Form 1042S Instructions 2022

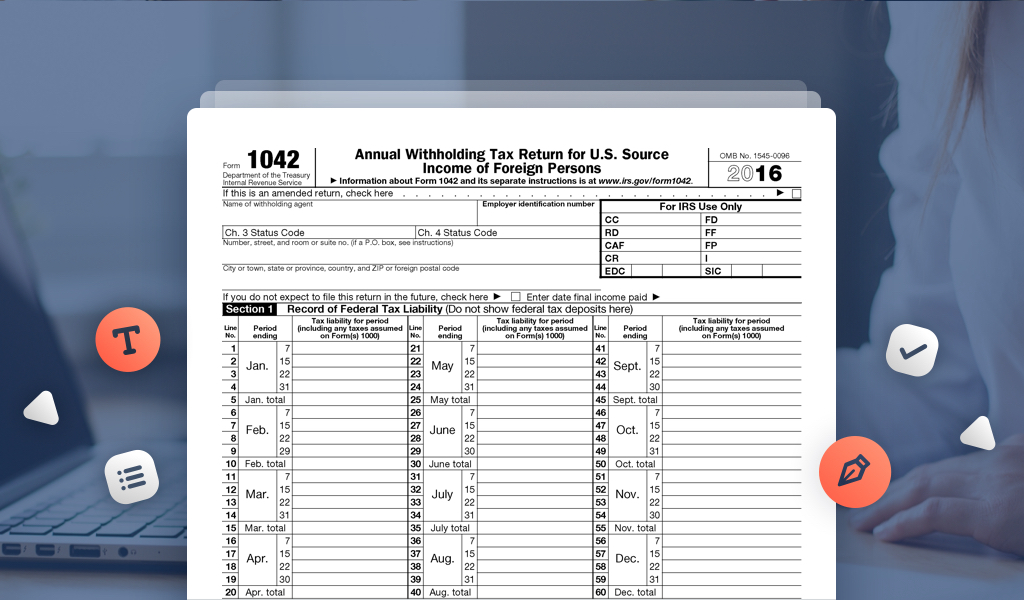

Form 1042S Instructions 2022 - Source income subject to withholding. Both nonresident withholding forms must be filed by march 15 of. Source income subject to withholding. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the instructions for. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income of foreign persons, including recent updates, related forms, and instructions on how to. Final instructions for the 2022 form 1042 mention the form can be filed online. Source income subject to withholding go to. Web foreign account tax compliance act (fatca).

Source income of foreign persons go to. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Final instructions for the 2022 form 1042 mention the form can be filed online. The first page of instructions begins by explaining any new items that affect that specific year. The form reports tax withheld from payments reported on form 1042. Both nonresident withholding forms must be filed by march 15 of. Web use form 1042 to report the following. Web information about form 1042, annual withholding tax return for u.s. Source income subject to withholding. You must enter both a chapter 4 and a chapter 3.

Both nonresident withholding forms must be filed by march 15 of. Web for tax year 2022, please see the 2022 instructions. Source income of foreign persons go to. You must enter both a chapter 4 and a chapter 3. Source income subject to withholding. The first page of instructions begins by explaining any new items that affect that specific year. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the instructions for. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain. Source income subject to withholding go to. The form reports tax withheld from payments reported on form 1042.

