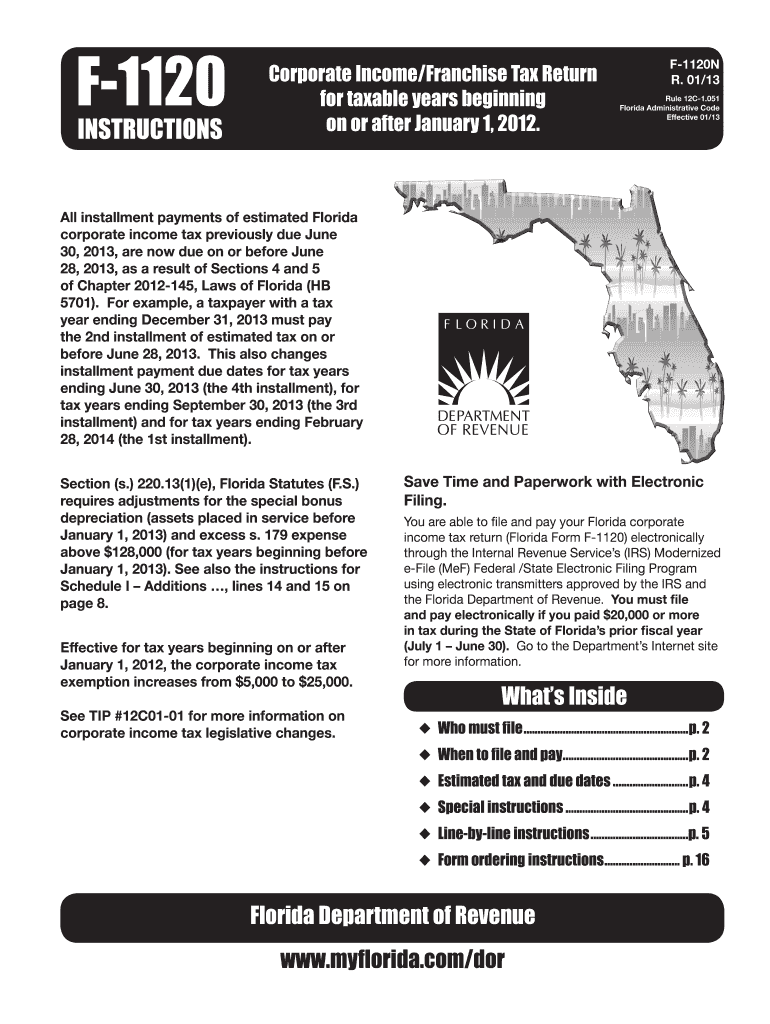

Florida Form F-1120 Instructions 2021

Florida Form F-1120 Instructions 2021 - Florida corporate short form income tax return. Florida net capital loss carryover deduction (see instructions) 4. Web instructions for corporate income/franchise tax return for taxable years beginning on or after january 1, 2021 uwho must file. Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Federal taxable income state income taxes deducted in computing. Complete, edit or print tax forms instantly. An extension of time will be void if: Web rate the florida form f 1120. Rate f 1120 as 5 stars rate f 1120 as 4 stars rate f 1120 as 3 stars rate f 1120 as 2 stars rate f 1120 as 1 stars. How do i submit this additional information?

