Form 1120-S Extension

Form 1120-S Extension - Choose form 1120 and enter the tax year. An s corporation can request an extension to get. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. Complete, edit or print tax forms instantly. Even if you file an extension, you must still pay the tax you owe by. Web add business details. The deadline to file form the 1120s is march 15 th of the tax year. Complete, edit or print tax forms instantly. Web enter code 25 in the box on form 7004, line 1.

Even if you file an extension, you must still pay the tax you owe by. The deadline to file form the 1120s is march 15 th of the tax year. Enter tentative taxes if any and choose efw or eftps to make payments. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. Complete, edit or print tax forms instantly. You can obtain the extension by. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Web enter code 25 in the box on form 7004, line 1. An s corporation can request an extension to get. Ad easy guidance & tools for c corporation tax returns.

File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. The deadline to file form the 1120s is march 15 th of the tax year. Here is how to file your. Web add business details. Web enter code 25 in the box on form 7004, line 1. Enter tentative taxes if any and choose efw or eftps to make payments. Web extension of time to file. Most corporations operate on the calendar tax year. Choose form 1120 and enter the tax year. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching.

1120 tax table

Complete, edit or print tax forms instantly. Web add business details. Web enter code 25 in the box on form 7004, line 1. Here is how to file your. Enter tentative taxes if any and choose efw or eftps to make payments.

Form 1120S (Schedule B1) Information on Certain Shareholders of an

Even if you file an extension, you must still pay the tax you owe by. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. Complete, edit or print tax forms instantly. The deadline to file form the 1120s is march 15 th of the tax year. You.

