Florida Irrevocable Trust Form

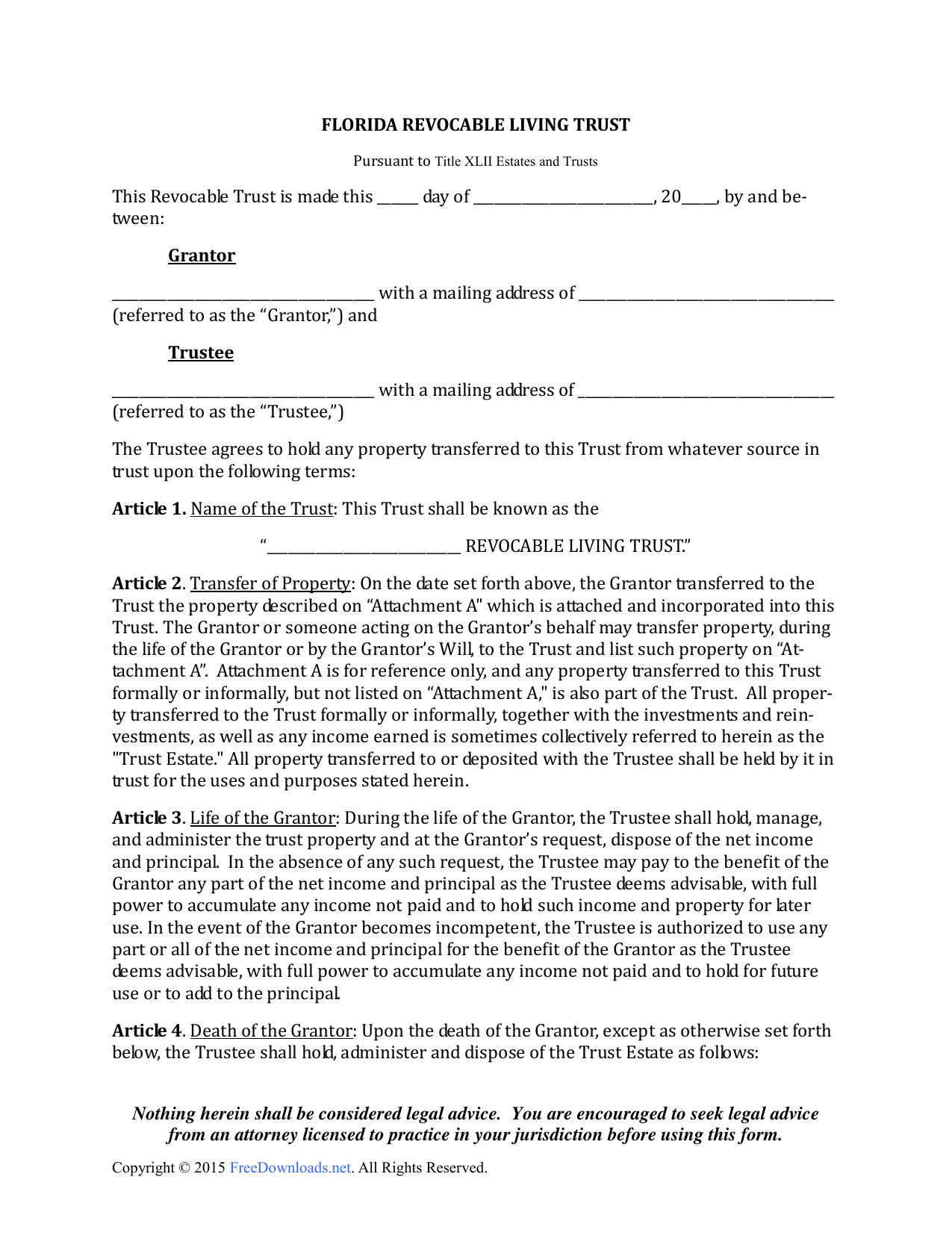

Florida Irrevocable Trust Form - Best tool to create, edit & share pdfs. This trust shall be known. (1) after the settlor’s death, a trust may be modified. Web 2) give notice to the qualified beneficiaries within 60 days of the creation of an irrevocable trust or the date a formerly revocable trust has become irrevocable, [5] of the trust’s. Pdffiller allows users to edit, sign, fill and share all type of documents online. Web if all or part of a living trust has become irrevocable after the death of a trustmaker, the successor trustee must obtain a federal taxpayer identification number. Web if you have questions about modifying an irrevocable trust created under florida law, we invite you to schedule a confidential consultation with a boca raton estate planning. Web an irrevocable trust in florida can help you meet your estate planning and asset protection goals, such as: Web florida irrevocable trust law, including spendthrift provisions, execution, discretionary distribution, and alive trusts. Web the trustee agrees to hold any property transferred to this trust, from whatever source, in trust under the following terms:

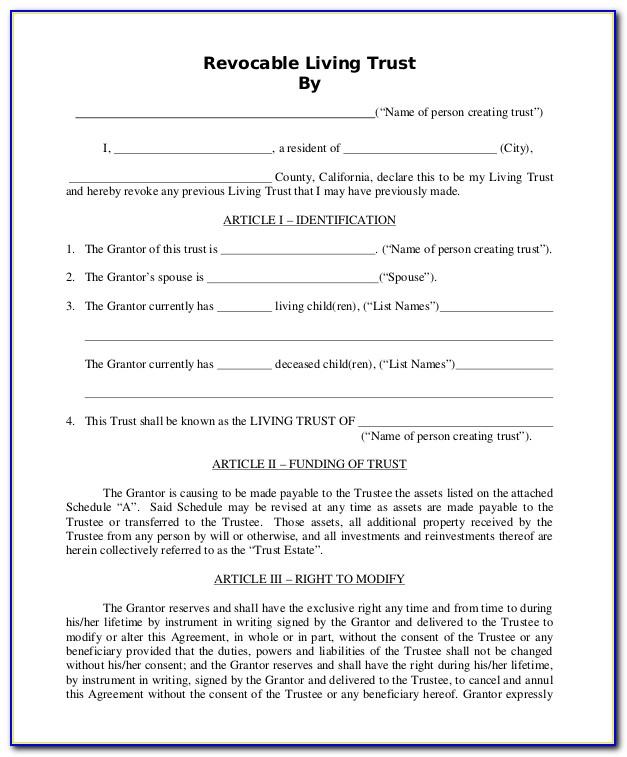

Ad draft legal documents through the cloud using a dynamic interview process. Web 2) give notice to the qualified beneficiaries within 60 days of the creation of an irrevocable trust or the date a formerly revocable trust has become irrevocable, [5] of the trust’s. Web the trustee agrees to hold any property transferred to this trust, from whatever source, in trust under the following terms: Web it is settlor's desire, by this instrument, to create an inter vivos irrevocable special needs trust, whereby the property placed in trust shall be managed for the benefit of the. Web a revocable trust becomes a separate entity for federal income tax purposes when it becomes irrevocable, or stops reporting income under your social security number for. This trust shall be known. Web florida irrevocable trust form category: Ad vast library of fillable legal documents. Web irrevocable asset protection trusts for medicaid and va purposes. An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary.

Web florida trust code. Web the trustee agrees to hold any property transferred to this trust, from whatever source, in trust under the following terms: Pdffiller allows users to edit, sign, fill and share all type of documents online. Florida will and trust forms a living trust is an effective estate. An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Web florida irrevocable trust law, including spendthrift provisions, execution, discretionary distribution, and alive trusts. Web it is settlor's desire, by this instrument, to create an inter vivos irrevocable special needs trust, whereby the property placed in trust shall be managed for the benefit of the. Web irrevocable trust irrevocable trust agreement this agreement made and entered into the ___ day of __ , __ , by and between _____ , an adult resident of ___ ,. Web if all or part of a living trust has become irrevocable after the death of a trustmaker, the successor trustee must obtain a federal taxpayer identification number. Ad draft legal documents through the cloud using a dynamic interview process.

