Form 5405 Instructions

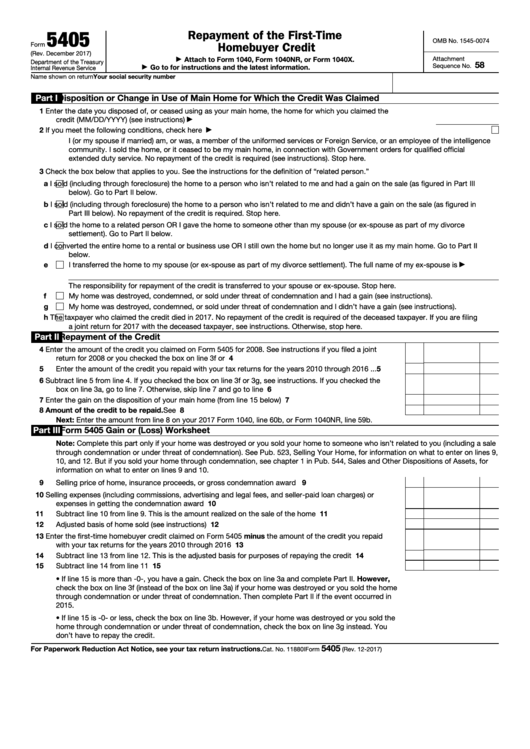

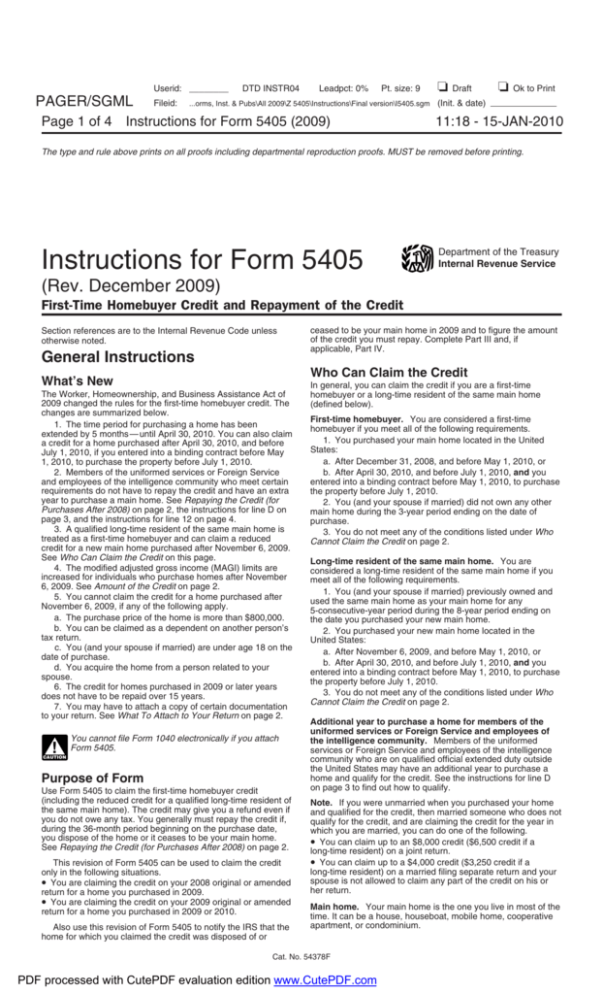

Form 5405 Instructions - You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Use form 5405 to do the following. Instead, enter the repayment on 2022 schedule. In all other cases, you aren't required to file form 5405. You disposed of it in 2022. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be your main home in 2022. See the instructions for line 5. Per the irs instructions for form 5405: You ceased using it as your main home in 2022. Web use this part to figure the amount of estimated tax that you were required to pay.

Complete part ii and, if applicable, part iii. You disposed of it in 2022. Web purpose of form use form 5405 to do the following: Complete part i and, if applicable, parts ii and iii. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2013. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web the purpose of the newly revised form 5405 is to: Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be your main home in 2021. You disposed of it in 2022. Use form 5405 to do the following.