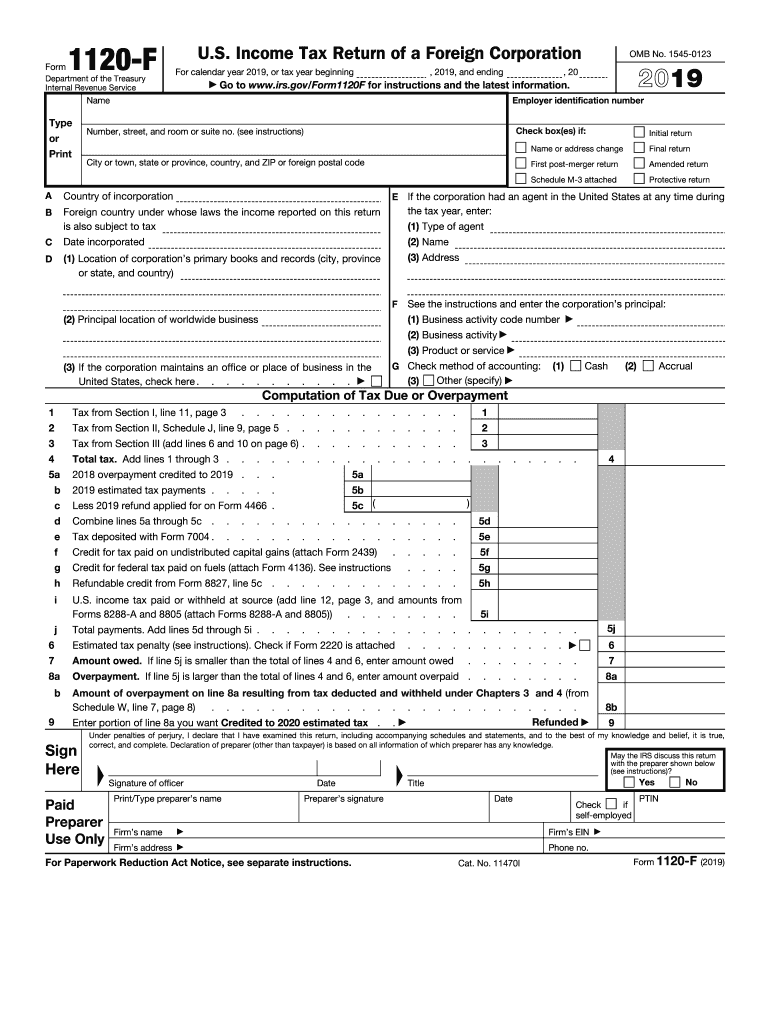

Florida corporate income/franchise tax return for 2020 tax year: Web rate the florida form f 1120. Rate f 1120 as 5 stars rate f 1120 as 4 stars rate f 1120 as 3 stars rate f 1120 as 2 stars rate f 1120 as 1 stars. Income tax return of a foreign corporation department of the treasury. Web instructions for corporate income/franchise tax return for taxable years beginning on or after january 1, 2021 uwho must file. Section 220.27, florida statutes, requires an. An extension of time will be void if: For paperwork reduction act notice, see separate instructions. Web we would like to show you a description here but the site won’t allow us. Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information.

Web rate the florida form f 1120. Florida net capital loss carryover deduction (see instructions) 4. Florida corporate income/franchise tax return for 2020 tax year: Insurance companies (attach copy of. Rate f 1120 as 5 stars rate f 1120 as 4 stars rate f 1120 as 3 stars rate f 1120 as 2 stars rate f 1120 as 1 stars. Section 220.27, florida statutes, requires an. An extension of time will be void if: Web part i fill in applicable items and use part ii to explain as originally reported or as adjusted any changes. Florida corporate short form income tax return. Complete, edit or print tax forms instantly.

