Form 1024-A

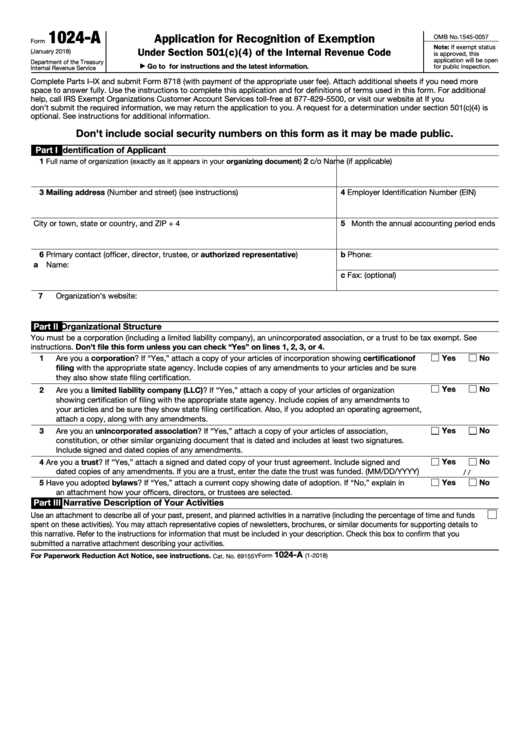

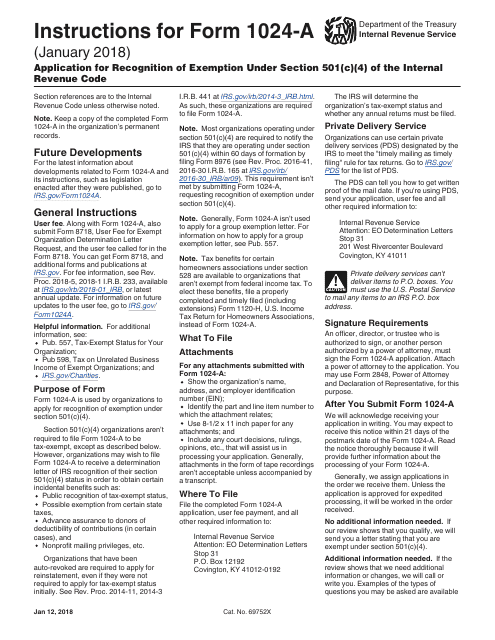

Form 1024-A - Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to file. Specify the law criteria in the heading unit, the applicant must select the correct legal criterion which. These nonprofits are the ones that. (january 2018) department of the treasury internal revenue service. Web follow the guide below to learn how to fill out the 1024 application form. Don't use form 1024 if you are applying under section 501 (c) (3) or section 501 (c) (4). Responses will vary based on an organization’s planned activities and mission. The irs now requires electronic filing of form 1024, application for recognition of. Complete, edit or print tax forms instantly. Web sample form 1024 attachment a this is a sample only.

Web form 1024 is used to document the waiver benefits that result in an individual service plan (isp) or individual plan of care (ipc) exceeding the assigned cost ceiling and to. Don't use form 1024 if you are applying under section 501 (c) (3) or section 501 (c) (4). These nonprofits are the ones that. Application for recognition of exemption. (january 2018) department of the treasury internal revenue service. Web sample form 1024 attachment a this is a sample only. Organizations file this form to apply for recognition of exemption from federal income tax under section 501 (a) (other than sections 501 (c) (3) or 501 (c) (4)). Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). Under section 501(c)(4) of the internal. Web follow the guide below to learn how to fill out the 1024 application form.

It’s actually a new form for 501 (c)4 social welfare nonprofits so that the irs recognizes them. Web form 1024 is used to document the waiver benefits that result in an individual service plan (isp) or individual plan of care (ipc) exceeding the assigned cost ceiling and to. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to file. Web sample form 1024 attachment a this is a sample only. Under section 501(c)(4) of the internal. (january 2018) department of the treasury internal revenue service. Don't use form 1024 if you are applying under section 501 (c) (3) or section 501 (c) (4). Web report error it appears you don't have a pdf plugin for this browser. The irs now requires electronic filing of form 1024, application for recognition of.