You ceased using it as your main home in 2022. Use form 5405 to do the following. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Part iii form 5405 gain or (loss) worksheet. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2013. Complete part i and, if applicable, parts ii and iii. Figure the amount of the credit you must repay with your 2013 tax return. Per the irs instructions for form 5405: You disposed of it in 2022. Web who must file form 5405?

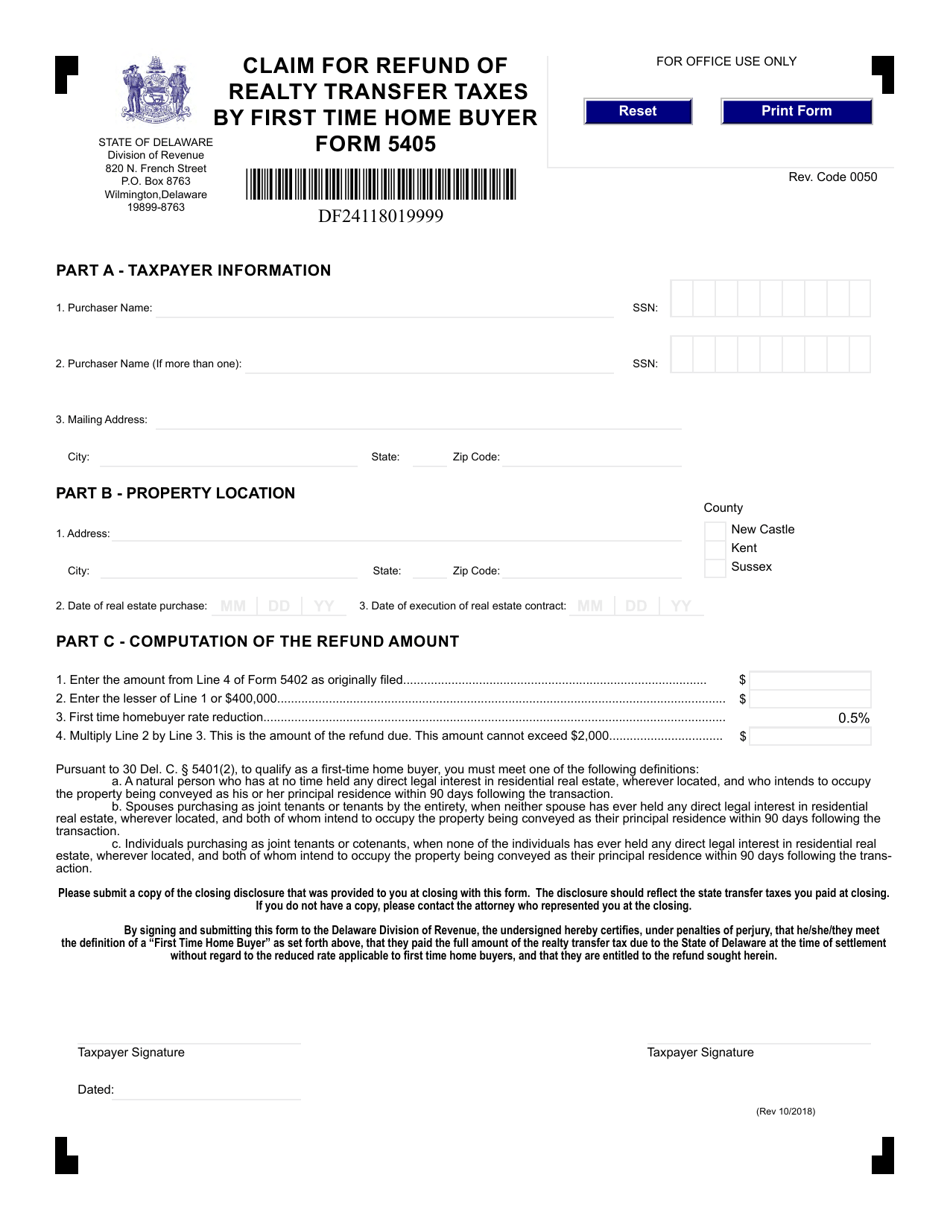

Form 5405 Download Fillable PDF or Fill Online Claim for Refund of

Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2013. Complete part i and, if applicable, parts ii and iii. You ceased using it as your main home in 2022. Per the irs instructions for form 5405: Notify the irs that the home you purchased in.

