Florida Notice Of Trust Form

Florida Notice Of Trust Form - See also the florida probate code statute 733.707. 733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s domicile and the court having jurisdiction of the settlor’s estate. A) expenses of administration and b) the decedent’s debts (creditor claims). Under section 736.05055(2), florida statutes, a notice of trust must contain “the name of the settlor, the settlor’s date of death, the title of the trust, if any, the date of the trust, and the name and address of the trustee.” To read statutes on rev trusts, click here. The name of the settlor the settlor’s date of death the title of the trust (if there is one) the date of the trust the name and address of the trustee a notice of trust will never include any of the private details set out in the trust. Web florida revocable living trust form. While operating similarly to a will, a living trust differs in that the assets placed within the trust are not subject to probate (court processing of a deceased person’s real estate and property). Web florida statute relating to a florida notice of trust: (1) upon the death of a settlor of a trust described in s.

733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s domicile and the court having jurisdiction of the settlor’s estate. 733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s domicile and the court having jurisdiction of the settlor’s estate. 736.05055 notice of trust.— (1) upon the death of a settlor of a trust described in s. The grantor appoints a trustee to manage the trust in the event they become mentally incapacitated. Upon the trustmaker’s death, florida statute 736.05055 requires that the successor trustee file a “notice of trust” with the court of the county of the trustmaker’s domicile. Web florida statute relating to a florida notice of trust: Web this notice of trust is found in florida trust code 736.05055. Web florida revocable living trust form. Web what information needs to be included in a notice of trust? A notice of trust is a legal record used to alert the court that the trustor’s of a florida trust has passed away, also providing the contact information of the person designated as the trust’s trustee.

Web a notice of trust in florida must include the following information: Under section 736.05055(2), florida statutes, a notice of trust must contain “the name of the settlor, the settlor’s date of death, the title of the trust, if any, the date of the trust, and the name and address of the trustee.” While operating similarly to a will, a living trust differs in that the assets placed within the trust are not subject to probate (court processing of a deceased person’s real estate and property). Upon the trustmaker’s death, florida statute 736.05055 requires that the successor trustee file a “notice of trust” with the court of the county of the trustmaker’s domicile. Web in florida, a notice of trust is the formal notice that a trustee provides to the public that the trustmaker has deceased. (1) upon the death of a settlor of a trust described in s. Web florida revocable living trust form. 733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s domicile and the court having jurisdiction of the settlor’s estate. Web the clerk shall file and index this notice of trust in the same manner as a caveat, unless there exists a probate proceeding for the grantor's estate in which case this notice of trust must be filed in the probate proceeding and the clerk shall send a. 736.05055 notice of trust.— (1) upon the death of a settlor of a trust described in s.