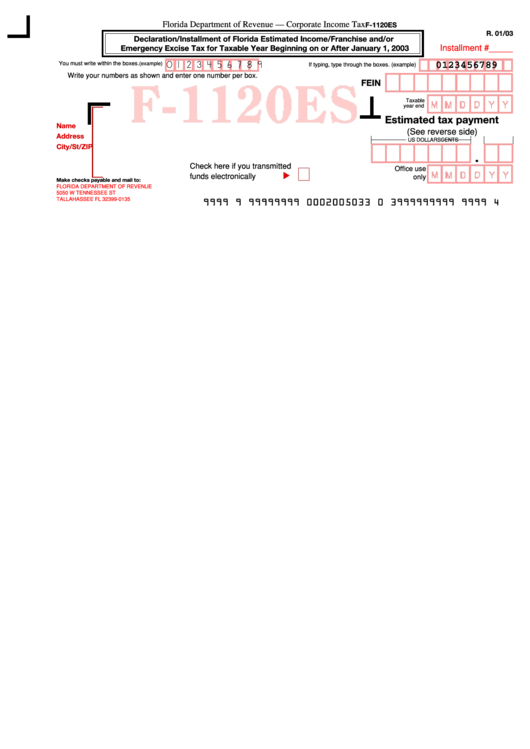

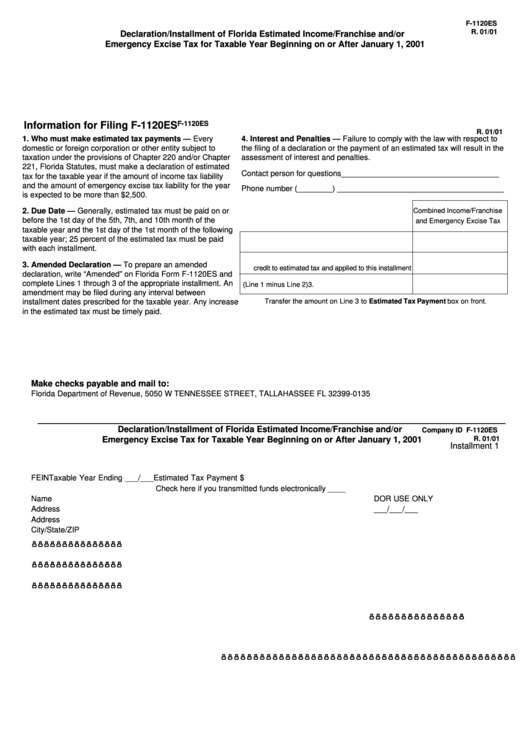

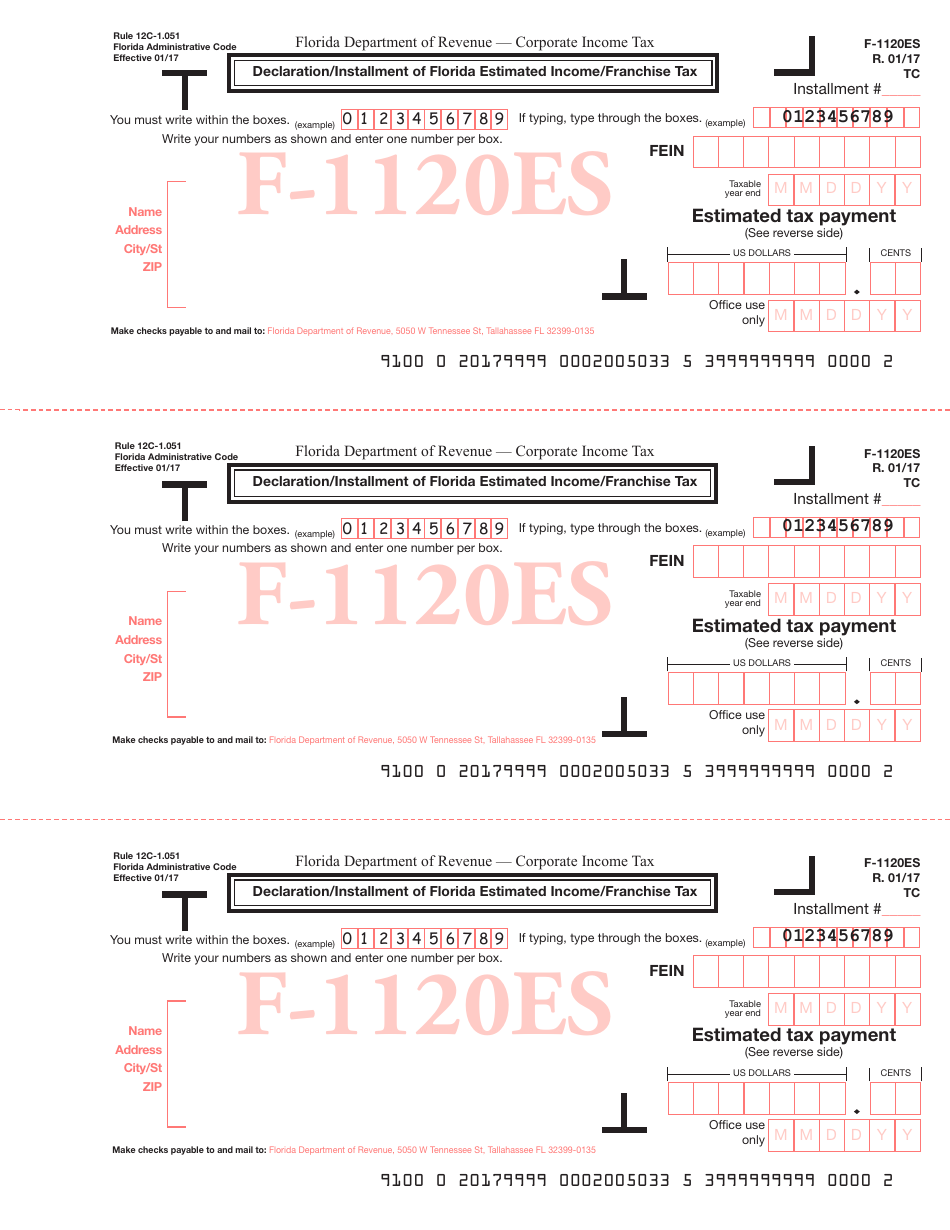

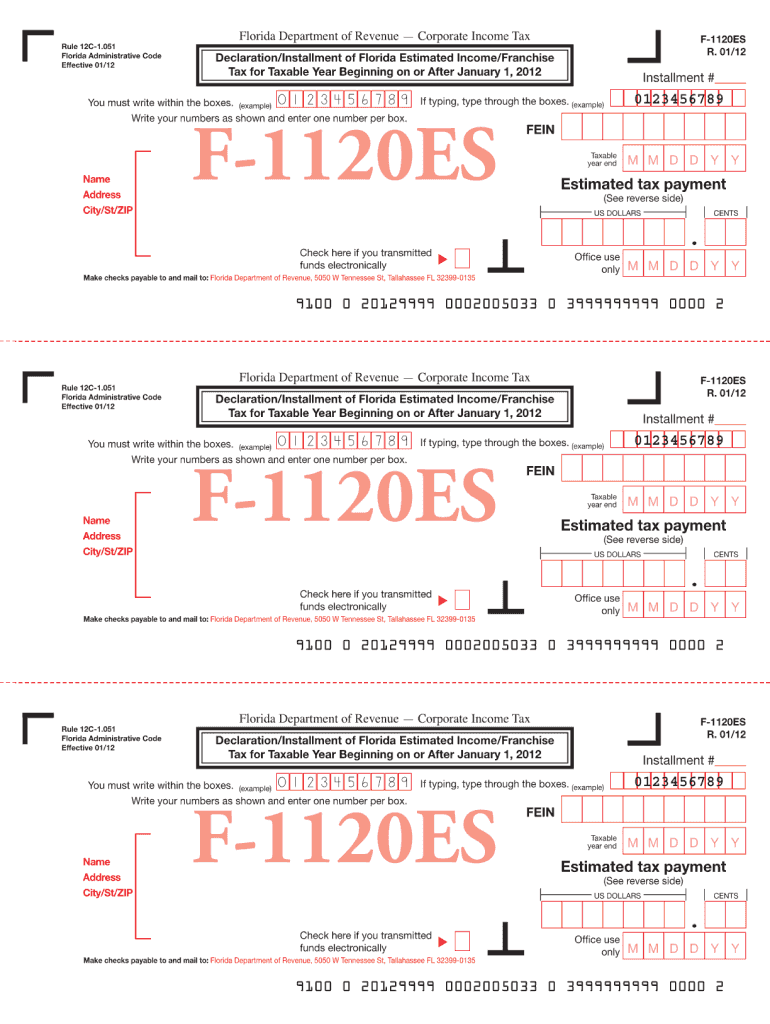

Form F1120es Declaration/installment Of Florida Estimated

Income tax return of a foreign corporation department of the treasury. Insurance companies (attach copy of. Complete, edit or print tax forms instantly. Section 220.27, florida statutes, requires an. Florida corporate short form income tax return.