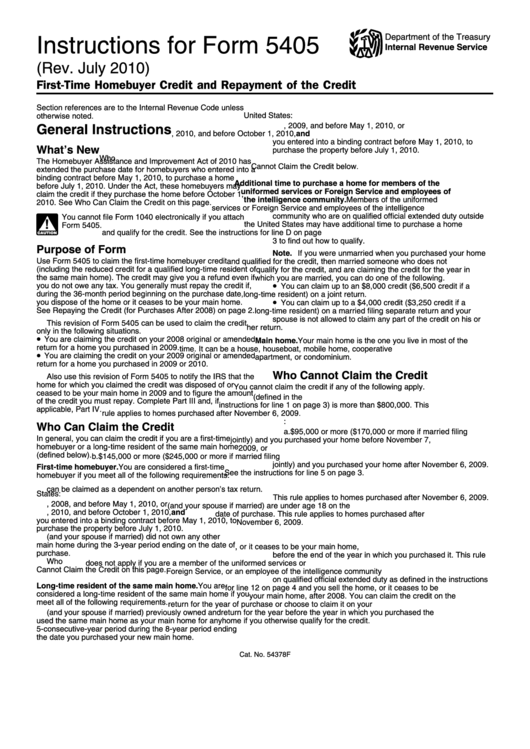

Instructions For Form 5405 (Rev. July 2010) printable pdf download

Instead, enter the repayment on 2022 schedule. Complete part ii and, if applicable, part iii. Part iii form 5405 gain or (loss) worksheet. You ceased using it as your main home in 2022. Complete this part only if your home was destroyed or you sold your home to someone who isn’t related to you (including.

Form 540 Ca amulette

Web who must file form 5405? You ceased using it as your main home in 2022. Web use this part to figure the amount of estimated tax that you were required to pay. Complete part i and, if applicable, parts ii and iii. Notify the irs that the home for which you claimed the credit was disposed of or ceased.

FIA Historic Database

See the instructions for line 5. Part iii form 5405 gain or (loss) worksheet. Web the purpose of the newly revised form 5405 is to: Complete part i and, if applicable, parts ii and iii. You disposed of it in 2022.

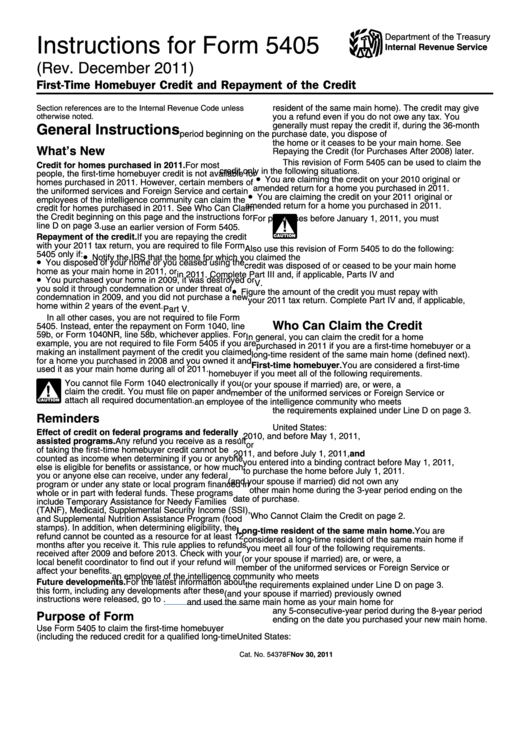

Instructions For Form 5405 FirstTime Homebuyer Credit And Repayment

You disposed of it in 2022. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be your main home in 2021. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions..

Form 5405 Fill Out and Sign Printable PDF Template signNow

See the instructions for line 5. You disposed of it in 2022. Complete part ii and, if applicable, part iii. Web who must file form 5405? Complete this part only if your home was destroyed or you sold your home to someone who isn’t related to you (including.

Fillable Form 5405 Repayment Of The FirstTime Homebuyer Credit

Web the purpose of the newly revised form 5405 is to: Figure the amount of the credit you must repay with your 2013 tax return. You disposed of it in 2022. Web this program was established to help blind or disabled u.s. Complete part ii and, if applicable, part iii.

