Form 4835 Vs Schedule E

Form 4835 Vs Schedule E - Web estates and trusts do not use form 4835 or schedule f (form 1040) for this purpose. (crop and livestock shares (not cash) received by landowner (or sub. Form 4835 (farm rental income. Web schedule e (form 1040) department of the treasury internal revenue service (99) supplemental income and loss (from rental real estate, royalties, partnerships, s. You can download or print. Web information about form 4835, farm rental income and expenses, including recent updates, related forms and instructions on how to file. Web report as income on schedule e (form 1040), part i; Use screen 4835 on the. Web farm rental income and expenses form 4835 (1995)page2 paperwork reduction actnotice we ask for the information on this form tocarry out the internal revenue laws. Irs form 4835 is a fairly straightforward form.

How do i complete irs form 4835? Web form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. You can download or print. Web report as income on schedule e (form 1040), part i; Web information about form 4835, farm rental income and expenses, including recent updates, related forms and instructions on how to file. If you own a part interest in a rental real estate property, report only your part of the. If you checked box 34b, you must complete form 6198 before going to form 8582. Web farm rental income and expenses form 4835 (1995)page2 paperwork reduction actnotice we ask for the information on this form tocarry out the internal revenue laws. In either case, enter the deductible loss here and on schedule e (form 1040),. One of the more common reasons you may find yourself filling out a schedule e is if you own real estate that you rent out.

Web information about form 4835, farm rental income and expenses, including recent updates, related forms and instructions on how to file. Web report as income on schedule e (form 1040), part i; Web farm rental income and expenses form 4835 (1995)page2 paperwork reduction actnotice we ask for the information on this form tocarry out the internal revenue laws. Web form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Web reporting rental income on schedule e. Department of the treasury internal revenue service (99) farm rental income and expenses. Web we last updated the farm rental income and expenses in december 2022, so this is the latest version of form 4835, fully updated for tax year 2022. In either case, enter the deductible loss here and on schedule e (form 1040),. Web estates and trusts do not use form 4835 or schedule f (form 1040) for this purpose. (crop and livestock shares (not cash) received by landowner (or sub.

Form 4835Farm Rental and Expenses

Form 4835 (farm rental income. Web what do you think? Web schedule f and form 4835 have separate lines for ag program payments, and those lines are the right place to report the payments. Irs form 4835 is a fairly straightforward form. One of the more common reasons you may find yourself filling out a schedule e is if you.