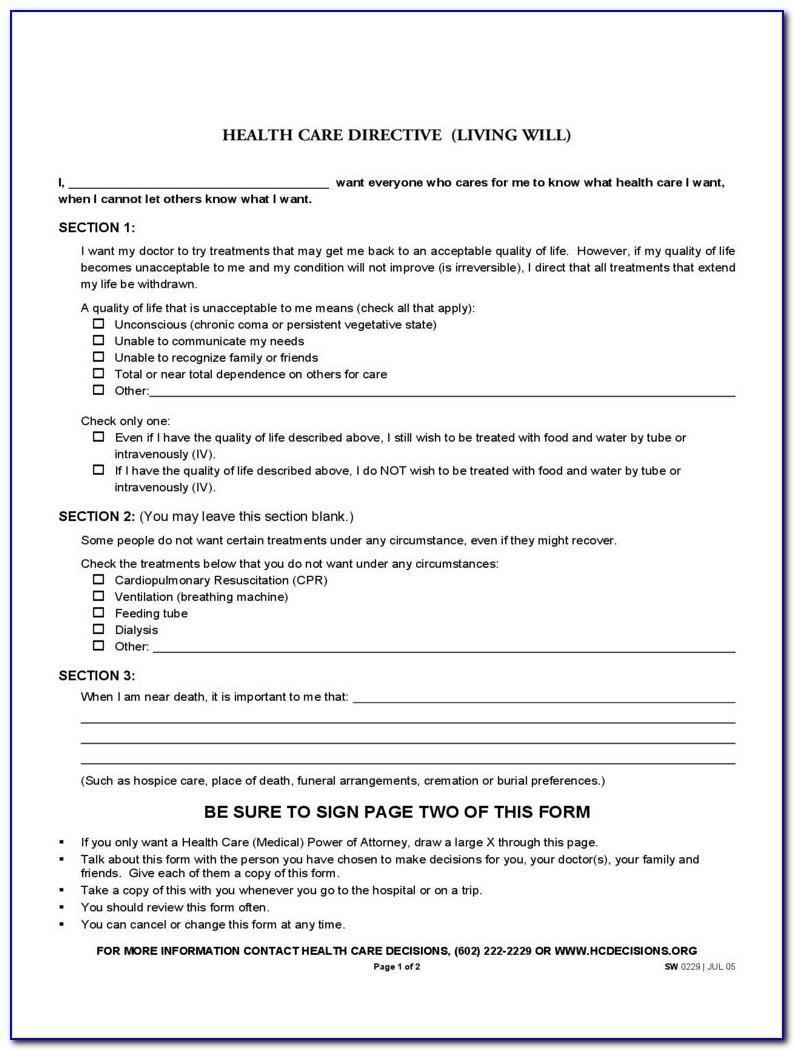

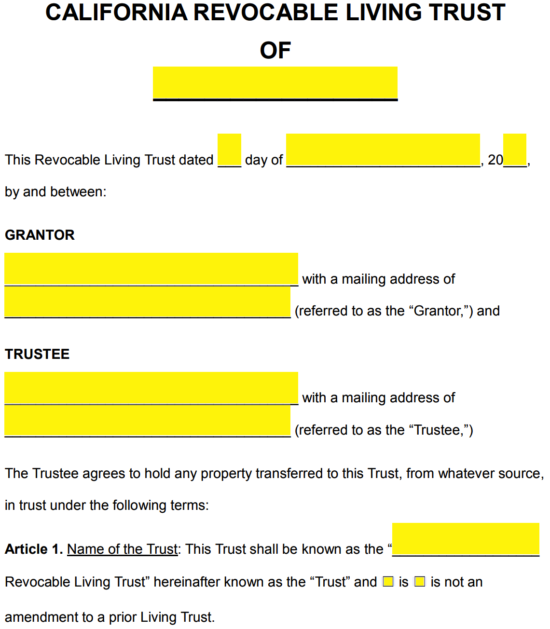

Florida Revocable Living Trust Form Free

733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s domicile and the court having jurisdiction of the settlor’s estate. To read statutes on rev trusts, click here. The trustee is the person who holds nominal ownership of the assets held in trust. Under section 736.05055(2), florida statutes, a notice of.