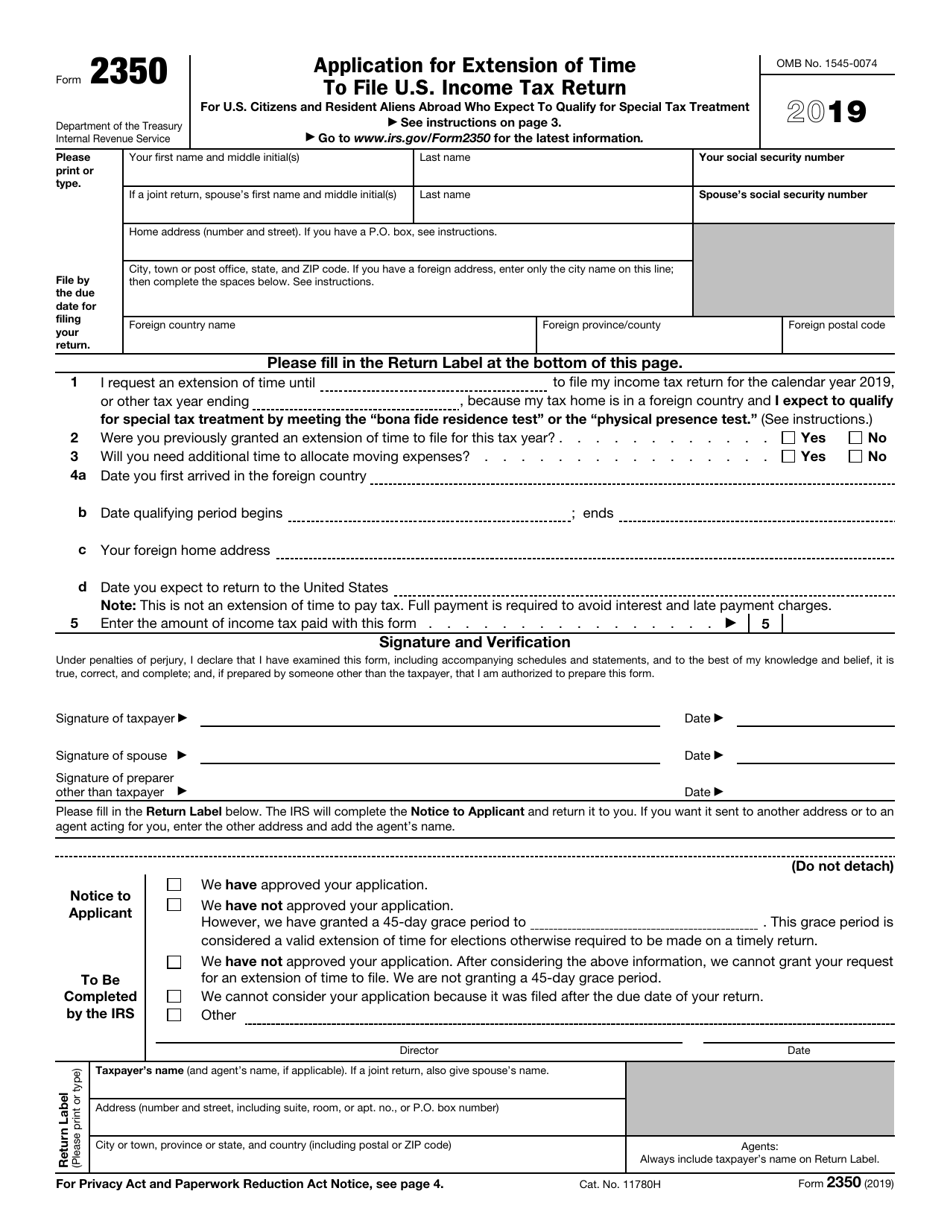

IRS Form 2350 Download Fillable PDF or Fill Online Application for

Choose form 1120 and enter the tax year. Web enter code 25 in the box on form 7004, line 1. Web extension of time to file. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. Most corporations operate on the calendar tax year.

File 1120 Extension Online Corporate Tax Extension Form for 2020

Web enter code 25 in the box on form 7004, line 1. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Most corporations operate on the calendar tax year. Here is how to file your. Enter tentative taxes if any and choose efw or eftps to make payments.

A Beginner's Guide to S Corporation Taxes The Blueprint

Here is how to file your. Even if you file an extension, you must still pay the tax you owe by. Complete, edit or print tax forms instantly. Web enter code 25 in the box on form 7004, line 1. An s corporation can request an extension to get.

1120S Extensions

Choose form 1120 and enter the tax year. You can obtain the extension by. Complete, edit or print tax forms instantly. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. An s corporation can request an extension to get.

IRS 1120S 2022 Form Printable Blank PDF Online

Choose form 1120 and enter the tax year. The deadline to file form the 1120s is march 15 th of the tax year. An s corporation can request an extension to get. You can obtain the extension by. Enter tentative taxes if any and choose efw or eftps to make payments.

Form 1120S Tax Return for an S Corporation (2013) Free Download

Complete, edit or print tax forms instantly. Most corporations operate on the calendar tax year. Complete, edit or print tax forms instantly. Ad easy guidance & tools for c corporation tax returns. Choose form 1120 and enter the tax year.

How to File an Extension for Your SubChapter S Corporation

You can obtain the extension by. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Most corporations operate on the calendar tax year. Web enter code 25 in the box on form 7004, line 1. The deadline to file form the 1120s is march 15 th of the tax.

