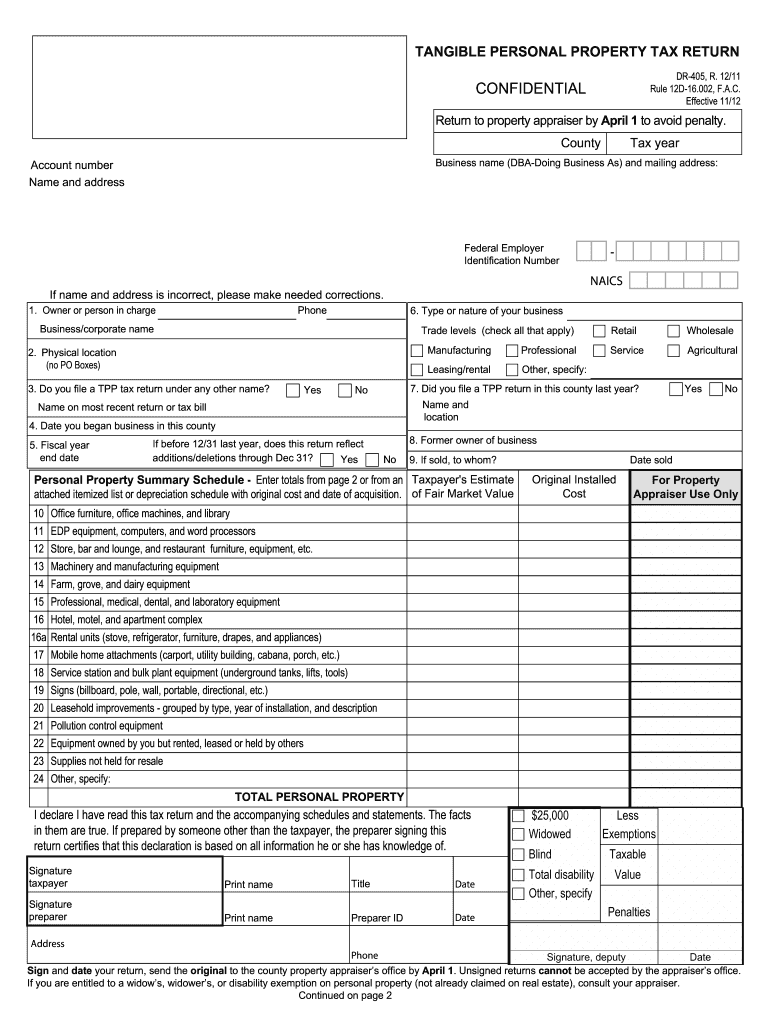

Florida Form Dr 405

Florida Form Dr 405 - Web each return is eligible for an exemption up to $25,000. Edit your tangible personal property tax online type text, add images, blackout confidential details, add comments, highlights and more. Complete, sign, print and send your tax documents easily with us legal forms. Report all property located in the county on january 1. You must file a single return for each site in. Account number name and address if name and address is incorrect, please make needed corrections. Please use this form to file your return, or attach it to your computer prepared form. If you were required to file a return in the previous year but did not, you may have to pay a. You have not added any tangible personal property since january 1 and the value of your. Untrended depreciation schedule (for use on replacement cost new) equipment index.

Please use this form to file your return, or attach it to your computer prepared form. Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value of your tangible. If you were required to file a return in the previous year but did not, you may have to pay a. In fact, at least one county requires the form to be filed online from the county's web site. Web each return is eligible for an exemption up to $25,000. Account number name and address if name and address is incorrect, please make needed corrections. Tangible personal property tax return, r. Download blank or fill out online in pdf format. Edit your tangible personal property tax online type text, add images, blackout confidential details, add comments, highlights and more. Untrended depreciation schedule (for use on replacement cost new) equipment index.

You must file a single return for each site in. Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value of your tangible. You have not added any tangible personal property since january 1 and the value of your. Web each return is eligible for an exemption up to $25,000. If you were required to file a return in the previous year but did not, you may have to pay a. Download blank or fill out online in pdf format. Web tpp tax return & instructions: Report all property located in the county on january 1. Please use this form to file your return, or attach it to your computer prepared form. Sign it in a few clicks draw.

Dr 405 instructions Fill Out and Sign Printable PDF Template signNow

If you were required to file a return in the previous year but did not, you may have to pay a. Tangible personal property tax return, r. You have not added any tangible personal property since january 1 and the value of your. Account number name and address if name and address is incorrect, please make needed corrections. Complete, sign,.