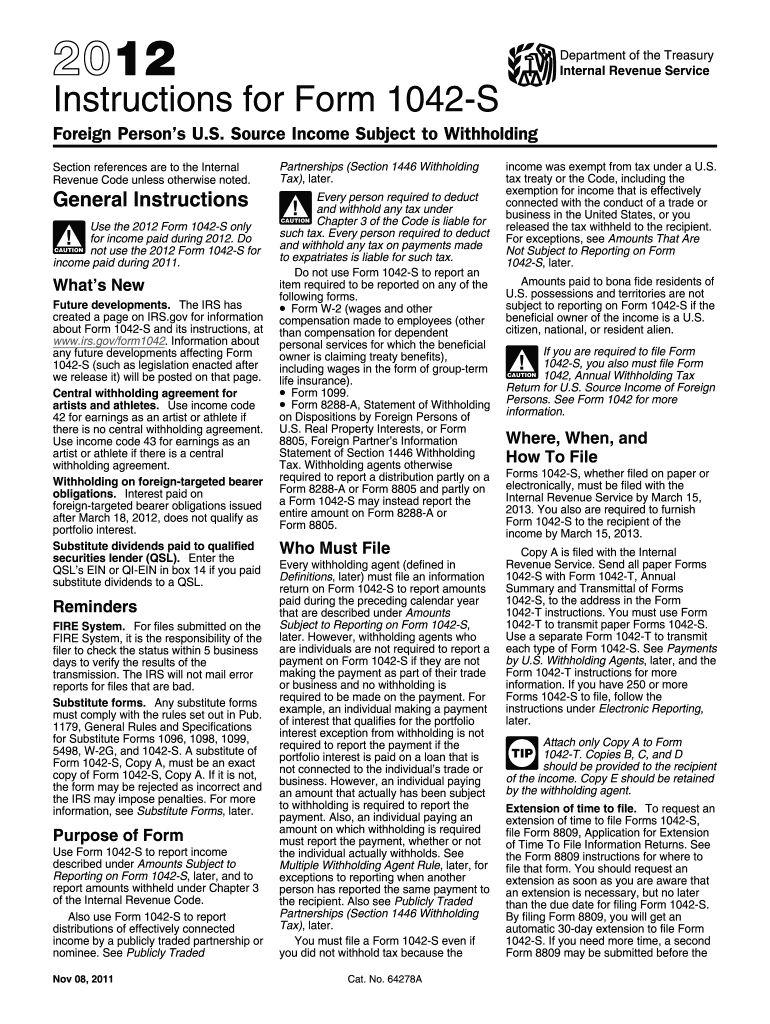

Instructions for IRS Form 1042S How to Report Your Annual

Web for tax year 2022, please see the 2022 instructions. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain. Web use form 1042 to report the following. Both nonresident withholding forms must be filed by march 15 of. Source income of foreign persons go to.

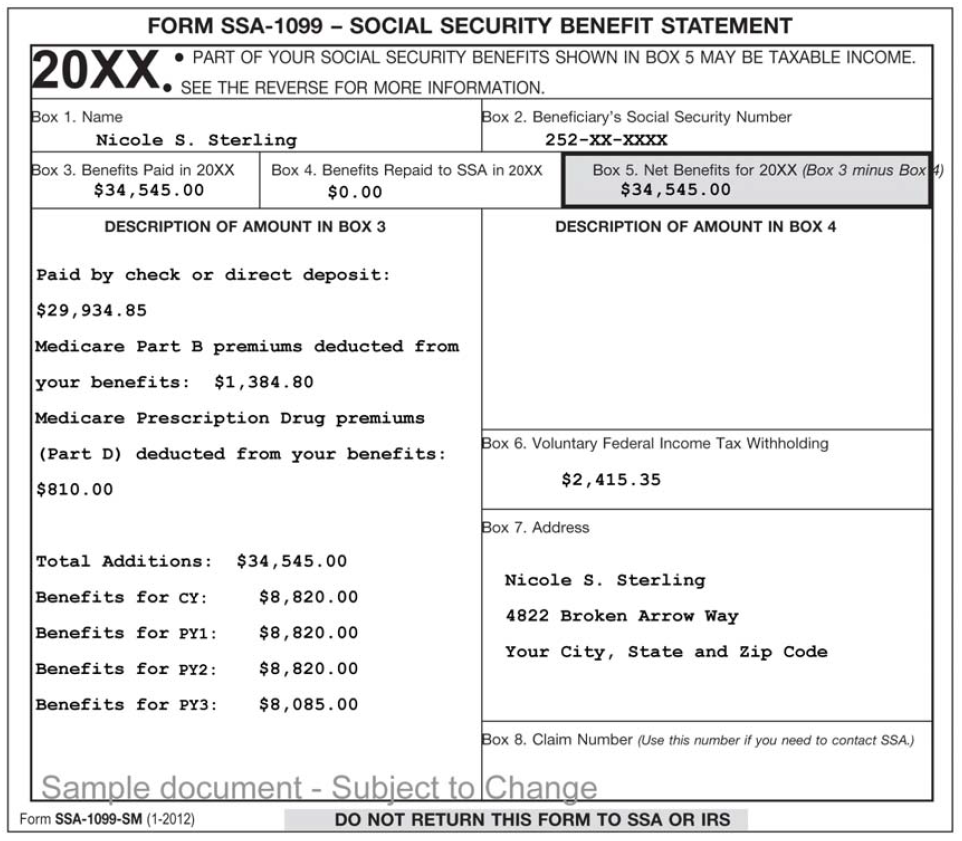

Printable Form Ssa 1099 Printable Form 2022

Source income of foreign persons go to. The form reports tax withheld from payments reported on form 1042. Final instructions for the 2022 form 1042 mention the form can be filed online. Source income subject to withholding. Web information about form 1042, annual withholding tax return for u.s.

