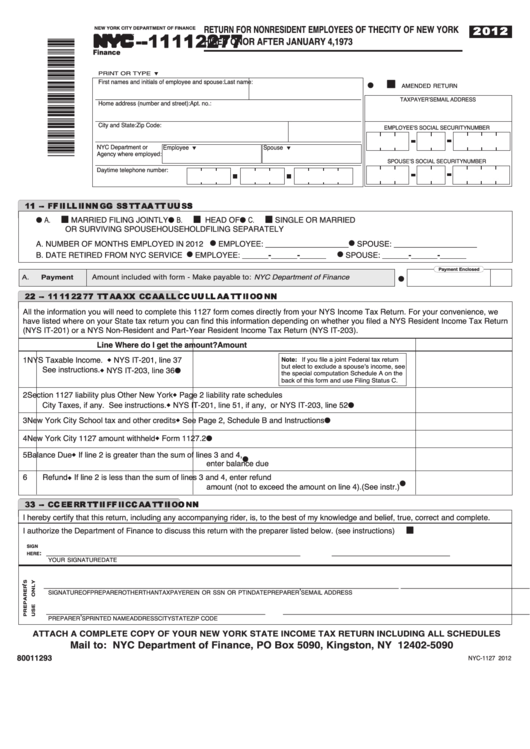

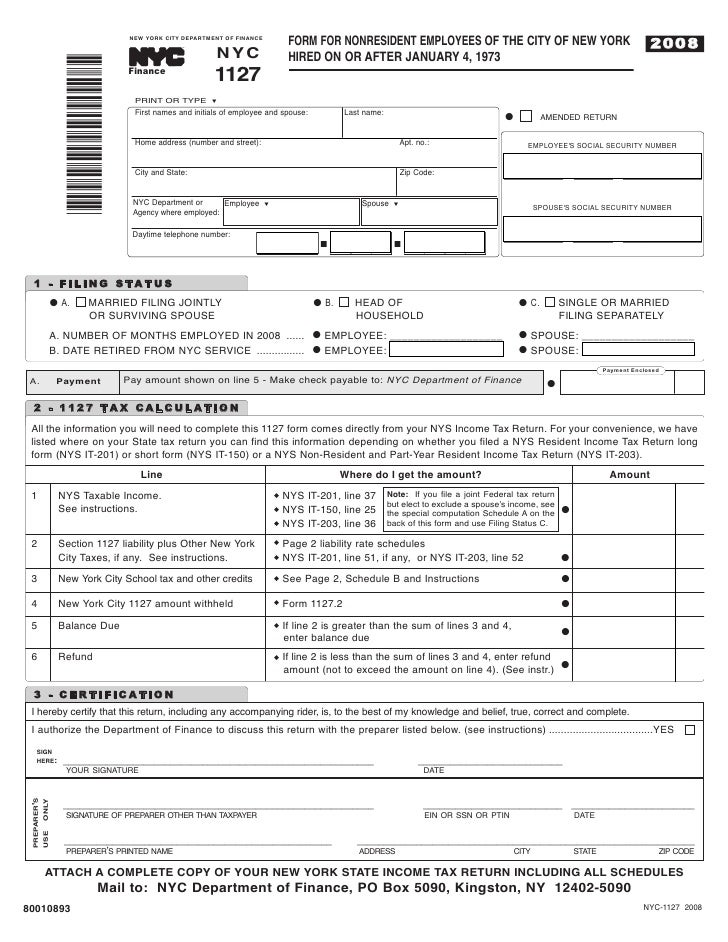

Form 1127 Nyc

Form 1127 Nyc - Refer to the outlined fillable lines. Open the pdf sample in the editor. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the new york city charter during all or part of the remainder of 2022, you must An 1127 in most return. Amendedreturn taxpayer’s email address home address (number and. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Here you can put in your data. This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc. Now it will take at most thirty minutes, and you can do it from any place. Shouldn't it be reported on line 5 as a local income tax?

Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment you agreed to pay to the city an amount equal to a city personal income tax on residents, computed and determined as if you were a resident of the city. Here you can put in your data. This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc. Shouldn't it be reported on line 5 as a local income tax? Now it will take at most thirty minutes, and you can do it from any place. The form will be tentatively available on. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the new york city charter during all or part of the remainder of 2022, you must An 1127 in most return. Amendedreturn taxpayer’s email address home address (number and. Refer to the outlined fillable lines.