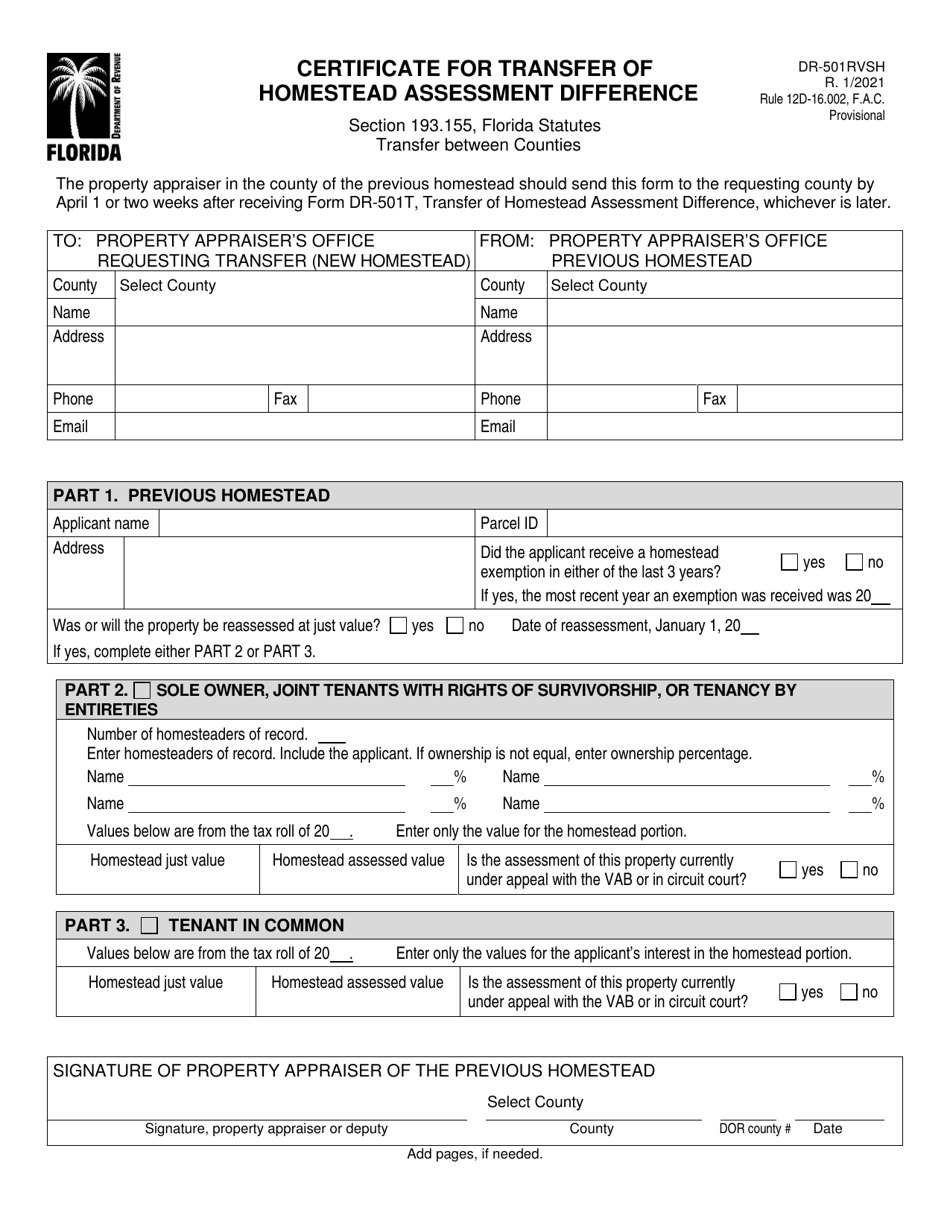

Form DR501RVSH Download Fillable PDF or Fill Online Certificate for

In fact, at least one county requires the form to be filed online from the county's web site. You must file a single return for each site in. Report all property located in the county on january 1. Report all property located in the county on january 1. Notice to taxpayer whose personal property return was waived in the previous.

