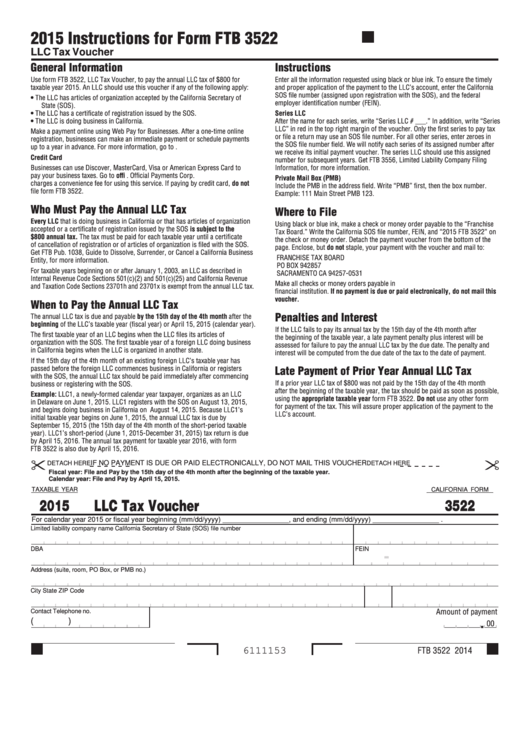

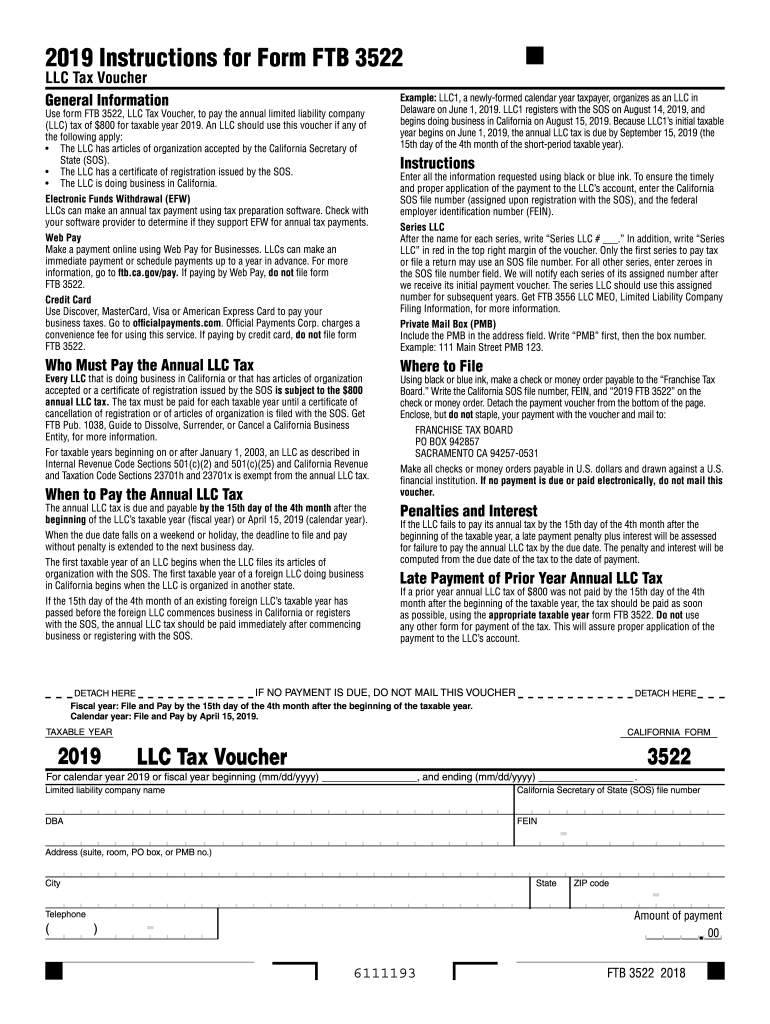

Form 3522 California

Form 3522 California - Edit your form 3522 california 2022 online type text, add images, blackout confidential details, add comments, highlights and more. An llc should use this voucher if any of the following. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2021. March 15, 2023 fiscal tax year: The 15th day of 3rd month after end of their tax year if the due date falls on a weekend or holiday, you have until the next. Form 3536 only needs to be filed if your income is $250,000. The california form 3522 is a document used for submitting change of address information. In addition to complying with the. What is the difference between ca form 3522. Web as stated earlier, this annual tax is a requirement of all california llcs.

