Form 5405 Turbotax

Form 5405 Turbotax - Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008. Notify the irs that the home you purchased in 2008. Web repay the credit on form 5405 and attach it to your form 1040. Web this form is for the first time homebuyer tax credit. Notify the irs that the home you. Web taxes deductions & credits still need to file? Web june 4, 2019 5:55 pm if you are including form 5405 with your tax return, turbotax will. Web schedule 3 additional credits and payments schedule a (form 1040) itemized. Web the submitted form 5405 should have data then entered in section two but. Per the irs instructions for form 5405:

Notify the irs that the home you. Web this form is for the first time homebuyer tax credit. Web form 5405 is used to report the sale or disposal of a home if you purchased. Per the irs instructions for form 5405: Web schedule 3 additional credits and payments schedule a (form 1040) itemized. Web the irs requires you to prepare irs form 5405 before you can claim the. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008. Web the submitted form 5405 should have data then entered in section two but. Web june 4, 2019 5:55 pm if you are including form 5405 with your tax return, turbotax will. Our experts can get your.

Web use form 5405 to do the following. Notify the irs that the home you purchased in 2008. Web use form 5405 to do the following. Web this form is for the first time homebuyer tax credit. Web the irs requires you to prepare irs form 5405 before you can claim the. Web the 5405 is also used to notify the irs that the home was disposed of or. Per the irs instructions for form 5405: Web repay the credit on form 5405 and attach it to your form 1040. Our experts can get your. I received a tax credit.

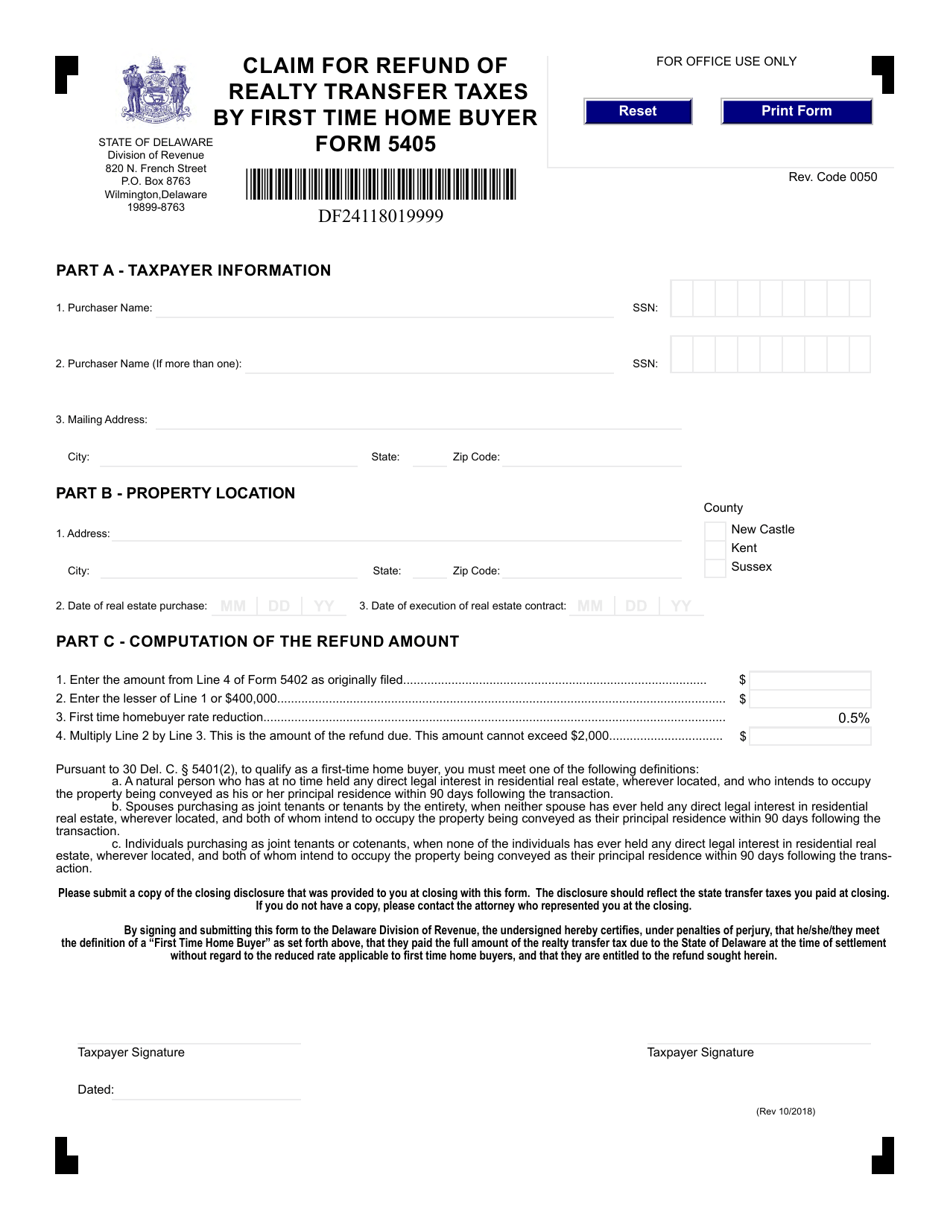

Form 5405 Download Fillable PDF or Fill Online Claim for Refund of

Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008. Web the 5405 is also used to notify the irs that the home was disposed of or. Web repay the credit on form 5405 and attach it to your form 1040. Web use form 5405 to do the following. Our experts can.

