Form 5500 Instruction

Form 5500 Instruction - The form 5500 version selection tool can help determine exactly which form in the. Schedule a (form 5500) 17 hr., 28 min. Web form 5500 (all other filers) 82 hr., 16 min. Department of labor, internal revenue service, and pension benefit guaranty corporation to. Web this clarification is proposed to be added to the 2023 form 5500 instructions for line 26b of schedule sb. Known as the “regular” form 5500, this version is for retirement. Certain foreign retirement plans are also required to file this form (see instructions). Schedule b (form 5500) part 2. Schedule b (form 5500) part 2. 48 min.9 hr., 32 min.

Web the form 5500 series consists of: Department of labor, internal revenue service, and pension benefit guaranty corporation to. 48 min.9 hr., 32 min. Web the instructions have been updated to reflect the penalty changes under section 6652 (e) for a plan failure to file a return. Web this form is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6047(e), 6057(b), and 6058(a) of the. Web this clarification is proposed to be added to the 2023 form 5500 instructions for line 26b of schedule sb. Web form 5500 (all other filers) 82 hr., 16 min. Schedule b (form 5500) part 2. Schedule a (form 5500) 17 hr., 28 min. Known as the “regular” form 5500, this version is for retirement.

Schedule a (form 5500) 17 hr., 28 min. Web this clarification is proposed to be added to the 2023 form 5500 instructions for line 26b of schedule sb. Those schedules provide detailed financial information about the plan’s. Web the instructions to the form 5500. Department of labor, internal revenue service, and pension benefit guaranty corporation to. Web form 5500 (all other filers) 82 hr., 16 min. Web irs form 5500 instructions indicate that one or more additional schedules may be required. Form 5500, annual return/report of employee benefit plan. The penalties have been increased to $250 a day, up to a. See pbgc’s august 29, 2022 notice of.

Form 5500 Instructions 5 Steps to Filing Correctly

Known as the “regular” form 5500, this version is for retirement. Web form 5500 (all other filers) 82 hr., 16 min. Those schedules provide detailed financial information about the plan’s. Form 5500, annual return/report of employee benefit plan. Web the form 5500 series consists of:

Form 5500 Instructions 5 Steps to Filing Correctly

Web form 5500 is used for plans that have 100 or more participants. The penalties have been increased to $250 a day, up to a. 48 min.9 hr., 32 min. Web this form is required to be filed under section 6058(a) of the internal revenue code. Form 5500, annual return/report of employee benefit plan.

form 5500 instructions 2022 Fill Online, Printable, Fillable Blank

48 min.9 hr., 32 min. Form 5500, annual return/report of employee benefit plan. Schedule a (form 5500) 17 hr., 28 min. Department of labor, internal revenue service, and pension benefit guaranty corporation to. Schedule b (form 5500) part 2.

5500 Instructions 2018 Fillable and Editable PDF Template

Web form 5500 is used for plans that have 100 or more participants. Web irs form 5500 instructions indicate that one or more additional schedules may be required. Web this form is required to be filed under section 6058(a) of the internal revenue code. The penalties have been increased to $250 a day, up to a. Web form 5500 (all.

Form 5500 Sf Instructions 2018 slidesharetrick

Schedule b (form 5500) part 2. 48 min.9 hr., 32 min. Web this form is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6047(e), 6057(b), and 6058(a) of the. Schedule a (form 5500) 17 hr., 28 min. Web irs form 5500 instructions indicate that one or more.

Form 5500 Search What You Need To Know Form 5500

Department of labor, internal revenue service, and pension benefit guaranty corporation to. 48 min.9 hr., 32 min. Web the form 5500 series consists of: Schedule a (form 5500) 17 hr., 28 min. Web form 5500 (all other filers) 82 hr., 16 min.

2019 2020 IRS Instructions 5500EZ Fill Out Digital PDF Sample

See pbgc’s august 29, 2022 notice of. Web the instructions have been updated to reflect the penalty changes under section 6652 (e) for a plan failure to file a return. The penalties have been increased to $250 a day, up to a. Schedule a (form 5500) 17 hr., 28 min. Schedule a (form 5500) 17 hr., 28 min.