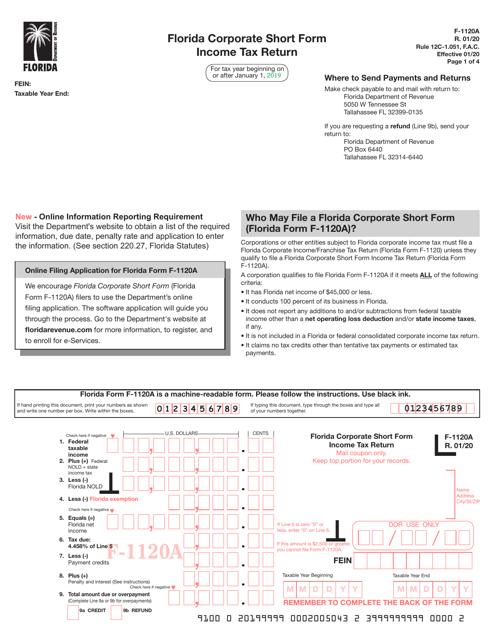

Form F1120A Download Printable PDF or Fill Online Florida Corporate

Insurance companies (attach copy of. Complete, edit or print tax forms instantly. An extension of time will be void if: Web instructions for corporate income/franchise tax return for taxable years beginning on or after january 1, 2021 uwho must file. Rate f 1120 as 5 stars rate f 1120 as 4 stars rate f 1120 as 3 stars rate f.