ITIN Renewal for Foreign Partner ITINCAA Your Puzzle Solution

Source income of foreign persons go to. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the instructions for. Web for tax year 2022, please see the 2022 instructions. Final instructions for the 2022 form 1042 mention the form can be filed online. The tax.

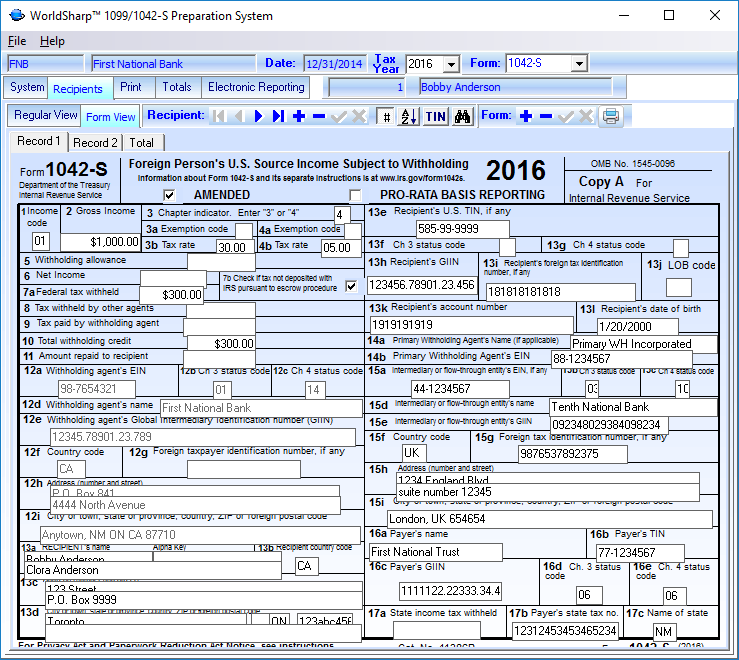

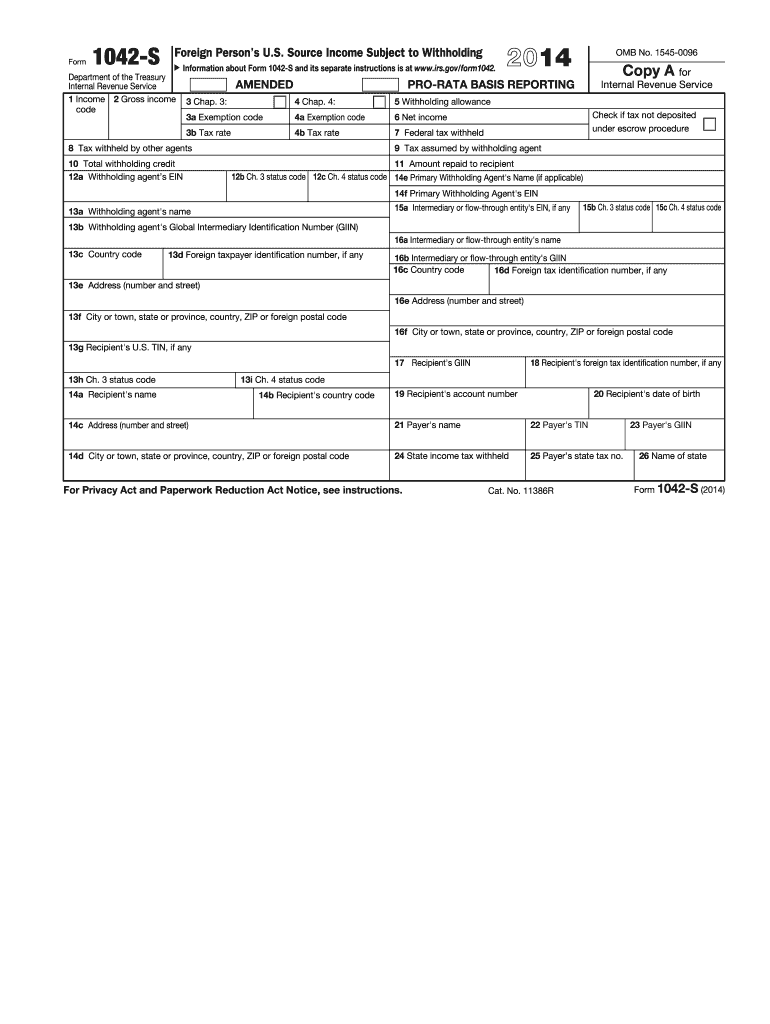

1042 S Form slideshare

Web foreign account tax compliance act (fatca). Web for tax year 2022, please see the 2022 instructions. Web information about form 1042, annual withholding tax return for u.s. Source income subject to withholding. Source income of foreign persons go to.