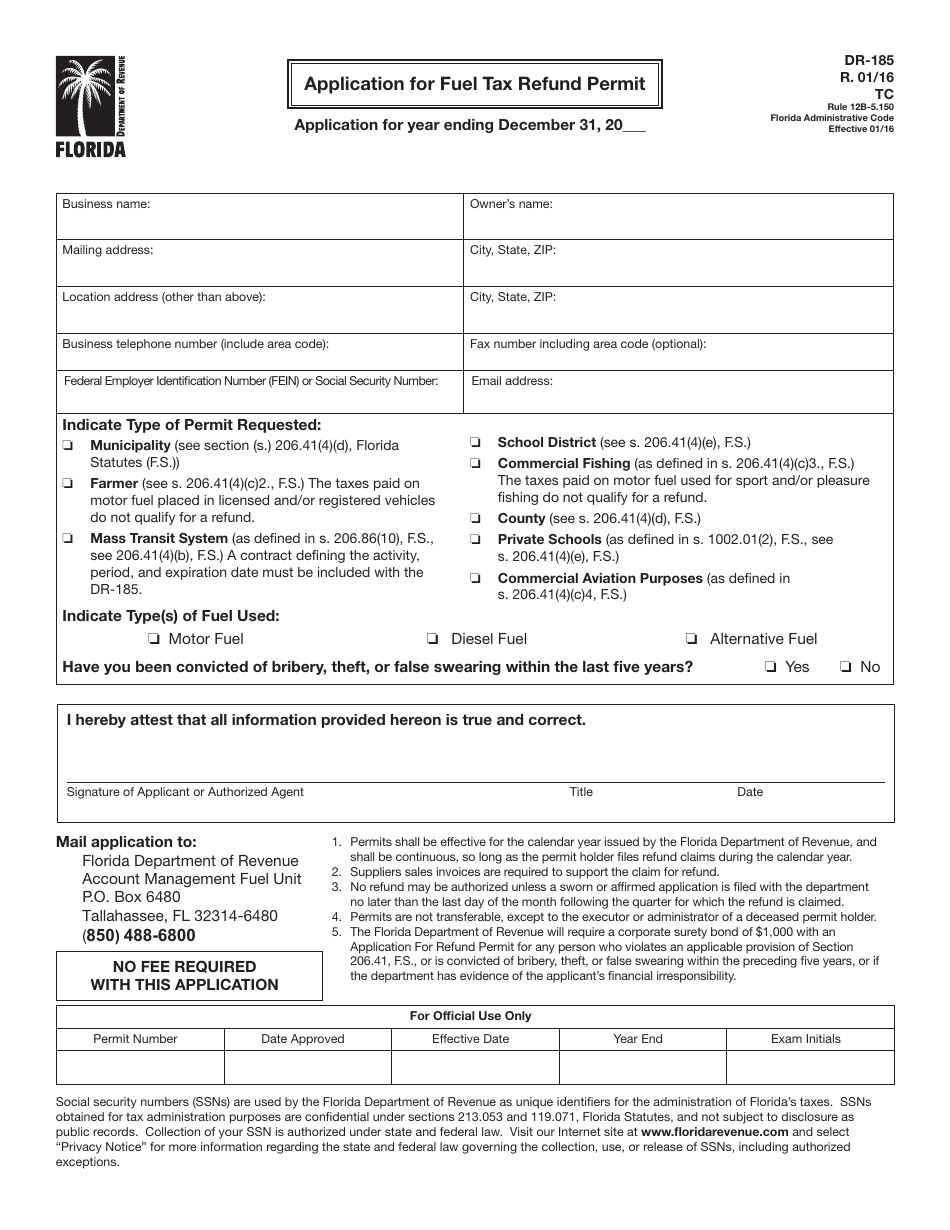

Form DR185 Download Printable PDF or Fill Online Application for Fuel

Edit your tangible personal property tax online type text, add images, blackout confidential details, add comments, highlights and more. Tangible personal property tax return, r. Report all property located in the county on january 1. Please use this form to file your return, or attach it to your computer prepared form. You must file a single return for each site.