Fill Free fillable Application for Recognition of Exemption Under

Web follow the guide below to learn how to fill out the 1024 application form. (january 2018) department of the treasury internal revenue service. Don't use form 1024 if you are applying under section 501 (c) (3) or section 501 (c) (4). Web form 1024 is used to document the waiver benefits that result in an individual service plan (isp).

Form 1024 Application for Recognition of Exemption under Section 501

Web follow the guide below to learn how to fill out the 1024 application form. Application for recognition of exemption under section 501 (a) in order to facilitate the completion of form 1024, below are answers to some of the questions. Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and.

Form 1024 Application for Recognition of Exemption under Section 501

Application for recognition of exemption under section 501 (a) in order to facilitate the completion of form 1024, below are answers to some of the questions. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). Under section 501(c)(4) of the internal. (january 2018) department of the treasury internal revenue.

4506t fillable 2017 Fill out & sign online DocHub

It’s actually a new form for 501 (c)4 social welfare nonprofits so that the irs recognizes them. Application for recognition of exemption. Responses will vary based on an organization’s planned activities and mission. The irs now requires electronic filing of form 1024, application for recognition of. Under section 501(c)(4) of the internal.

IRS Form 1024A Download Fillable PDF or Fill Online Application for

Don't use form 1024 if you are applying under section 501 (c) (3) or section 501 (c) (4). The irs now requires electronic filing of form 1024, application for recognition of. Web follow the guide below to learn how to fill out the 1024 application form. Ad access irs tax forms. Application for recognition of exemption.

