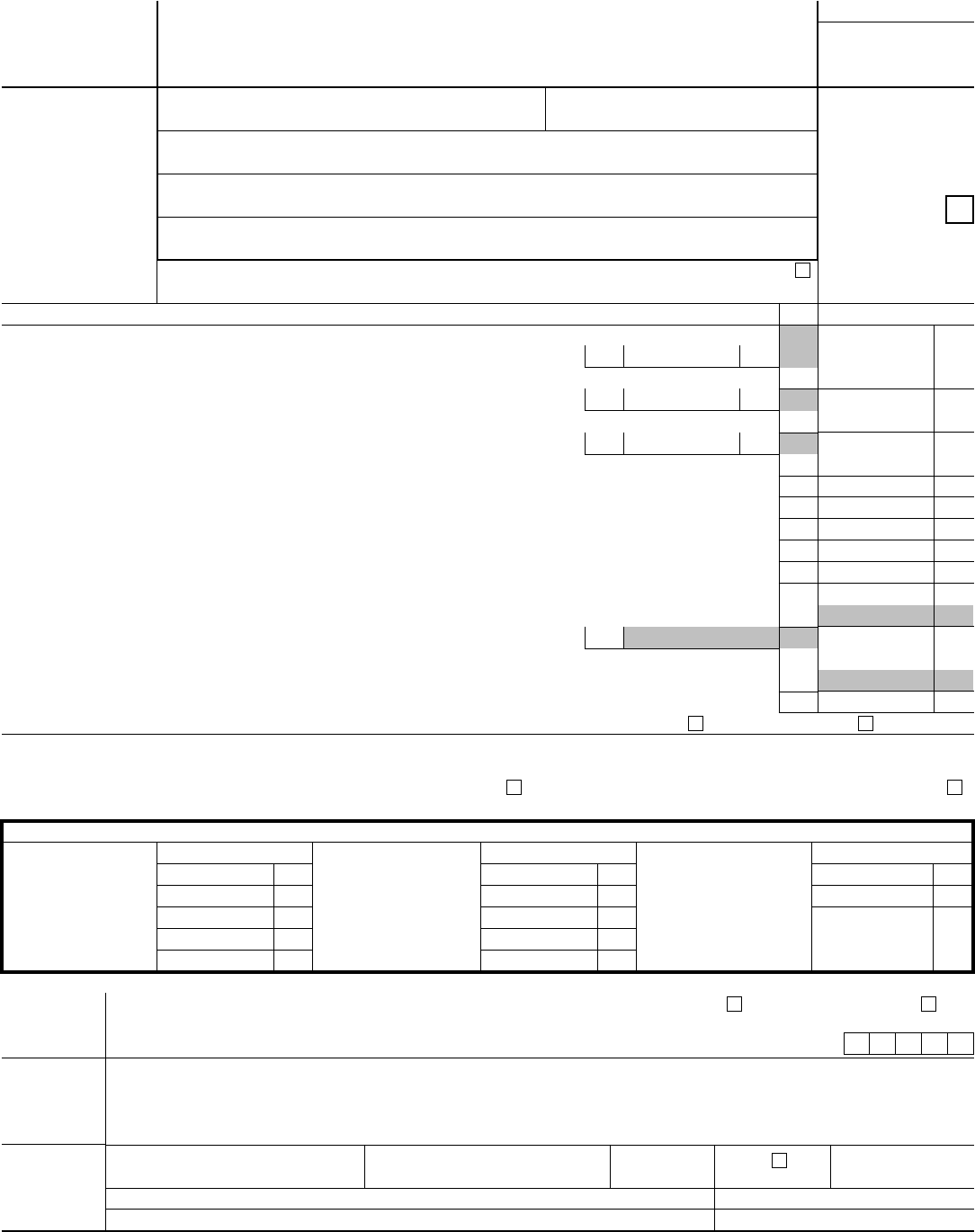

Fill Free fillable F943x Accessible Form 943X (Rev. February 2018

A form an agricultural employer files with the irs each year to report income and fica taxes it withholds from its employees. Complete, edit or print tax forms instantly. Once completed you can sign your fillable. Form 943 (employer’s annual federal tax. Edit, sign and save agricultural employer tax form.

