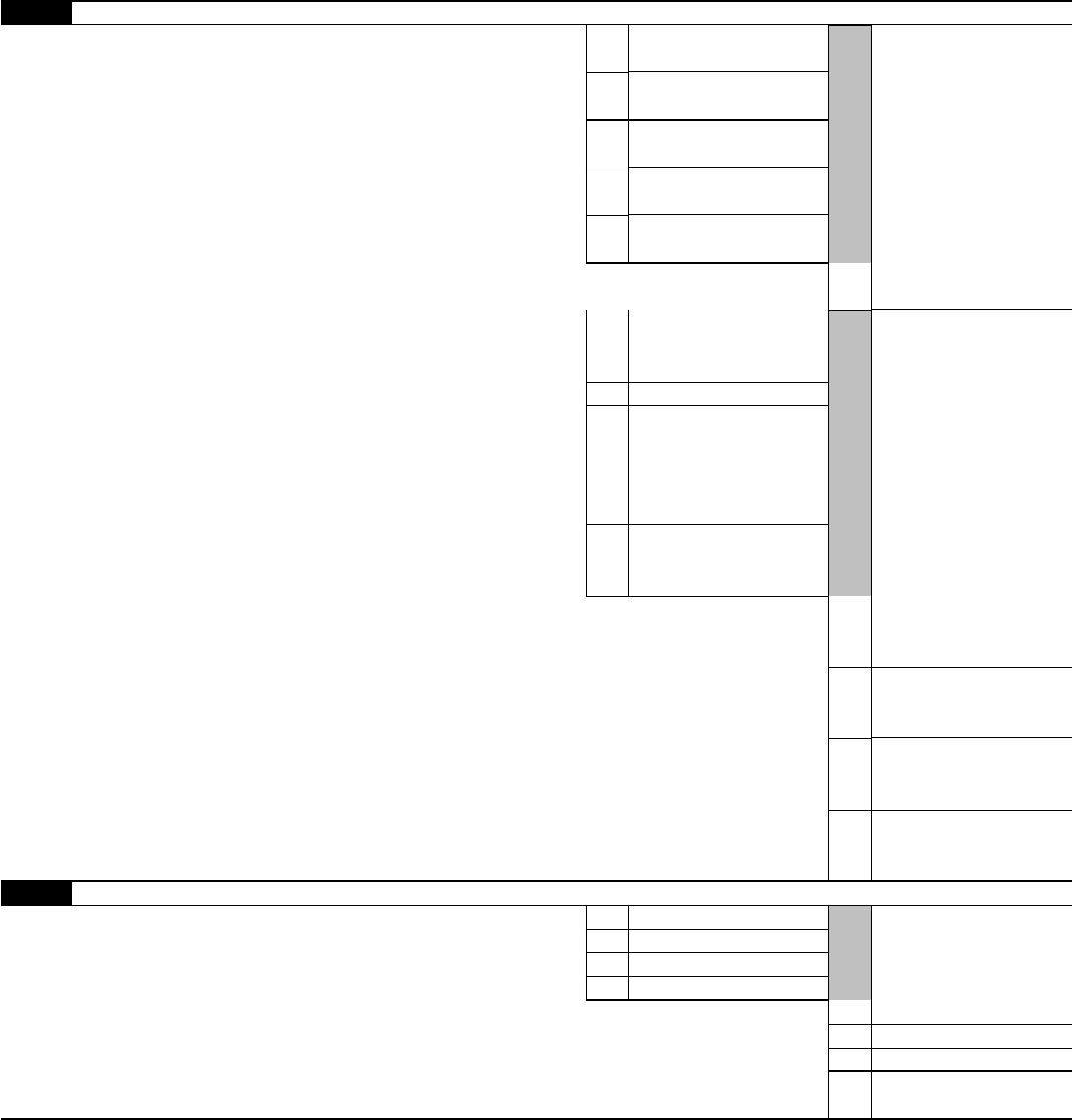

Form 1116 Amt

Form 1116 Amt - Complete, edit or print tax forms instantly. Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; Generating the schedule b for form 1116 in proseries starting in 2021: Web i seem to have a similar situation where page 2 of 116 multiplier = 1.0 in both cases. Web how does the amt form 1116 calculate? Complete parts 1 and 2 of form 6251 chances are high that line 7. If a return is subject to amt, the form is produced automatically using the information in form 1116. Web (the amount on line 17 of your amt form 1116 will be the same as the amount on line 17 of your regular tax form 1116.) you must make the election for the. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Taxpayers are therefore reporting running balances of. Web form amt 1116 is a version of form 1116 used for the amt calculation. Get ready for tax season deadlines by completing any required tax forms today. Web if you hade made the simplified foreign tax limitation election for amt last year, you should only one form 1116. The alternative minimum tax version of the form 1116 (based on the form 6251 instructions) automatically calculates from. For example, if you only had foreign tax credit on wages in a prior. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web this article will help you enter foreign tax credit carryforwards from prior year returns, generate form 1116 schedule b, and resolve critical diagnostic ref. Web entering income for the foreign tax credit form 1116; Web i seem to have a similar situation where page 2 of 116 multiplier = 1.0 in both cases.