Florida Irrevocable Trust Execution Formalities Form Resume

This trust shall be known. Historically, courts held the belief that the intent of. Web if you have questions about modifying an irrevocable trust created under florida law, we invite you to schedule a confidential consultation with a boca raton estate planning. Ad vast library of fillable legal documents. Ad instant download and complete your irrevocable trust forms, start now!

Florida Nfa Gun Trust Form Universal Network

Ad instant download and complete your irrevocable trust forms, start now! Ad vast library of fillable legal documents. Web an irrevocable trust in florida can help you meet your estate planning and asset protection goals, such as: Free living will and designation of healthcare surrogate request information. 736.0412 nonjudicial modification of irrevocable trust.—.

Florida Irrevocable Trust Execution Formalities Form Resume

Web a revocable trust becomes a separate entity for federal income tax purposes when it becomes irrevocable, or stops reporting income under your social security number for. Web an irrevocable trust in florida can help you meet your estate planning and asset protection goals, such as: Web florida irrevocable trust form category: Florida will and trust forms a living trust.

Irrevocable Trust Template Florida Template 1 Resume Examples

Historically, courts held the belief that the intent of. Best tool to create, edit & share pdfs. Free living will and designation of healthcare surrogate request information. Web this article discusses creating such an irrevocable trust and the treatment of such trusts for federal income tax, estate tax, ad valorem tax, and the treatment of such trusts for. Web irrevocable.