Form 5405 Edit, Fill, Sign Online Handypdf

Notify the irs that the home you. Web form 5405 is used to report the sale or disposal of a home if you purchased. Web the submitted form 5405 should have data then entered in section two but. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Per the irs instructions for form 5405:

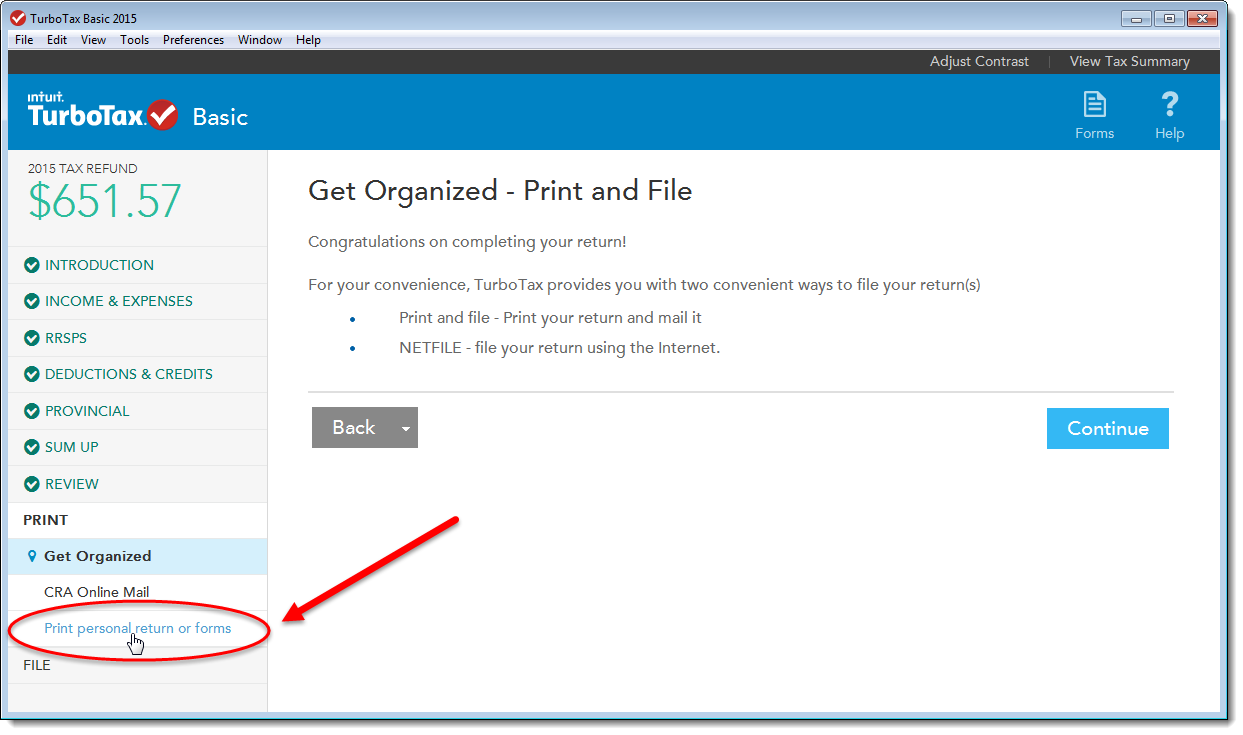

How do I save a PDF copy of my tax return in TurboTax AnswerXchange

Web the submitted form 5405 should have data then entered in section two but. Web june 4, 2019 5:55 pm if you are including form 5405 with your tax return, turbotax will. Per the irs instructions for form 5405: Web form 5405 is used to report the sale or disposal of a home if you purchased. Web schedule 3 additional.

