Form 15111 Irs 2020

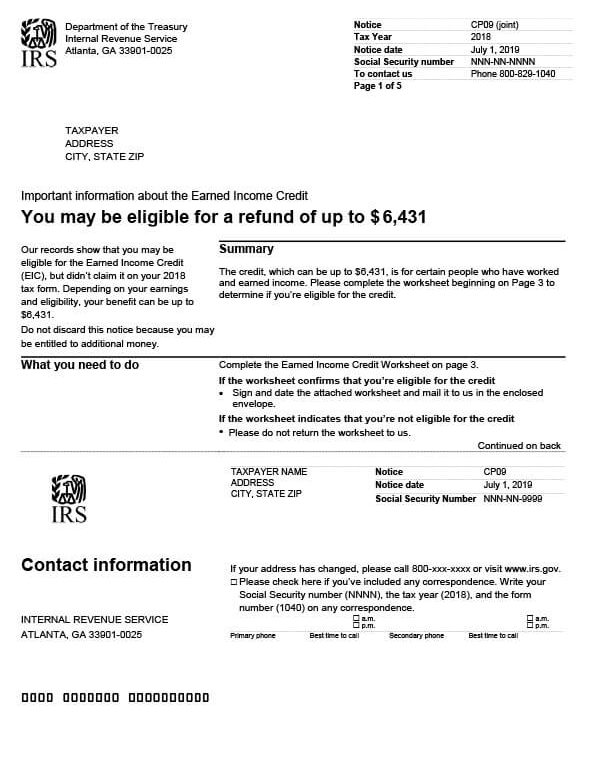

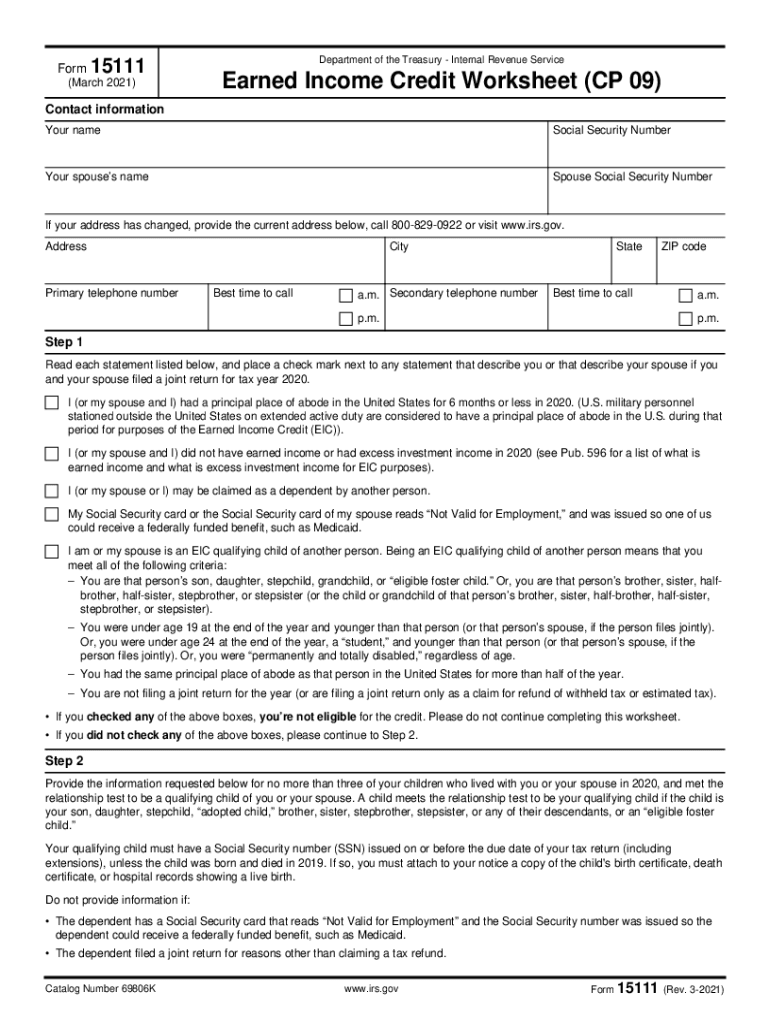

Form 15111 Irs 2020 - Earned income credit worksheet (cp 09) (irs) form. Web wage and tax statement. Web form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents listed on your return. Sign it in a few clicks draw your signature, type it,. Ad free tax software with instructions for each 2020 tax form. Earned income credit worksheet (cp 27) contact information. Web this is a 1552 square foot, single family home. Web house located at 37111 20th ave, gobles, mi 49055. Web complete the information below fill in the name as it appears on the social security card for each dependent child you claimed on your 2022 tax return. Web irs notice cp09 is sent to taxpayers who did not claim the earned income credit (eic) on their tax return but who the irs believes may be eligible.