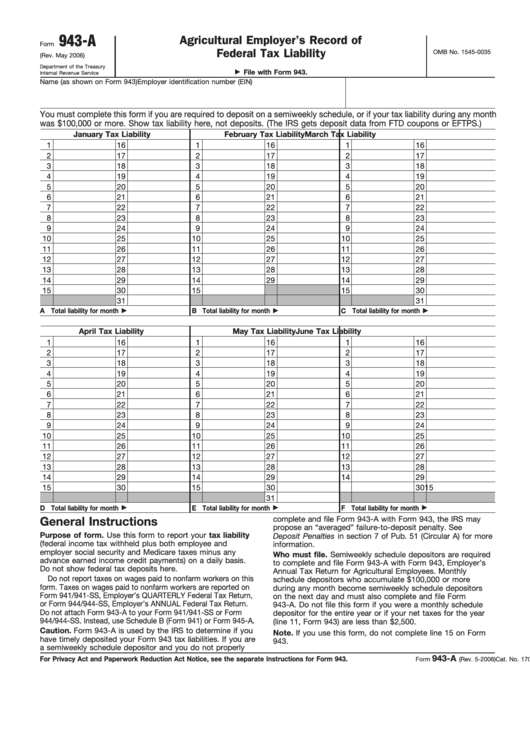

Fillable Form 943A Agricultural Employer'S Record Of Federal Tax

Form 943 (employer’s annual federal tax. Complete, edit or print tax forms instantly. Web fill online, printable, fillable, blank f943 accessible 2019 form 943 form. Web employer’s annual federal tax return. Complete, edit or print tax forms instantly.

Fill Free fillable F943apr Form 943 APR (Rev. October 2017) PDF form

Form 943 (employer’s annual federal tax. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Department of the treasury internal revenue. Web irs form 943: Save or instantly send your ready documents.

IRS Form 943 Complete PDF Tenplate Online in PDF

Use fill to complete blank online irs pdf forms for free. The form lists federal income tax, social. Create a free taxbandits account or login if you have one already step 2: Exception for exempt organizations, federal, state and local. Taxable qualified sick and family leave wages for leave.

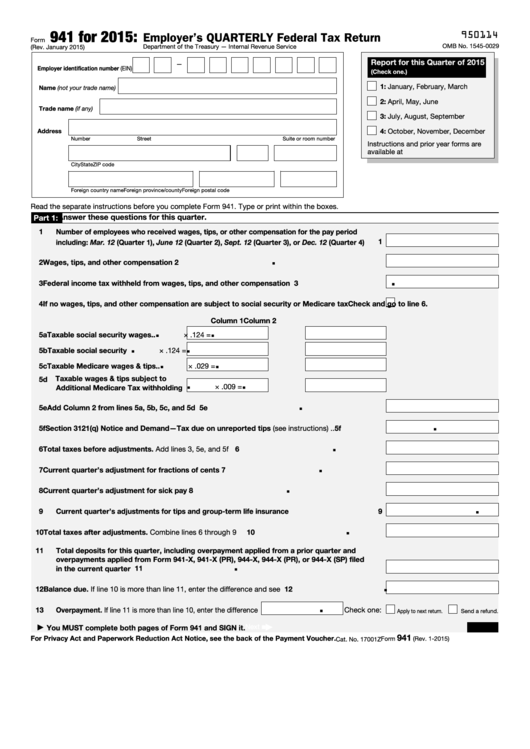

Fillable Form 941 Employer S Quarterly Federal Tax Printable Form 2022

The form lists federal income tax, social. Web simply follow the steps below to file your form 943: Web how you report qualified sick and family leave wages and the credit for qualified sick and family leave wages has changed. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web fillable form 943 (2021) fill.

Form 943 Edit, Fill, Sign Online Handypdf

Line by line instruction for 2022. If you don’t already have an ein, you can. Department of the treasury internal revenue service. Web “form 943,” and “2022” on your check or money order. Web employer’s annual federal tax return.

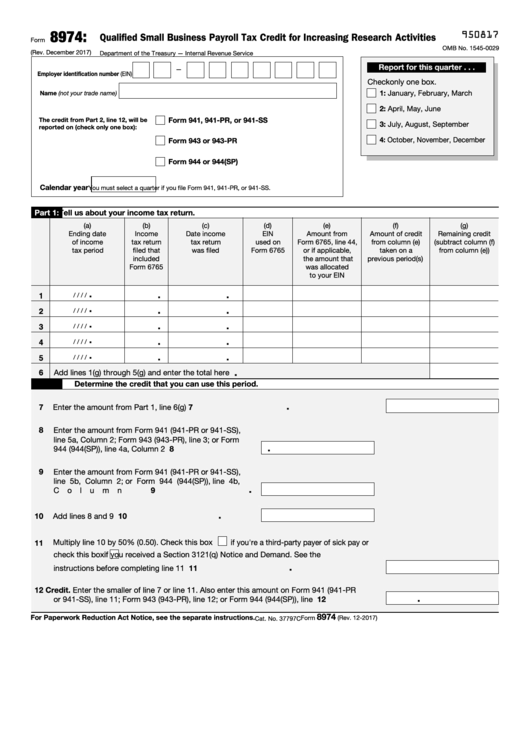

Fillable Form 8974 Qualified Small Business Payroll Tax Credit For

Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. Web simply follow the steps below to file your form 943: Once completed you can sign your fillable. Annual record of federal tax liability and file it with form.

