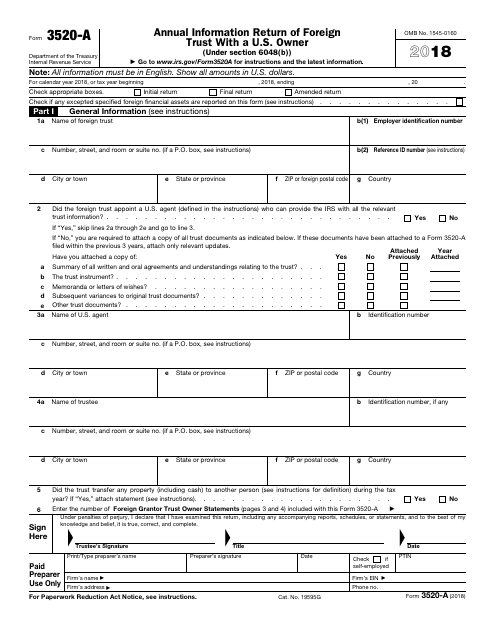

Form 3520 Part Iv

Form 3520 Part Iv - Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Check either the “yes” or “no” box below for additional authorizations you would like to grant your representative(s) in addition to those. Irs form 3520 is known as the. Web form 3520 & instructions: Separately, you need to file an. The first component of the form 3520 is fairly. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. See the instructions for part iv. It does not have to be a “foreign gift.” rather, if a.

How can i obtain a copy of irs form 3520? The first component of the form 3520 is fairly. Talk to our skilled attorneys by scheduling a free consultation today. A poa declaration gives representatives general privileges listed in part iii. Use part iv to indicate additional acts your named. The word “certain” in the form’s title. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web file a separate form 3520 for each foreign trust. Web the fourth and final component of the form 3520 is utilized to report u.s person’s receipt of gifts or bequests from foreign persons. Web the form is due when a person’s tax return is due to be filed.

Irs form 3520 is known as the. It does not have to be a “foreign gift.” rather, if a. This due date gets extended only if the taxpayer files a timely extension. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web form 3520’s full designation is a mouthful: Web form 3520 is due the fourth month following the end of the person's tax year, typically april 15. Web complete the identifying information on page 1 of the form and part iv. The word “certain” in the form’s title. Transferor who, directly or indirectly, transferred money or other property during the. Talk to our skilled attorneys by scheduling a free consultation today.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

It does not have to be a “foreign gift.” rather, if a. Separately, you need to file an. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Transferor who, directly or indirectly, transferred money or other property during the. Web the fourth and final component of the form 3520 is utilized to report u.s person’s.

3520 1 Form Fill Online, Printable, Fillable, Blank pdfFiller

Web you must report the entire value of the inheritance, using the us dollar value as of the date of the person's death, not just the cash. You may be required to file financial crimes enforcement network. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. This due date.