Web (form 1116) (december 2021) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see separate instructions. Web i seem to have a similar situation where page 2 of 116 multiplier = 1.0 in both cases. Complete parts 1 and 2 of form 6251 chances are high that line 7. Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; Use form 2555 to claim. Web entering income for the foreign tax credit form 1116; Web there are two options for suppressing the form 1116 and form 1116 amt: If a return is subject to amt, the form is produced automatically using the information in form 1116. Department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today.

How can I add Form 1116? General Chat ATX Community

Web (the amount on line 17 of your amt form 1116 will be the same as the amount on line 17 of your regular tax form 1116.) you must make the election for the. If a return is subject to amt, the form is produced automatically using the information in form 1116. Web there are two options available to suppress.

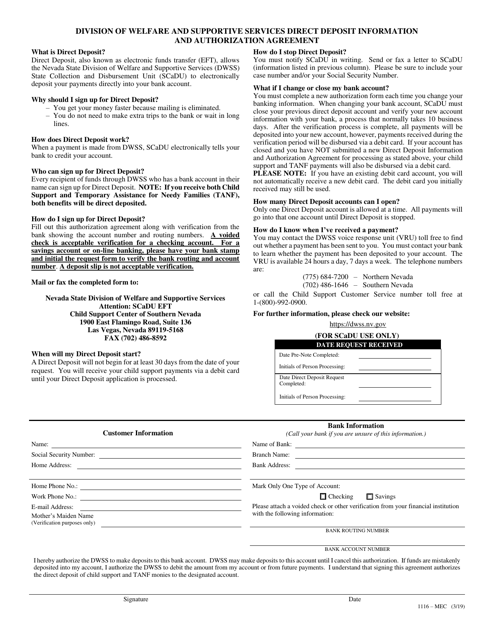

2010 Form 1116 Edit, Fill, Sign Online Handypdf

Starting in tax year 2021, the irs released a new. Web there are two options for suppressing the form 1116 and form 1116 amt: Department of the treasury internal revenue service. For those taxed at 0%, do not include the. Complete, edit or print tax forms instantly.

Form 1116Foreign Tax Credit

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web how does the amt form 1116 calculate? The amt applies to taxpayers. Web if you hade made the simplified foreign tax limitation election for amt last year, you should only one form 1116. Complete parts 1 and.

