Form 2439 Tax

Form 2439 Tax - If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for the section 1202 exclusion. Fill, sign, print and send online instantly. You will be mailing your returns to specific addresses based on the type of. Web irs mailing addresses by residence & form. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. Securely download your document with other editable templates,. Web the information on form 2439 is reported on schedule d. Web (1) complete all three copies of form 2439 for each owner. Cp60 tax year 2016 january 30, 2017 social security. From within your taxact return ( online or.

Web form 2439 is a form used by the irs to request an extension of time to file a return. You will be mailing your returns to specific addresses based on the type of. Web irs mailing addresses by residence & form. To enter form 2439 go to investment. Cp60 tax year 2016 january 30, 2017 social security. If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for the section 1202 exclusion. Securely download your document with other editable templates,. Web (1) complete all three copies of form 2439 for each owner. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. From within your taxact return ( online or.

Below, find tables with addresses by residency. Web the information on form 2439 is reported on schedule d. Cp60 tax year 2016 january 30, 2017 social security. Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. Web irs mailing addresses by residence & form. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. It will flow to your schedule d when it is entered into turbotax. From within your taxact return ( online or. To enter form 2439 go to investment. Securely download your document with other editable templates,.

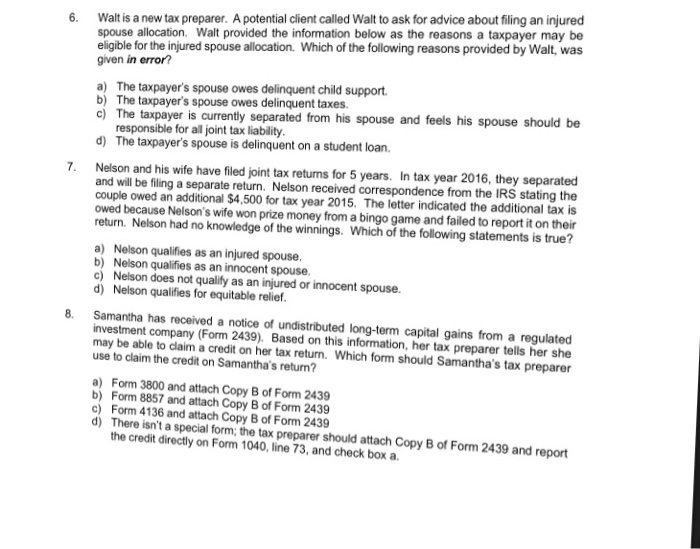

Solved 6 Walt is a new tax preparer. A potential client

Web (1) complete all three copies of form 2439 for each owner. These where to file addresses. If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for the section 1202 exclusion. Web gain from form 2439. Web irs mailing addresses by.

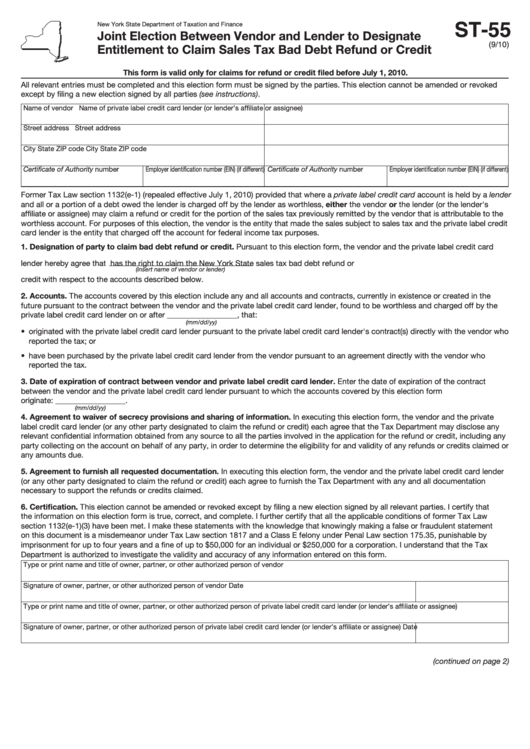

Form St55 Joint Election Between Vendor And Lender To Designate

Web (1) complete all three copies of form 2439 for each owner. Securely download your document with other editable templates,. Cp60 tax year 2016 january 30, 2017 social security. Web up to $40 cash back do whatever you want with a form 14039 (rev. Web form 2439 is a form used by the irs to request an extension of time.

Fill Free fillable IRS PDF forms

To enter form 2439 go to investment. Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. Web (1) complete all three copies of form 2439 for each owner. Below, find tables with addresses by residency. From within your.

Breanna Form 2439 Instructions 2019

To enter form 2439 go to investment. Below, find tables with addresses by residency. Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. If you received a form 2439 with a gain in box 1c, part or all.

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Web (1) complete all three copies of form 2439 for each owner. You will be mailing your returns to specific addresses based on the type of. Web the information on form 2439 is reported on schedule d. To enter form 2439 go to investment. Web up to $40 cash back do whatever you want with a form 14039 (rev.

Breanna Tax Form 2439

Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. Web gain from form 2439. Web the information on form 2439 is reported on schedule d. Securely download your document with other editable templates,. Web form 2439 is a.

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. Web form 2439 is a form used by the irs to request an extension of time to file a return. Fill, sign, print and send online instantly. These where.

Ssurvivor Form 2439 Statements

Web (1) complete all three copies of form 2439 for each owner. Cp60 tax year 2016 january 30, 2017 social security. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. Fill, sign, print and send online instantly. If you received a form 2439 with a gain in box 1c,.

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Web form 2439 is a form used by the irs to request an extension of time to file a return. Fill, sign, print and send online instantly. These where to file addresses. Web (1) complete all three copies of form 2439 for each owner. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for.

Web Irs Mailing Addresses By Residence & Form.

Web up to $40 cash back do whatever you want with a form 14039 (rev. Cp60 tax year 2016 january 30, 2017 social security. Below, find tables with addresses by residency. Web gain from form 2439.

It Will Flow To Your Schedule D When It Is Entered Into Turbotax.

These where to file addresses. Web the information on form 2439 is reported on schedule d. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. To enter form 2439 go to investment.

You Will Be Mailing Your Returns To Specific Addresses Based On The Type Of.

Securely download your document with other editable templates,. Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. Web (1) complete all three copies of form 2439 for each owner. Web form 2439 is a form used by the irs to request an extension of time to file a return.

From Within Your Taxact Return ( Online Or.

If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for the section 1202 exclusion. Fill, sign, print and send online instantly.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)