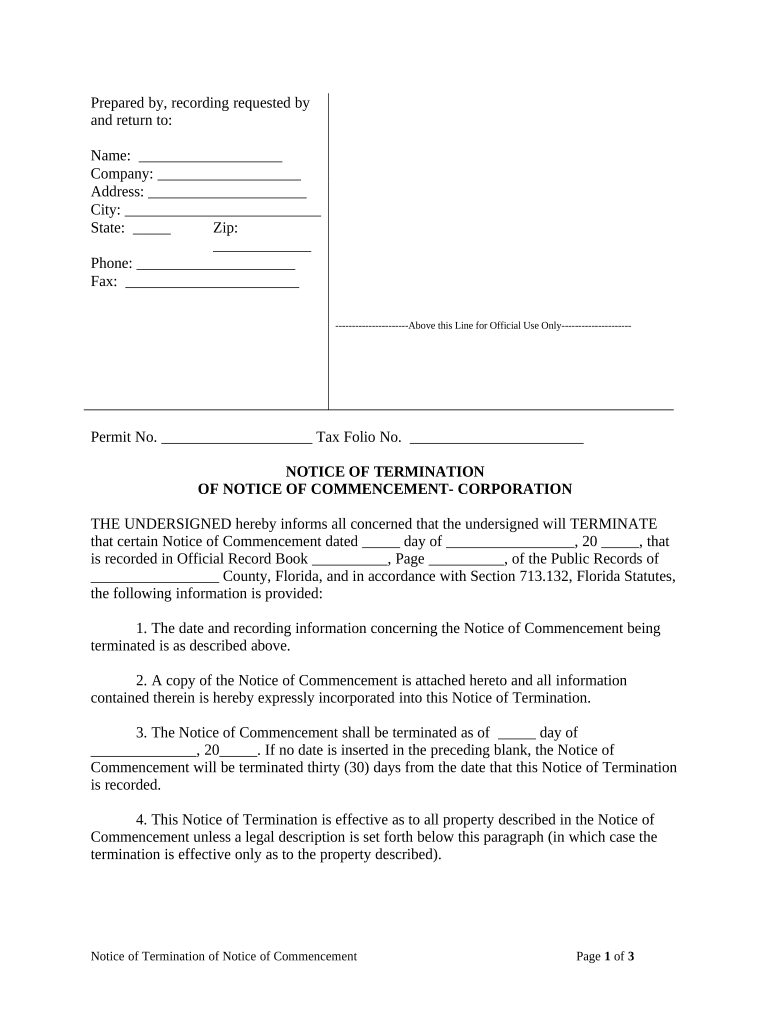

notice commencement Doc Template pdfFiller

Web florida revocable living trust form. To read statutes on rev trusts, click here. You see, when one has a revocable trust, and they die, that revocable trust may have to pay: Upon the trustmaker’s death, florida statute 736.05055 requires that the successor trustee file a “notice of trust” with the court of the county of the trustmaker’s domicile. Web.

