Form 1065 Excel Template

Form 1065 Excel Template - Part i information about the partnership. May be extended until october 15th. For instructions and the latest information. Form 1065 = ordinary income or loss (partnership); Provide it to your client to get started with tax planning and preparation. The form must be filed on or before april 15thof the year following the calendar year being reported. Here you would be taken into a splasher that allows you to make edits on the document. You must file your own form 5713 to report the partnership's activities and any other boycott operations that you may have. Add pictures, crosses, check and text boxes, if it is supposed. Return of partnership income, including recent updates, related forms and instructions on how to file.

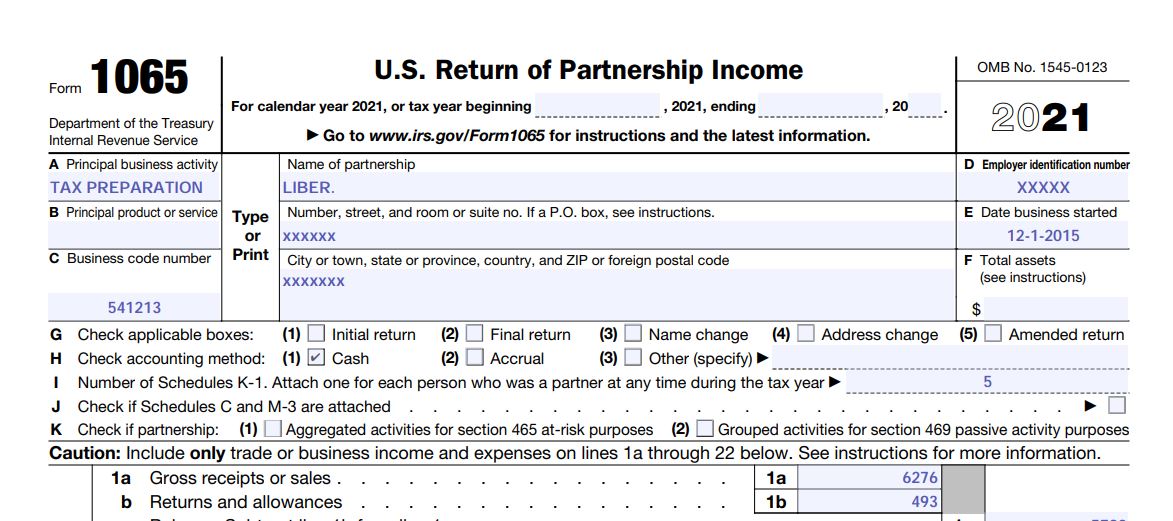

Return of partnership income, including recent updates, related forms and instructions on how to file. The 2022 form 1065 may also be used if: Here you would be taken into a splasher that allows you to make edits on the document. The form must be filed on or before april 15thof the year following the calendar year being reported. Web the partnership tax return organizer should be used with the preparation of form 1065, u.s. Open the excel template of form 1065 on your computer. Use get form or simply click on the template preview to open it in the editor. Web keep to these simple actions to get form 1065 excel template ready for submitting: Department of the treasury internal revenue service omb no. Signnow has paid close attention to ios users and developed an application just for them.

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Provide it to your client to get started with tax planning and preparation. Web where to file your taxes for form 1065. Web this organizer is provided to help you gather and organize information that will be needed in the preparation of your partnership tax returns. Use the following internal revenue service center address: Part i information about the partnership. Read the instructions to determine which information you must provide. If you are a first time client to nw tax & accounting llc, please provide us with a copy of the last three years of returns for your partnership/llc. Here you would be taken into a splasher that allows you to make edits on the document. Find the document you require in our library of templates.

