Form 5471 Schedule B

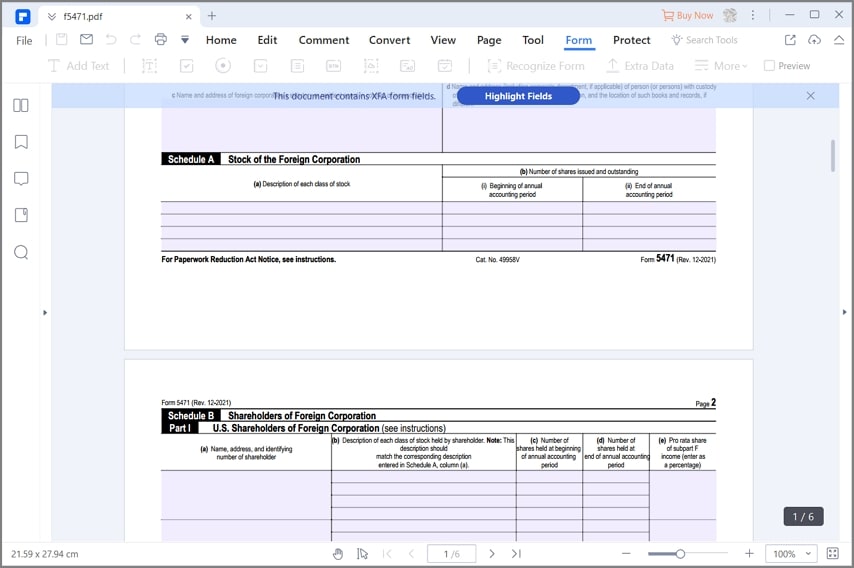

Form 5471 Schedule B - Web form 5471 schedule b, part i. No statement is required to be attached to tax returns for persons claiming the constructive ownership exception. Web october 25, 2022 resource center forms form 5471: Web schedule b of the form 5471 asks the filer to list the name, address, and identify the number of shares in the foreign corporation. Citizens should know at a glance if you’re a u.s. Web part i of schedule b is to be completed by category 3 and 4 filers who owned directly or indirectly 10% or more in value or voting power of any class of foreign corporation stock. Schedule b asks you to name the u.s. Web 6 schedule b shareholders of foreign corporation on form 5471 7 schedule c income statement for form 5471 8 schedule f balance sheet for form 5471 9 schedule g. This is the sixth of a series of articles designed. Web schedule b is completed with a form 5471 to disclose the direct and indirect u.s.

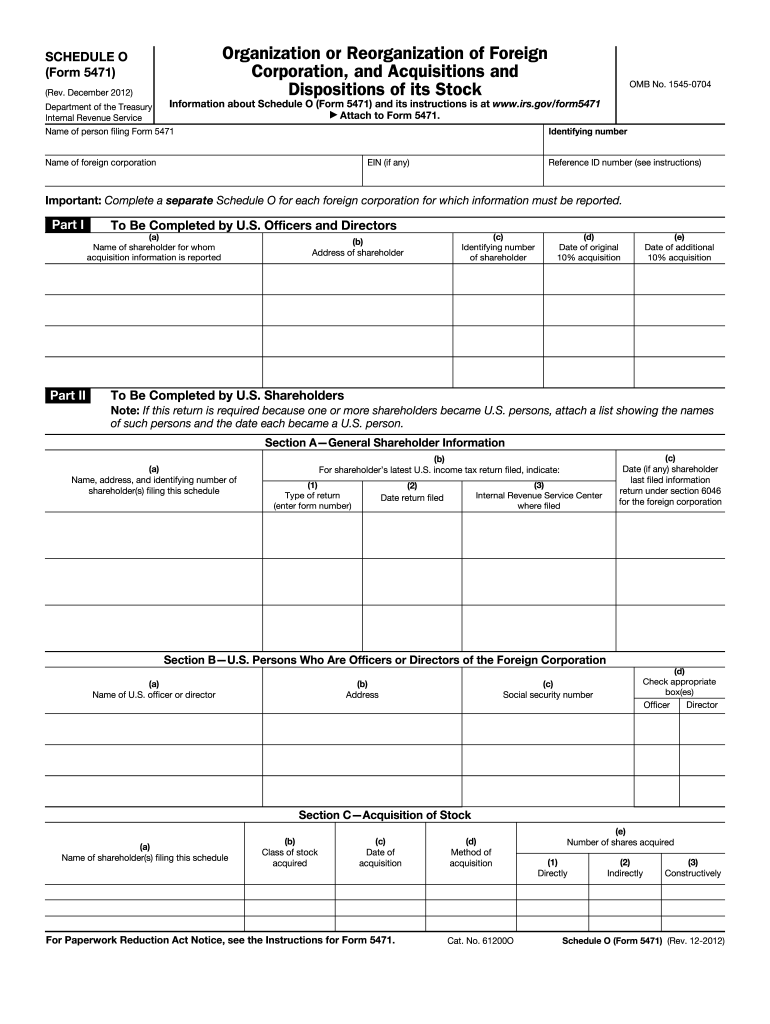

Web form 5471, schedule b, (a) if the name is entered then a us or foreign address must be entered. Citizens should know at a glance if you’re a u.s. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. This is the sixth of a series of articles designed. Web on schedule p of the form 5471 with respect to cfc1 filed by corporation b, corporation b will report on line 7, column (h), $50x of ptep as a result of its section 951a inclusion. Enter the filer name or. Web 6 schedule b shareholders of foreign corporation on form 5471 7 schedule c income statement for form 5471 8 schedule f balance sheet for form 5471 9 schedule g. Name of person filing form 5471. Web part i of schedule b is to be completed by category 3 and 4 filers who owned directly or indirectly 10% or more in value or voting power of any class of foreign corporation stock. Web attach to form 5471.