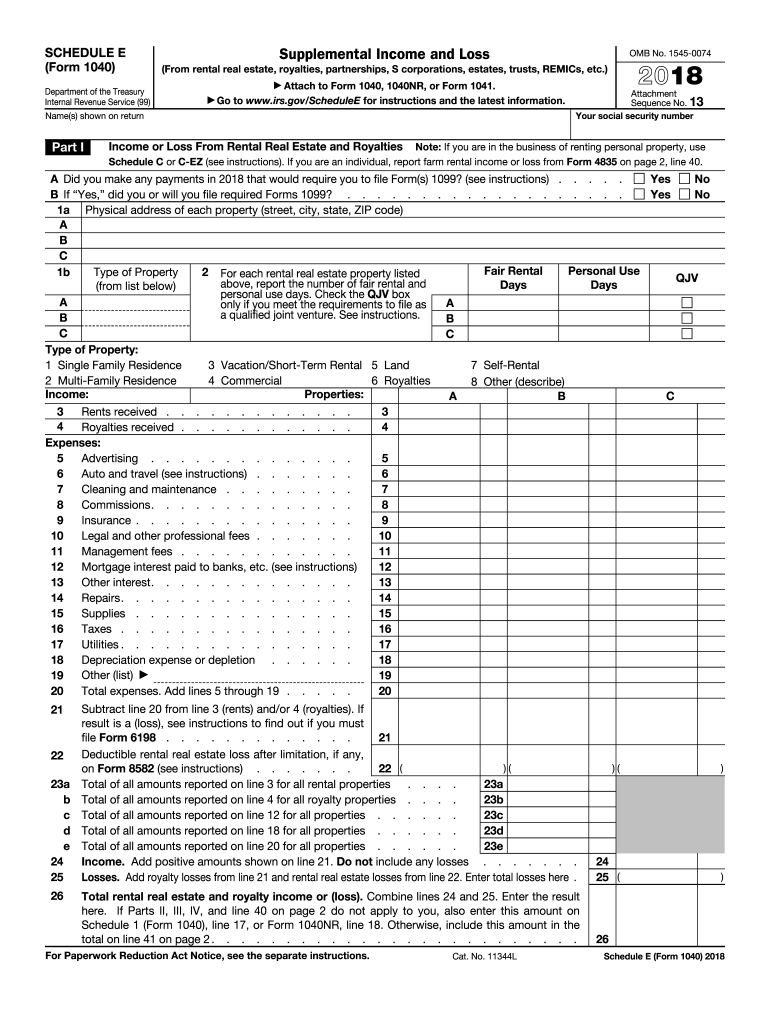

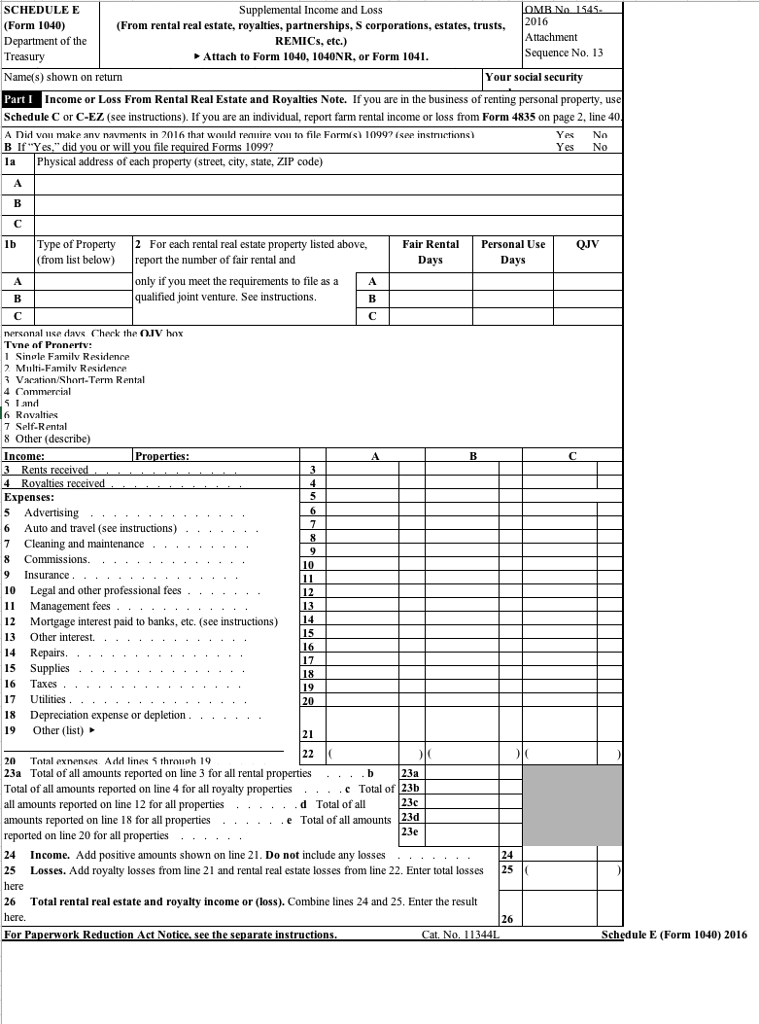

2018 Form IRS 1040 Schedule E Fill Online, Printable, Fillable, Blank

Form 4835 (farm rental income. Web form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Web farm rental income and expenses form 4835 (1995)page2 paperwork reduction actnotice we ask for the information on this form tocarry out the internal revenue laws. Department of.

Solved SCHEDULE E (Form 1040) Department of the Treasury

One of the more common reasons you may find yourself filling out a schedule e is if you own real estate that you rent out. Web schedule f and form 4835 have separate lines for ag program payments, and those lines are the right place to report the payments. Much interest you are allowed to deduct on form 4835. When.

