Form 12153 Irs

Form 12153 Irs - View our interactive tax map to see where you are in the tax process. 3 what is required in the form cdp 12153? View our interactive tax map to see where you are in the tax process. Web form 12153, request for collection due process or equivalent hearing. 6 what are examples of reasons for requesting a hearing? It’s important to identify all the reasons for any disagreement you have; Collection due process hearing (cdp) 2 what is included on the cdp form 12153? Use this form to request a collection due process (cdp) or equivalent hearing (eh) with the irs independent office of appeals (appeals) if you have received a letter Web use this form to request a collection due process (cdp) or equivalent hearing with the irs office of appeals if you have been issued one of the following lien or levy notices: Web complete form 12153, request for a collection due process or equivalent hearing pdf.

Notice of federal tax lien filing and your right to a hearing under irc 6320, notice of intent to levy and notice of your right to a hearing, Web form 12153 is an irs document also known as a request for a collection due process or equivalent hearing. 7 examples of when a cdp request may work Collection due process hearing (cdp) 2 what is included on the cdp form 12153? Send the completed form 12153 to the same address that is shown on your cdp notice View our interactive tax map to see where you are in the tax process. Use this form to request a collection due process (cdp) or equivalent hearing (eh) with the irs independent office of appeals (appeals) if you have received a letter This chapter discusses the rights taxpayers have to appeal collection actions, proposed or taken, and the related appeal procedures. However, as explained in publication 1660, in a cdp hearing with appeals, you can only discuss the existence of or amount that you owe under limited circumstances. Web complete form 12153, request for a collection due process or equivalent hearing pdf.

Web complete form 12153, request for a collection due process or equivalent hearing pdf. Show on roadmap notice overview However, as explained in publication 1660, in a cdp hearing with appeals, you can only discuss the existence of or amount that you owe under limited circumstances. This chapter discusses the rights taxpayers have to appeal collection actions, proposed or taken, and the related appeal procedures. View our interactive tax map to see where you are in the tax process. 3 what is required in the form cdp 12153? Send the completed form 12153 to the same address that is shown on your cdp notice It’s important to identify all the reasons for any disagreement you have; View our interactive tax map to see where you are in the tax process. Web form 12153 is an irs document also known as a request for a collection due process or equivalent hearing.