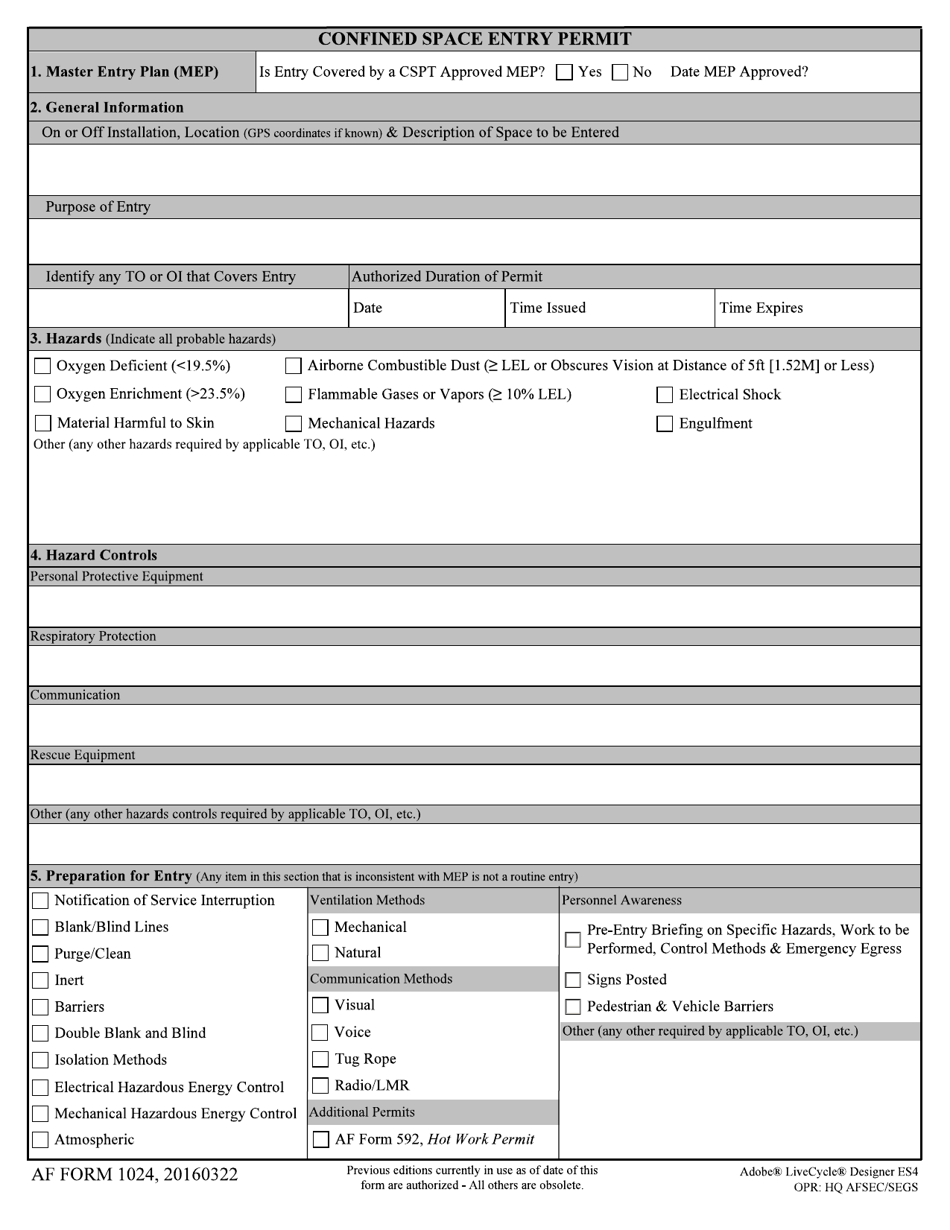

AF Form 1024 Fill Out, Sign Online and Download Fillable PDF

Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). Web form 1024 is used to document the waiver benefits that result in an individual service plan (isp) or individual plan of care (ipc) exceeding the assigned cost ceiling and to. Download or email irs 1024 & more fillable forms,.

Fillable Form 1024A Application For Recognition Of Exemption

Web report error it appears you don't have a pdf plugin for this browser. (january 2018) department of the treasury internal revenue service. Web sample form 1024 attachment a this is a sample only. Web follow the guide below to learn how to fill out the 1024 application form. Ad access irs tax forms.

The IRS’s Dumbest Form The 1024A Aaron Hamlin Medium

It’s actually a new form for 501 (c)4 social welfare nonprofits so that the irs recognizes them. Application for recognition of exemption under section 501 (a) in order to facilitate the completion of form 1024, below are answers to some of the questions. Specify the law criteria in the heading unit, the applicant must select the correct legal criterion which..

Download Instructions for IRS Form 1024A Application for Recognition

Web report error it appears you don't have a pdf plugin for this browser. Web sample form 1024 attachment a this is a sample only. Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to file. Web follow the guide below to learn how to fill out.

Form 1024 Edit, Fill, Sign Online Handypdf

Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). Application for recognition of exemption under section 501 (a) in order to facilitate the completion of form 1024, below are answers to some of the questions. Ad access irs tax forms. Don't use form 1024 if you are applying under.

Ad Download Or Email Irs 1024 & More Fillable Forms, Register And Subscribe Now!

Web follow the guide below to learn how to fill out the 1024 application form. Web sample form 1024 attachment a this is a sample only. Ad access irs tax forms. Complete, edit or print tax forms instantly.

It’s Actually A New Form For 501 (C)4 Social Welfare Nonprofits So That The Irs Recognizes Them.

(january 2018) department of the treasury internal revenue service. Web form 1024 is used to document the waiver benefits that result in an individual service plan (isp) or individual plan of care (ipc) exceeding the assigned cost ceiling and to. The irs now requires electronic filing of form 1024, application for recognition of. Application for recognition of exemption under section 501 (a) in order to facilitate the completion of form 1024, below are answers to some of the questions.

Specify The Law Criteria In The Heading Unit, The Applicant Must Select The Correct Legal Criterion Which.

Organizations file this form to apply for recognition of exemption from federal income tax under section 501 (a) (other than sections 501 (c) (3) or 501 (c) (4)). Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to file. These nonprofits are the ones that. Don't use form 1024 if you are applying under section 501 (c) (3) or section 501 (c) (4).

Responses Will Vary Based On An Organization’s Planned Activities And Mission.

Web report error it appears you don't have a pdf plugin for this browser. Download or email irs 1024 & more fillable forms, register and subscribe now! Application for recognition of exemption. Under section 501(c)(4) of the internal.