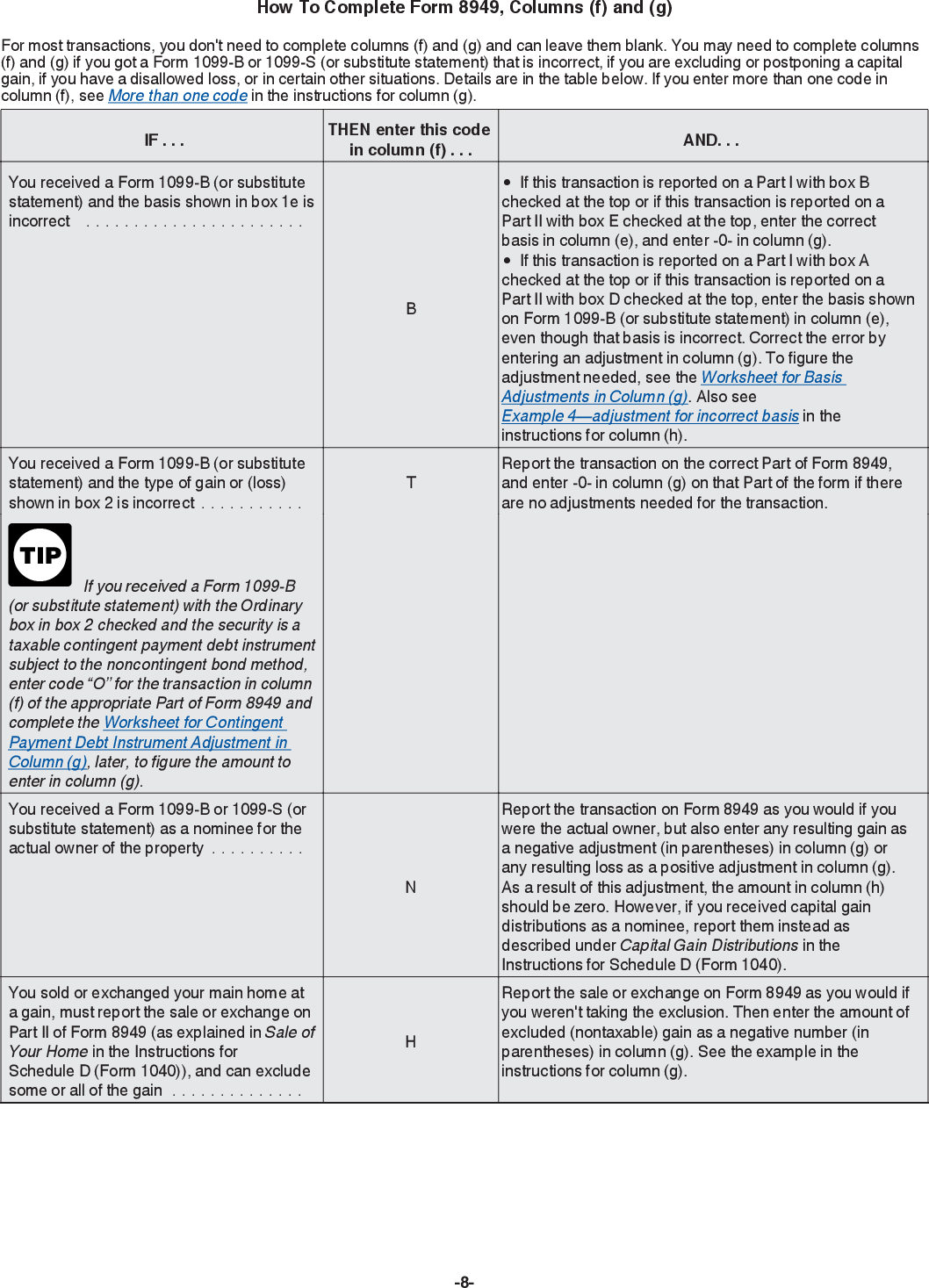

Online generation of Schedule D and Form 8949 for 10.00

(crop and livestock shares (not cash) received by landowner (or sub. (1) schedule f (farm income and expenses); In either case, enter the deductible loss here and on schedule e (form 1040),. Web form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Form.

IRS Schedule C Instructions Schedule C Form Free Download

Web tax management starts with understanding the relationship of gross income to adjusted gross income and taxable income. Web farmland lease income may be reported on one of three possible irs forms: How do i complete irs form 4835? Web what do you think? Web information about form 4835, farm rental income and expenses, including recent updates, related forms and.

Example of 1040 Filled Out Legacy Tax & Resolution Services

Web report as income on schedule e (form 1040), part i; Use screen 4835 on the. Web estates and trusts do not use form 4835 or schedule f (form 1040) for this purpose. Department of the treasury internal revenue service (99) farm rental income and expenses. Web we last updated the farm rental income and expenses in december 2022, so.