2020 Form IRS 943 Fill Online, Printable, Fillable, Blank pdfFiller

Department of the treasury internal revenue. It is used to record how much income tax,. Complete, edit or print tax forms instantly. Web form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Web ogden, ut 84409.

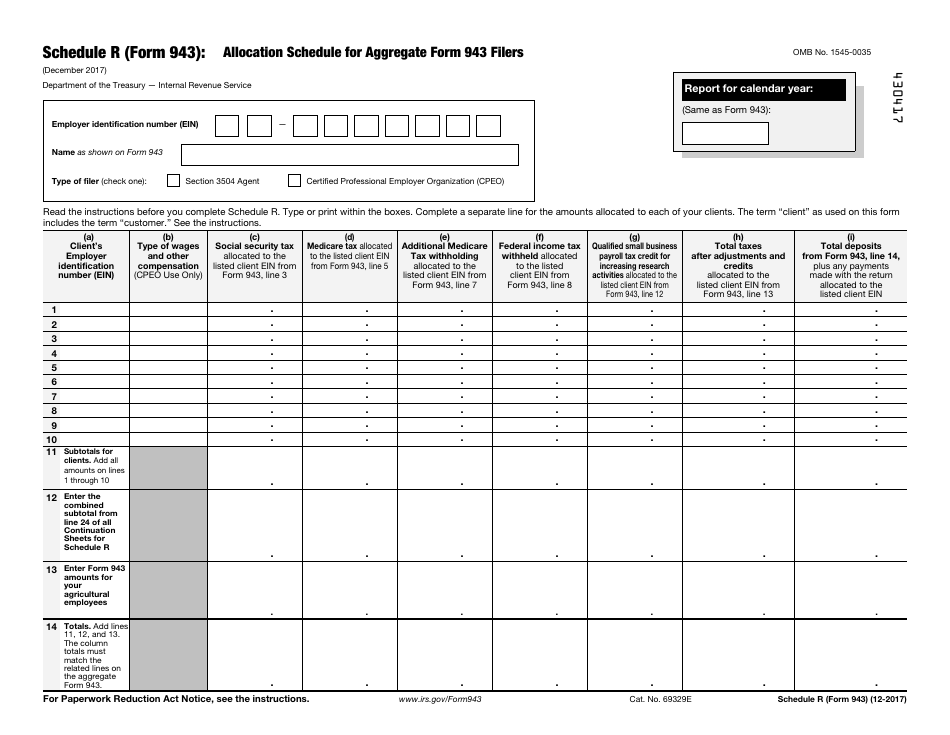

IRS Form 943 Schedule R Download Fillable PDF or Fill Online Allocation

Use fill to complete blank online irs pdf forms for free. Web employer’s annual federal tax return. The form lists federal income tax, social. Annual record of federal tax liability and file it with form 943 if you are a semiweekly depositor or if your tax liability on any day during. Web to fill out form 943, you need your.

Complete, Edit Or Print Tax Forms Instantly.

Edit, sign and save agricultural employer tax form. A form an agricultural employer files with the irs each year to report income and fica taxes it withholds from its employees. Employer’s annual federal tax return for agricultural employees. Form 943, is the employer's.

Complete Irs Tax Forms Online Or Print Government Tax Documents.

Exception for exempt organizations, federal, state and local. Create a free taxbandits account or login if you have one already step 2: Web form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Employer’s annual federal tax return for agricultural employees.

Web How You Report Qualified Sick And Family Leave Wages And The Credit For Qualified Sick And Family Leave Wages Has Changed.

Form 943 (employer’s annual federal tax. Line by line instruction for 2022. Save or instantly send your ready documents. Web employer’s annual federal tax return.

It Is Used To Record How Much Income Tax,.

Web fill online, printable, fillable, blank f943 accessible 2019 form 943 form. Taxable qualified sick and family leave wages for leave. Complete, edit or print tax forms instantly. Web to fill out form 943, you need your employer identification number (ein), your legal name, and your business address.