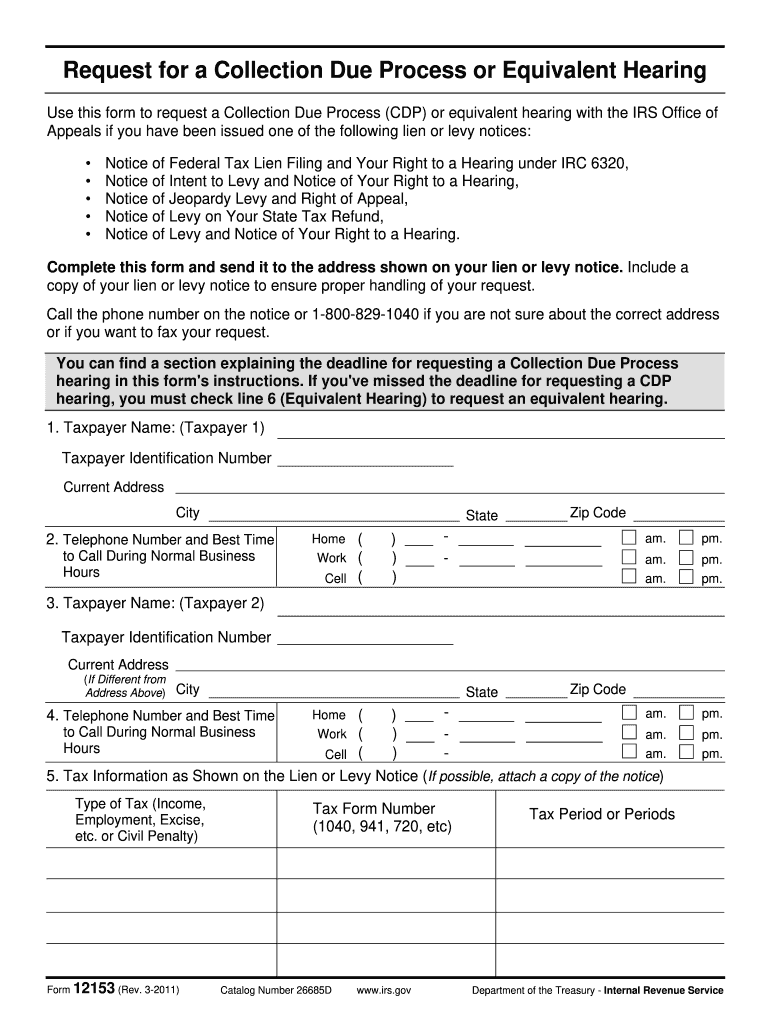

Form 12153 Request for a Collection Due Process or Equivalent Hearing

You can file this form in response to an irs notice of intent to levy or notice of intent to file a lien on your assets. View our interactive tax map to see where you are in the tax process. Web form 12153, request for collection due process or equivalent hearing. View our interactive tax map to see where you.

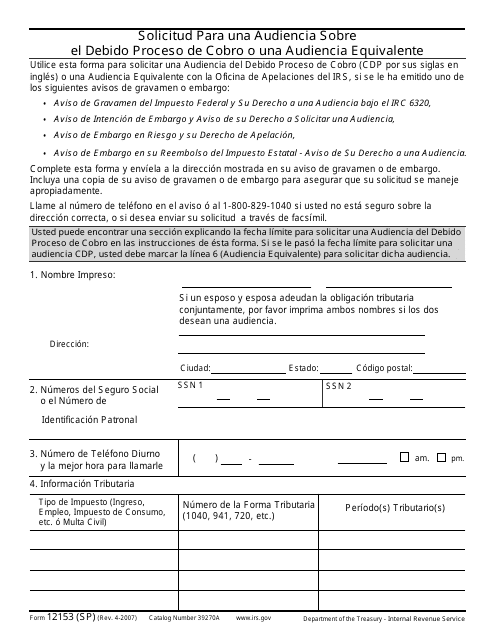

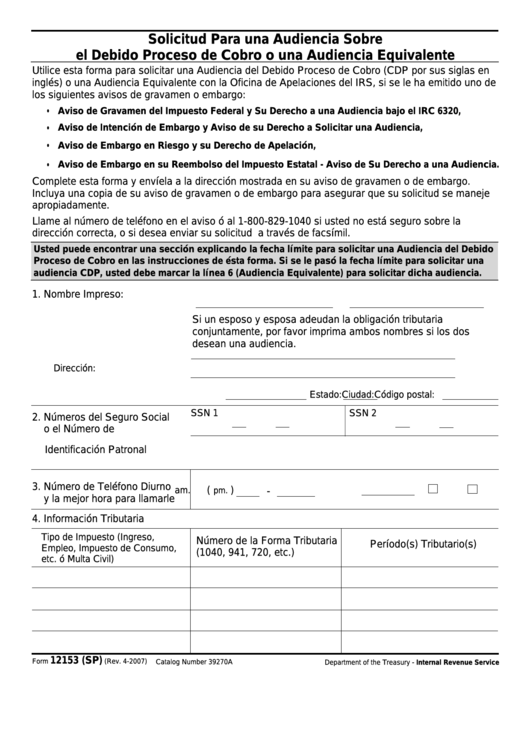

IRS Formulario 12153 (SP) Download Fillable PDF or Fill Online

Web the form 12153 is used to request a collection due process (cdp) hearing within 30 days of receiving the notice, or an equivalent hearing within 1 year of the notice. Web complete form 12153, request for a collection due process or equivalent hearing pdf. Web form 12153, request for collection due process or equivalent hearing. This irm is designed.

IRSForm12153Amended

View our interactive tax map to see where you are in the tax process. Web the form 12153 is used to request a collection due process (cdp) hearing within 30 days of receiving the notice, or an equivalent hearing within 1 year of the notice. Send the completed form 12153 to the same address that is shown on your cdp.

IRS Form 12153 Request for a Collection Due Process or Equivalent Hearing

Notice of federal tax lien filing and your right to a hearing under irc 6320, notice of intent to levy and notice of your right to a hearing, It could help you navigate your way through the irs. Request for a collection due process or equivalent hearing. Web complete form 12153, request for a collection due process or equivalent hearing.

IRS Form 12153 YouTube

Collection due process hearing (cdp) 2 what is included on the cdp form 12153? This chapter discusses the rights taxpayers have to appeal collection actions, proposed or taken, and the related appeal procedures. Web manual transmittal may 12, 2022 purpose (1) this transmits revised irm 8.22.4, collection due process, collection due process appeals program. Web complete form 12153, request for.

Form 12153 Request for a Collection Due Process or Equivalent Hearing

Show on roadmap notice overview Web form 12153, request for collection due process or equivalent hearing. This chapter discusses the rights taxpayers have to appeal collection actions, proposed or taken, and the related appeal procedures. Web use this form to request a collection due process (cdp) or equivalent hearing with the irs office of appeals if you have been issued.

Fillable Form 12153 (Sp) Solicitud Para Una Audiencia Sobre El Debido

View our interactive tax map to see where you are in the tax process. Web you should request a cdp hearing using form 12153 if you feel the lien is inappropriate. Web use this form to request a collection due process (cdp) or equivalent hearing with the irs office of appeals if you have been issued one of the following.

IRS form 12153 in 2022 Tax forms, Irs forms, Form

It could help you navigate your way through the irs. Web complete form 12153, request for a collection due process or equivalent hearing pdf. View our interactive tax map to see where you are in the tax process. Web the form 12153 is used to request a collection due process (cdp) hearing within 30 days of receiving the notice, or.

Online IRS Form 12153 2013 2019 Fillable and Editable PDF Template

Web you should request a cdp hearing using form 12153 if you feel the lien is inappropriate. Web form 12153, request for collection due process or equivalent hearing. Send the completed form 12153 to the same address that is shown on your cdp notice It could help you navigate your way through the irs. Use this form to request a.

Irs Form 12153 Fill in Fill Out and Sign Printable PDF Template signNow

Collection due process hearing (cdp) 2 what is included on the cdp form 12153? Web complete form 12153, request for a collection due process or equivalent hearing pdf. However, as explained in publication 1660, in a cdp hearing with appeals, you can only discuss the existence of or amount that you owe under limited circumstances. It could help you navigate.

4 What Is An Equivalent Hearing?

5 where should you file your cdp or equivalent hearing request? It could help you navigate your way through the irs. Web form 12153 is an irs document also known as a request for a collection due process or equivalent hearing. However, as explained in publication 1660, in a cdp hearing with appeals, you can only discuss the existence of or amount that you owe under limited circumstances.

Collection Due Process Hearing (Cdp) 2 What Is Included On The Cdp Form 12153?

Web use this form to request a collection due process (cdp) or equivalent hearing with the irs office of appeals if you have been issued one of the following lien or levy notices: View our interactive tax map to see where you are in the tax process. Send the completed form 12153 to the same address that is shown on your cdp notice Web you should request a cdp hearing using form 12153 if you feel the lien is inappropriate.

Web Manual Transmittal May 12, 2022 Purpose (1) This Transmits Revised Irm 8.22.4, Collection Due Process, Collection Due Process Appeals Program.

7 examples of when a cdp request may work Web the form 12153 is used to request a collection due process (cdp) hearing within 30 days of receiving the notice, or an equivalent hearing within 1 year of the notice. 3 what is required in the form cdp 12153? It’s important to identify all the reasons for any disagreement you have;

This Irm Is Designed For Use By Revenue Officers And Their Managers.

View our interactive tax map to see where you are in the tax process. This chapter discusses the rights taxpayers have to appeal collection actions, proposed or taken, and the related appeal procedures. Web form 12153, request for collection due process or equivalent hearing. Notice of federal tax lien filing and your right to a hearing under irc 6320, notice of intent to levy and notice of your right to a hearing,