Form 4506-B

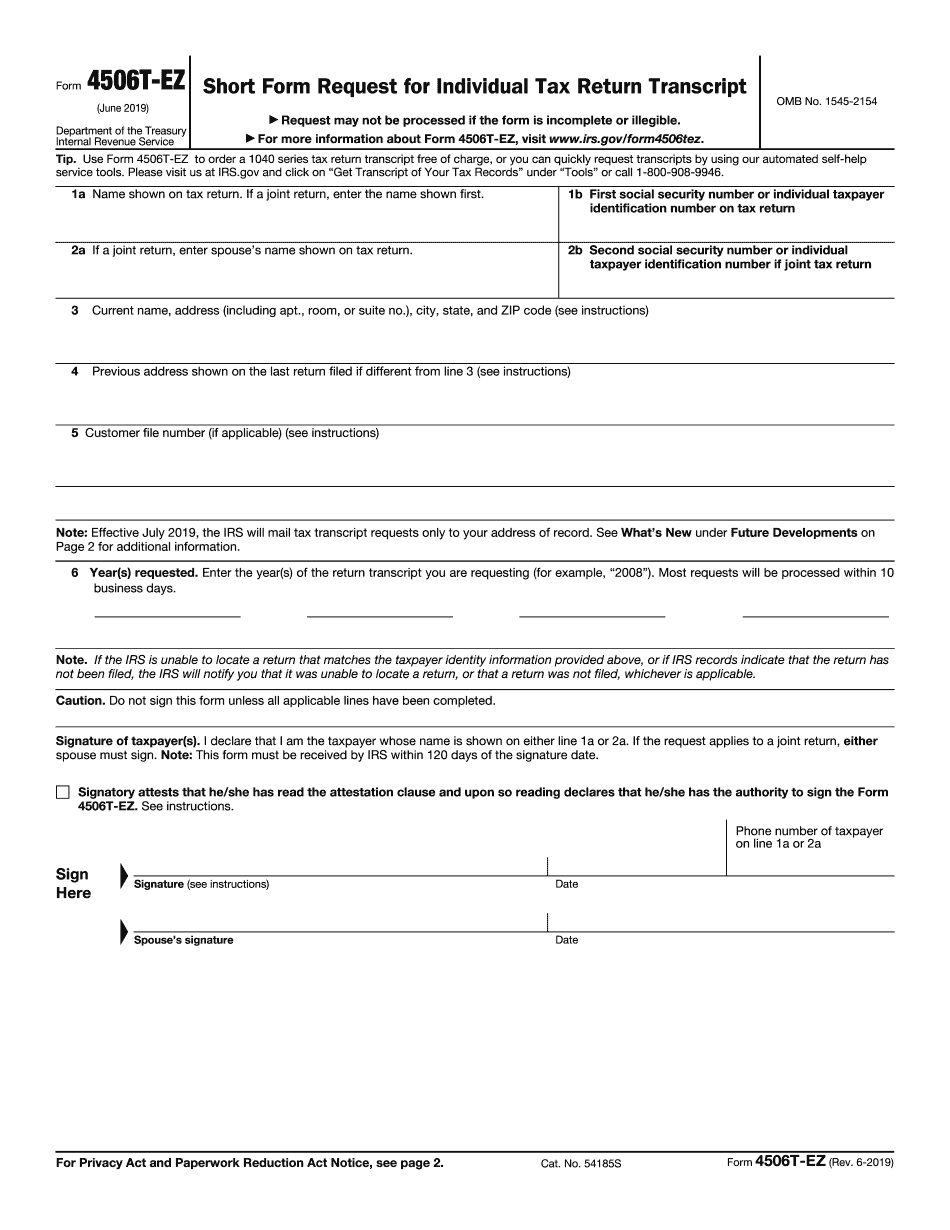

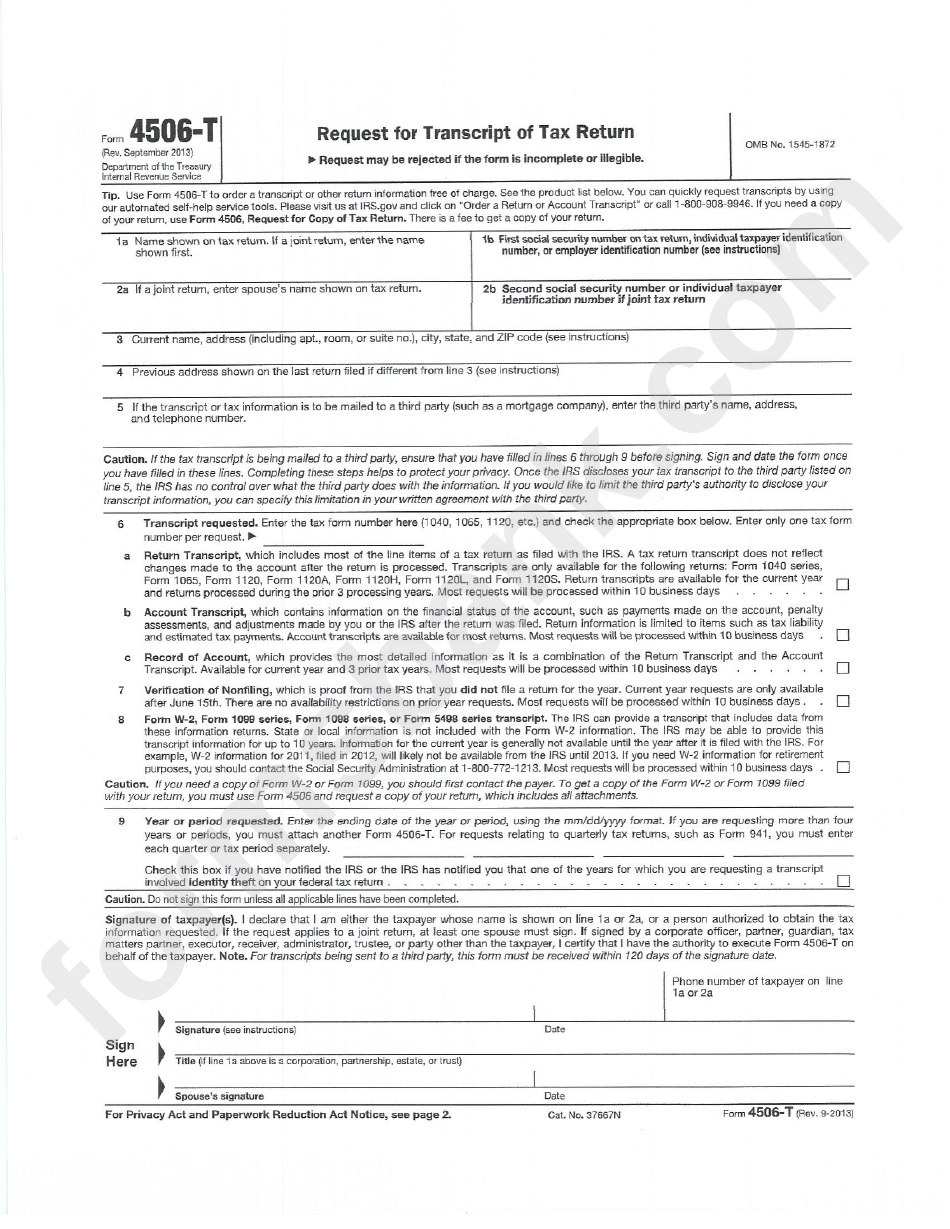

Form 4506-B - Signatory attests that he/she has read the attestation clause. Have a copy of your 2019 federal tax return available. This form must be received by irs within 120 days of the signature date. Confirm you are using the march 2019 version available on the sba.gov website: Use form 4506 to request a copy of your tax return. You can also all others. If you are requesting more than eight years or periods, you must. Web irs form 4506 is the “request for copy of tax return.” the internal revenue service (irs) requires that you file form 4506 or one of its versions if you want. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. Request a copy of your tax return, or designate a third party to.