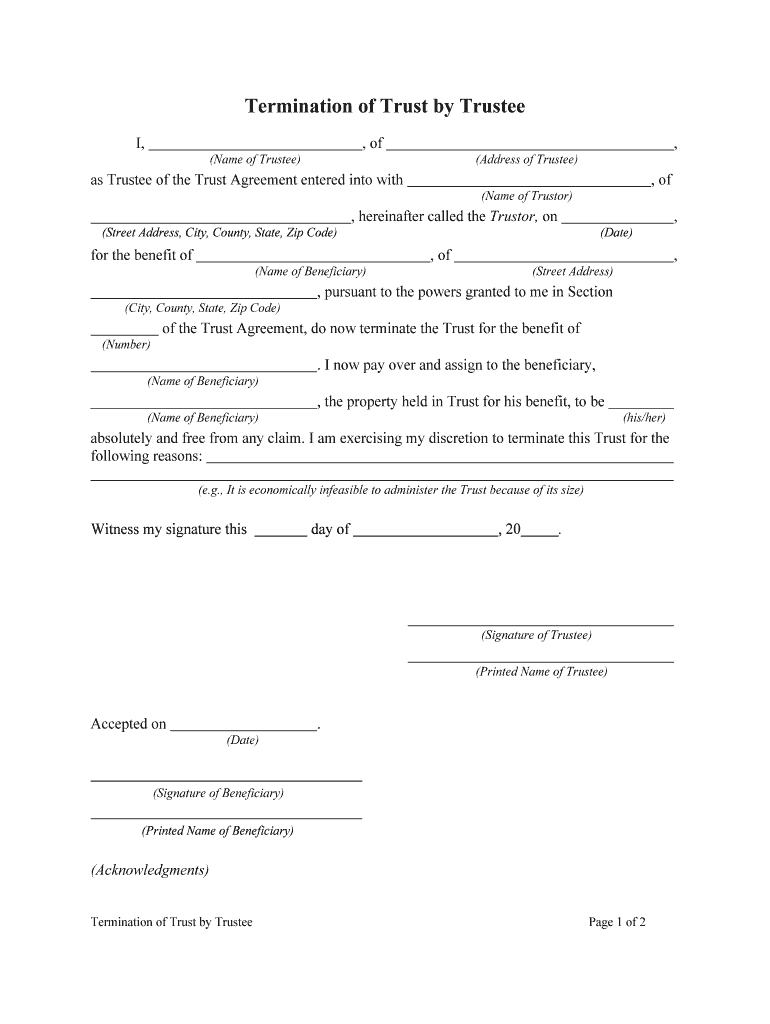

Termination Trustee Fill Online, Printable, Fillable, Blank pdfFiller

736.05055 notice of trust.— (1) upon the death of a settlor of a trust described in s. See also the florida probate code statute 733.707. Under section 736.05055(2), florida statutes, a notice of trust must contain “the name of the settlor, the settlor’s date of death, the title of the trust, if any, the date of the trust, and the.

Certificate of Trust Form Fill Out and Sign Printable PDF Template

Under section 736.05055(2), florida statutes, a notice of trust must contain “the name of the settlor, the settlor’s date of death, the title of the trust, if any, the date of the trust, and the name and address of the trustee.” 733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s.