Open the pdf sample in the editor. Shouldn't it be reported on line 5 as a local income tax? The form will be tentatively available on. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the new york city charter during all or part of the remainder of 2022, you must Refer to the outlined fillable lines. Here you can put in your data. Amendedreturn taxpayer’s email address home address (number and. Now it will take at most thirty minutes, and you can do it from any place. Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment you agreed to pay to the city an amount equal to a city personal income tax on residents, computed and determined as if you were a resident of the city.

Fillable Form Nyc1127 Return For Nonresident Employees Of The City

Refer to the outlined fillable lines. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Now it will take at most thirty minutes, and you can do it from any place. An 1127 in most return. This form calculates the city.

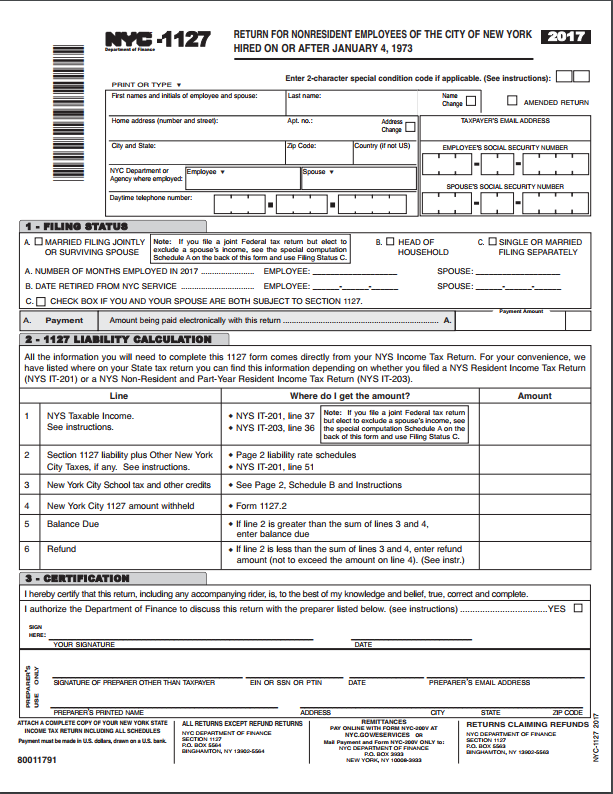

NYC1127 Form for Nonresident Employees of the City of New York Hired…

An 1127 in most return. Now it will take at most thirty minutes, and you can do it from any place. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Open the pdf sample in the editor. This form calculates the.

NYC1127 (2017) Edit Forms Online PDFFormPro

Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section 1127 of the new york city charter during all or part of the remainder of 2022, you must Here you can put in your data. The form will be tentatively available on. Web.

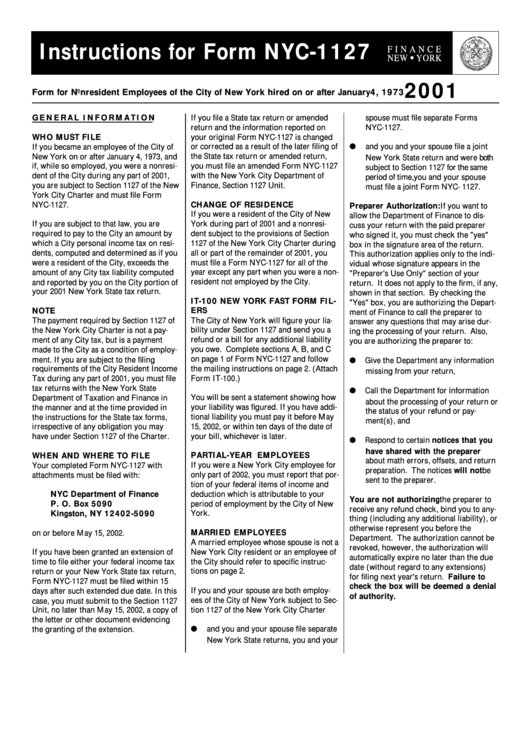

Instructions For Form Nyc1127 For Nonresident Employees Of The City Of

Shouldn't it be reported on line 5 as a local income tax? This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc. Amendedreturn taxpayer’s email address home address (number and. The form will be tentatively available on. Open the pdf sample in the editor.