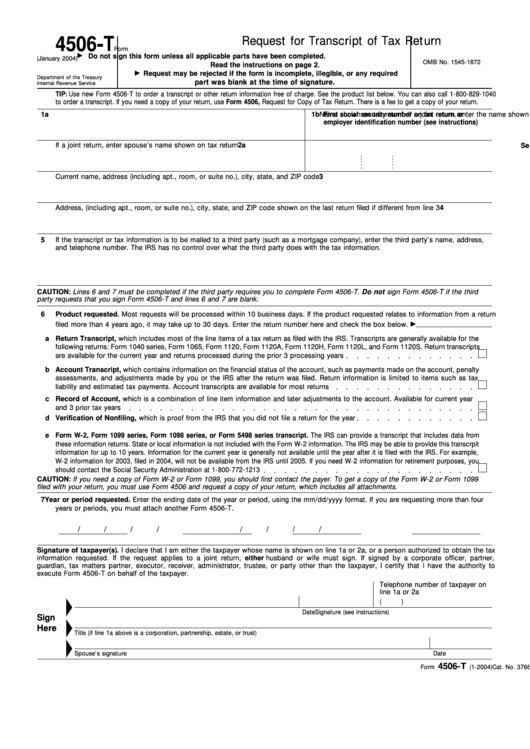

Confirm you are using the march 2019 version available on the sba.gov website: Enter the ending date of the year or period, using the mm/dd/yyyy format. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. Web jun 8, 2023 • knowledge if you are in a declared disaster area and have suffered any disaster related damage you may be eligible for federal disaster assistance. Web request for transcript of tax return (march 2019)do not sign this form unless all applicable lines have been completed. Signatory attests that he/she has read the attestation clause. Use form 4506 to request a copy of your tax return. Web these where to file addresses are to be used by taxpayers and tax professionals filing form 4506. A copy of an exempt organization’s exemption application or letter. You can also all others.

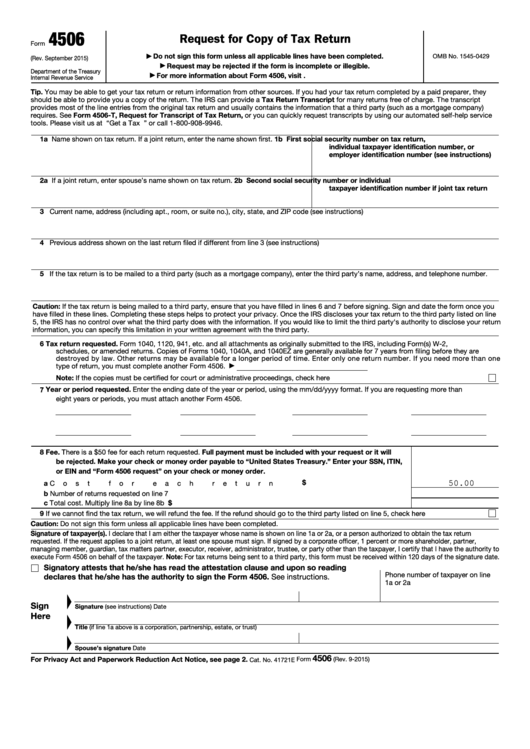

Web the 4506t should be completed using your employer identification number (ein) for your business if you file on any other form other than a 1040. Signatory attests that he/she has read the attestation clause. Request a copy of your tax return, or designate a third party to. You can also all others. May proceed to close and disburse the loan; Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. A copy of an exempt organization’s exemption application or letter. Web request for transcript of tax return (march 2019)do not sign this form unless all applicable lines have been completed. Attach payment and mail form 4506 to the address. Web jun 8, 2023 • knowledge if you are in a declared disaster area and have suffered any disaster related damage you may be eligible for federal disaster assistance.

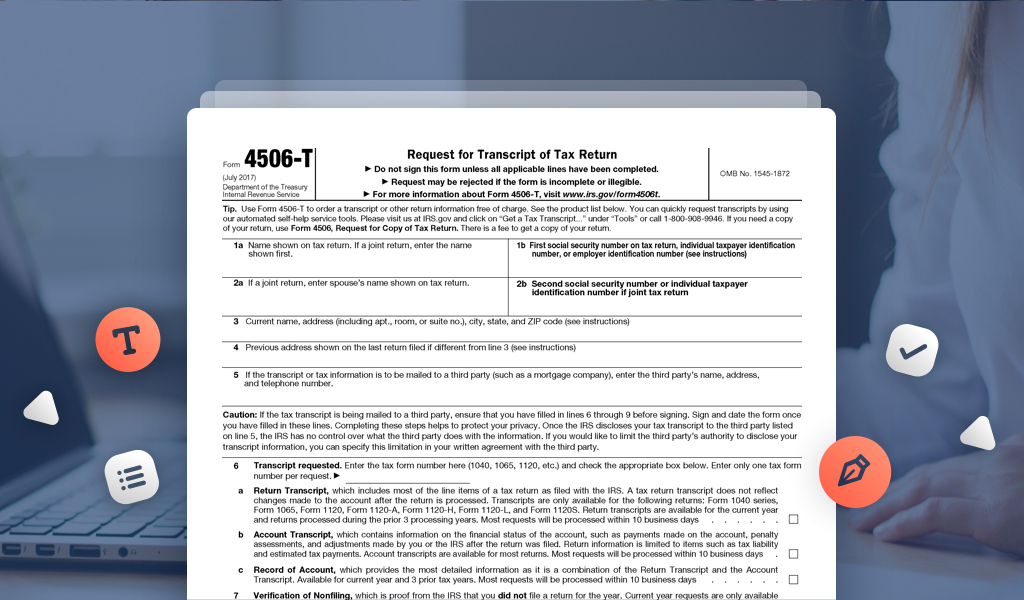

How To Fill Out 4506 T Form Create A Digital Sample in PDF

Web the 4506t should be completed using your employer identification number (ein) for your business if you file on any other form other than a 1040. Web these where to file addresses are to be used by taxpayers and tax professionals filing form 4506. Enter the ending date of the year or period, using the mm/dd/yyyy format. Designate (on line.