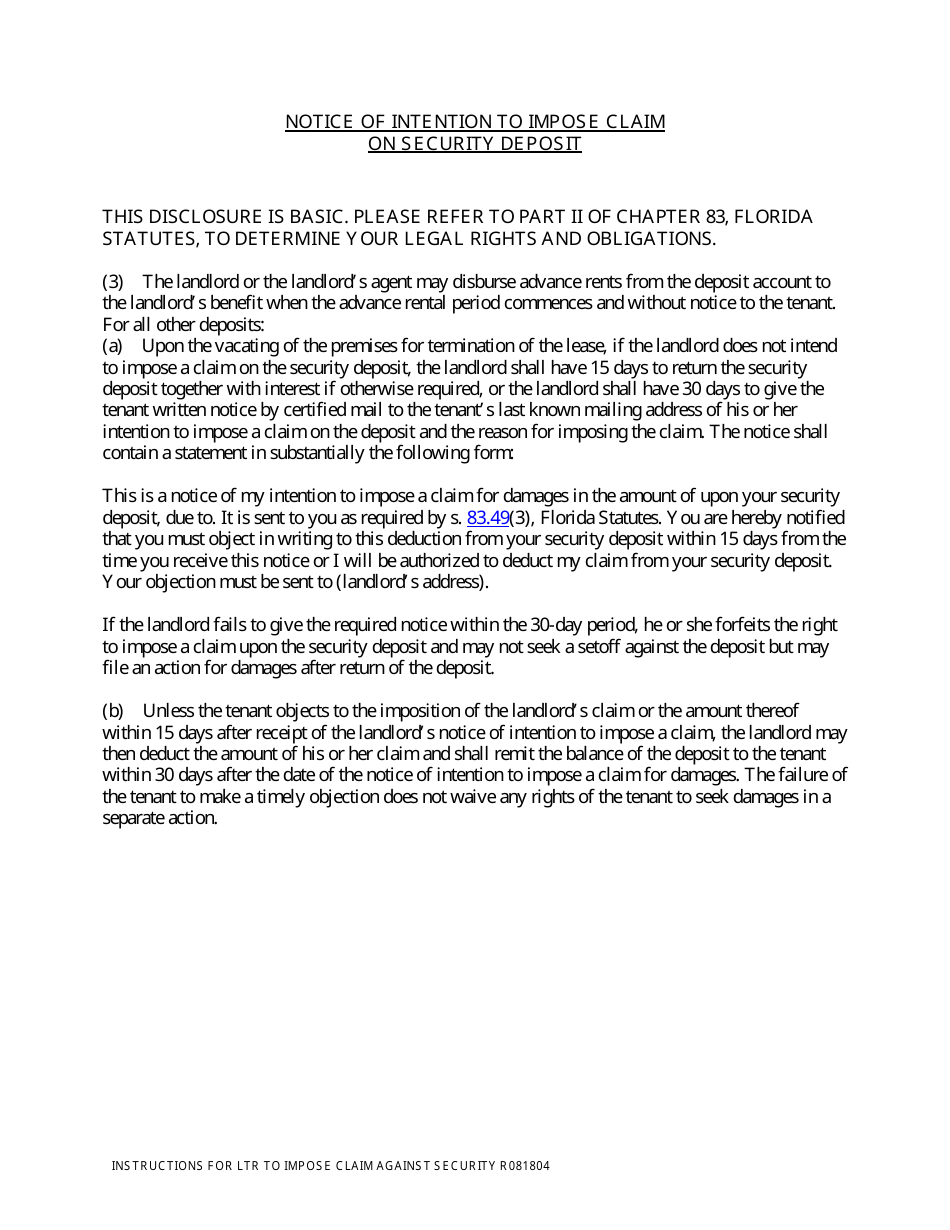

Florida Notice of Intention to Impose Claim on Security Deposit

Web this notice of trust is found in florida trust code 736.05055. To read statutes on rev trusts, click here. Upon the trustmaker’s death, florida statute 736.05055 requires that the successor trustee file a “notice of trust” with the court of the county of the trustmaker’s domicile. Under section 736.05055(2), florida statutes, a notice of trust must contain “the name.

