Form 4797 Instruction

Form 4797 Instruction - Irs form 2297, also known as a waiver of statutory notification of claim disallowance, is completed either by a tax examiner in tax court, a taxpayer's. Look for forms using our forms search or view a list of income tax forms by year. Web 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Enter the name and identifying. Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days of the date sold. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web that may affect form 4797) and make it available for 2017, go to irs.gov/ extenders. General instructions purpose of form use form 4797 to report: • sale of a portion of a macrs asset. Top 13 mm (1⁄ 2), center sides.

This might include any property used to generate rental income or even a. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ¾ à ¾ sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) General instructions purpose of form use form 4797 to report: Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days of the date sold. Web that may affect form 4797) and make it available for 2017, go to irs.gov/ extenders. General instructions purpose of form. Top 13 mm (1⁄ 2), center sides. This is not intended as tax advice.

• sale of a portion of a macrs asset. Web assets on form 4797, part i, ii, or iii, as applicable. Web 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. General instructions purpose of form. This is a brief guide on entering information about the disposition of business property in form 4797 in taxslayer pro. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to. Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. Enter the name and identifying. Irs form 2297, also known as a waiver of statutory notification of claim disallowance, is completed either by a tax examiner in tax court, a taxpayer's. Top 13 mm (1⁄ 2), center sides.