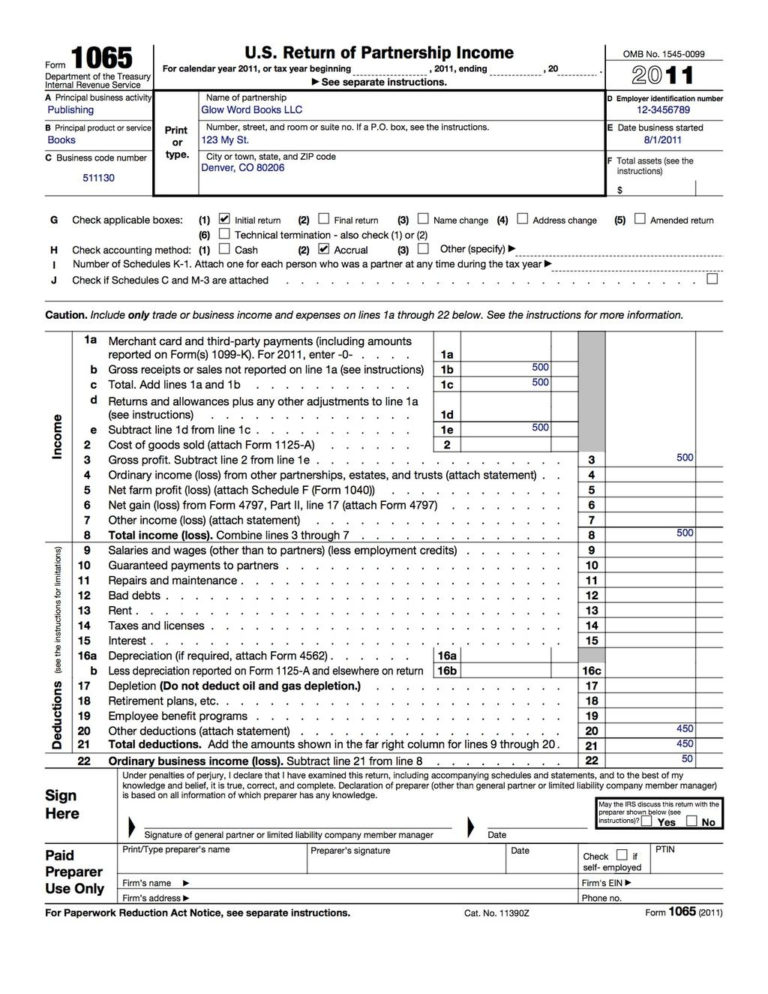

How To Complete Form 1065 US Return of Partnership

Conduct the desired edits on your document with the toolbar on the top of the dashboard. Open the excel template of form 1065 on your computer. Web information about form 1065, u.s. Web schedule c = net profit or loss (sole proprietorship); May be extended until october 15th.

S Corp Buy Sell Agreement Template Classles Democracy

The form must be filed on or before april 15thof the year following the calendar year being reported. Read the instructions to determine which information you must provide. Start at the top of the form, and enter the required information in the appropriate fields. May be extended until october 15th. Open the excel template of form 1065 on your computer.

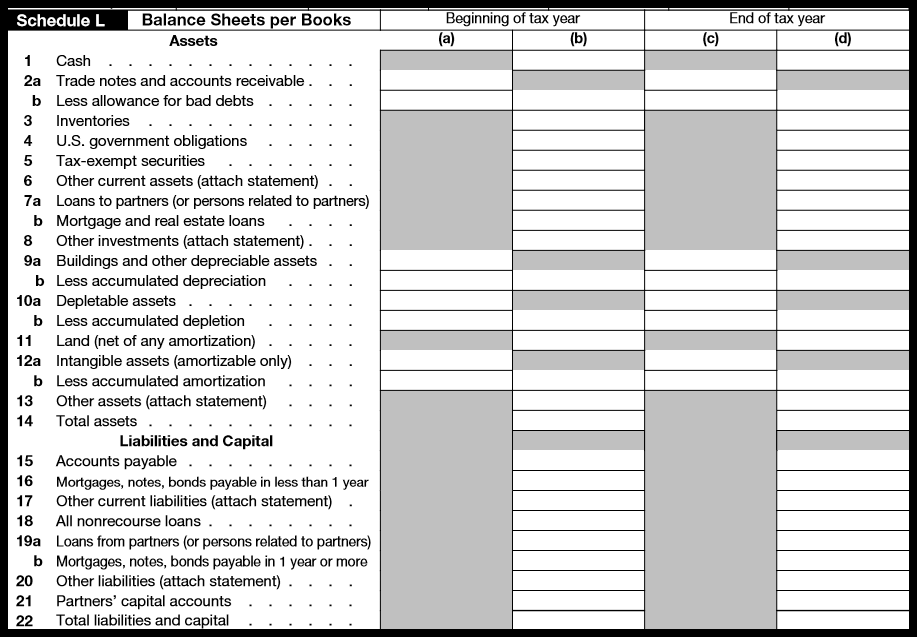

Llc Capital Account Spreadsheet within How To Fill Out An Llc 1065 Irs

You must file your own form 5713 to report the partnership's activities and any other boycott operations that you may have. And the total assets at the end of the tax year are: Ending / / partner’s share of income, deductions, credits, etc. Repeating fields will be filled automatically after the first input. Import a document you want to edit.