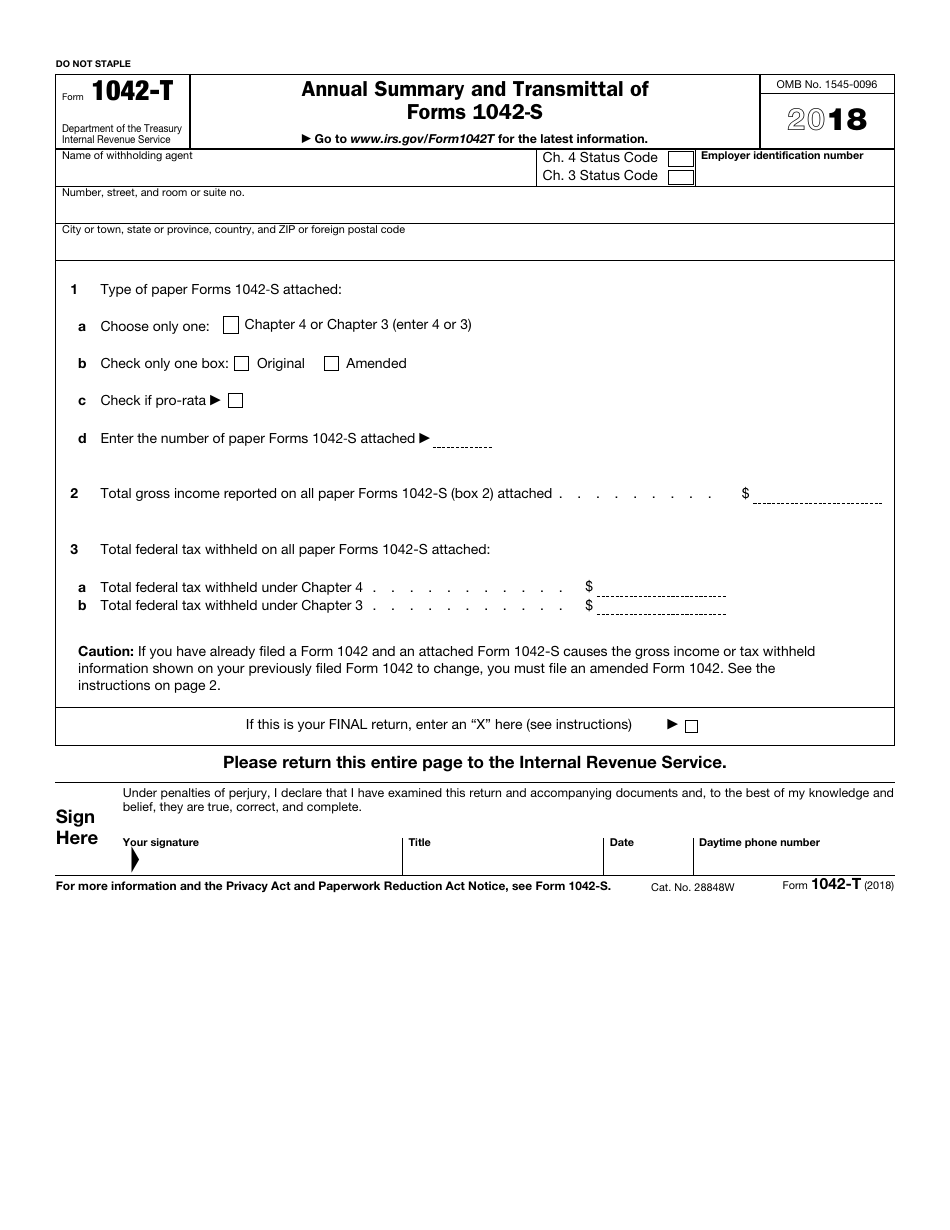

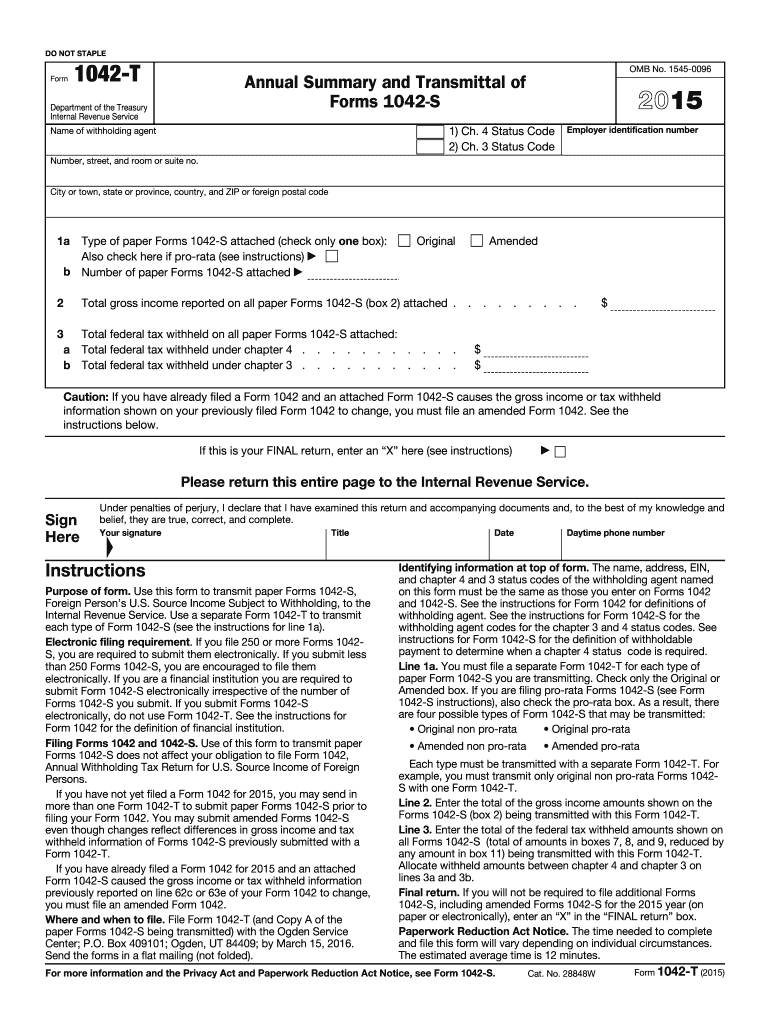

IRS Form 1042T Download Fillable PDF or Fill Online Annual Summary and

The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain. Both nonresident withholding forms must be filed by march 15 of. Web information about form 1042, annual withholding tax return for u.s. Source income of foreign persons go to. Web for tax year 2022, please see the 2022 instructions.

form 1042s instructions 2021 Fill Online, Printable, Fillable Blank

Web for tax year 2022, please see the 2022 instructions. Web information about form 1042, annual withholding tax return for u.s. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Web foreign account tax compliance act (fatca). You must enter both a chapter 4 and a chapter 3.

The Newly Issued Form 1042S Foreign Person's U.S. Source

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Web use form 1042 to report the following. You must enter both a chapter 4 and a chapter 3. Source income subject to withholding go to. The first page of instructions begins by explaining any new items that affect that specific year.

Form 1042 S Fill Out and Sign Printable PDF Template signNow

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Web use form 1042 to report the following. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the instructions for. The form reports tax withheld from payments reported on.

Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs Fill

The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the instructions for. Both nonresident withholding forms must be filed by march 15 of. Source income subject.