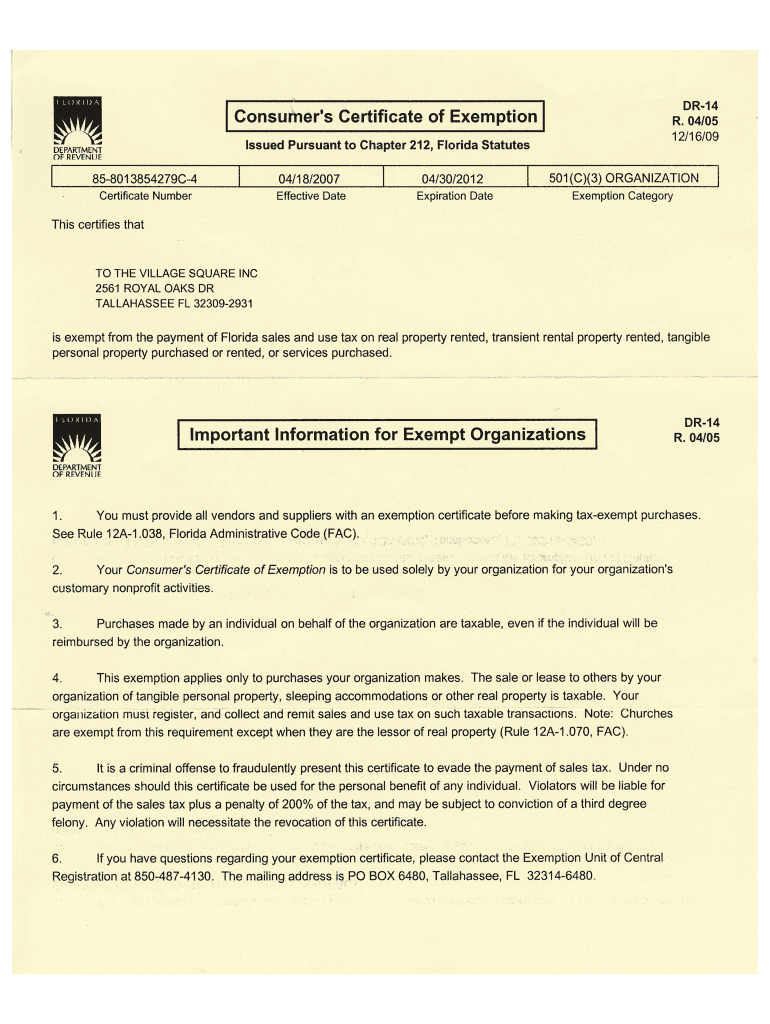

Dr 14 Form Fill Out and Sign Printable PDF Template signNow

Download blank or fill out online in pdf format. Web tpp tax return & instructions: You must file a single return for each site in. Sign it in a few clicks draw. Report all property located in the county on january 1.

Form DR157WT Download Printable PDF or Fill Online Additional Fuel

Please use this form to file your return, or attach it to your computer prepared form. Notice to taxpayer whose personal property return was waived in the previous year:. You have not added any tangible personal property since january 1 and the value of your. Web each return is eligible for an exemption up to $25,000. Web all businesses are.

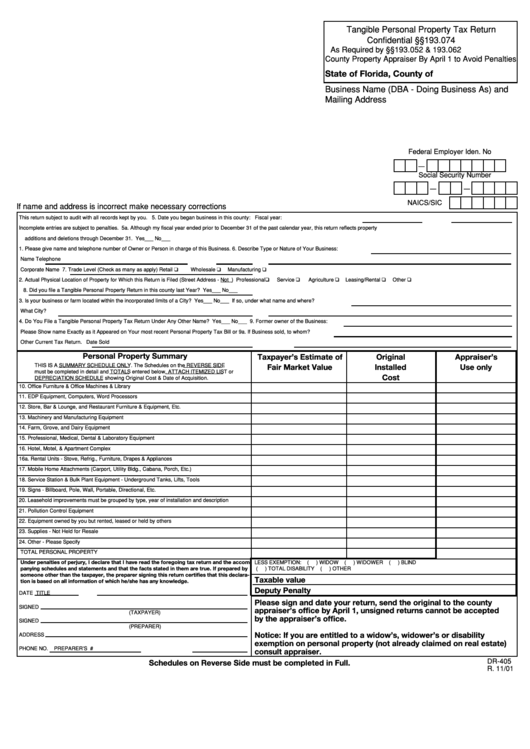

Form Dr405 Tangible Personal Property Tax Return 2001 printable pdf

If you do not file on time, florida law provides for the loss of the $25,000 exemption. Tangible personal property tax return, r. Please use this form to file your return, or attach it to your computer prepared form. If you were required to file a return in the previous year but did not, you may have to pay a..