Download Form 1065 for Free Page 2 FormTemplate

Repeating fields will be filled automatically after the first input. Gleen reeves' excel1040 let's start with one of the most comprehensive calculators. Start completing the fillable fields and carefully type in required information. Select the fillable fields and put the. Reeves meticulously updates the template for each tax year, including all recent changes.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

Part i information about the partnership. For calendar year 2022, or tax year beginning / / 2022. Web schedule c = net profit or loss (sole proprietorship); If you have any difficulties, use the wizard tool. The 2022 form 1065 may also be used if:

Schedule M 3 Instructions 1065 Blank Sample to Fill out Online in PDF

Web form 5713, international boycott report. Signnow has paid close attention to ios users and developed an application just for them. And the total assets at the end of the tax year are: To find it, go to the appstore and type signnow in the search field. Select the fillable fields and put the.

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

The form must be filed on or before april 15thof the year following the calendar year being reported. Department of the treasury internal revenue service omb no. Return of partnership income, including recent updates, related forms and instructions on how to file. Partner’s share of income, deductions, credits, etc.—. Open the excel template of form 1065 on your computer.

Form 1065x Editable Fill out and Edit Online PDF Template

Department of the treasury internal revenue service. Partner’s share of income, deductions, credits, etc.—. Web a simple manual to edit form 1065 excel template online go to the cocodoc's online pdf editing page. For calendar year 2022, or tax year beginning. You must file your own form 5713 to report the partnership's activities and any other boycott operations that you.

1How to complete 2021 IRS Form 1065 and Schedule K1 For your LLC

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Provide it to your client to get started with tax planning and preparation. Select the fillable fields and put the. Signnow has paid close attention to ios users and developed an application just for them. Web.

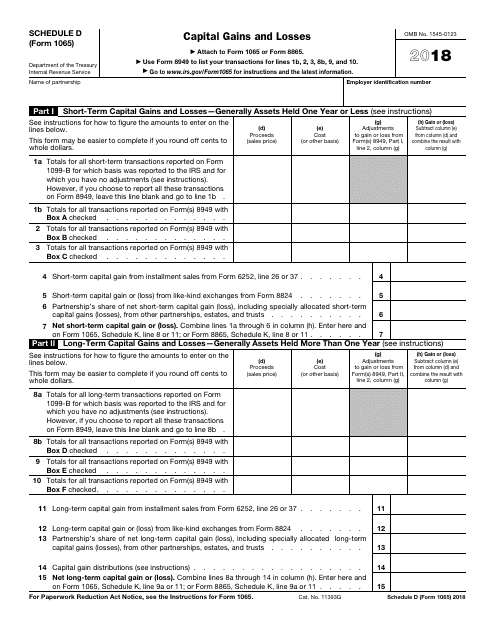

IRS Form 1065 Schedule D Download Fillable PDF or Fill Online Capital

Start at the top of the form, and enter the required information in the appropriate fields. Use the following internal revenue service center address: Enter percentage of increase or decrease where indicated. Edit your form 1065 excel template online type text, add images, blackout confidential details, add comments, highlights and more. Open the form in the online editing tool.

Or Getting Income From U.s.

Below you can get an idea about how to edit and complete a form 1065 in excel easily. If the partnership cooperated with an international boycott, it must give you a copy of its form 5713. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Web form 5713, international boycott report.

For Instructions And The Latest Information.

Form 1120 = taxable income (corporation); Push the“get form” button below. The template is available as a fillable pdf and in word (for word versions, see the 2022 annual tax compliance kit zip file). Here you would be taken into a splasher that allows you to make edits on the document.

If You Are A First Time Client To Nw Tax & Accounting Llc, Please Provide Us With A Copy Of The Last Three Years Of Returns For Your Partnership/Llc.

This includes the name of the partnership, ein (employer identification number), address, and phone number. You may lose certain tax benefits if the partnership participated in, or Web a simple manual to edit form 1065 excel template online go to the cocodoc's online pdf editing page. Web keep to these simple actions to get form 1065 excel template ready for submitting:

If The Partnership's Principal Business, Office, Or Agency Is Located In:

Reeves meticulously updates the template for each tax year, including all recent changes. Partner’s share of income, deductions, credits, etc.—. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Department of the treasury internal revenue service.