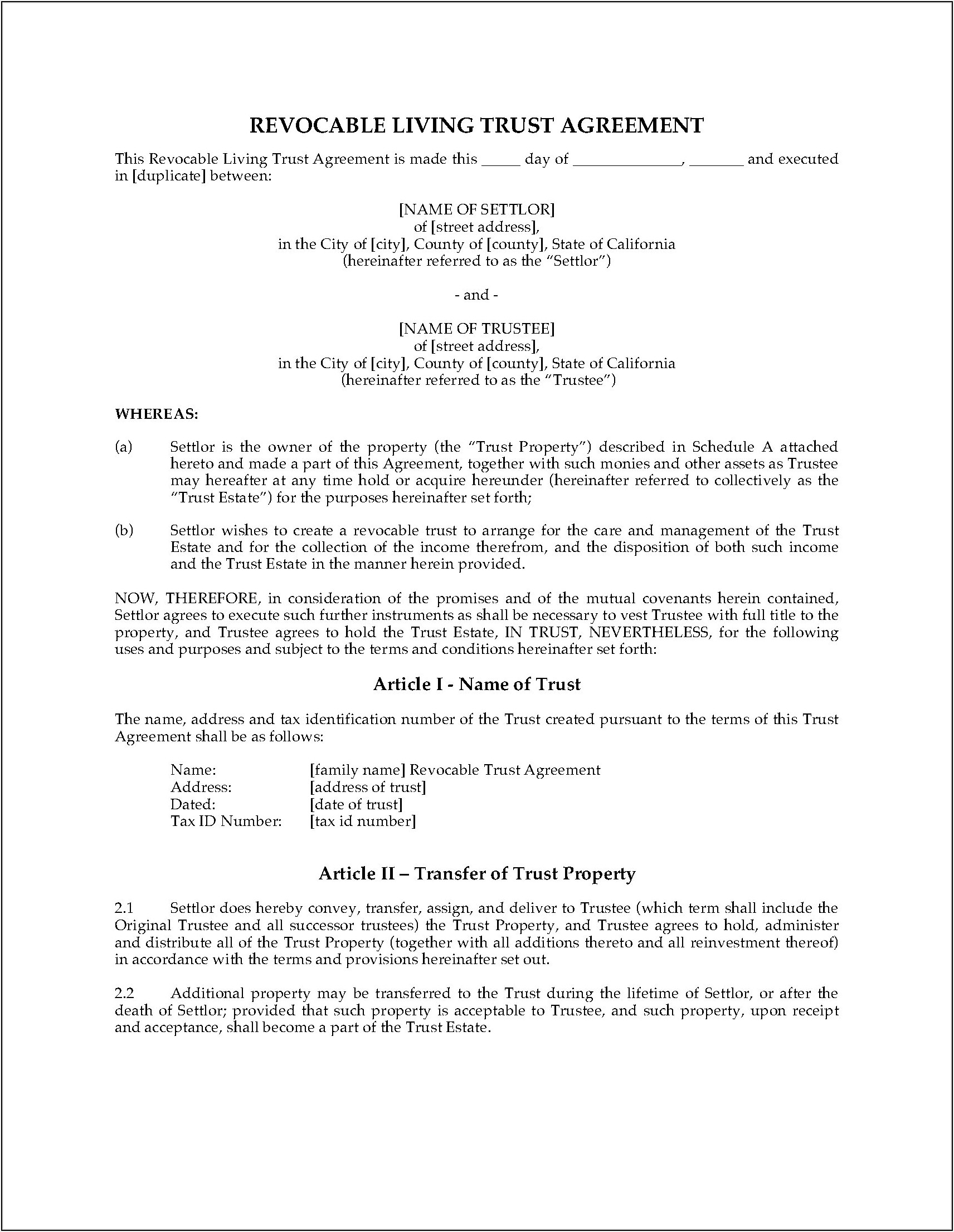

Download Florida Revocable Living Trust Form PDF RTF Word

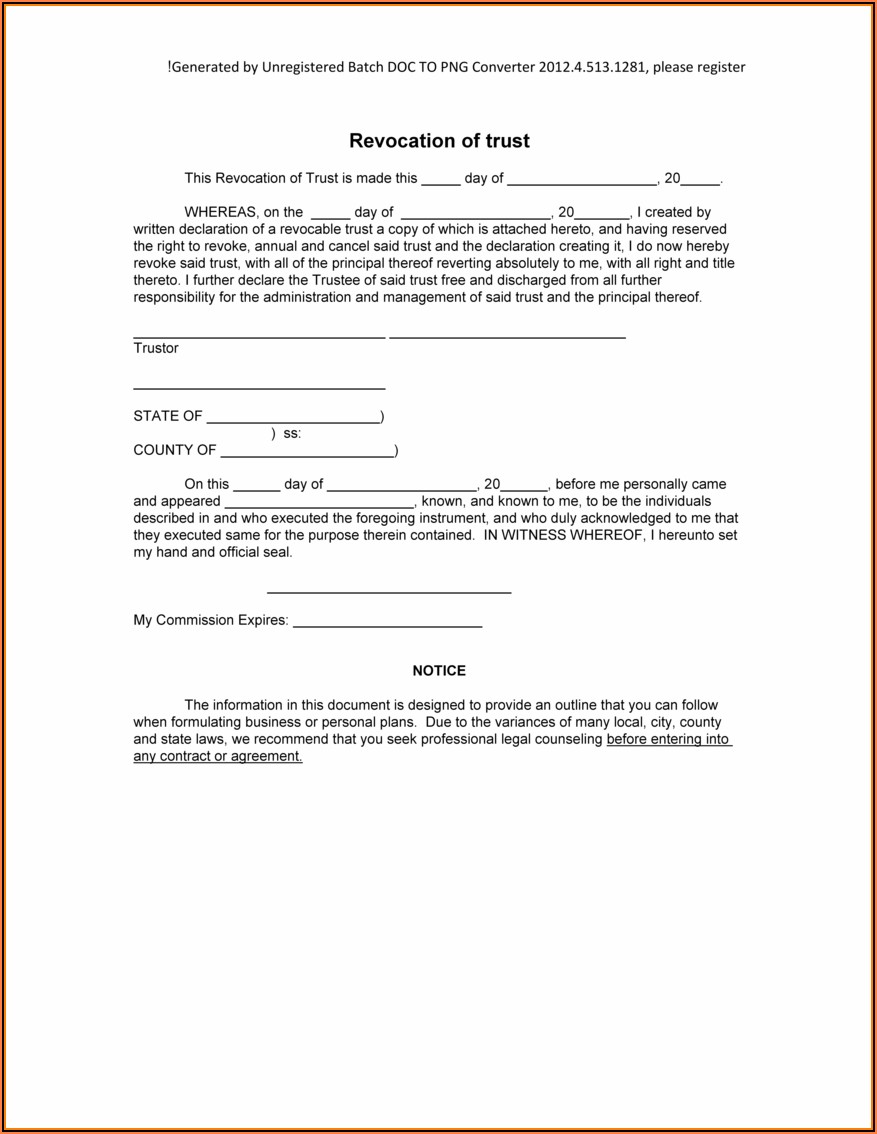

Web in florida, courts are now permitted to judicially modify an irrevocable trust even when a trust is unambiguous. Ad vast library of fillable legal documents. Web this article discusses creating such an irrevocable trust and the treatment of such trusts for federal income tax, estate tax, ad valorem tax, and the treatment of such trusts for. Best tool to.

Irrevocable Trust Template Nevada Template 1 Resume Examples

736.0412 nonjudicial modification of irrevocable trust.—. Best tool to create, edit & share pdfs. Florida will and trust forms a living trust is an effective estate. Web florida irrevocable trust law, including spendthrift provisions, execution, discretionary distribution, and alive trusts. Web an irrevocable trust in florida can help you meet your estate planning and asset protection goals, such as:

Free Revocable Living Trust Forms Florida

Web this article discusses creating such an irrevocable trust and the treatment of such trusts for federal income tax, estate tax, ad valorem tax, and the treatment of such trusts for. Ad draft legal documents through the cloud using a dynamic interview process. Web if all or part of a living trust has become irrevocable after the death of a.

Irrevocable Trust Form Texas Universal Network

Web florida irrevocable trust law, including spendthrift provisions, execution, discretionary distribution, and alive trusts. Web if you have questions about modifying an irrevocable trust created under florida law, we invite you to schedule a confidential consultation with a boca raton estate planning. Web in florida, courts are now permitted to judicially modify an irrevocable trust even when a trust is.

Irrevocable Trust Form Colorado Universal Network

An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Web 2) give notice to the qualified beneficiaries within 60 days of the creation of an irrevocable trust or the date a formerly revocable trust has become irrevocable, [5] of the trust’s. Web the trustee agrees to.