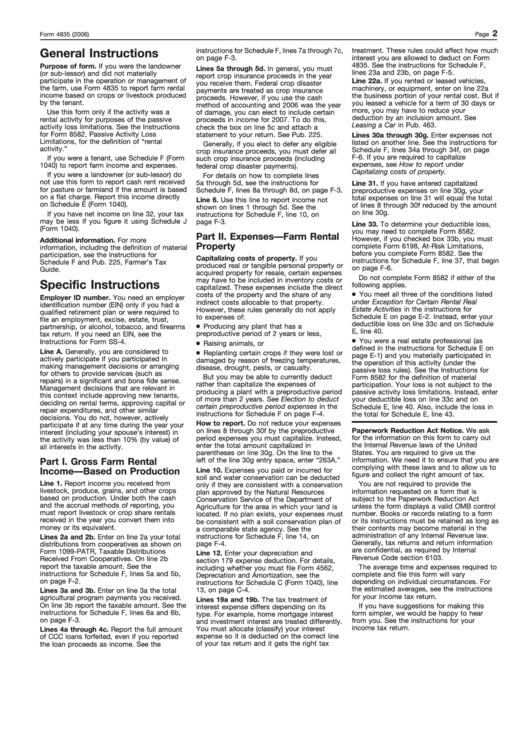

Instructions For Form 4835 2006 printable pdf download

Web farm rental income and expenses form 4835 (1995)page2 paperwork reduction actnotice we ask for the information on this form tocarry out the internal revenue laws. You can download or print. Form 4835 (farm rental income. Web we last updated the farm rental income and expenses in december 2022, so this is the latest version of form 4835, fully updated.

Fill Free fillable Farm Rental and Expenses Form 4835 PDF form

(crop and livestock shares (not cash) received by landowner (or sub. Web farmland lease income may be reported on one of three possible irs forms: Department of the treasury internal revenue service (99) farm rental income and expenses. (1) schedule f (farm income and expenses); Web we last updated the farm rental income and expenses in december 2022, so this.

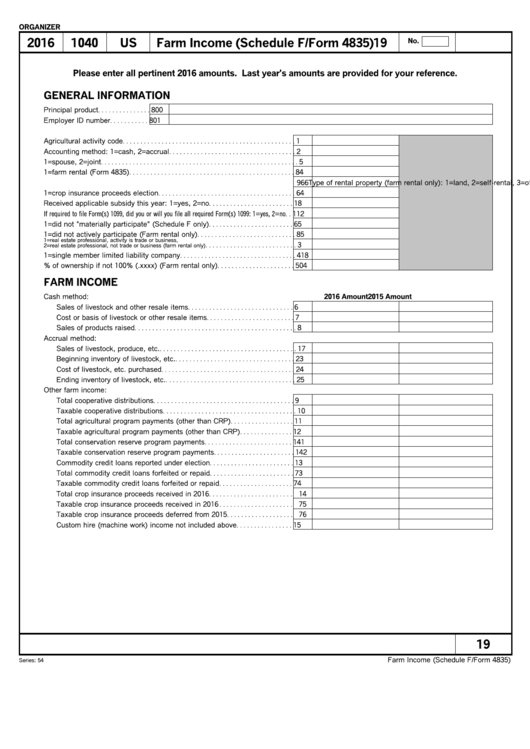

Farm (Schedule F / Form 4835) printable pdf download

How do i complete irs form 4835? If you checked box 34b, you must complete form 6198 before going to form 8582. Common questions for fiduciary (form 1041) distributions. Web schedule f and form 4835 have separate lines for ag program payments, and those lines are the right place to report the payments. Web what do you think?

Schedule C vs Schedule E For Rental Property TFX Tax

Web farmland lease income may be reported on one of three possible irs forms: • estate or trust with rental income and expenses from. (1) schedule f (farm income and expenses); Web lacerte tax ask questions, get answers, and join our large community of intuit accountants users. How do i complete irs form 4835?

Web Estates And Trusts Do Not Use Form 4835 Or Schedule F (Form 1040) For This Purpose.

In either case, enter the deductible loss here and on schedule e (form 1040),. Web information about form 4835, farm rental income and expenses, including recent updates, related forms and instructions on how to file. Web what do you think? When determining your gross income, net.

Common Questions For Fiduciary (Form 1041) Distributions.

Web farm rental income and expenses form 4835 (1995)page2 paperwork reduction actnotice we ask for the information on this form tocarry out the internal revenue laws. One of the more common reasons you may find yourself filling out a schedule e is if you own real estate that you rent out. Use screen 4835 on the. (crop and livestock shares (not cash) received by landowner (or sub.

Form 4835 (Farm Rental Income.

Web schedule f and form 4835 have separate lines for ag program payments, and those lines are the right place to report the payments. Web reporting rental income on schedule e. Web report as income on schedule e (form 1040), part i; Much interest you are allowed to deduct on form 4835.

(1) Schedule F (Farm Income And Expenses);

Irs form 4835 is a fairly straightforward form. If you own a part interest in a rental real estate property, report only your part of the. Web schedule e (form 1040) department of the treasury internal revenue service (99) supplemental income and loss (from rental real estate, royalties, partnerships, s. Web we last updated the farm rental income and expenses in december 2022, so this is the latest version of form 4835, fully updated for tax year 2022.