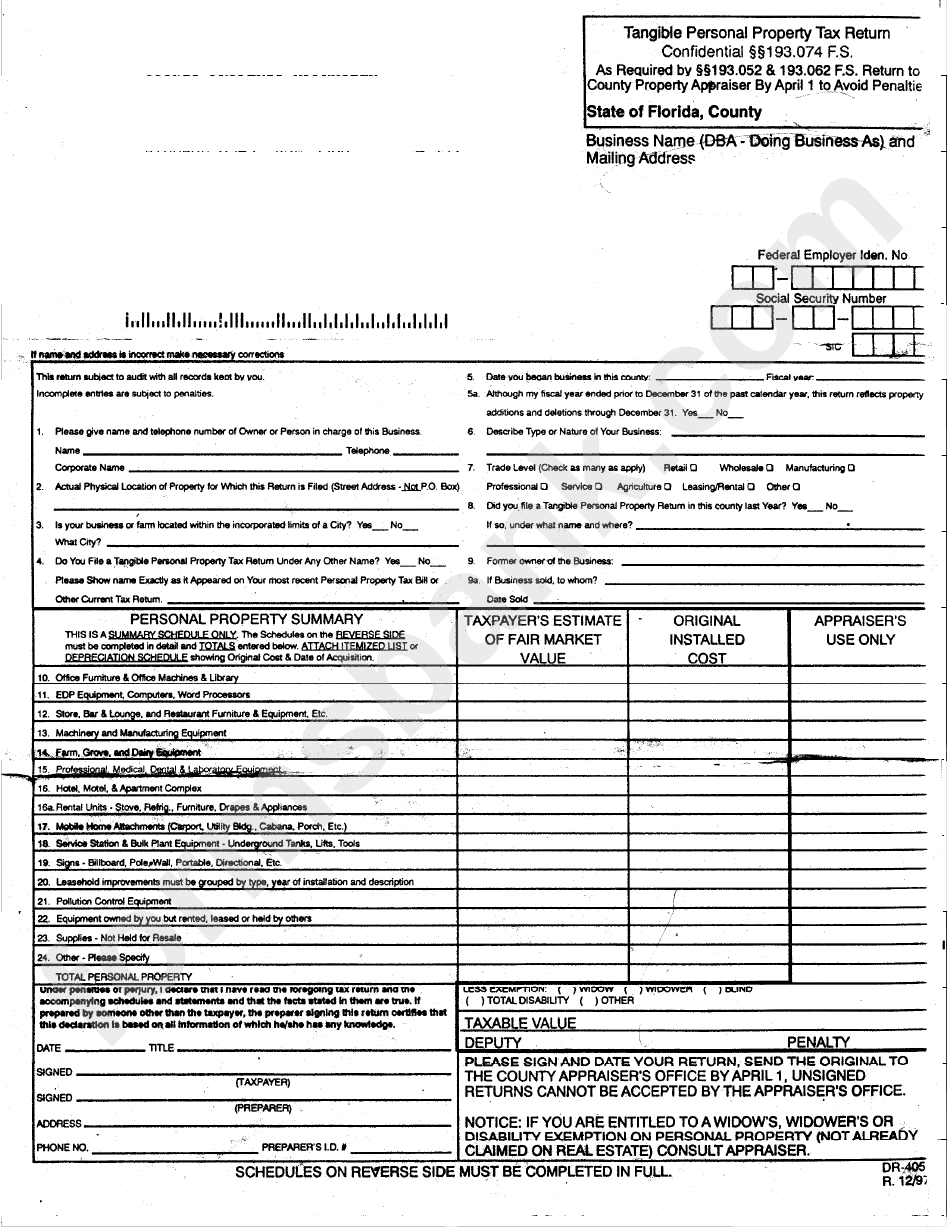

Fillable Form Dr405 Tangible Personal Property Tax Return printable

In fact, at least one county requires the form to be filed online from the county's web site. Account number name and address if name and address is incorrect, please make needed corrections. Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value.

1997 Form FL DoR DR405 Fill Online, Printable, Fillable, Blank PDFfiller

Sign it in a few clicks draw. Report all property located in the county on january 1. Tangible personal property tax return, r. Please use this form to file your return, or attach it to your computer prepared form. Edit your tangible personal property tax online type text, add images, blackout confidential details, add comments, highlights and more.