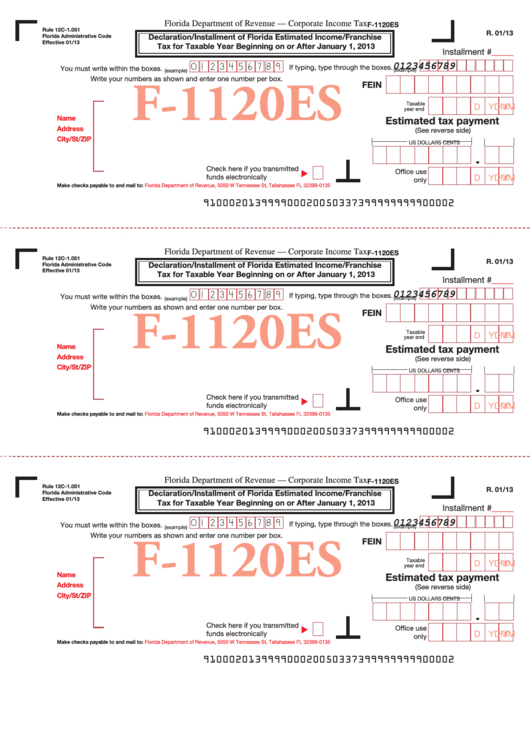

Form F1120es Declaration/installment Of Florida Estimated

2 uwhen to file and pay. Florida corporate income/franchise tax return for 2020 tax year: Florida corporate short form income tax return. How do i submit this additional information? Web we would like to show you a description here but the site won’t allow us.

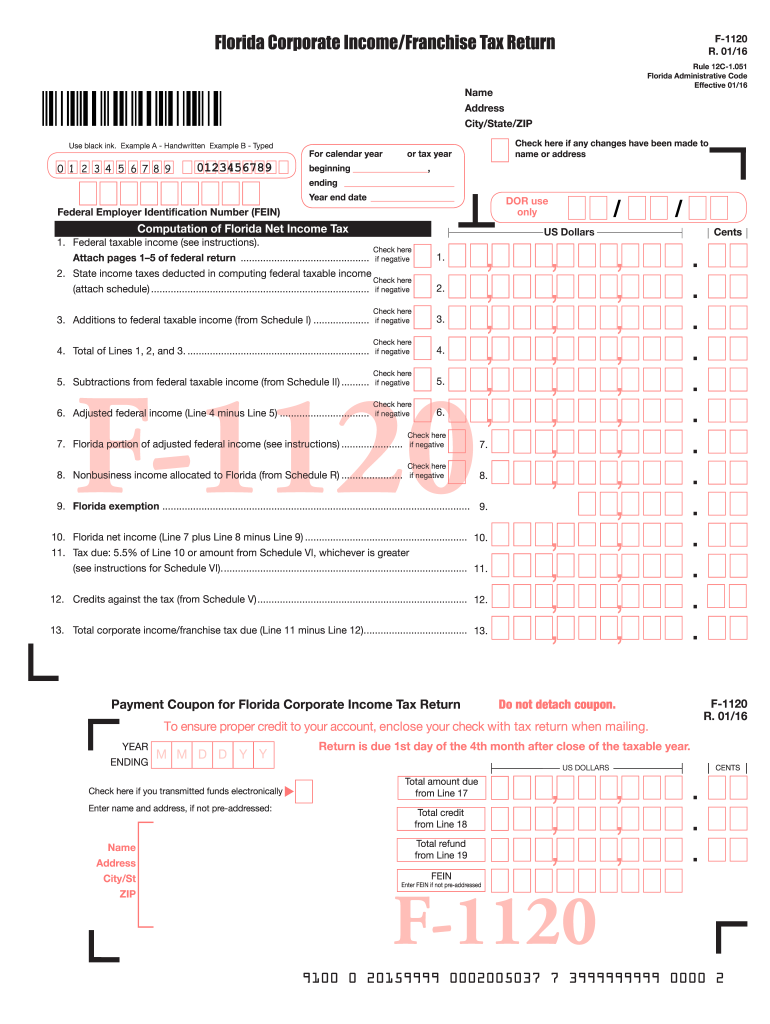

F 1120 2016 form Fill out & sign online DocHub

An extension of time will be void if: Income tax return of a foreign corporation department of the treasury. Web rate the florida form f 1120. Complete, edit or print tax forms instantly. Federal taxable income state income taxes deducted in computing.