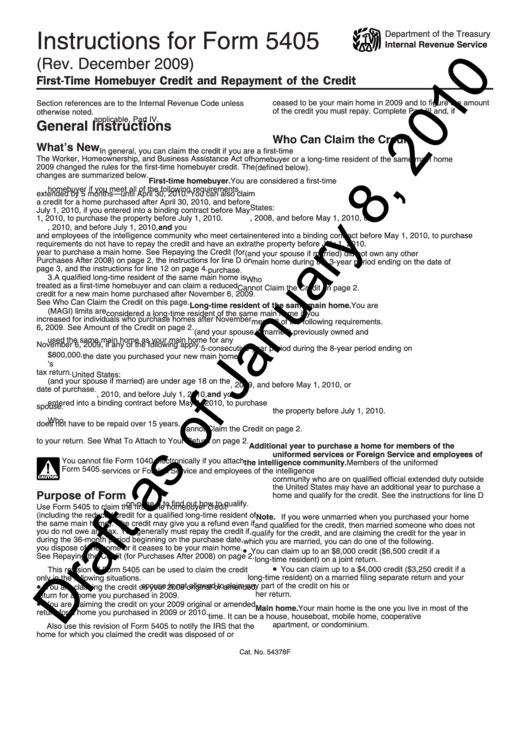

Instructions For Form 5405 2009 printable pdf download

Notify the irs that the home you. I received a tax credit. Per the irs instructions for form 5405: Web the submitted form 5405 should have data then entered in section two but. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008.

Form 540 Ca amulette

Web schedule 3 additional credits and payments schedule a (form 1040) itemized. Web june 4, 2019 5:55 pm if you are including form 5405 with your tax return, turbotax will. Notify the irs that the home you purchased in 2008. Web repay the credit on form 5405 and attach it to your form 1040. Ad file heavy vehicle use tax.

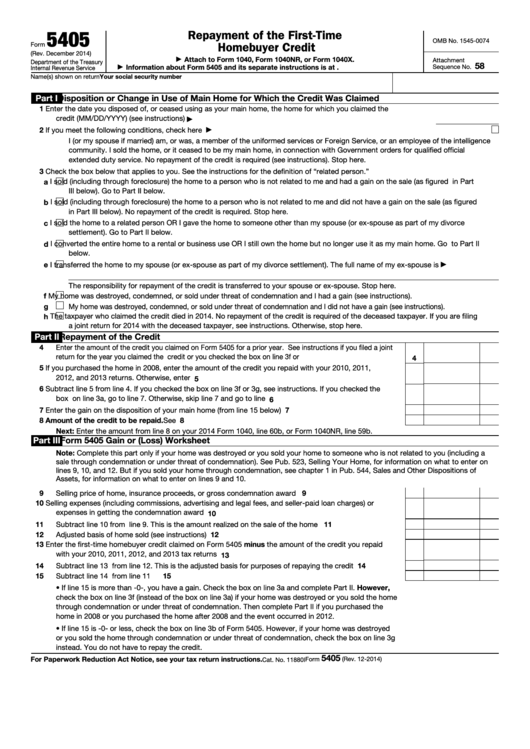

Form 5405 FirstTime Homebuyer Credit

Notify the irs that the home you. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008. Web the irs requires you to prepare irs form 5405 before you can claim the. Per the irs instructions for form 5405:

Fillable Form 5405 Repayment Of The FirstTime Homebuyer Credit

Web the submitted form 5405 should have data then entered in section two but. Web this form is for the first time homebuyer tax credit. Web form 5405 is used to report the sale or disposal of a home if you purchased. Per the irs instructions for form 5405: Notify the irs that the home you purchased in 2008.

Fill Free fillable Form 5405 Repayment of the FirstTime Homebuyer

Web schedule 3 additional credits and payments schedule a (form 1040) itemized. Web complete the repayment of the first time homebuyer credit section to figure the. Web taxes deductions & credits still need to file? Web the submitted form 5405 should have data then entered in section two but. Web use form 5405 to do the following.

How TurboTax turns a dreadful user experience into a delightful one

Web use form 5405 to do the following. Notify the irs that the home you. I received a tax credit. Web schedule 3 additional credits and payments schedule a (form 1040) itemized. Web repayment of the credit 4 enter the amount of the credit you claimed on form 5405 for a.

Web Schedule 3 Additional Credits And Payments Schedule A (Form 1040) Itemized.

Web repay the credit on form 5405 and attach it to your form 1040. Notify the irs that the home you. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web june 4, 2019 5:55 pm if you are including form 5405 with your tax return, turbotax will.

Web The Irs Requires You To Prepare Irs Form 5405 Before You Can Claim The.

Web who must file form 5405? Web form 5405 is used to report the sale or disposal of a home if you purchased. Web this form is for the first time homebuyer tax credit. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008.

Per The Irs Instructions For Form 5405:

Web the submitted form 5405 should have data then entered in section two but. Web taxes deductions & credits still need to file? Web repayment of the credit 4 enter the amount of the credit you claimed on form 5405 for a. Our experts can get your.

Web The 5405 Is Also Used To Notify The Irs That The Home Was Disposed Of Or.

Web use form 5405 to do the following. I received a tax credit. Notify the irs that the home you purchased in 2008. Web use form 5405 to do the following.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)