20162021 Form FL DR15AIR Fill Online, Printable, Fillable, Blank

If you do not file on time, florida law. Web each return is eligible for an exemption up to $25,000. You must file a single return for each site in. Tangible personal property tax return, r. Download blank or fill out online in pdf format.

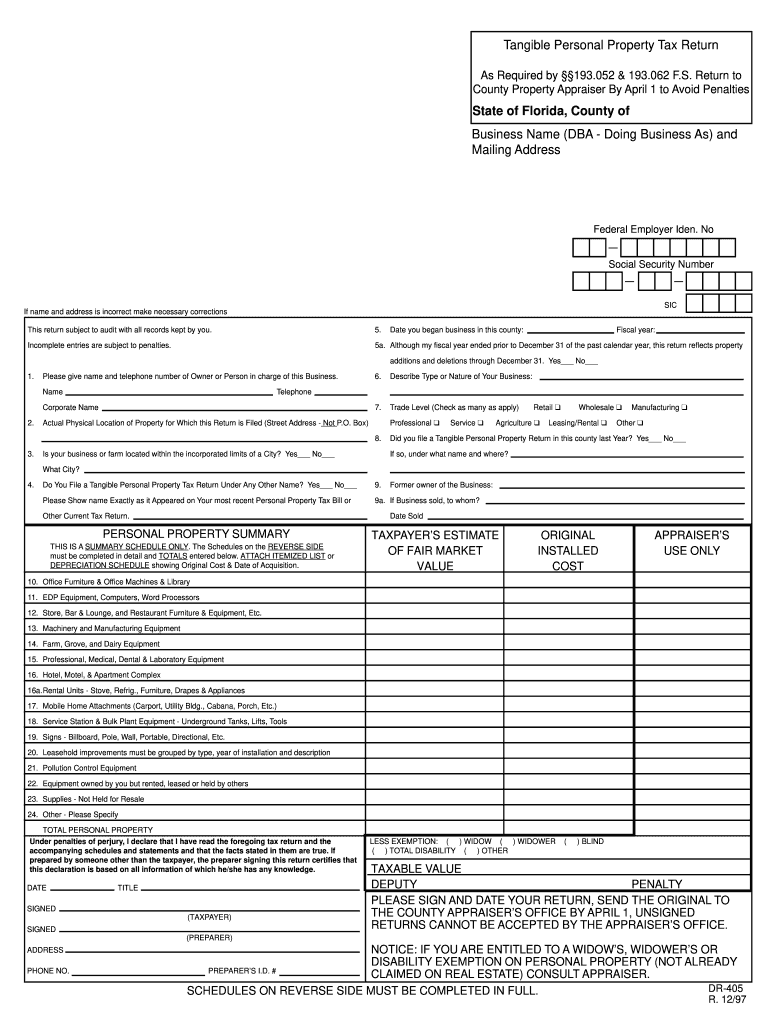

form dr 405 florida Fill out & sign online DocHub

Sign it in a few clicks draw. You have not added any tangible personal property since january 1 and the value of your. Web mail this form to your county property appraiser. In fact, at least one county requires the form to be filed online from the county's web site. Untrended depreciation schedule (for use on replacement cost new) equipment.

Web All Businesses Are Required To File A Tangible Personal Property Tax Return ( Form Dr 405) Annually By April 1St (Florida Statutes 193.062), Unless The Value Of Your Tangible.

You have not added any tangible personal property since january 1 and the value of your. You must file a single return for each site in. Complete, sign, print and send your tax documents easily with us legal forms. Notice to taxpayer whose personal property return was waived in the previous year:.

Web Each Return Is Eligible For An Exemption Up To $25,000.

Report all property located in the county on january 1. Download blank or fill out online in pdf format. Please use this form to file your return, or attach it to your computer prepared form. If you do not file on time, florida law.

Untrended Depreciation Schedule (For Use On Replacement Cost New) Equipment Index.

Edit your tangible personal property tax online type text, add images, blackout confidential details, add comments, highlights and more. Web tpp tax return & instructions: If you do not file on time, florida law provides for the loss of the $25,000 exemption. If you were required to file a return in the previous year but did not, you may have to pay a.

In Fact, At Least One County Requires The Form To Be Filed Online From The County's Web Site.

Sign it in a few clicks draw. Tangible personal property tax return, r. Report all property located in the county on january 1. Web mail this form to your county property appraiser.