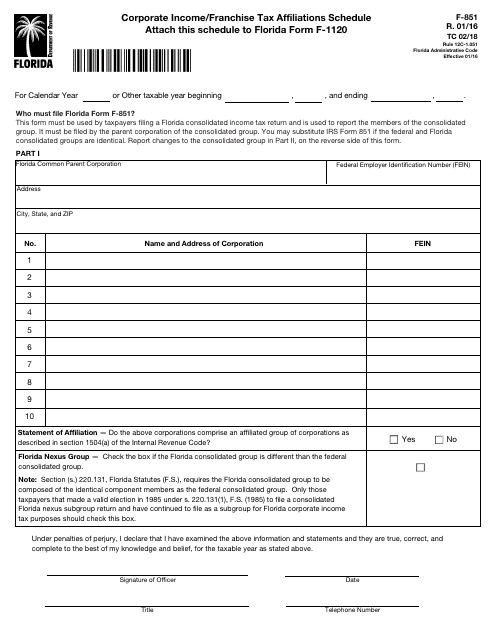

Form F1120 Schedule F851 Download Fillable PDF or Fill Online

How do i submit this additional information? Federal taxable income state income taxes deducted in computing. Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. For paperwork reduction act notice, see separate instructions. Web we would like to show you a description here but.

Fl F 1120 Instructions Form Fill Out and Sign Printable PDF Template

How do i submit this additional information? Florida corporate income/franchise tax return for 2020 tax year: An extension of time will be void if: Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Insurance companies (attach copy of.

Form F1120es Declaration/installment Of Florida Estimated

Rate f 1120 as 5 stars rate f 1120 as 4 stars rate f 1120 as 3 stars rate f 1120 as 2 stars rate f 1120 as 1 stars. How do i submit this additional information? For paperwork reduction act notice, see separate instructions. Florida corporate income/franchise tax return for 2020 tax year: Section 220.27, florida statutes, requires an.

2019 Form IRS 1120F Fill Online, Printable, Fillable, Blank pdfFiller

For paperwork reduction act notice, see separate instructions. An extension of time will be void if: Federal taxable income state income taxes deducted in computing. Florida corporate income/franchise tax return for 2020 tax year: Web instructions for corporate income/franchise tax return for taxable years beginning on or after january 1, 2021 uwho must file.

Form F1120ES Download Printable PDF or Fill Online Declaration

Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Web part i fill in applicable items and use part ii to explain as originally reported or as adjusted any changes. Florida net capital loss carryover deduction (see instructions) 4. Rate f 1120 as 5.

Florida Form F 1120Es Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Florida corporate income/franchise tax return for 2020 tax year: Florida net capital loss carryover deduction (see instructions) 4. Rate f 1120 as 5 stars rate f 1120 as 4 stars rate f 1120 as 3 stars rate f 1120 as 2 stars rate f 1120 as 1 stars. Income tax return of a.

An Extension Of Time Will Be Void If:

Florida net capital loss carryover deduction (see instructions) 4. Income tax return of a foreign corporation department of the treasury. Corporation income tax return for calendar year 2021 or tax year beginning, 2021, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Complete, edit or print tax forms instantly.

Section 220.27, Florida Statutes, Requires An.

Rate f 1120 as 5 stars rate f 1120 as 4 stars rate f 1120 as 3 stars rate f 1120 as 2 stars rate f 1120 as 1 stars. Web rate the florida form f 1120. Insurance companies (attach copy of. For paperwork reduction act notice, see separate instructions.

Web Part I Fill In Applicable Items And Use Part Ii To Explain As Originally Reported Or As Adjusted Any Changes.

Florida corporate short form income tax return. Web instructions for corporate income/franchise tax return for taxable years beginning on or after january 1, 2021 uwho must file. Web we would like to show you a description here but the site won’t allow us. Florida corporate income/franchise tax return for 2020 tax year:

Federal Taxable Income State Income Taxes Deducted In Computing.

How do i submit this additional information? 2 uwhen to file and pay.