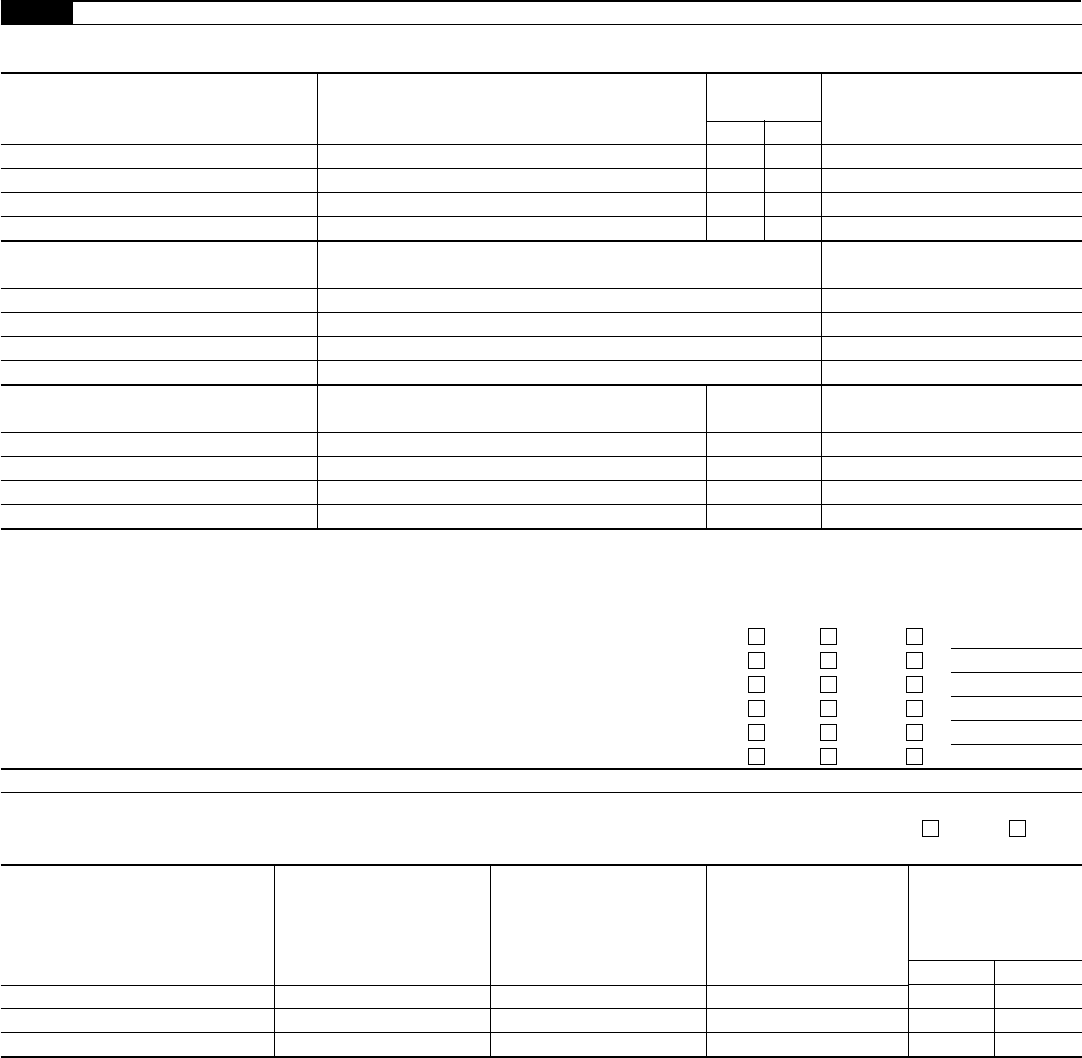

Form 3520A Annual Information Return of Foreign Trust with a U.S

Check either the “yes” or “no” box below for additional authorizations you would like to grant your representative(s) in addition to those. The first component of the form 3520 is fairly. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. The word “certain” in the form’s title. The.

Steuererklärung dienstreisen Form 3520

Web the form is due when a person’s tax return is due to be filed. Web you must report the entire value of the inheritance, using the us dollar value as of the date of the person's death, not just the cash. A poa declaration gives representatives general privileges listed in part iii. The word “certain” in the form’s title..

Form 3520 2012 Edit, Fill, Sign Online Handypdf

The first component of the form 3520 is fairly. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web you must report the entire value of the inheritance, using the us dollar value as of the date of the person's death, not just the cash. See the instructions for part iv. Web form 3520’s full.

form 3520a 2021 Fill Online, Printable, Fillable Blank

Web file a separate form 3520 for each foreign trust. Separately, you need to file an. Web the fourth and final component of the form 3520 is utilized to report u.s person’s receipt of gifts or bequests from foreign persons. Even if the person does not have to file a tax return, they still must submit the form 3520, if.

Steuererklärung dienstreisen Form 3520

It does not have to be a “foreign gift.” rather, if a. Check either the “yes” or “no” box below for additional authorizations you would like to grant your representative(s) in addition to those. A poa declaration gives representatives general privileges listed in part iii. The irs f orm 3520 is used to report a foreign gift, inheritance or trust.

IRS Creates “International Practice Units” for their IRS Revenue Agents

Web the form is due when a person’s tax return is due to be filed. Use part iv to indicate additional acts your named. Irs form 3520 is known as the. The word “certain” in the form’s title. Web the fourth and final component of the form 3520 is utilized to report u.s person’s receipt of gifts or bequests from.

3.21.19 Foreign Trust System Internal Revenue Service

The word “certain” in the form’s title. Web complete the identifying information on page 1 of the form and part iv. Web you must report the entire value of the inheritance, using the us dollar value as of the date of the person's death, not just the cash. Use part iv to indicate additional acts your named. This due date.

Epa form 3520 21 Instructions Fresh Wo A1 Model Based Controls for Use with

Web complete the identifying information on page 1 of the form and part iv. The word “certain” in the form’s title. Web the form is due when a person’s tax return is due to be filed. Web you must report the entire value of the inheritance, using the us dollar value as of the date of the person's death, not.

Talk To Our Skilled Attorneys By Scheduling A Free Consultation Today.

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Use part iv to indicate additional acts your named. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Separately, you need to file an.

How Can I Obtain A Copy Of Irs Form 3520?

Transferor who, directly or indirectly, transferred money or other property during the. Web the form is due when a person’s tax return is due to be filed. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. See the instructions for part iv.

Web Form 3520 Is Due The Fourth Month Following The End Of The Person's Tax Year, Typically April 15.

Web you must report the entire value of the inheritance, using the us dollar value as of the date of the person's death, not just the cash. What is irs form 3520? It does not have to be a “foreign gift.” rather, if a. Irs form 3520 is known as the.

A Poa Declaration Gives Representatives General Privileges Listed In Part Iii.

Check either the “yes” or “no” box below for additional authorizations you would like to grant your representative(s) in addition to those. This due date gets extended only if the taxpayer files a timely extension. The first component of the form 3520 is fairly. Web form 3520’s full designation is a mouthful: