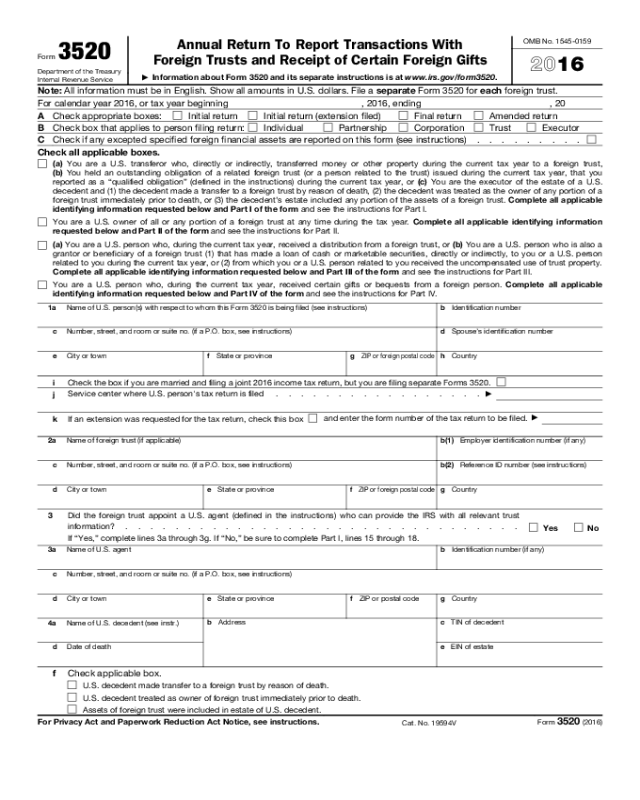

Form 3520 Gift From Foreign Person

Form 3520 Gift From Foreign Person - Persons who have received more than $100,000 in gifts or bequests during the. The reporting of a foreign gift or inheritance is the main catalyst for having to file the form. Person receives a gift (s) from a foreign person individual or entity (such as a foreign corporation) and the aggregate value of. Web the irs form 3520 reports (annually) information about us persons’ (a) ownership of foreign trusts, (b) contributions to foreign trusts, (c) distributions from foreign trusts and. Complete all applicable identifying information requested below. Web the irs filing requirements for form 3520 for certain foreign gifts apply to u.s. Web otherwise, you must file irs form 3520, the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Person who, during the current tax year, received certain gifts or bequests from a foreign person. Web foreign gift from related persons: Web if the value of the foreign gift(s) received from a foreign corporation or partnership exceeds $16,388, then the u.s.

Web specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report transactions with foreign. Web 5 form 3520 foreign gift reporting specialist team gift from foreign person reporting gift from foreign person: Web foreign entity and form 3520 filing. Person who, during the current tax year, received certain gifts or bequests from a foreign person. When a person receives a gift from a foreign entity, the rules are different. Person is required to report the gift on. Person receives a gift from a foreign person in excess of $100,000, the transaction triggers a form. Persons receive gifts from foreign persons, the. It does not have to be a “foreign gift.”. Web foreign person gift of more than $100,000 (common form 3520 example) a gift from a foreign person is by far the most common form 3520 situation.

Web 5 form 3520 foreign gift reporting specialist team gift from foreign person reporting gift from foreign person: Web gifts from foreign persons — form 3520. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Ad talk to our skilled attorneys by scheduling a free consultation today. Persons may not be aware of their requirement to file a. Person receives a gift from a foreign person, the irs may require the gift to be reported to the internal revenue service on form 3520. Web foreign person gift of more than $100,000 (common form 3520 example) a gift from a foreign person is by far the most common form 3520 situation. The threshold requirement for reporting is much lower, and in. Web if the value of the foreign gift(s) received from a foreign corporation or partnership exceeds $16,388, then the u.s. Web reporting foreign gifts & inheritance on form 3520.

Steuererklärung dienstreisen Form 3520

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. In order to skirt the issue. The reporting of a foreign gift or inheritance is the main catalyst for having to file the form. Persons receive gifts from foreign persons, the. Person is required to report the gift on.

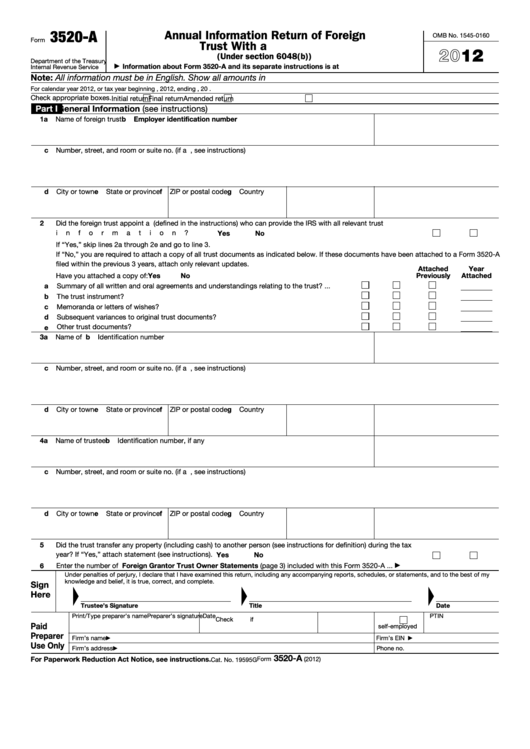

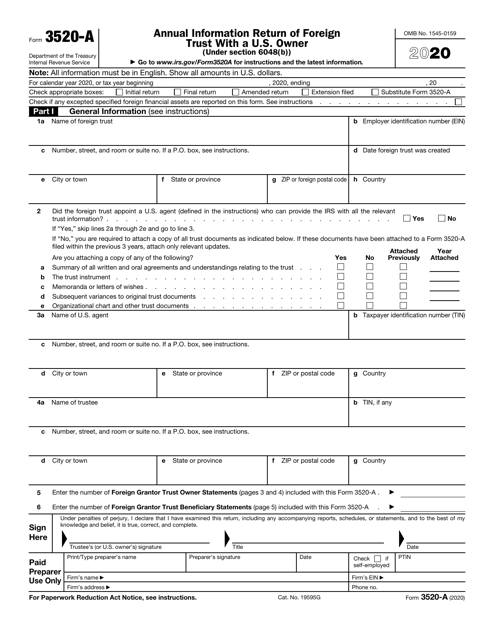

Fillable Form 3520A Annual Information Return Of Foreign Trust With

In order to skirt the issue. Ad talk to our skilled attorneys by scheduling a free consultation today. Web if the value of the foreign gift(s) received from a foreign corporation or partnership exceeds $16,388, then the u.s. Person receives a gift from a foreign person in excess of $100,000, the transaction triggers a form. Complete all applicable identifying information.

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Persons receive gifts from foreign persons, the. It does not have to be a “foreign gift.”. Persons who have received more than $100,000 in gifts or bequests during the. Web the irs filing requirements for form 3520 for certain foreign gifts apply to u.s. Person is required to report the gift on.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web otherwise, you must file irs form 3520, the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Persons who have received more than $100,000 in gifts or bequests during the. It does not have.

Forex trading irs

Web 5 form 3520 foreign gift reporting specialist team gift from foreign person reporting gift from foreign person: Person receives a gift from a foreign person, the irs may require the gift to be reported to the internal revenue service on form 3520. Person is required to report the gift on. Web reporting foreign gifts & inheritance on form 3520..

When to File Form 3520 Gift or Inheritance From a Foreign Person

Web if the value of the foreign gift(s) received from a foreign corporation or partnership exceeds $16,388, then the u.s. When a person receives a gift from a foreign entity, the rules are different. Web foreign gift from related persons: Person receives a gift from a foreign person in excess of $100,000, the transaction triggers a form. Web reporting foreign.

Form 3520 (2020) Instructions for Foreign Gifts & Inheritance

Person who, during the current tax year, received certain gifts or bequests from a foreign person. Web reporting foreign gifts & inheritance on form 3520. Web foreign person gift of more than $100,000 (common form 3520 example) a gift from a foreign person is by far the most common form 3520 situation. Person receives a gift (s) from a foreign.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

It does not have to be a “foreign gift.”. Web form 3520 is used to report the existence of a gift, trust, or inheritance received from foreign persons. Person receives a gift from a foreign person in excess of $100,000, the transaction triggers a form. Web foreign gift from related persons: The irs f orm 3520 is used to report.

Form 3520 Reporting Foreign Trusts and Gifts for US Citizens

Web foreign entity and form 3520 filing. Us persons may be required to. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Persons receive gifts from foreign persons, the. It does not have to be a “foreign gift.”.

Form 3520 Reporting Foreign Gifts and Distributions From a Foreign Trust

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web if the value of the foreign gift(s) received from a foreign corporation or partnership exceeds $16,388, then the u.s. Web otherwise, you must file irs form 3520, the annual return to report transactions with foreign trusts and receipt of.

Persons Receive Gifts From Foreign Persons, The.

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Person receives a gift from a foreign person, the irs may require the gift to be reported to the internal revenue service on form 3520. Person is required to report the gift on. Person receives a gift from a foreign person in excess of $100,000, the transaction triggers a form.

Web Foreign Entity And Form 3520 Filing.

When a person receives a gift from a foreign entity, the rules are different. The reporting of a foreign gift or inheritance is the main catalyst for having to file the form. Complete all applicable identifying information requested below. Web the irs filing requirements for form 3520 for certain foreign gifts apply to u.s.

Web Foreign Gift From Related Persons:

Web you are a u.s. Web form 3520 & instructions: Us persons may be required to. The threshold requirement for reporting is much lower, and in.

Web The Irs Form 3520 Reports (Annually) Information About Us Persons’ (A) Ownership Of Foreign Trusts, (B) Contributions To Foreign Trusts, (C) Distributions From Foreign Trusts And.

Web foreign person gift of more than $100,000 (common form 3520 example) a gift from a foreign person is by far the most common form 3520 situation. Web otherwise, you must file irs form 3520, the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. It does not have to be a “foreign gift.”. Web gifts from foreign persons — form 3520.