540 Introduction Fall 2016 YouTube

Web this program was established to help blind or disabled u.s. You ceased using it as your main home in 2022. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web purpose of form. Complete part i and, if applicable, parts ii and.

Instructions for Form 5405

Part iii form 5405 gain or (loss) worksheet. Web this program was established to help blind or disabled u.s. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed.

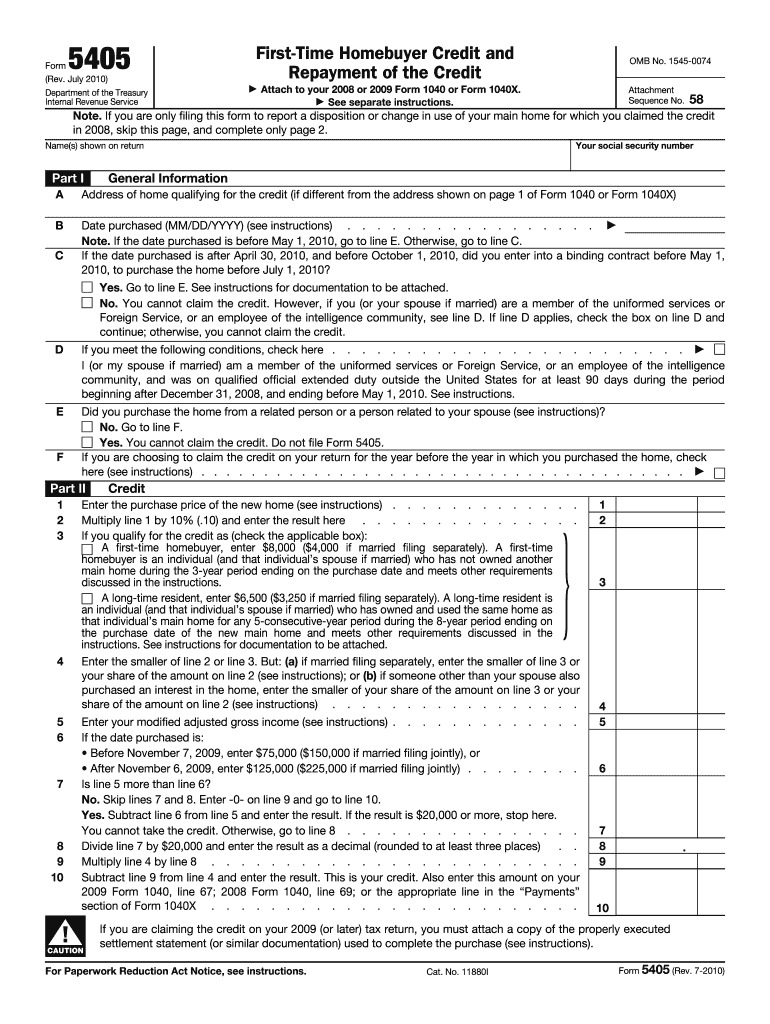

Form 5405 FirstTime Homebuyer Credit and Repayment of the Credit

In all other cases, you aren't required to file form 5405. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be your main home in 2021. Per the irs instructions for form 5405: Notify the irs that the home for which you claimed the credit was.

Web Who Must File Form 5405?

In all other cases, you aren't required to file form 5405. Complete this part only if your home was destroyed or you sold your home to someone who isn’t related to you (including. Per the irs instructions for form 5405: Web use this part to figure the amount of estimated tax that you were required to pay.

Figure The Amount Of The Credit You Must Repay With Your 2013 Tax Return.

Web purpose of form use form 5405 to do the following: Web the purpose of the newly revised form 5405 is to: Complete part i and, if applicable, parts ii and iii. Use form 5405 to do the following.

Notify The Irs That The Home You Purchased In 2008 And For Which You Claimed The Credit Was Disposed Of Or Ceased To Be Your Main Home In 2022.

Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2013. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. See the instructions for line 5. Part iii form 5405 gain or (loss) worksheet.

Web This Program Was Established To Help Blind Or Disabled U.s.

Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home. Web purpose of form. Complete part i and, if applicable, parts ii and iii. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be your main home in 2021.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)