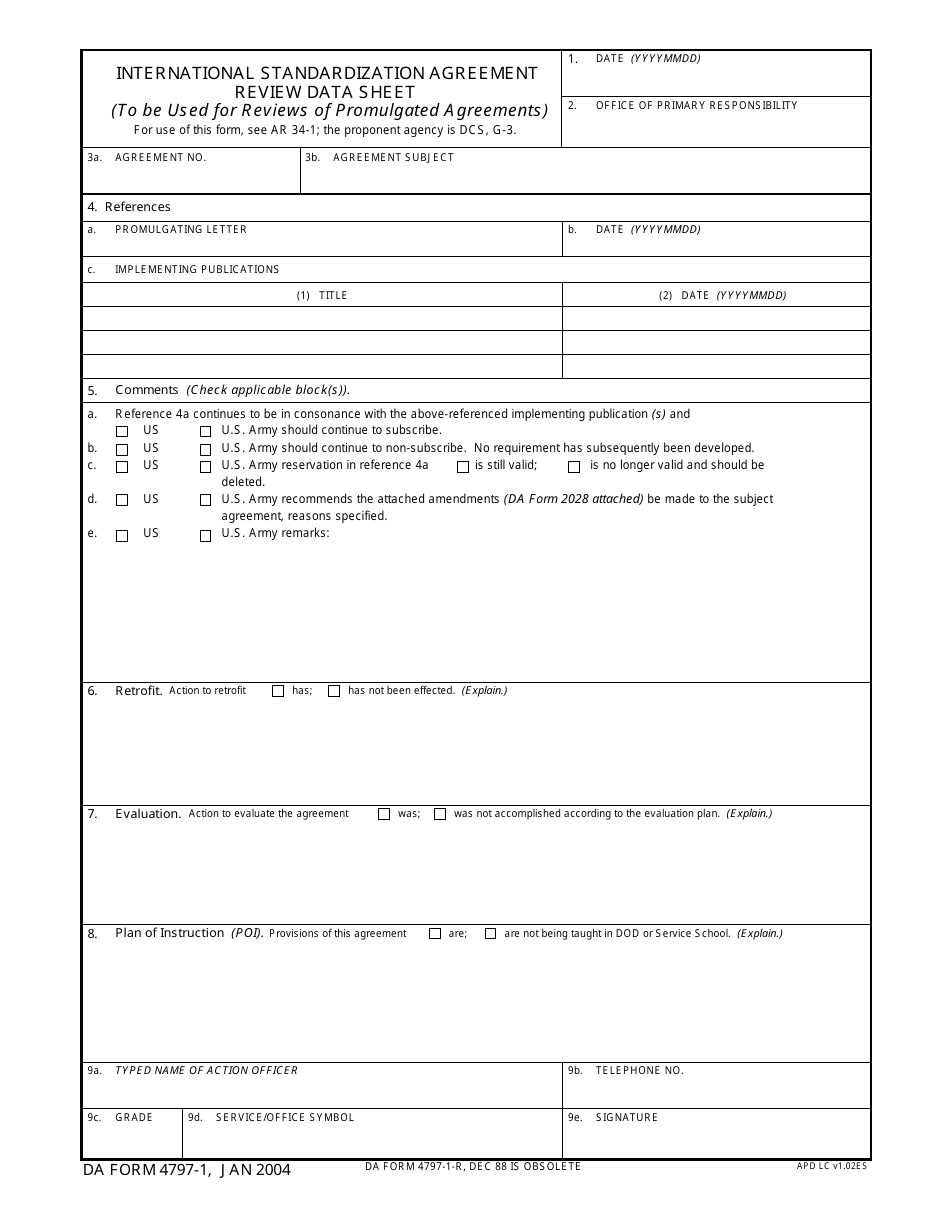

DD Form 47971 Download Fillable PDF or Fill Online International

Look for forms using our forms search or view a list of income tax forms by year. Enter the name and identifying. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web form 4797, line 2, report the qualified section.

TURBOTAX InvestorVillage

General instructions purpose of form. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. This is not intended as tax advice. Irs form 2297, also known as a waiver of statutory notification of claim disallowance, is completed either by a tax examiner in tax court, a taxpayer's. Enter the.