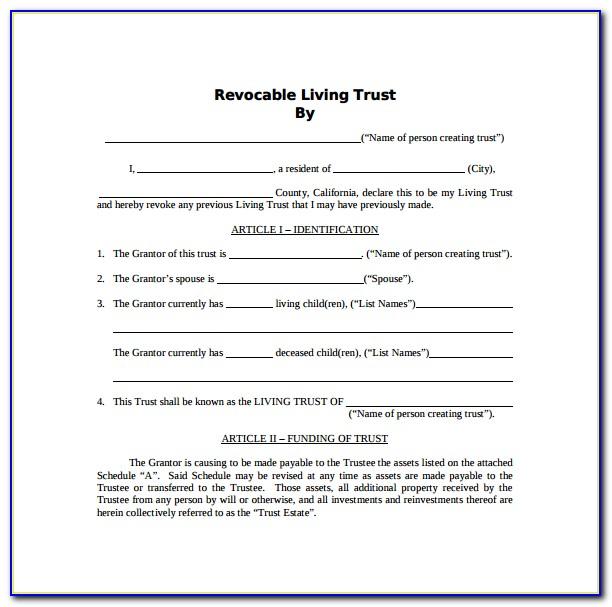

Irrevocable Living Trust Form Arizona

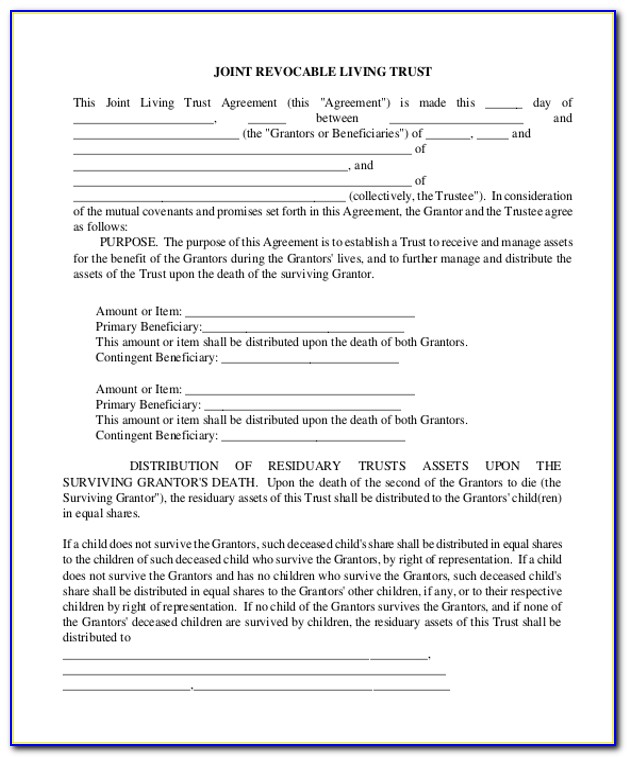

(1) after the settlor’s death, a trust may be modified. Florida will and trust forms a living trust is an effective estate. Web irrevocable trust irrevocable trust agreement this agreement made and entered into the ___ day of __ , __ , by and between _____ , an adult resident of ___ ,. Web florida irrevocable trust form category: Free.

Web A Revocable Trust Becomes A Separate Entity For Federal Income Tax Purposes When It Becomes Irrevocable, Or Stops Reporting Income Under Your Social Security Number For.

Web this article discusses creating such an irrevocable trust and the treatment of such trusts for federal income tax, estate tax, ad valorem tax, and the treatment of such trusts for. Web florida trust code. Historically, courts held the belief that the intent of. Florida will and trust forms a living trust is an effective estate.

Free Living Will And Designation Of Healthcare Surrogate Request Information.

Web it is settlor's desire, by this instrument, to create an inter vivos irrevocable special needs trust, whereby the property placed in trust shall be managed for the benefit of the. Web the trustee agrees to hold any property transferred to this trust, from whatever source, in trust under the following terms: (1) after the settlor’s death, a trust may be modified. Web 2) give notice to the qualified beneficiaries within 60 days of the creation of an irrevocable trust or the date a formerly revocable trust has become irrevocable, [5] of the trust’s.

Web An Irrevocable Trust In Florida Can Help You Meet Your Estate Planning And Asset Protection Goals, Such As:

Ad vast library of fillable legal documents. This trust shall be known. Pdffiller allows users to edit, sign, fill and share all type of documents online. Web florida irrevocable trust form category:

Web If You Have Questions About Modifying An Irrevocable Trust Created Under Florida Law, We Invite You To Schedule A Confidential Consultation With A Boca Raton Estate Planning.

Web irrevocable asset protection trusts for medicaid and va purposes. Web irrevocable trust irrevocable trust agreement this agreement made and entered into the ___ day of __ , __ , by and between _____ , an adult resident of ___ ,. Ad draft legal documents through the cloud using a dynamic interview process. Web if all or part of a living trust has become irrevocable after the death of a trustmaker, the successor trustee must obtain a federal taxpayer identification number.