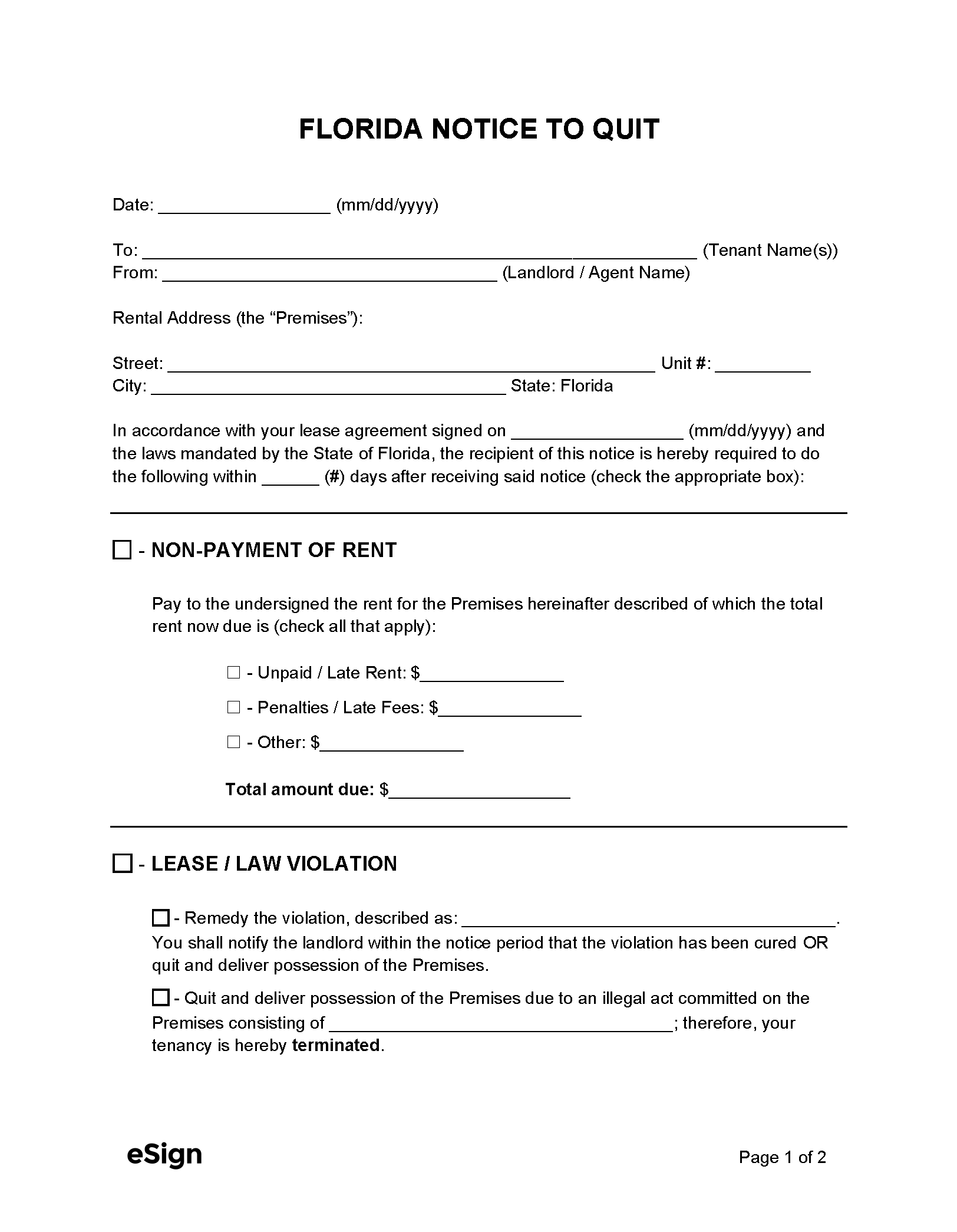

Free Florida Eviction Notice Templates Laws PDF Word

733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s domicile and the court having jurisdiction of the settlor’s estate. To read statutes on rev trusts, click here. A notice of trust is a legal record used to alert the court that the trustor’s of a florida trust has passed away,.

Florida Nfa Gun Trust Form Universal Network

The trustee is the person who holds nominal ownership of the assets held in trust. Web a notice of trust in florida must include the following information: Web florida statute relating to a florida notice of trust: A notice of trust is a legal record used to alert the court that the trustor’s of a florida trust has passed away,.