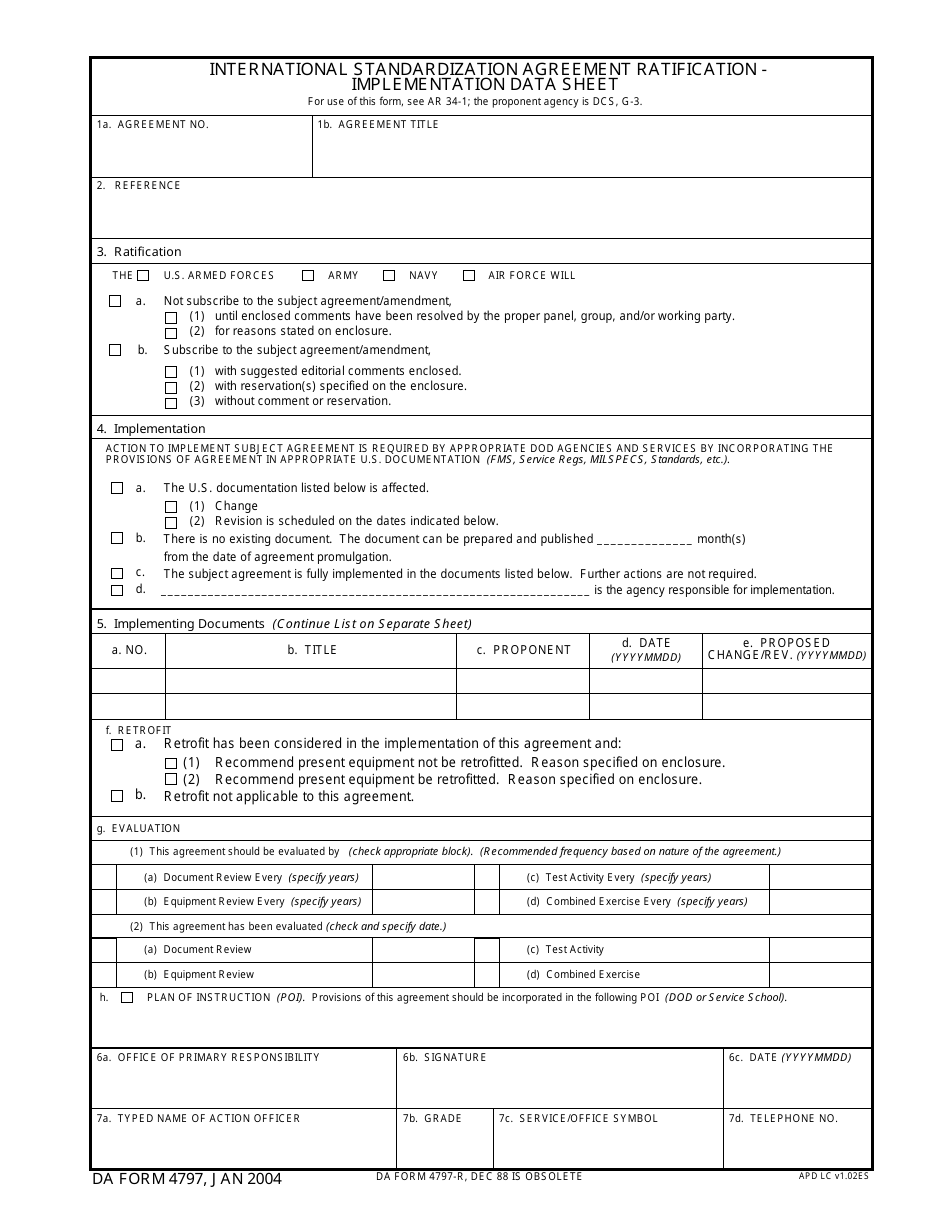

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

General instructions purpose of form use form 4797 to report: • involuntary conversion of a portion of a macrs asset other than from a casualty or theft. Web assets on form 4797, part i, ii, or iii, as applicable. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. •.

DA Form 4797 Download Fillable PDF or Fill Online International

Web that may affect form 4797) and make it available for 2017, go to irs.gov/ extenders. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ¾ à ¾ sales of business property (also involuntary.

Fillable Form Mi4797 Michigan Adjustments Of Gains And Losses From

• sale of a portion of a macrs asset. Irs form 2297, also known as a waiver of statutory notification of claim disallowance, is completed either by a tax examiner in tax court, a taxpayer's. Enter the name and identifying. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Web instructions.

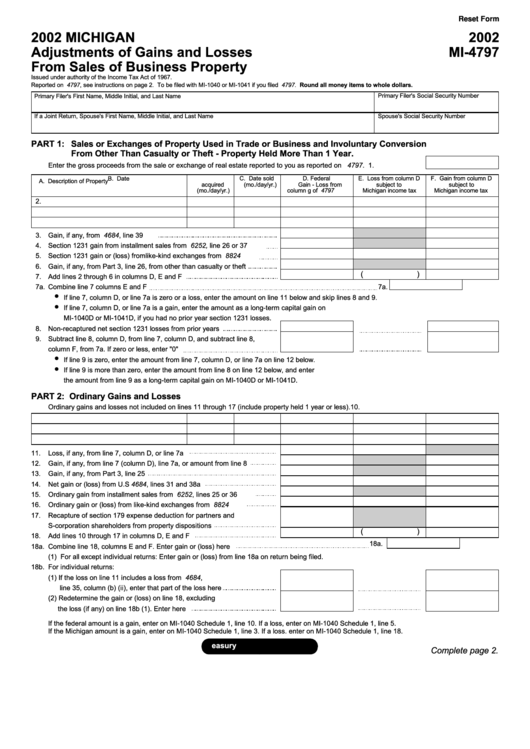

Line 7 of Form 4797 is 50,898At what rate(s) is

• involuntary conversion of a portion of a macrs asset other than from a casualty or theft. Look for forms using our forms search or view a list of income tax forms by year. This is not intended as tax advice. First of all, you can get this form from the department of treasury or you can just download the.