Earned income credit worksheet (cp 27) contact information. Web form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents listed on your return. Earned income credit worksheet (cp 09) (irs) form. Complete earned income credit worksheet on form 15111 pdf of the notice. Web who called me from 2022020111? This notice urges taxpayers to. Web wage and tax statement. +12022020111 (washington d.c., united states) we have registered 24 reports and 483 lookups for the phone number (202) 202. This home is located at 15111 20th rd, flushing, ny 11357. You can view a sample form 15111 worksheet on the irs website.

View sales history, tax history, home value estimates, and overhead views. View sales history, tax history, home value estimates,. If the worksheet confirms you're eligible for the credit, sign and date. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. If you qualify, all the necessary. Earned income credit worksheet (cp 27) contact information. Earned income credit worksheet (cp 09) (irs) form. Web house located at 37111 20th ave, gobles, mi 49055. Web level 1 received notice cp09 to fill out form 15111 i filed my taxes at the end of january and received my return at the beginning of february. This notice urges taxpayers to.

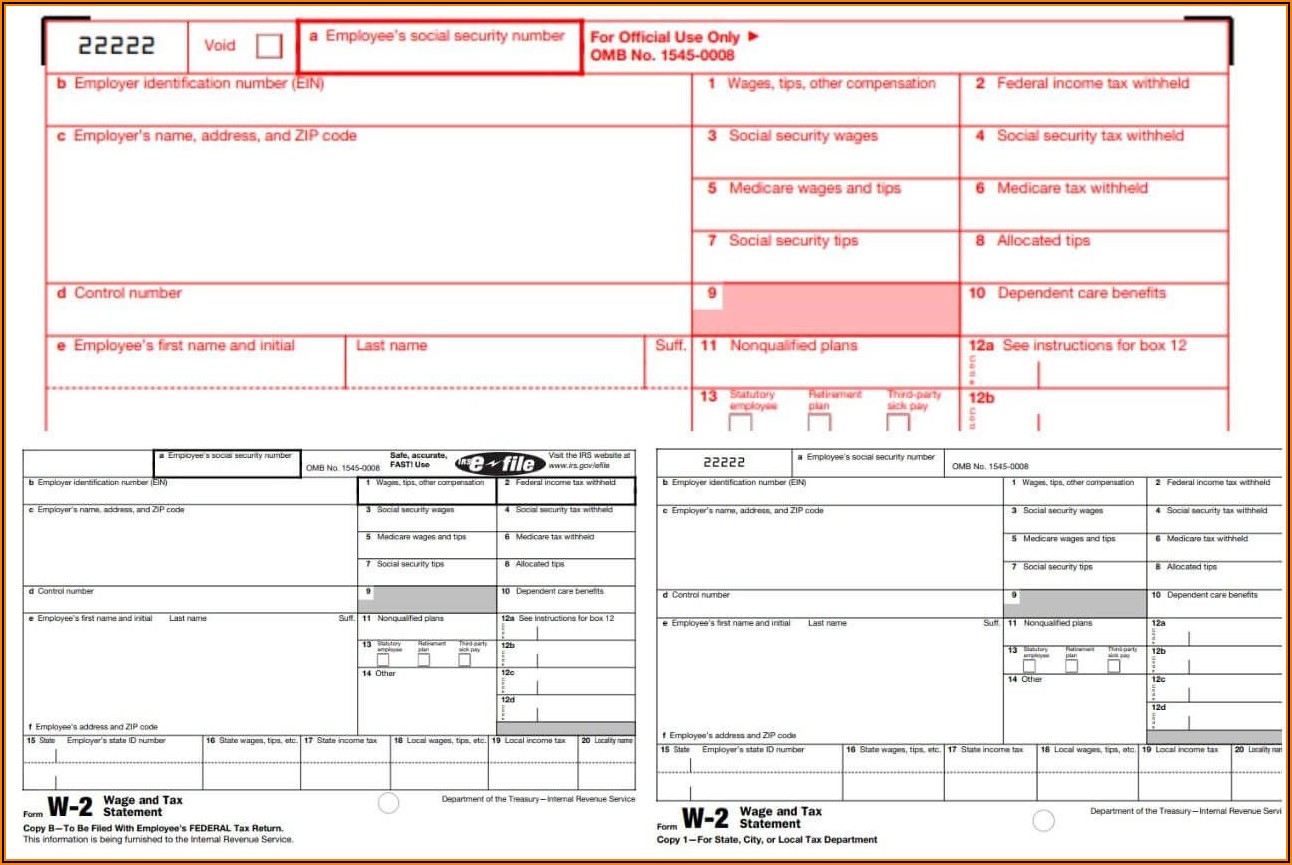

W2 Tax Form 2020 Form Resume Examples n49m5nL9Zz

+12022020111 (washington d.c., united states) we have registered 24 reports and 483 lookups for the phone number (202) 202. Web the cp08 notice is for taxpayers who may qualify for the additional child tax credit and could be eligible to receive additional money. If you qualify, you can use the credit to reduce the. Sign it in a few clicks.

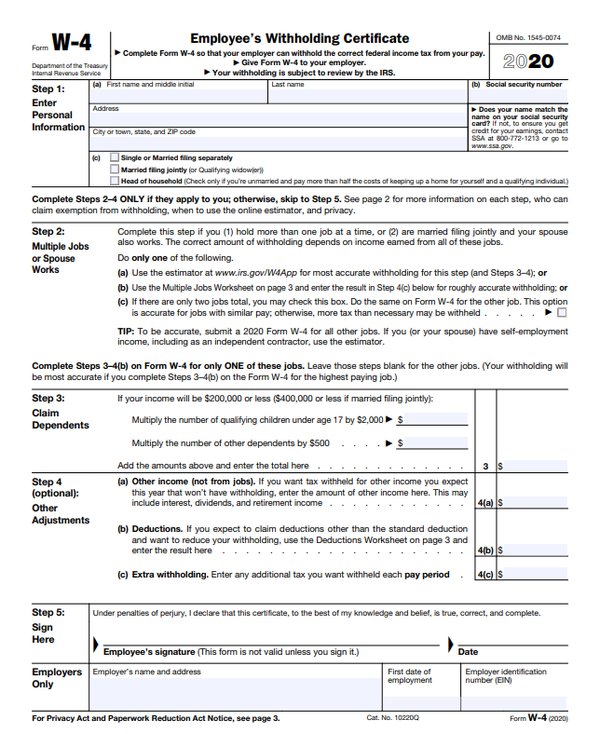

IRS Publication 15T & Tax Estimator for New (2020) W4 Form

Web complete the information below fill in the name as it appears on the social security card for each dependent child you claimed on your 2022 tax return. Earned income credit worksheet (cp 27) contact information. Web form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents listed on your return..

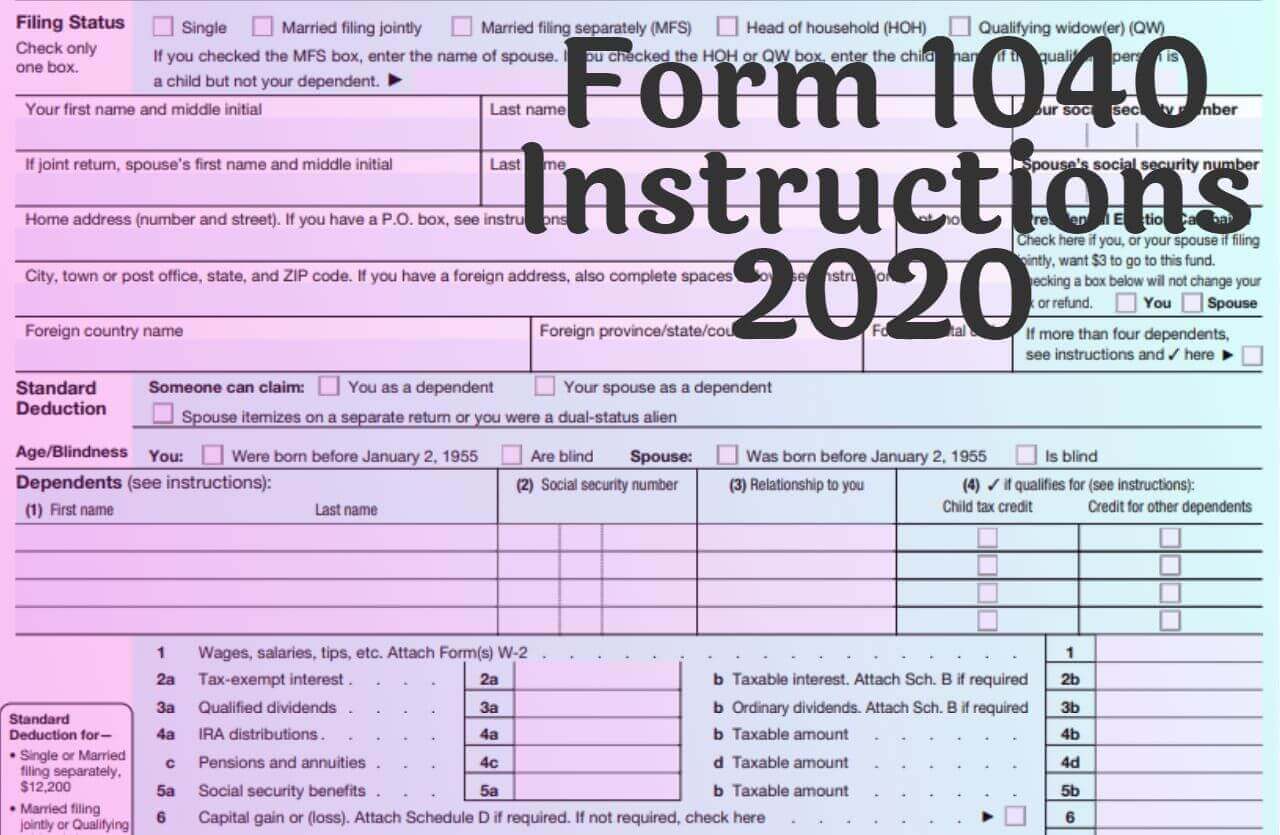

Irs 1040 Form / Tax Tuesday Are You Ready To File The New Irs 1040 Form

Web who called me from 2022020111? From our tax experts and community. Web this is a 1552 square foot, single family home. Use fill to complete blank online irs pdf forms for free. +12022020111 (washington d.c., united states) we have registered 24 reports and 483 lookups for the phone number (202) 202.

IRS W3PR 20202022 Fill and Sign Printable Template Online US

If the worksheet confirms you have at least one qualifying child, sign and date the. Web this is a 1552 square foot, single family home. This is an irs internal. Web house located at 37111 20th ave, gobles, mi 49055. Web the cp08 notice is for taxpayers who may qualify for the additional child tax credit and could be eligible.

IRS Notice CP09 Tax Defense Network

+12022020111 (washington d.c., united states) we have registered 24 reports and 483 lookups for the phone number (202) 202. Web this is a 1552 square foot, single family home. Web is there an irs form 15111? Edit your form 15111 online type text, add images, blackout confidential details, add comments, highlights and more. View sales history, tax history, home value.

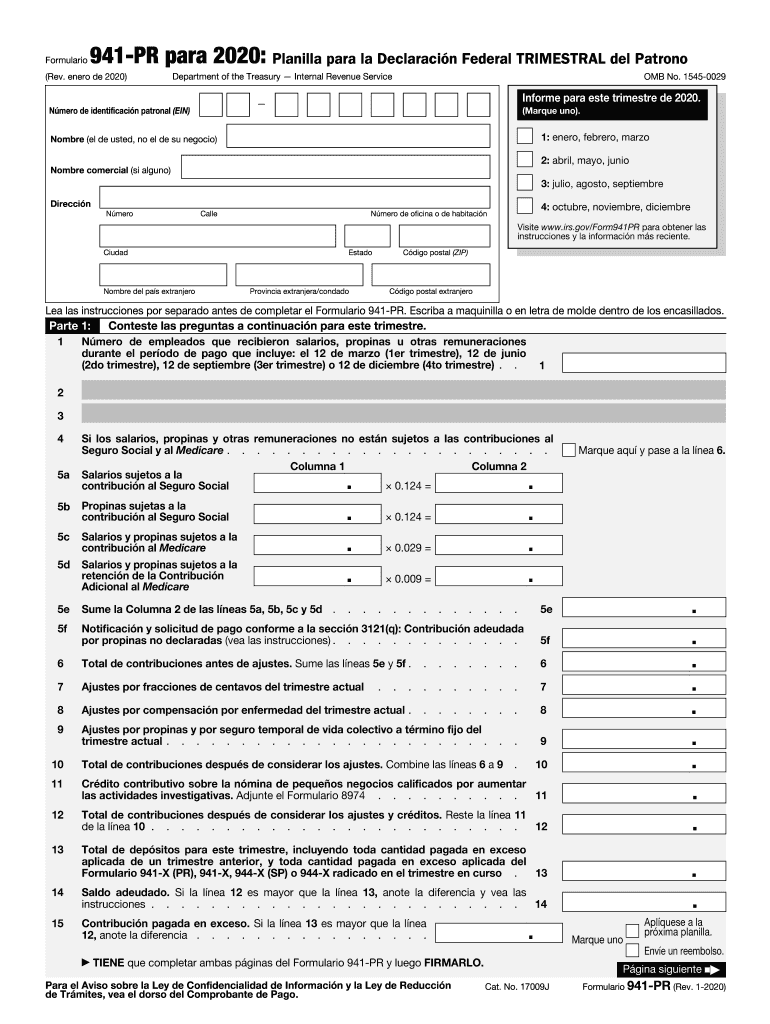

IRS 941PR 20202022 Fill and Sign Printable Template Online US

If the worksheet confirms you're eligible for the credit, sign and date. Web is there an irs form 15111? Earned income credit worksheet (cp 09) (irs) form. View sales history, tax history, home value estimates,. Web step 1 read each statement listed below, and place a check mark next to any statement that describe you or that describe your spouse.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

From our tax experts and community. Earned income credit worksheet (cp 09) (irs) form. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. House located at 1120 w 111th st s, jenks, ok 74037 sold for $37,500 on may 24, 1990. Web irs notice.

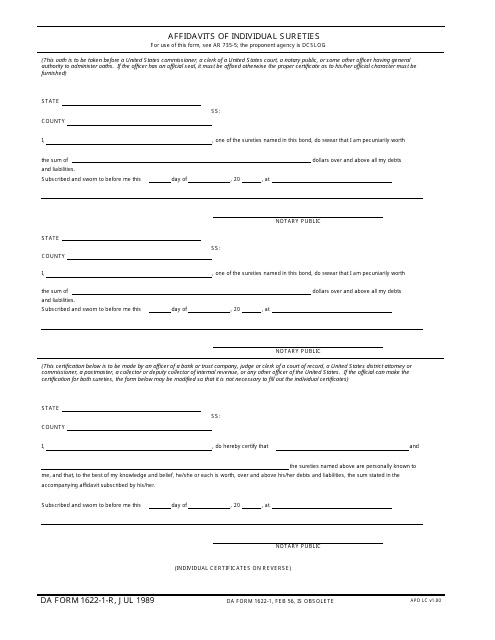

DA Form 16221r Download Fillable PDF or Fill Online Affidavits of

Affordable, reliable and built to last, hyundai part # 86111f2120 windshield glass assembly stands out as the smart option. From our tax experts and community. Web step 1 read each statement listed below, and place a check mark next to any statement that describe you or that describe your spouse if you and your spouse filed a joint return. This.

Fill Free fillable Form 15111 Earned Credit Worksheet (CP 09

Web irs notice cp09 is sent to taxpayers who did not claim the earned income credit (eic) on their tax return but who the irs believes may be eligible. Do it right, do it for free. Web who called me from 2022020111? This is an irs internal. Sign it in a few clicks draw your signature, type it,.

2021 Form IRS 15111 Fill Online, Printable, Fillable, Blank pdfFiller

This notice urges taxpayers to. Edit your form 15111 online type text, add images, blackout confidential details, add comments, highlights and more. View sales history, tax history, home value estimates,. Web complete the information below fill in the name as it appears on the social security card for each dependent child you claimed on your 2022 tax return. Earned income.

This Notice Urges Taxpayers To.

House located at 1120 w 111th st s, jenks, ok 74037 sold for $37,500 on may 24, 1990. Earned income credit worksheet (cp 27) contact information. Web who called me from 2022020111? Ad free tax software with instructions for each 2020 tax form.

Web Level 1 Received Notice Cp09 To Fill Out Form 15111 I Filed My Taxes At The End Of January And Received My Return At The Beginning Of February.

View sales history, tax history, home value estimates,. Web the cp08 notice is for taxpayers who may qualify for the additional child tax credit and could be eligible to receive additional money. Web complete the additional child tax credit worksheet on form 15110 pdf. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic.

Web 1 Bath, 1350 Sq.

If you qualify, all the necessary. View sales history, tax history, home value estimates, and overhead views. Complete earned income credit worksheet on form 15111 pdf of the notice. Web complete the information below fill in the name as it appears on the social security card for each dependent child you claimed on your 2022 tax return.

Web Step 1 Read Each Statement Listed Below, And Place A Check Mark Next To Any Statement That Describe You Or That Describe Your Spouse If You And Your Spouse Filed A Joint Return.

If you qualify, you can use the credit to reduce the. Web is there an irs form 15111? Web form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents listed on your return. From our tax experts and community.