The california form 3522 is a document used for submitting change of address information. Web everything you need to know about form 3522. The form must be completed by anyone who has earned income in california, and it must be filed. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. Use get form or simply click on the template preview to open it in the editor. Form 3536 only needs to be filed if your income is $250,000. An llc should use this voucher if any of the following. Web form 3522 is a california corporate income tax form. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2019. Form ftb 3522, with the $800 should be sent to:

Form ftb 3522, with the $800 should be sent to: Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. An llc should use this voucher if any of the following. An llc should use this voucher if any of the following. Web i filled out the california form 3522 and requested electronic payment of the $800 annual fee on april 15, 2022/ the client letter indicates that this is an estimated. What is the difference between ca form 3522. March 15, 2023 fiscal tax year: An llc should use this voucher if any of the following. In addition to complying with the. The 15th day of 3rd month after end of their tax year if the due date falls on a weekend or holiday, you have until the next.

California Form 3522 Llc Tax Voucher 2015 printable pdf download

Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2020. Franchise tax board po box 942857 sacramento,. In addition to complying with the. Sign it in a few clicks draw your. The california form 3522 is a document used for submitting change of address information.

2015 Form Ftb 3522 Llc Tax Voucher Tax Walls

Edit your form 3522 california 2022 online type text, add images, blackout confidential details, add comments, highlights and more. The california form 3522 is a document used for submitting change of address information. Web form 3522 california — limited liability company tax voucher download this form print this form it appears you don't have a pdf plugin for this browser..

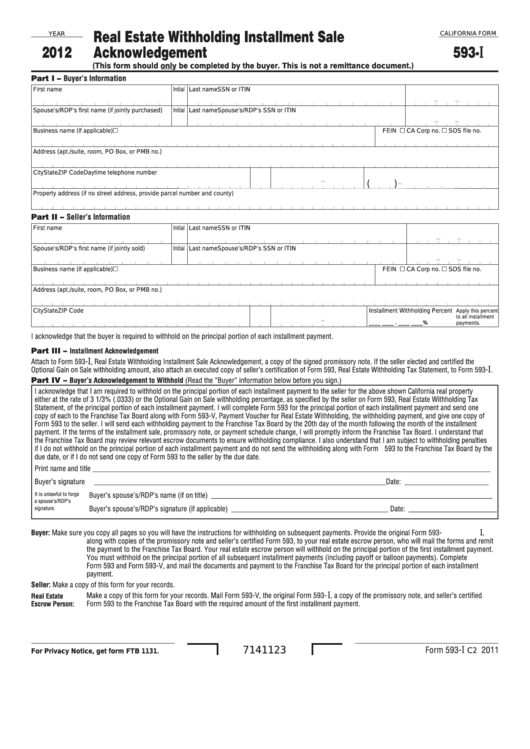

Fillable California Form 593I Real Estate Withholding Installment

The california form 3522 is a document used for submitting change of address information. Franchise tax board po box 942857 sacramento,. Web what's the goal of assembly bill 85 for business owners? Web i filled out the california form 3522 and requested electronic payment of the $800 annual fee on april 15, 2022/ the client letter indicates that this is.

California Form 3522 ≡ Fill Out Printable PDF Forms Online

An llc should use this voucher if any of the following. Web ca ftb 3522 is not the easiest one, but you do not have reason for worry in any case. Web getting a authorized professional, creating a scheduled appointment and coming to the workplace for a personal conference makes completing a ca ftb 3522 from beginning. The 15th day.

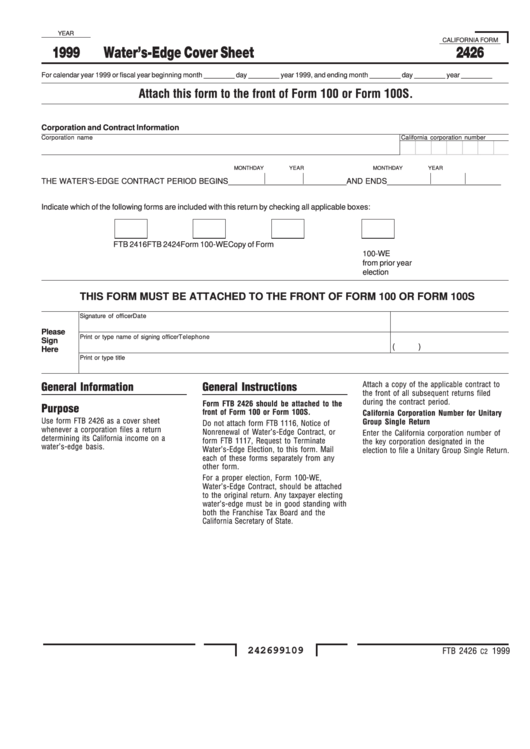

3028 California Tax Forms And Templates free to download in PDF

Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2020. Edit your form 3522 california 2022 online type text, add images, blackout confidential details, add comments, highlights and more. Web as stated earlier, this annual tax is a requirement of all california llcs. An llc should use.

공장등록증명(신청)서(자가공장, 임대공장) 샘플, 양식 다운로드

An llc should use this voucher if any of the following. Web form 3522 is a california corporate income tax form. Sign it in a few clicks draw your. Form 3536 only needs to be filed if your income is $250,000. Use get form or simply click on the template preview to open it in the editor.

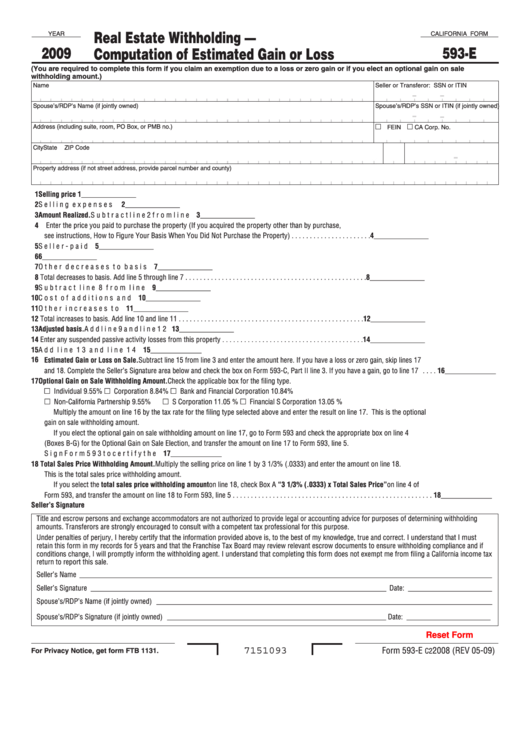

Fillable California Form 593E Real Estate Withholding Computation

Form ftb 3522, with the $800 should be sent to: Edit your form 3522 california 2022 online type text, add images, blackout confidential details, add comments, highlights and more. What is the difference between ca form 3522. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022..

2019 Form CA FTB 3522 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 3522 california is a tax form that is used to report certain types of income. Web form 3522 is a california corporate income tax form. Use get form or simply click on the template preview to open it in the editor. Northwest will form your llc for $39 (60% discount). In addition to complying with the.

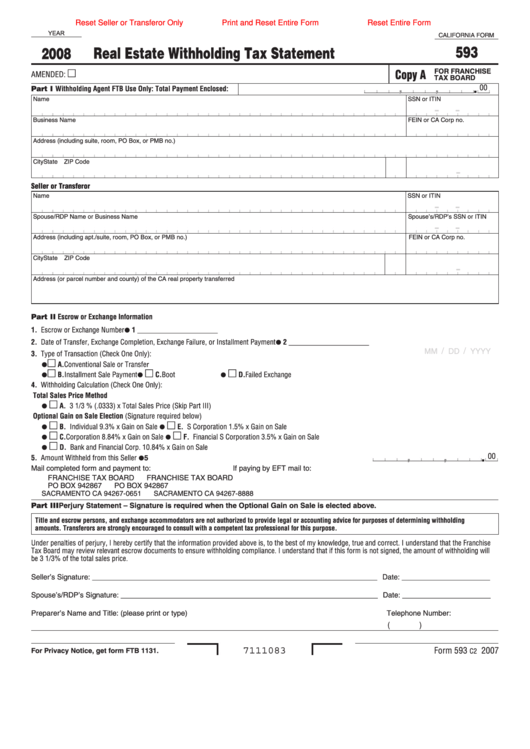

Fillable California Form 593 Real Estate Withholding Tax Statement

Web form 3522 california — limited liability company tax voucher download this form print this form it appears you don't have a pdf plugin for this browser. An llc should use this voucher if any of the following. The 15th day of 3rd month after end of their tax year if the due date falls on a weekend or holiday,.

Form 3522 California ≡ Fill Out Printable PDF Forms Online

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. An llc should use this voucher if any of the following. Web form 3522 california — limited liability company tax voucher download this form print this form it appears you don't have a pdf plugin for this browser. Franchise tax board.

The Form Must Be Completed By Anyone Who Has Earned Income In California, And It Must Be Filed.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web i filled out the california form 3522 and requested electronic payment of the $800 annual fee on april 15, 2022/ the client letter indicates that this is an estimated. Web getting a authorized professional, creating a scheduled appointment and coming to the workplace for a personal conference makes completing a ca ftb 3522 from beginning. Northwest will form your llc for $39 (60% discount).

Form Ftb 3522, With The $800 Should Be Sent To:

Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. Web form 3522 california is a tax form that is used to report certain types of income. Use get form or simply click on the template preview to open it in the editor. Edit your form 3522 california 2022 online type text, add images, blackout confidential details, add comments, highlights and more.

Web Use Form Ftb 3522, Llc Tax Voucher, To Pay The Annual Limited Liability Company (Llc) Tax Of $800 For Taxable Year 2021.

Form 3536 only needs to be filed if your income is $250,000. Web ca ftb 3522 is not the easiest one, but you do not have reason for worry in any case. As we mentioned before, the filing of this form is compulsory for all california llcs; Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022.

An Llc Should Use This Voucher If Any Of The Following.

In addition to complying with the. Web form 3522 is a california corporate income tax form. Web what's the goal of assembly bill 85 for business owners? What is the difference between ca form 3522.