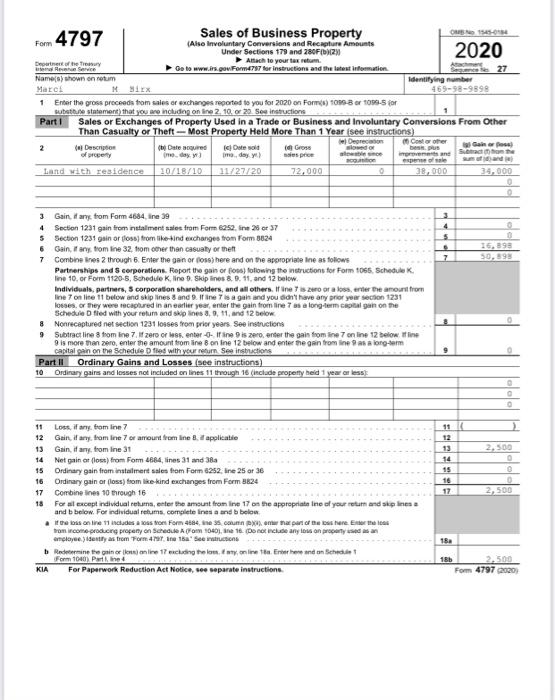

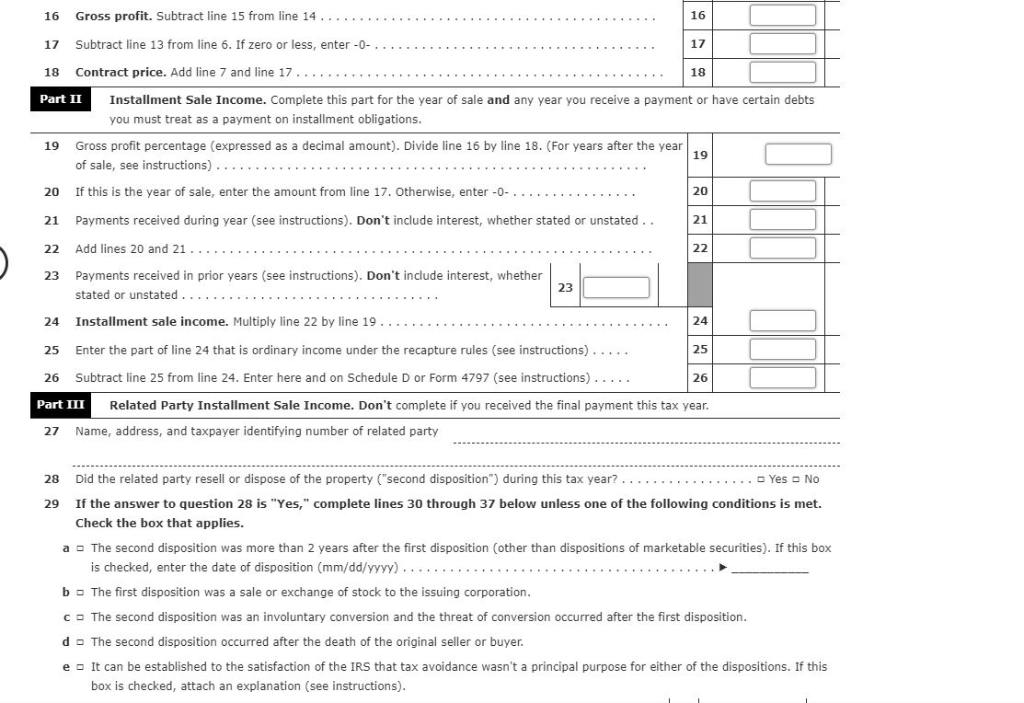

I need some assistance in filing out a 2005 form 6252 Installment Sale

Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ¾ à ¾ sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to. Web form 4797 is a tax form required to be filed with the internal revenue service (irs).

Does Sale Of Rental Property Go On Form 4797 Property Walls

Web general instructions for the latest information about form 4797, see www.irs.gov/form4797 purpose of form use form 4797 to report: Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days of the date sold. Web form 4797 is strictly used to report.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Web that may affect form 4797) and make it available for 2017, go to irs.gov/ extenders. Look for forms using our forms search or view a list of income tax forms by year. Web assets on form 4797, part i, ii, or iii, as applicable. This is not intended as tax advice. Web form 4797 is strictly used to report.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

This might include any property used to generate rental income or even a. Top 13 mm (1⁄ 2), center sides. Web 2022 individual income tax forms and instructions need a different form? Web 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Irs form 2297, also known.

Irs Form 2297, Also Known As A Waiver Of Statutory Notification Of Claim Disallowance, Is Completed Either By A Tax Examiner In Tax Court, A Taxpayer's.

• sale of a portion of a macrs asset. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days of the date sold. Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ¾ à ¾ sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2))

Web General Instructions For The Latest Information About Form 4797, See Www.irs.gov/Form4797 Purpose Of Form Use Form 4797 To Report:

This might include any property used to generate rental income or even a. General instructions purpose of form. Enter the name and identifying. Web 2022 individual income tax forms and instructions need a different form?

Top 13 Mm (1⁄ 2), Center Sides.

Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. This is a brief guide on entering information about the disposition of business property in form 4797 in taxslayer pro. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to. First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here.

Web 4797 Department Of The Treasury Internal Revenue Service Sales Of Business Property (Also Involuntary Conversions And Recapture Amounts Under Sections 179 And.

This is not intended as tax advice. General instructions purpose of form use form 4797 to report: Web assets on form 4797, part i, ii, or iii, as applicable. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions.

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://i0.wp.com/millerfsllc.com/wp-content/uploads/Form-4797.jpg?fit=521%2C647&ssl=1)

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://image.slidesharecdn.com/1273290/95/form-4797sales-of-business-property-2-728.jpg?cb=1239371111)

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://data.templateroller.com/pdf_docs_html/2125/21255/2125519/irs-form-4797-sales-of-business-property_print_big.png)