New York City Form 1127 Blank Sample to Fill out Online in PDF

An 1127 in most return. Amendedreturn taxpayer’s email address home address (number and. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Web under section 1127 of the city charter, if you are a city employee who lives outside the city.

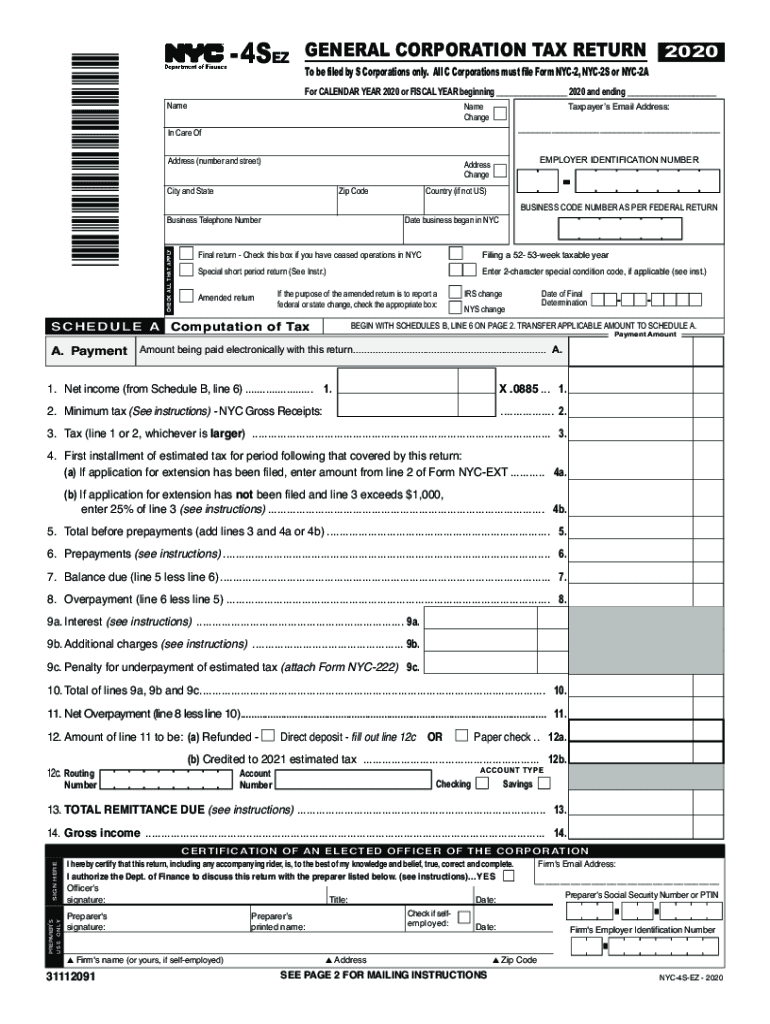

2020 Form NYC DoF NYC4SEZ Fill Online, Printable, Fillable, Blank

An 1127 in most return. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Change of residence if you were a resident of the city of new york during part of 2022 and a nonresident subject to the provisions of section.

NYC1127 Form for Nonresident Employees of the City of New York Hired…

Open the pdf sample in the editor. Refer to the outlined fillable lines. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. The form will be tentatively available on. Change of residence if you were a resident of the city of.

NYC1127 Form for Nonresident Employees of the City of New York Hired…

An 1127 in most return. This form calculates the city waiver liability, which is the amount due as if the filer were a resident of nyc. Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment you agreed.

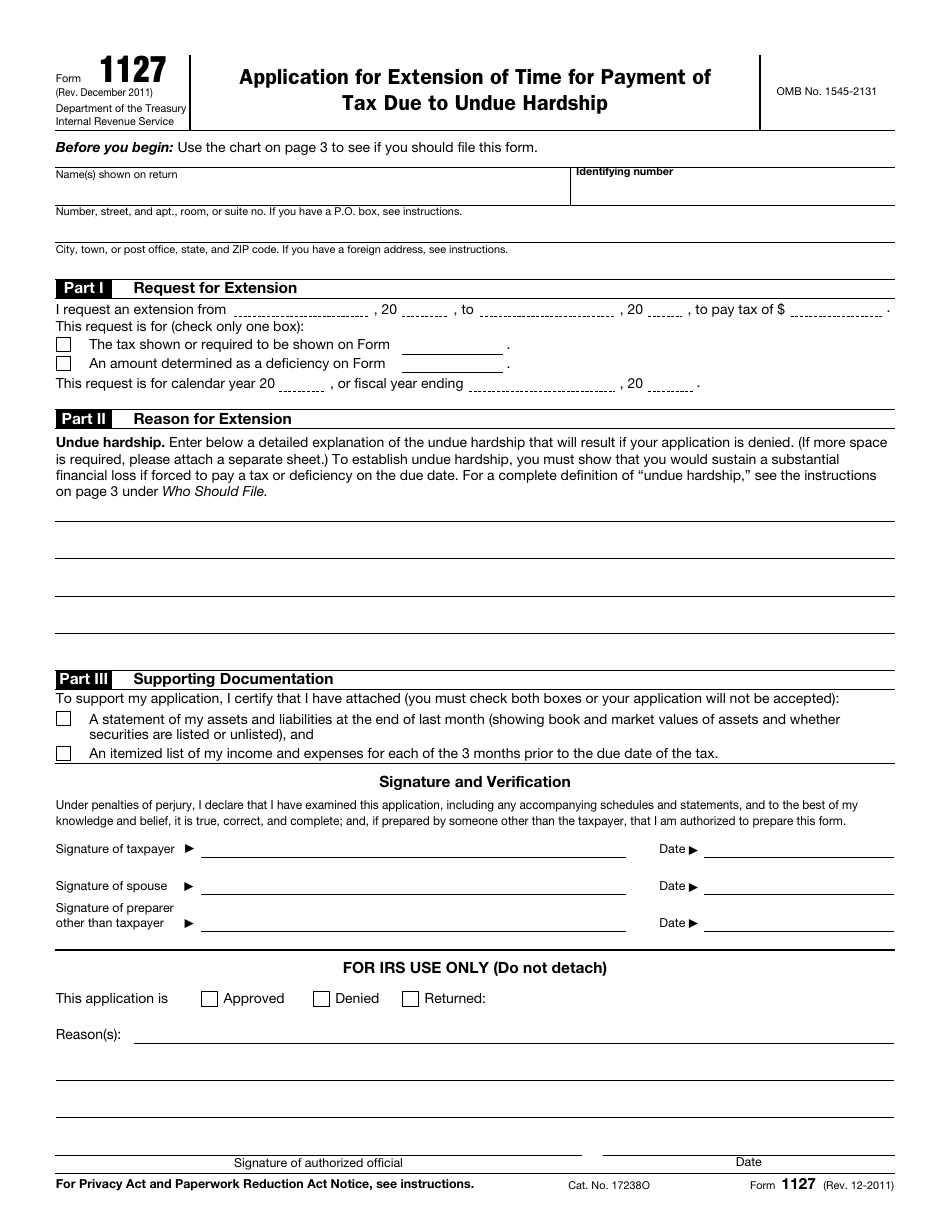

Form 1127 Application for Extension of Time for Payment of Tax Due To

An 1127 in most return. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Refer to the outlined fillable lines. Now it will take at most thirty minutes, and you can do it from any place. This form calculates the city.

IRS Form 1127 Download Fillable PDF or Fill Online Application for

Refer to the outlined fillable lines. Now it will take at most thirty minutes, and you can do it from any place. Amendedreturn taxpayer’s email address home address (number and. An 1127 in most return. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must.

Change Of Residence If You Were A Resident Of The City Of New York During Part Of 2022 And A Nonresident Subject To The Provisions Of Section 1127 Of The New York City Charter During All Or Part Of The Remainder Of 2022, You Must

Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment you agreed to pay to the city an amount equal to a city personal income tax on residents, computed and determined as if you were a resident of the city. Now it will take at most thirty minutes, and you can do it from any place. Web ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an 1127 return. Shouldn't it be reported on line 5 as a local income tax?

This Form Calculates The City Waiver Liability, Which Is The Amount Due As If The Filer Were A Resident Of Nyc.

Refer to the outlined fillable lines. Amendedreturn taxpayer’s email address home address (number and. An 1127 in most return. The form will be tentatively available on.

Open The Pdf Sample In The Editor.

Here you can put in your data.