1042 Form Fill Out and Sign Printable PDF Template signNow

Final instructions for the 2022 form 1042 mention the form can be filed online. The first page of instructions begins by explaining any new items that affect that specific year. Source income subject to withholding go to. The form reports tax withheld from payments reported on form 1042. Source income subject to withholding, including recent updates, related forms, and instructions.

Web Of Course, The Form 1042 Instructions, Publication 515 Which Explains The Withholding Of Tax On Nonresident Aliens And Foreign Entities, Form 7004 That's The Instructions For.

Source income of foreign persons, including recent updates, related forms, and instructions on how to. Source income subject to withholding. Both nonresident withholding forms must be filed by march 15 of. Web use form 1042 to report the following.

Web Information About Form 1042, Annual Withholding Tax Return For U.s.

Web foreign account tax compliance act (fatca). The form reports tax withheld from payments reported on form 1042. Web for tax year 2022, please see the 2022 instructions. Source income of foreign persons go to.

The Tax Withheld Under Chapter 3 (Excluding Withholding Under Sections 1445 And 1446 Except As Indicated Below) On Certain.

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Final instructions for the 2022 form 1042 mention the form can be filed online. The first page of instructions begins by explaining any new items that affect that specific year.

You Must Enter Both A Chapter 4 And A Chapter 3.

Source income subject to withholding go to. Source income subject to withholding.