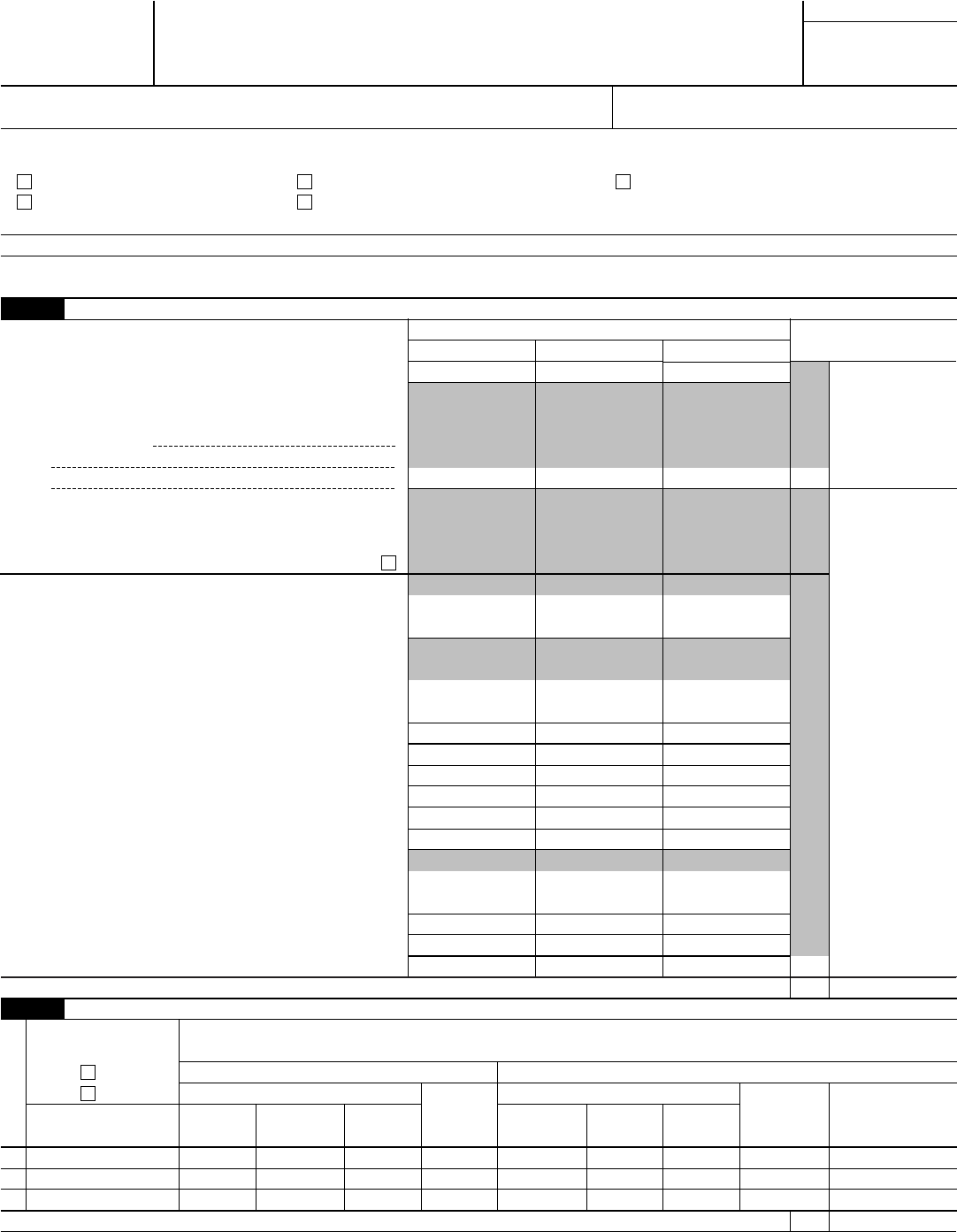

Instructions for Form 1116

If a return is subject to amt, the form is produced automatically using the information in form 1116. Web entering income for the foreign tax credit form 1116; Starting in tax year 2021, the irs released a new. Web this article will help you enter foreign tax credit carryforwards from prior year returns, generate form 1116 schedule b, and resolve.

f1116_AMT.pdf DocDroid

Web how does the amt form 1116 calculate? Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. For those taxed at 0%, do not include the. Taxpayers are therefore reporting running balances of.

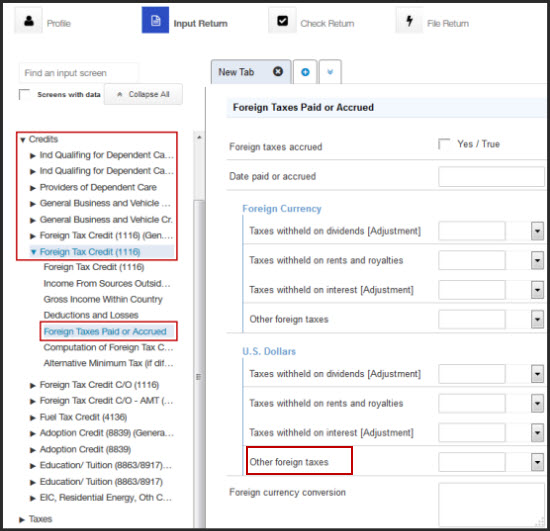

How do I generate Form 1116 Foreign Tax Credit in ProConnect Tax

Web there are two options available to suppress the form 1116 and 1116 amt: Web this article will help you enter foreign tax credit carryforwards from prior year returns, generate form 1116 schedule b, and resolve critical diagnostic ref. Complete, edit or print tax forms instantly. Web schedule b (form 1116) is used to reconcile your prior year foreign tax.