Fillable Form 4506 Request For Copy Of Tax Return printable pdf download

Signatory attests that he/she has read the attestation clause. Web these where to file addresses are to be used by taxpayers and tax professionals filing form 4506. Determination letters issued 2014 or later are available on tax exempt organization. Web jun 8, 2023 • knowledge if you are in a declared disaster area and have suffered any disaster related damage.

Form 4506 Edit, Fill, Sign Online Handypdf

Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Enter the ending date of the year or period, using the mm/dd/yyyy format. If you are requesting more than eight years or periods, you must. Internal revenue code section 6104 states that if an organization described in section 501 (c) or (d) is.

Information of form 4506 T YouTube

A copy of an exempt organization’s exemption application or letter. Designate (on line 5) a third party to receive the tax massachusetts, return. Enter the ending date of the year or period, using the mm/dd/yyyy format. Web these where to file addresses are to be used by taxpayers and tax professionals filing form 4506. Web jun 8, 2023 • knowledge.

Irs Form 4506a Fillable and Editable PDF Template

Web 7 year or period requested. Web use the right form. Use form 4506 to request a copy of your tax return. Web the 4506t should be completed using your employer identification number (ein) for your business if you file on any other form other than a 1040. Web irs form 4506 is the “request for copy of tax return.”.

Form 4506T Request For Transcript Of Tax Return, Authorization To

Web these where to file addresses are to be used by taxpayers and tax professionals filing form 4506. Internal revenue code section 6104 states that if an organization described in section 501 (c) or (d) is exempt from. Confirm you are using the march 2019 version available on the sba.gov website: Web irs form 4506 is the “request for copy.

Form 4506T Form Request For Transcript Of Tax Return printable pdf

This form must be received by irs within 120 days of the signature date. Confirm you are using the march 2019 version available on the sba.gov website: Web 7 year or period requested. Web use the right form. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee.

Download IRS Form 4506t for Free FormTemplate

May proceed to close and disburse the loan; Attach payment and mail form 4506 to the address. Web irs form 4506 is the “request for copy of tax return.” the internal revenue service (irs) requires that you file form 4506 or one of its versions if you want. Signatory attests that he/she has read the attestation clause. Designate (on line.

DISCOVER FORM 4506T??? myFICO® Forums 5645421

If you are requesting more than eight years or periods, you must. Web irs form 4506 is the “request for copy of tax return.” the internal revenue service (irs) requires that you file form 4506 or one of its versions if you want. Web request for transcript of tax return (march 2019)do not sign this form unless all applicable lines.

Request Previous Tax Returns with Form 4506T pdfFiller Blog

Attach payment and mail form 4506 to the address. Confirm you are using the march 2019 version available on the sba.gov website: Determination letters issued 2014 or later are available on tax exempt organization. Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Web jun 8, 2023 • knowledge if you are.

Web Use The Right Form.

Enter the ending date of the year or period, using the mm/dd/yyyy format. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. This form must be received by irs within 120 days of the signature date. Web the 4506t should be completed using your employer identification number (ein) for your business if you file on any other form other than a 1040.

Web These Where To File Addresses Are To Be Used By Taxpayers And Tax Professionals Filing Form 4506.

Internal revenue code section 6104 states that if an organization described in section 501 (c) or (d) is exempt from. The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Web request for transcript of tax return (march 2019)do not sign this form unless all applicable lines have been completed. Request may be rejected if department of thetreasury the.

Request A Copy Of Your Tax Return, Or Designate A Third Party To.

Confirm you are using the march 2019 version available on the sba.gov website: Attach payment and mail form 4506 to the address. Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Designate (on line 5) a third party to receive the tax massachusetts, return.

Use Form 4506 To Request A Copy Of Your Tax Return.

You can also all others. Web irs form 4506 is the “request for copy of tax return.” the internal revenue service (irs) requires that you file form 4506 or one of its versions if you want. Determination letters issued 2014 or later are available on tax exempt organization. Web jun 8, 2023 • knowledge if you are in a declared disaster area and have suffered any disaster related damage you may be eligible for federal disaster assistance.