Form 2210 Line 4

Form 2210 Line 4 - Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. The form doesn't always have to be. You don’t owe a penalty. Enter the total penalty from line 14 of the worksheet for form 2210, part iv, section b—figure the penalty. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. Web complete lines 1 through 7 below. No d complete lines 8 and 9 below. Is line 6 equal to or. Web waiver in certain circumstances, the irs will waive all or part of the penalty. After completing lines 1 through 7 on irs form 2210, is line 4 or line 7 less than $1,000?

Web form 2210 error line d withholding sum of 4 columns not equal to total withholding if your software is up to date, try deleting the form and adding it back. No d complete lines 8 and 9 below. Is line 6 equal to or more than line 9? Is line 7 less than $1,000? Complete lines 1 through 7 below. Does any box in part ii below apply? See waiver of penalty in the instructions. Enter the total penalty from line 14 of the worksheet for form 2210, part iii, section b—figure penalty. Is line 4 or line 7 less than $1,000? Is line 6 equal to or.

Complete lines 1 through 7 below. Enter the total penalty from line 14 of the worksheet for form 2210, part iv, section b—figure the penalty. Add the amounts on federal schedule a (form 1040), line 4, line 9, and line 15 plus any gambling losses included on line 16 ; Web to request a waiver when you file, complete irs form 2210 and submit it with your tax return. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. Does any box in part ii below apply? Web enter the amount from part iii, line 4; Web do you have to file form 2210? You do not owe a penalty. Web 2 best answer.

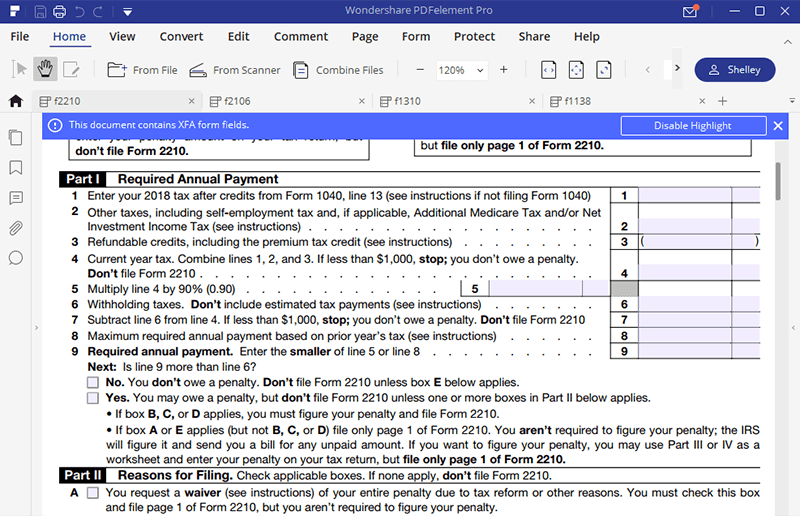

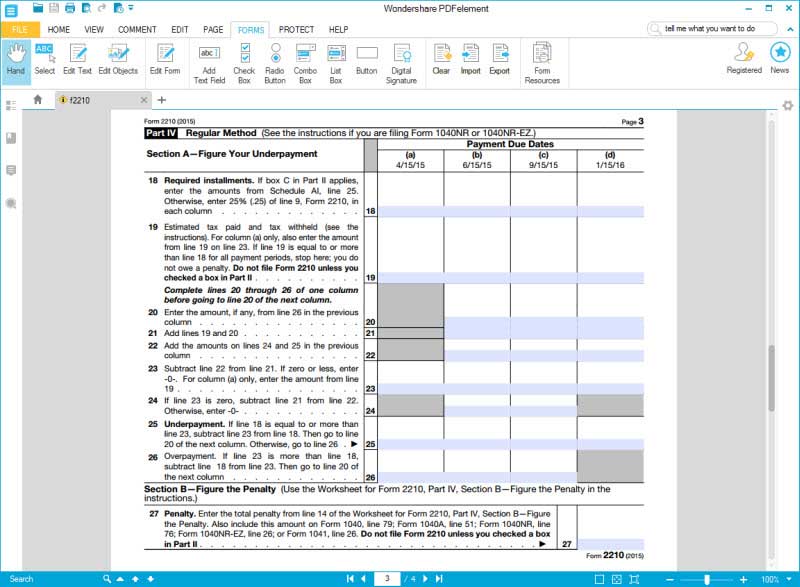

IRS Form 2210Fill it with the Best Form Filler

You do not owe a penalty. No complete lines 8 and. Is line 6 equal to or. Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so.

MI2210_260848_7 michigan.gov documents taxes

Web complete lines 8 and 9 below. Is line 6 equal to or. The amount on line 4 of your 2210 form last year would be the same as the amount on line. Is line 4 or line 7 less than $1,000? No complete lines 8 and.

IRS Form 2210 walkthrough (Underpayment of Estimated Tax by Individuals

Web to request a waiver when you file, complete irs form 2210 and submit it with your tax return. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Is line 6 equal to or. Dispute a penalty if you don’t qualify for penalty removal or. Complete lines 1 through 7 below.

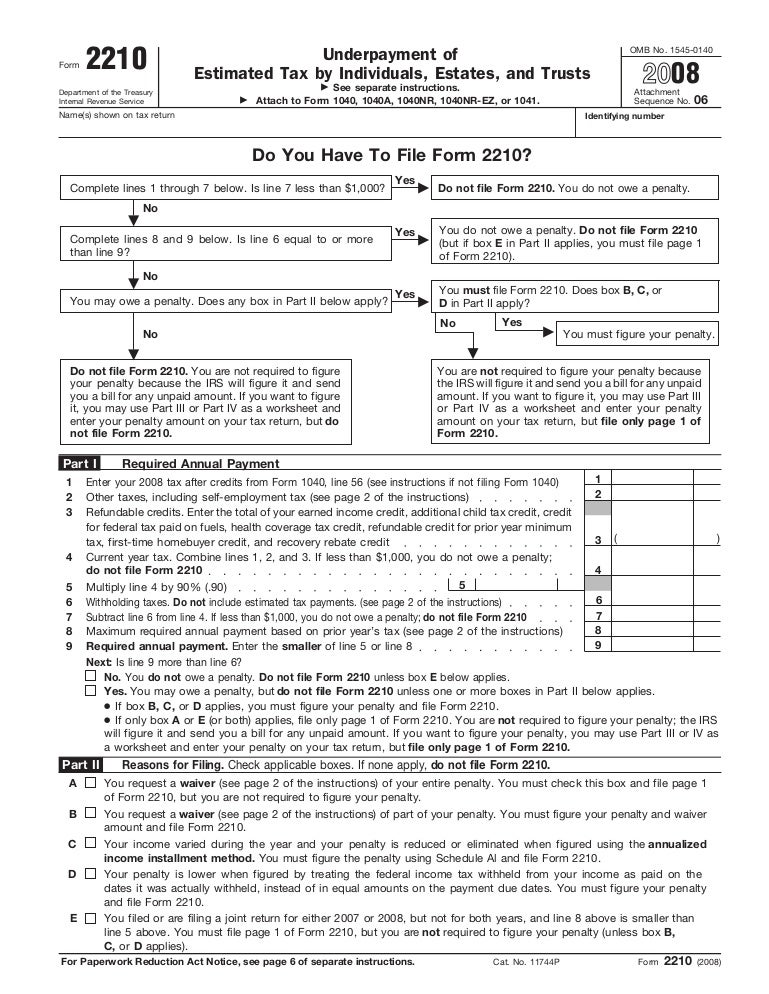

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web waiver in certain circumstances, the irs will waive all or part of the penalty. You don’t owe a penalty. No d complete lines 8 and 9 below. Also include this amount on form 1040, 1040. Yes do not file form 2210.

Form 2210Underpayment of Estimated Tax

No you may owe a penalty. Web complete lines 8 and 9 below. Web enter the amount from part iii, line 4; Web is line 4 or line 7 less than. Enter the total penalty from line 14 of the worksheet for form 2210, part iv, section b—figure the penalty.

Form 2210Underpayment of Estimated Tax

No you may owe a penalty. Yes adon’t file form 2210. Is line 7 less than $1,000? Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are. Also include this amount on form 1040, 1040.

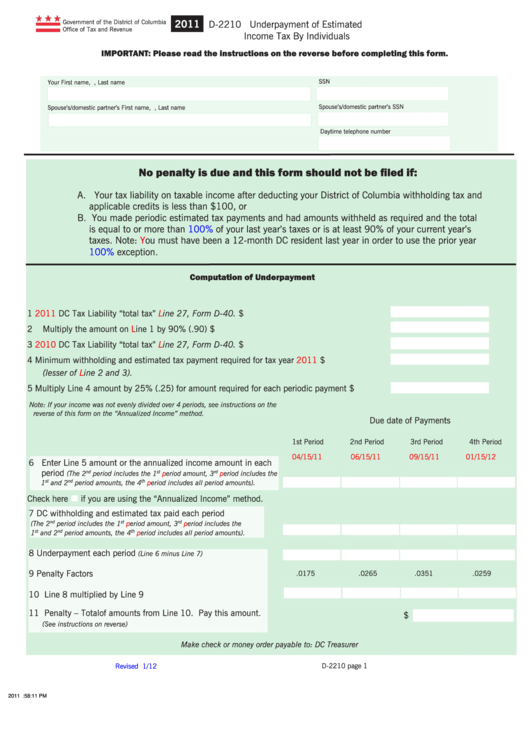

Form D2210 Underpayment Of Estimated Tax By Individuals

Web complete lines 8 and 9 below. Web waiver in certain circumstances, the irs will waive all or part of the penalty. Web 2 best answer. Also include this amount on form 1040, 1040. Web do you have to file form 2210?

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Is line 7 less than $1,000? Yes do not file form 2210. B you filed or are filing a joint return for either 2021 or 2022,. No do not file form 2210. Complete lines 1 through 7 below.

Form 2210 Edit, Fill, Sign Online Handypdf

No you may owe a penalty. Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are. No do not file form 2210. Web 2 best answer. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is.

IRS Form 2210 Fill it with the Best Form Filler

Enter the total penalty from line 14 of the worksheet for form 2210, part iv, section b—figure the penalty. With the form, attach an explanation for why you didn’t pay estimated taxes in the. No complete lines 8 and. You may not have had to file form 2210 last year. Web form 2210 is used by individuals (as well as.

Web Is Line 4 Or Line 7 Less Than $1,000?

Does any box in part ii below apply? Enter the total penalty from line 14 of the worksheet for form 2210, part iii, section b—figure penalty. No do not file form 2210. Is line 4 or line 7 less than $1,000?

The Amount On Line 4 Of Your 2210 Form Last Year Would Be The Same As The Amount On Line.

Also include this amount on form 1040, 1040. If yes, the taxpayer is not required to file irs form 2210 because they do not owe a. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Web is line 4 or line 7 less than.

You Don’t Owe A Penalty.

Web form 2210 error line d withholding sum of 4 columns not equal to total withholding if your software is up to date, try deleting the form and adding it back. After completing lines 1 through 7 on irs form 2210, is line 4 or line 7 less than $1,000? Enter the total penalty from line 14 of the worksheet for form 2210, part iv, section b—figure the penalty. With the form, attach an explanation for why you didn’t pay estimated taxes in the.

Web Do You Have To File Form 2210?

Add the amounts on federal schedule a (form 1040), line 4, line 9, and line 15 plus any gambling losses included on line 16 ; The form doesn't always have to be. Web enter the amount from part iii, line 4; Is line 6 equal to or more than line 9?