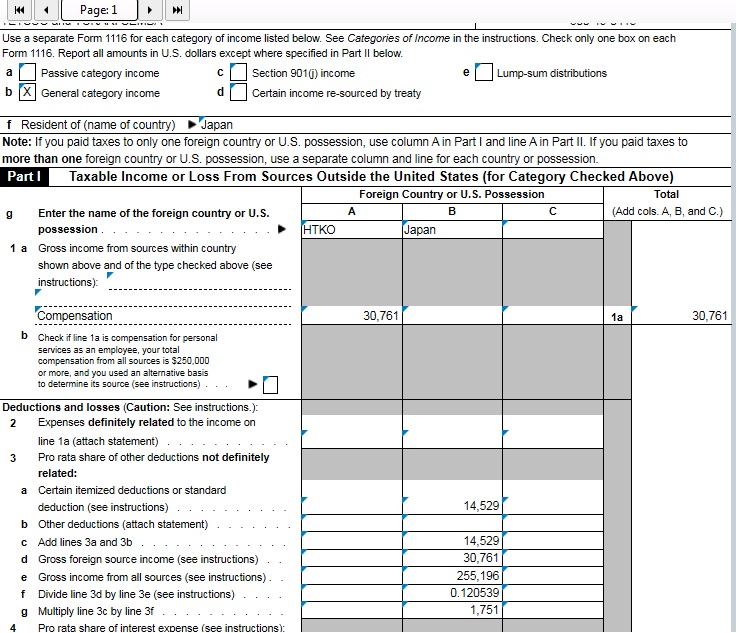

Form 1116 part 1 instructions

The alternative minimum tax version of the form 1116 (based on the form 6251 instructions) automatically calculates from. Get ready for tax season deadlines by completing any required tax forms today. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Web this article.

Form 1116 Edit, Fill, Sign Online Handypdf

Web i seem to have a similar situation where page 2 of 116 multiplier = 1.0 in both cases. Complete, edit or print tax forms instantly. Web this article will help you enter foreign tax credit carryforwards from prior year returns, generate form 1116 schedule b, and resolve critical diagnostic ref. Starting in tax year 2021, the irs released a.

Fillable Form 1116 Foreign Tax Credit printable pdf download

Complete, edit or print tax forms instantly. Web if you hade made the simplified foreign tax limitation election for amt last year, you should only one form 1116. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. For example, if you only had.

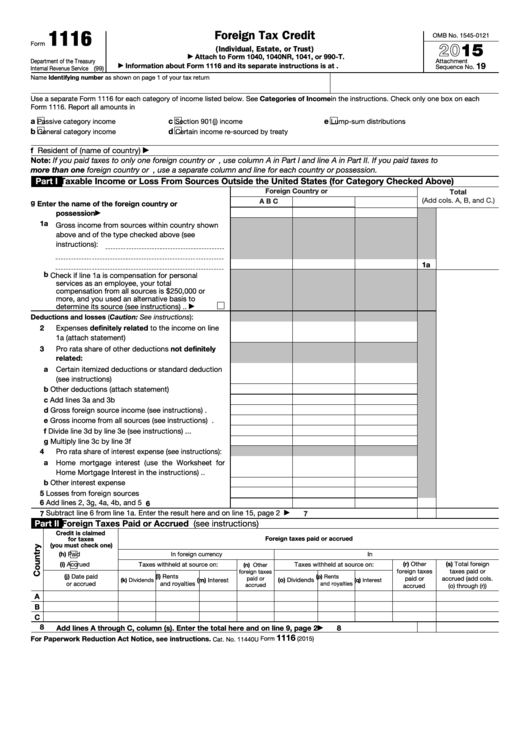

Form 1116MEC Download Fillable PDF or Fill Online Division of Welfare

If a return is subject to amt, the form is produced automatically using the information in form 1116. Complete parts 1 and 2 of form 6251 chances are high that line 7. Web how does the amt form 1116 calculate? Complete, edit or print tax forms instantly. Web the calculation for line 1a adjustments to foreign source qualified dividends and.

If A Return Is Subject To Amt, The Form Is Produced Automatically Using The Information In Form 1116.

Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Web i seem to have a similar situation where page 2 of 116 multiplier = 1.0 in both cases. Web there are two options available to suppress the form 1116 and 1116 amt: Web the calculation for line 1a adjustments to foreign source qualified dividends and capital gain distributions on amt form 1116 are as follows:

Starting In Tax Year 2021, The Irs Released A New.

For those taxed at 0%, do not include the. Web how does the amt form 1116 calculate? Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; For example, if you only had foreign tax credit on wages in a prior.

Web (Form 1116) (December 2021) Foreign Tax Carryover Reconciliation Schedule Department Of The Treasury Internal Revenue Service See Separate Instructions.

Web if you hade made the simplified foreign tax limitation election for amt last year, you should only one form 1116. Complete, edit or print tax forms instantly. The alternative minimum tax version of the form 1116 (based on the form 6251 instructions) automatically calculates from. Taxpayers are therefore reporting running balances of.

Complete Parts 1 And 2 Of Form 6251 Chances Are High That Line 7.

Department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Web entering income for the foreign tax credit form 1116; Generating the schedule b for form 1116 in proseries starting in 2021: