Form 3921 Deadline

Form 3921 Deadline - Web deadline for startups to file form 3921 as of 2022, form 3921 must be filed on paper by february 28 or electronically by march 31 of the year following the tax year in. Web in addition to notifying employees, the corporation must file the forms 3921 with the irs. How to file form 3921 with taxbandits 1. Although this information is not taxable unless. On the other hand, under copy a, 28th february. You must be aware of the steps. Electronic filing is required if 250 or more forms must be filed. Web form 3921 deadlines. The corporation must send or. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed.

Irs form 3921 is used to report. Electronic filing is required if 250 or more forms must be filed. Web the deadline for filing the forms is february 28, 2023, or march 31, 2023, if filed electronically. Web in the case of copy b, isos or espps exercised in 2022, will be required to file form 3921 and form 3922 by 31st january 2023. You must be aware of the steps. Web deadline for startups to file form 3921 as of 2022, form 3921 must be filed on paper by february 28 or electronically by march 31 of the year following the tax year in. Web form 3921 deadlines. Web in addition to notifying employees, the corporation must file the forms 3921 with the irs. Deadline to provide copy b to all employees who exercised isos in the previous. Web when is the deadline for filing form 3921?

Web in addition to notifying employees, the corporation must file the forms 3921 with the irs. On the other hand, under copy a, 28th february. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web tip if you exercise an iso during 2020, you should receive form 3921, or a statement, from the corporation for each transfer made during 2020. How to file form 3921 with taxbandits 1. Web a form 3921 is not required for the exercise of an incentive stock option by an employee who is a nonresident alien (as defined in section 7701 (b)) and to whom the. The deadlines to file are as follows: Web due dates and deadlines for form 3921. Web 1099 pro products range from i) client server / asp applications capable of filing over 100 million records utilizing a ms sql back end with a multi year presentation of forms via. What is 3921 tax form?

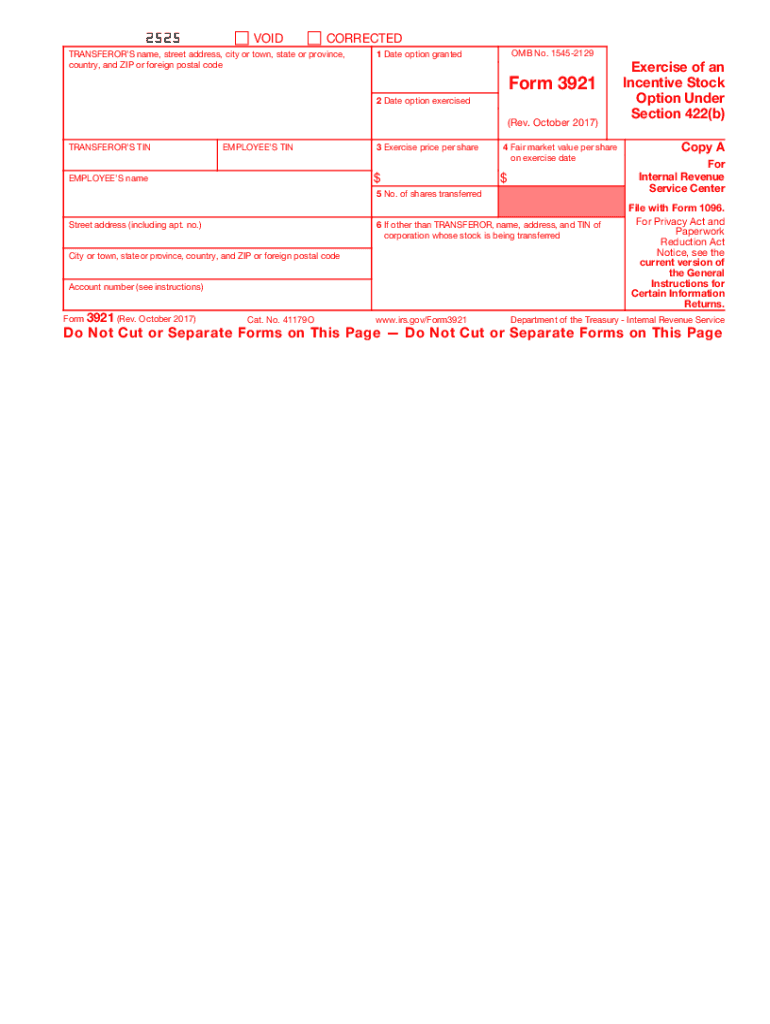

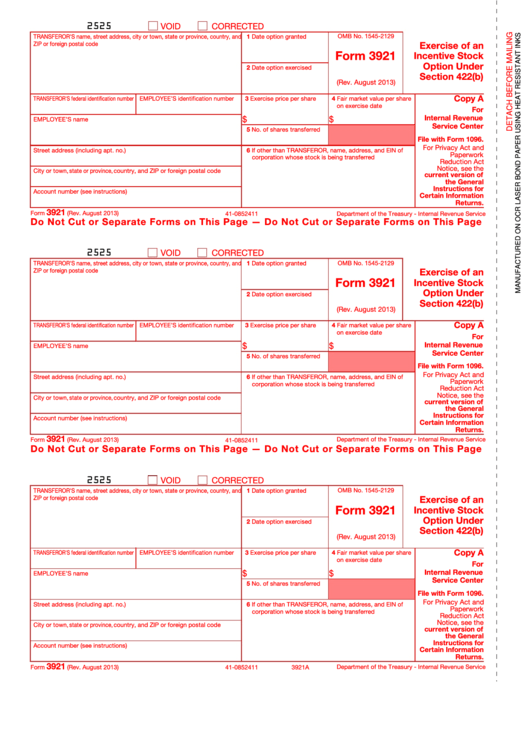

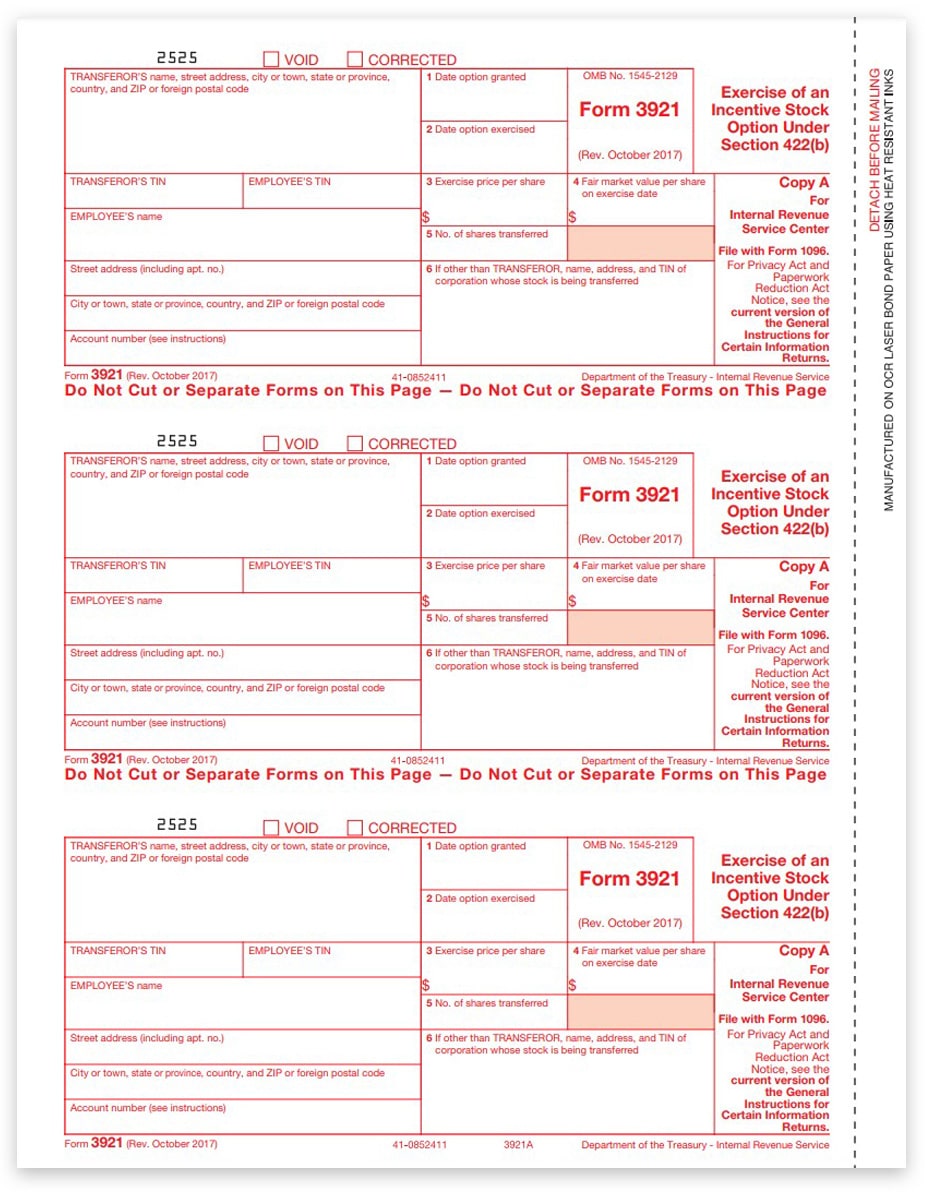

Purpose of form 3921 Fill out & sign online DocHub

The corporation must send or. It is a requirement by law for corporations to fill out form 3921 by specific dates. Web if you are a startup that has employees who exercised incentive stock options (isos), the deadline/due date to provide form 3921 to those employees, and file with the irs, by. Web when is the deadline to file form.

· IRS Form 3921 Toolbx

Although this information is not taxable unless. The deadline for filing the forms is march 1, 2021, or march 31, 2021, if. How to file form 3921 with taxbandits 1. It is a requirement by law for corporations to fill out form 3921 by specific dates. Web when is the deadline to file form 3921 for the 2022 tax year?

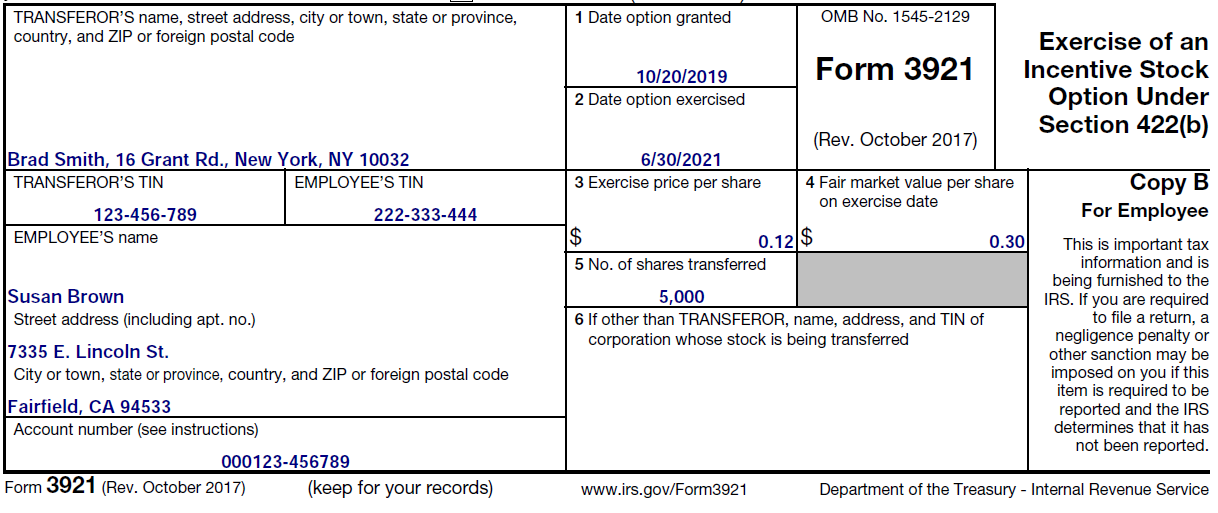

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Web when is the deadline to file form 3921 for the 2022 tax year? Deadline to provide copy b to all employees who exercised isos in the previous. Web form 3921 deadlines. How to file form 3921 with taxbandits 1. Web 1099 pro products range from i) client server / asp applications capable of filing over 100 million records utilizing.

3921 Tax Forms for Incentive Stock Option, IRS Copy A DiscountTaxForms

Web the deadline for filing the forms is february 28, 2023, or march 31, 2023, if filed electronically. The corporation must send or. It is a requirement by law for corporations to fill out form 3921 by specific dates. Electronic filing is required if 250 or more forms must be filed. Web tip if you exercise an iso during 2020,.

What Are a Company's Tax Reporting Obligations for Incentive Stock

Web when is the deadline to file form 3921 for the 2022 tax year? The corporation must send or. Electronic filing is required if 250 or more forms must be filed. Web tip if you exercise an iso during 2020, you should receive form 3921, or a statement, from the corporation for each transfer made during 2020. Deadline to provide.

What do I do with Form 3921? (Exercise of ISO) r/tax

You must be aware of the steps. Although this information is not taxable unless. Web in the case of copy b, isos or espps exercised in 2022, will be required to file form 3921 and form 3922 by 31st january 2023. Web tip if you exercise an iso during 2020, you should receive form 3921, or a statement, from the.

IRS Form 3921

Web form 3921 deadlines. On the other hand, under copy a, 28th february. You must be aware of the steps. The deadlines to file are as follows: Web in the case of copy b, isos or espps exercised in 2022, will be required to file form 3921 and form 3922 by 31st january 2023.

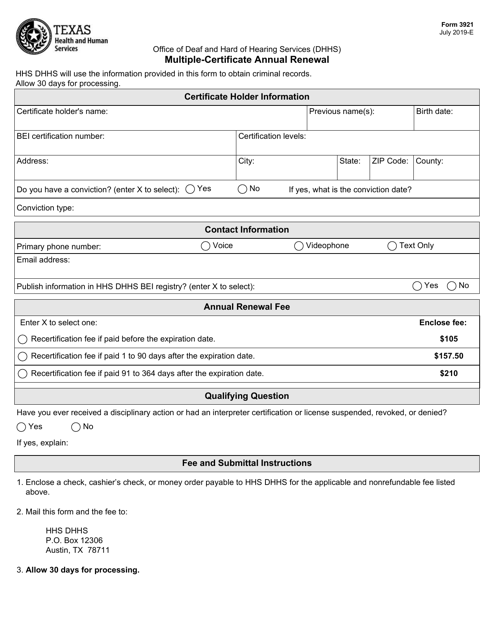

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

It is a requirement by law for corporations to fill out form 3921 by specific dates. Web due dates and deadlines for form 3921. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web when is the deadline to file form 3921 for the 2022 tax year? For iso exercises.

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

Web 1099 pro products range from i) client server / asp applications capable of filing over 100 million records utilizing a ms sql back end with a multi year presentation of forms via. Electronic filing is required if 250 or more forms must be filed. Irs form 3921 is used to report. How to file form 3921 with taxbandits 1..

File Form 3921 Eqvista

Web if you are a startup that has employees who exercised incentive stock options (isos), the deadline/due date to provide form 3921 to those employees, and file with the irs, by. Web due dates and deadlines for form 3921. Web in the case of copy b, isos or espps exercised in 2022, will be required to file form 3921 and.

The Corporation Must Send Or.

The deadlines to file are as follows: Your company needs to provide copy b of the form to all applicable shareholder by the 1st of february. Web the irs instructions to form 3921 and 3922 may be obtained here. It is a requirement by law for corporations to fill out form 3921 by specific dates.

Web When Is The Deadline To File Form 3921 For The 2022 Tax Year?

What is 3921 tax form? Web 1099 pro products range from i) client server / asp applications capable of filing over 100 million records utilizing a ms sql back end with a multi year presentation of forms via. Deadline to provide copy b to all employees who exercised isos in the previous. Irs form 3921 is used to report.

Web The Deadline For Filing The Forms Is February 28, 2023, Or March 31, 2023, If Filed Electronically.

Web a form 3921 is not required for the exercise of an incentive stock option by an employee who is a nonresident alien (as defined in section 7701 (b)) and to whom the. Web in the case of copy b, isos or espps exercised in 2022, will be required to file form 3921 and form 3922 by 31st january 2023. The deadline for filing the forms is march 1, 2021, or march 31, 2021, if. Web form 3921 deadlines.

Web Tip If You Exercise An Iso During 2020, You Should Receive Form 3921, Or A Statement, From The Corporation For Each Transfer Made During 2020.

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Although this information is not taxable unless. Electronic filing is required if 250 or more forms must be filed. Web deadline for startups to file form 3921 as of 2022, form 3921 must be filed on paper by february 28 or electronically by march 31 of the year following the tax year in.