Web schedule b shareholders of foreign corporation on form 5471. Web form 5471 schedule b, part i. Web schedule b of the form 5471 asks the filer to list the name, address, and identify the number of shares in the foreign corporation. Part i category three and four filers are. Schedule b asks you to name the u.s. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Name of foreign corporation ein (if any) reference id number (see. Web on schedule p of the form 5471 with respect to cfc1 filed by corporation b, corporation b will report on line 7, column (h), $50x of ptep as a result of its section 951a inclusion. No statement is required to be attached to tax returns for persons claiming the constructive ownership exception. Form 5471 schedule b, part i refers to the different shareholders accounted for on the form that are being reported on the form.

Worksheet A Form 5471 Irs Tripmart

Citizen and you have ownership in a foreign. Name of foreign corporation ein (if any) reference id number (see. Enter the filer name or. Web (form 8992) or schedule b (form 8992) with respect to the cfc, the reference id number on form 5471 and the reference id number on schedule a (form 8992) or schedule b. This is the.

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

Web part i of schedule b is to be completed by category 3 and 4 filers who owned directly or indirectly 10% or more in value or voting power of any class of foreign corporation stock. Citizens should know at a glance if you’re a u.s. Web october 25, 2022 resource center forms form 5471: 4 (viii) current year tax.

Form 5471 and Corresponding Schedules SDG Accountant

Citizens should know at a glance if you’re a u.s. Web form 5471 to report all of the required information. Enter the filer name or. Citizen and you have ownership in a foreign. Form 5471 schedule b, part i refers to the different shareholders accounted for on the form that are being reported on the form.

Demystifying the Form 5471 Part 7. Schedule P SF Tax Counsel

This is the sixth of a series of articles designed. Web schedule b is completed with a form 5471 to disclose the direct and indirect u.s. Web on schedule p of the form 5471 with respect to cfc1 filed by corporation b, corporation b will report on line 7, column (h), $50x of ptep as a result of its section.

5471 O Form Fill Out and Sign Printable PDF Template signNow

Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Part 1 and part 2. Web part i of schedule b is to be completed by category 3 and 4 filers who owned directly or indirectly 10% or more in value or voting power of any class.

2012 form 5471 instructions Fill out & sign online DocHub

Web attach to form 5471. Web schedule b shareholders of foreign corporation on form 5471. Web 6 schedule b shareholders of foreign corporation on form 5471 7 schedule c income statement for form 5471 8 schedule f balance sheet for form 5471 9 schedule g. Name of foreign corporation ein (if any) reference id number (see. Enter the filer name.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Web (form 8992) or schedule b (form 8992) with respect to the cfc, the reference id number on form 5471 and the reference id number on schedule a (form 8992) or schedule b. Form 5471 schedule b, part i refers to the different shareholders accounted for on the form that are being reported on the form. Web october 25, 2022.

IRS Issues Updated New Form 5471 What's New?

Name of foreign corporation ein (if any) reference id number (see. Users should complete both parts 1 and 2. 4 (viii) current year tax on reattributed income from disregarded payments (ix) current year tax on all other disregarded payments. Web form 5471, schedule b, (a) if the name is entered then a us or foreign address must be entered. Web.

5471 Worksheet A

Web on schedule p of the form 5471 with respect to cfc1 filed by corporation b, corporation b will report on line 7, column (h), $50x of ptep as a result of its section 951a inclusion. Web schedule b shareholders of foreign corporation on form 5471. Web form 5471, schedule b, (a) if the name is entered then a us.

How to Fill out IRS Form 5471 (2020 Tax Season)

Form 5471 schedule b, part i refers to the different shareholders accounted for on the form that are being reported on the form. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Web (form 8992) or schedule b (form 8992) with respect to the cfc, the.

4 (Viii) Current Year Tax On Reattributed Income From Disregarded Payments (Ix) Current Year Tax On All Other Disregarded Payments.

Web on schedule p of the form 5471 with respect to cfc1 filed by corporation b, corporation b will report on line 7, column (h), $50x of ptep as a result of its section 951a inclusion. Form 5471 schedule b, part i refers to the different shareholders accounted for on the form that are being reported on the form. Part i category three and four filers are. Citizens should know at a glance if you’re a u.s.

Web Schedule B Shareholders Of Foreign Corporation On Form 5471.

Web attach to form 5471. Web if category 3 or 4 isn't checked, schedule b won't generate. Web form 5471 to report all of the required information. No statement is required to be attached to tax returns for persons claiming the constructive ownership exception.

Name Of Person Filing Form 5471.

Web (form 8992) or schedule b (form 8992) with respect to the cfc, the reference id number on form 5471 and the reference id number on schedule a (form 8992) or schedule b. Citizen and you have ownership in a foreign. Web part i of schedule b is to be completed by category 3 and 4 filers who owned directly or indirectly 10% or more in value or voting power of any class of foreign corporation stock. Web schedule b of the form 5471 asks the filer to list the name, address, and identify the number of shares in the foreign corporation.

Web Form 5471 Schedule B, Part I.

Web schedule b is completed with a form 5471 to disclose the direct and indirect u.s. Web 6 schedule b shareholders of foreign corporation on form 5471 7 schedule c income statement for form 5471 8 schedule f balance sheet for form 5471 9 schedule g. Name of foreign corporation ein (if any) reference id number (see. Part 1 and part 2.