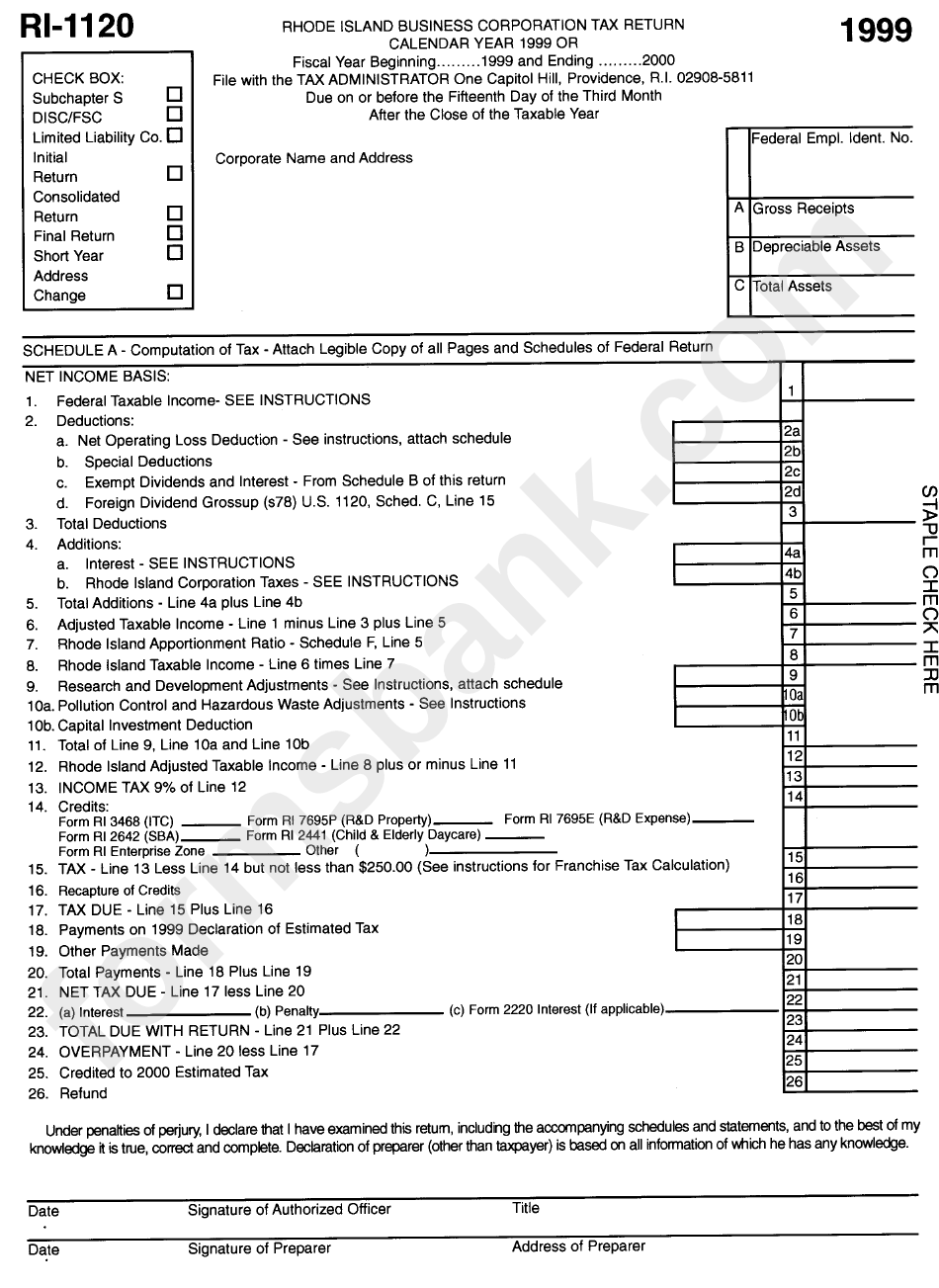

Form Ri1120 Rhode Island Business Corporation Tax Return printable

Web extension of time to file. Even if you file an extension, you must still pay the tax you owe by. The deadline to file form the 1120s is march 15 th of the tax year. Enter tentative taxes if any and choose efw or eftps to make payments. Web add business details.

Even If You File An Extension, You Must Still Pay The Tax You Owe By.

Here is how to file your. Choose form 1120 and enter the tax year. Web extension of time to file. Complete, edit or print tax forms instantly.

Ad Easy Guidance & Tools For C Corporation Tax Returns.

Complete, edit or print tax forms instantly. Enter tentative taxes if any and choose efw or eftps to make payments. Web enter code 25 in the box on form 7004, line 1. Most corporations operate on the calendar tax year.

You Can Obtain The Extension By.

The deadline to file form the 1120s is march 15 th of the tax year. Web add business details. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching.