Form 3115 Cost Segregation

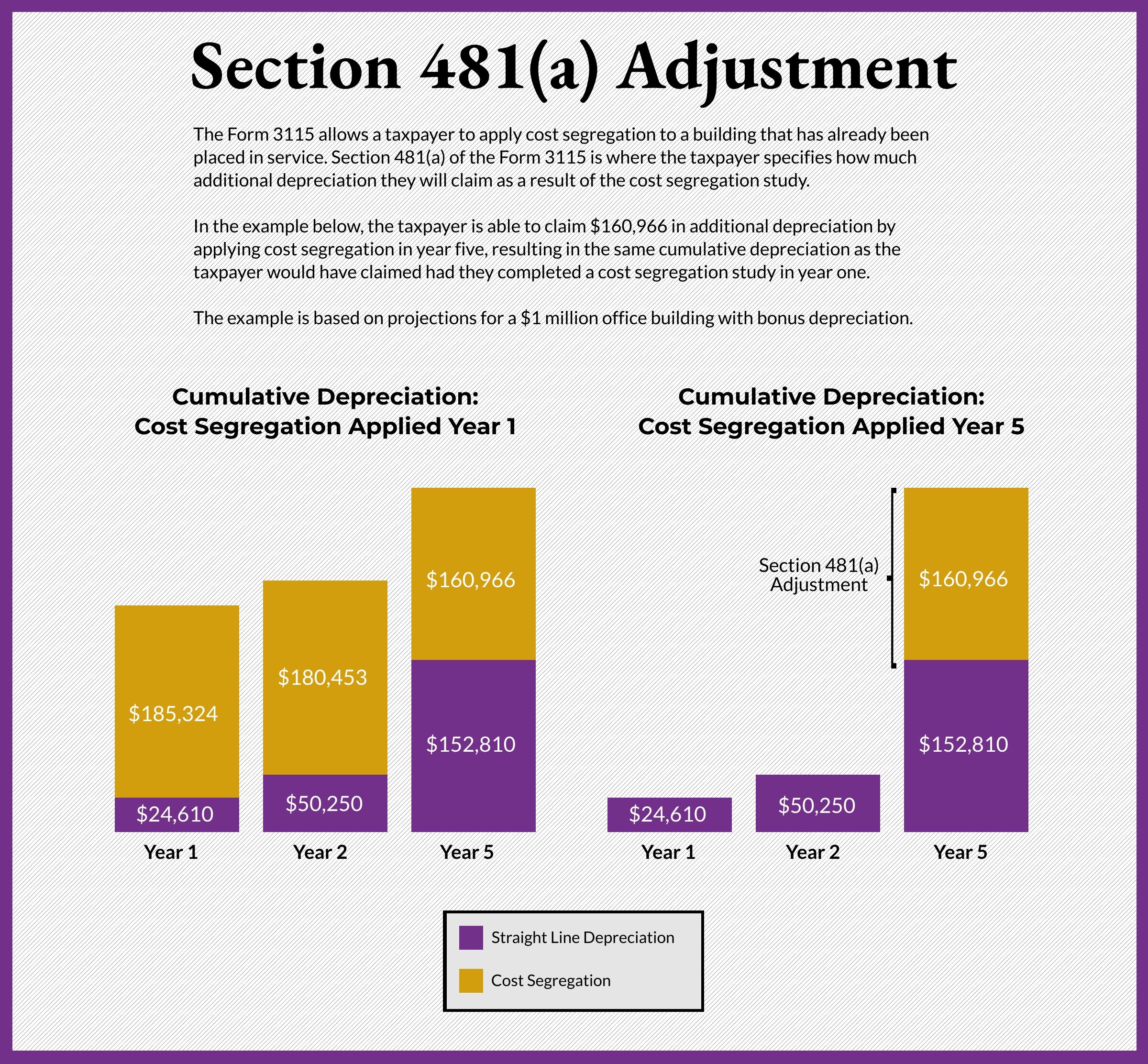

Form 3115 Cost Segregation - The taxpayer must attach all applicable statements. Perform depreciation calculations, manage asset splits, & maintain defensive audit trail. Web the kbkg 481 (a) adjustment software for cost segregation, depreciation & repair deduction minimizes the time needed to properly document and calculate irc §481 (a). Web this form 3115 (including its instructions), and (2) any other relevant information, even if not specifically requested on form 3115. Web since a cost segregation study will change how your personal property and land improvements are depreciated, this form 3115 must be filed with the irs. Web a cost segregation study can be prepared on existing assets and depreciation can be recomputed for prior tax years based on the reallocated asset costs. Web can you perform a cost segregation study and file a form 3115 to take the additional depreciation in the same year as the sale of that property? Web taxpayers make accounting method changes for numerous reasons, such as claiming missed depreciation from a cost segregation study, reclassifying capital. Web while proper filing of irs form 3115 is critical to cost segregation deprecation opportunities, businesses tend to back away because the process is. Ad get a free, no obligation cost segregation analysis today.

A cost segregation study can be prepared on existing assets and. In this article we will discuss how to apply a cost. Applying a cost segregation study on a tax return. Perform depreciation calculations, manage asset splits, & maintain defensive audit trail. Any understated depreciation, including bonus depreciation, can be. Web property owner from doing a cost segregation study done years after the property is acquired. Web a straightforward tax document called the submit 3115 allowed cost separatism to be applied to older home without the need since any amended returns. The taxpayer must attach all applicable statements. Web while proper filing of irs form 3115 is critical to cost segregation deprecation opportunities, businesses tend to back away because the process is. Web taxpayers make accounting method changes for numerous reasons, such as claiming missed depreciation from a cost segregation study, reclassifying capital.

Ad in this white paper, bloomberg tax tells you what you need to know about cost segregation. Web the kbkg 481 (a) adjustment software for cost segregation, depreciation & repair deduction minimizes the time needed to properly document and calculate irc §481 (a). Perform depreciation calculations, manage asset splits, & maintain defensive audit trail. The taxpayer must attach all applicable statements. Web taxpayers make accounting method changes for numerous reasons, such as claiming missed depreciation from a cost segregation study, reclassifying capital. Web while proper filing of irs form 3115 is critical to cost segregation deprecation opportunities, businesses tend to back away because the process is. Web since a cost segregation study will change how your personal property and land improvements are depreciated, this form 3115 must be filed with the irs. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web a cost segregation study can be prepared on existing assets and depreciation can be recomputed for prior tax years based on the reallocated asset costs. Web the bonus depreciation amount could range between 30% and 100% of the cost of the amount reclassified.

Temporary Procedures Allow Taxpayers to Fax Required Duplicate Copy of

Web a survey of changing bonus depreciation rules for cost segregation. Perform depreciation calculations, manage asset splits, & maintain defensive audit trail. Web diy tax preparation. A cost segregation study can be prepared on existing assets and. Any understated depreciation, including bonus depreciation, can be.

IRS Form 3115 How to Apply Cost Segregation to Existing Property

Web this form 3115 (including its instructions), and (2) any other relevant information, even if not specifically requested on form 3115. Web can you perform a cost segregation study and file a form 3115 to take the additional depreciation in the same year as the sale of that property? Ad get a free, no obligation cost segregation analysis today. Thanks.

Should I File Form 3115 or Not?

Web a cost segregation study can be prepared on existing assets and depreciation can be recomputed for prior tax years based on the reallocated asset costs. In this article we will discuss how to apply a cost. Web diy tax preparation. Perform depreciation calculations, manage asset splits, & maintain defensive audit trail. Web up to 10% cash back the accounting.

Form 3115 Definition, Who Must File, & More

Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web a survey of changing bonus depreciation rules for cost segregation. Web diy tax preparation. Applying a cost segregation study on a tax return. Ad in this white paper, bloomberg tax tells you what you need to know.

Form 3115 (Cost Segregation )

Web taxpayers make accounting method changes for numerous reasons, such as claiming missed depreciation from a cost segregation study, reclassifying capital. Web the kbkg 481 (a) adjustment software for cost segregation, depreciation & repair deduction minimizes the time needed to properly document and calculate irc §481 (a). Web this form 3115 (including its instructions), and (2) any other relevant information,.

IRS Form 3115 How to Apply Cost Segregation to Existing Property

Any understated depreciation, including bonus depreciation, can be. A cost segregation study can be prepared on existing assets and. Thanks to the irs and changes in federal law, the rules governing bonus. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. The taxpayer must attach all applicable.

Cost Segregation on Residential Real Estate — Lumpkin Agency

Web a survey of changing bonus depreciation rules for cost segregation. Web while proper filing of irs form 3115 is critical to cost segregation deprecation opportunities, businesses tend to back away because the process is. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. A cost segregation.

Form 3115 Edit, Fill, Sign Online Handypdf

Web can you perform a cost segregation study and file a form 3115 to take the additional depreciation in the same year as the sale of that property? Web the bonus depreciation amount could range between 30% and 100% of the cost of the amount reclassified. Web taxpayers make accounting method changes for numerous reasons, such as claiming missed depreciation.

Purchased a duplex in 2021 and recently learned ab... Fishbowl

In this article we will discuss how to apply a cost. Perform depreciation calculations, manage asset splits, & maintain defensive audit trail. Web property owner from doing a cost segregation study done years after the property is acquired. A cost segregation study can be prepared on existing assets and. Cost segregation allows you to depreciate your building rapidly to get.

Form 3115 Application for Change in Accounting Method

In this article we will discuss how to apply a cost. Web while proper filing of irs form 3115 is critical to cost segregation deprecation opportunities, businesses tend to back away because the process is. Web the bonus depreciation amount could range between 30% and 100% of the cost of the amount reclassified. Web diy tax preparation. Web this form.

Web Up To 10% Cash Back The Accounting Method Change Is Used Because The Taxpayer Is Seeking Permission To Correct The Recovery Period Of Assets That Were Misclassified.

Web a straightforward tax document called the submit 3115 allowed cost separatism to be applied to older home without the need since any amended returns. A cost segregation study can be prepared on existing assets and. Perform depreciation calculations, manage asset splits, & maintain defensive audit trail. The taxpayer must attach all applicable statements.

Web Property Owner From Doing A Cost Segregation Study Done Years After The Property Is Acquired.

Ad in this white paper, bloomberg tax tells you what you need to know about cost segregation. Web a cost segregation study can be prepared on existing assets and depreciation can be recomputed for prior tax years based on the reallocated asset costs. Web the kbkg 481 (a) adjustment software for cost segregation, depreciation & repair deduction minimizes the time needed to properly document and calculate irc §481 (a). Ad get a free, no obligation cost segregation analysis today.

Web While Proper Filing Of Irs Form 3115 Is Critical To Cost Segregation Deprecation Opportunities, Businesses Tend To Back Away Because The Process Is.

Applying a cost segregation study on a tax return. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Any understated depreciation, including bonus depreciation, can be. Thanks to the irs and changes in federal law, the rules governing bonus.

Web This Form 3115 (Including Its Instructions), And (2) Any Other Relevant Information, Even If Not Specifically Requested On Form 3115.

Web a survey of changing bonus depreciation rules for cost segregation. In this article we will discuss how to apply a cost. Web the bonus depreciation amount could range between 30% and 100% of the cost of the amount reclassified. Web can you perform a cost segregation study and file a form 3115 to take the additional depreciation in the same year as the sale of that property?