Notice of Trustee's Sale

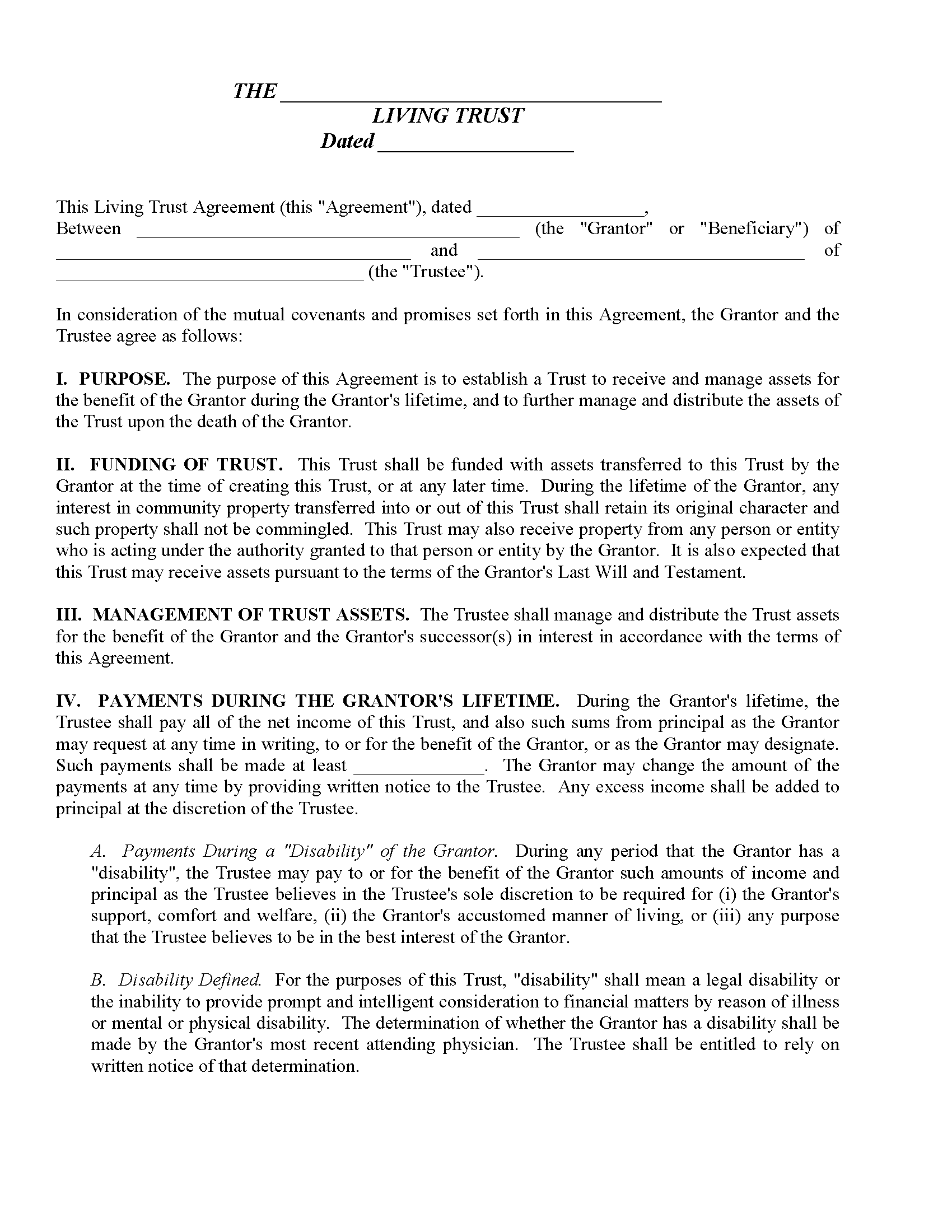

The florida revocable living trust is a legal form created by a person (a grantor) into which assets are placed with instructions on who will benefit from them. Web florida revocable living trust form. Web updated june 01, 2022 a florida living trust allows a person (the grantor) to legally define the recipient (s) of their assets after they die..

Free California Revocable Living Trust Form PDF Word eForms

The name of the settlor the settlor’s date of death the title of the trust (if there is one) the date of the trust the name and address of the trustee a notice of trust will never include any of the private details set out in the trust. Web a notice of trust in florida must include the following information:.

Florida Revocable Living Trust Form Free Printable Legal Forms

(2) the notice of trust must contain the name. 733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s domicile and the court having jurisdiction of the settlor’s estate. Web a notice of trust in florida must include the following information: The name of the settlor the settlor’s date of death.

736.05055 Notice Of Trust.— (1) Upon The Death Of A Settlor Of A Trust Described In S.

Web the clerk shall file and index this notice of trust in the same manner as a caveat, unless there exists a probate proceeding for the grantor's estate in which case this notice of trust must be filed in the probate proceeding and the clerk shall send a. You see, when one has a revocable trust, and they die, that revocable trust may have to pay: Under section 736.05055(2), florida statutes, a notice of trust must contain “the name of the settlor, the settlor’s date of death, the title of the trust, if any, the date of the trust, and the name and address of the trustee.” 733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s domicile and the court having jurisdiction of the settlor’s estate.

Web In Florida, A Notice Of Trust Is The Formal Notice That A Trustee Provides To The Public That The Trustmaker Has Deceased.

(2) the notice of trust must contain the name. 733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s domicile and the court having jurisdiction of the settlor’s estate. Web what information needs to be included in a notice of trust? A) expenses of administration and b) the decedent’s debts (creditor claims).

To Read Statutes On Rev Trusts, Click Here.

Web florida revocable living trust form. Web florida statute relating to a florida notice of trust: The florida revocable living trust is a legal form created by a person (a grantor) into which assets are placed with instructions on who will benefit from them. The grantor appoints a trustee to manage the trust in the event they become mentally incapacitated.

While Operating Similarly To A Will, A Living Trust Differs In That The Assets Placed Within The Trust Are Not Subject To Probate (Court Processing Of A Deceased Person’s Real Estate And Property).

The trustee is the person who holds nominal ownership of the assets held in trust. (1) upon the death of a settlor of a trust described in s. Web a notice of trust in florida must include the following information: Web this notice of trust is found in florida trust code 736.05055.