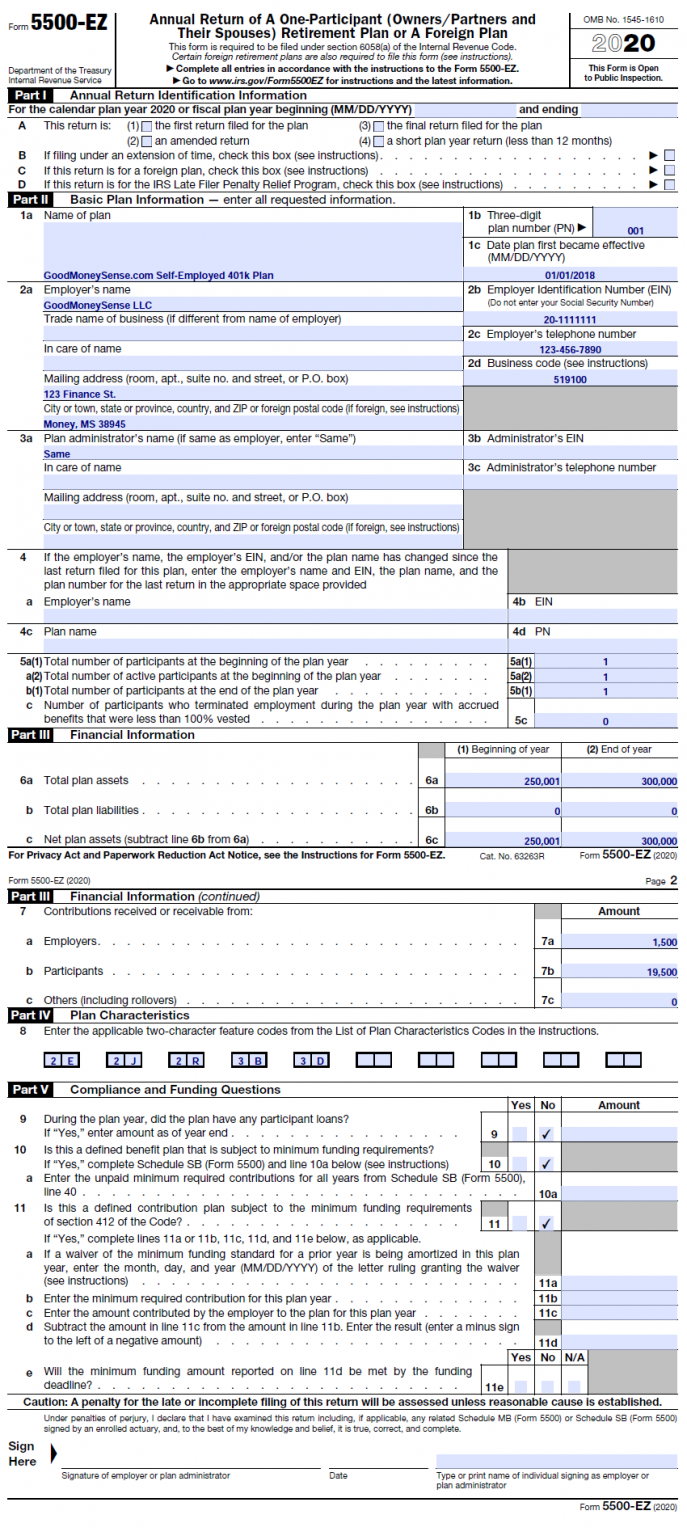

How To File The Form 5500EZ For Your Solo 401k in 2021 Good Money Sense

Schedule b (form 5500) part 2. Schedule b (form 5500) part 2. Web this form is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6047(e), 6057(b), and 6058(a) of the. The form 5500 version selection tool can help determine exactly which form in the. Those schedules provide.

Form 5500 Instructions 5 Steps to Filing Correctly

Web the instructions have been updated to reflect the penalty changes under section 6652 (e) for a plan failure to file a return. Web this clarification is proposed to be added to the 2023 form 5500 instructions for line 26b of schedule sb. Department of labor, internal revenue service, and pension benefit guaranty corporation to. Schedule b (form 5500) part.

10 Common Errors in Form 5500 Preparation Outsourcing Services

Web the instructions have been updated to reflect the penalty changes under section 6652 (e) for a plan failure to file a return. Web the instructions to the form 5500. Web this form is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6047(e), 6057(b), and 6058(a) of.

The Form 5500 Version Selection Tool Can Help Determine Exactly Which Form In The.

Known as the “regular” form 5500, this version is for retirement. Those schedules provide detailed financial information about the plan’s. 48 min.9 hr., 32 min. Web form 5500 (all other filers) 82 hr., 16 min.

Schedule A (Form 5500) 17 Hr., 28 Min.

Schedule b (form 5500) part 2. Web the instructions have been updated to reflect the penalty changes under section 6652 (e) for a plan failure to file a return. Web irs form 5500 instructions indicate that one or more additional schedules may be required. Certain foreign retirement plans are also required to file this form (see instructions).

Schedule B (Form 5500) Part 2.

Schedule a (form 5500) 17 hr., 28 min. Web form 5500 (all other filers) 82 hr., 16 min. See pbgc’s august 29, 2022 notice of. Web the instructions to the form 5500.

Web This Form Is Required To Be Filed Under Sections 104 And 4065 Of The Employee Retirement Income Security Act Of 1974 (Erisa) And Sections 6047(E), 6057(B), And 6058(A) Of The.

Web the form 5500 series consists of: Web this form is required to be filed under section 6058(a) of the internal revenue code. Web this clarification is proposed to be added to the 2023 form 5500 instructions for line 26b of schedule sb. Form 5500, annual return/report of employee benefit plan.