Form 5500 Late Filing Penalty

Form 5500 Late Filing Penalty - First, check to see if the information in your delinquency notice (cp 403 or cp 406 ) is correct. Web the calculator will determine the number of days late and the penalty for each filing. For returns required to be filed after december 31, 2019, the penalty for failure to file is increased to $250 a day (up to (150,000). Web generally the dfvcp penalty is capped at $1,500 for most small plans, $4,000 for large plans, and $750 for small 501 (c) (3) plans. Some plan sponsors, especially those that must have an audit performed, typically file a form 5558 to obtain an extension of that filing deadline. See irc section 6652 (e). If a late filing is due to reasonable cause, you can make. Disclaimer and limitations the u.s. That means that, for a calendar plan year, the due date would be july 31. Form 5500ez delinquent filing penalty relief.

For returns required to be filed after december 31, 2019, the penalty for failure to file is increased to $250 a day (up to (150,000). Web the calculator will determine the number of days late and the penalty for each filing. Form 5500ez delinquent filing penalty relief. Each plan must be submitted separately. If you can resolve an issue in your notice, there may be no penalty. Web the penalty notice is cp 283, penalty charged on your form 5500 return. See irc section 6652 (e). Penalties for large plans (generally 100 employees and over) are capped at $2,000 for a single late form 5500 and $4,000 for multiple years per plan. Web a form 5500 is typically due seven months following the end of the plan year, without extension. Department of labor is not responsible for any loss of calculations and data.

If you can resolve an issue in your notice, there may be no penalty. Web a form 5500 is typically due seven months following the end of the plan year, without extension. Penalties for large plans (generally 100 employees and over) are capped at $2,000 for a single late form 5500 and $4,000 for multiple years per plan. Department of labor is not responsible for any loss of calculations and data. Web generally the dfvcp penalty is capped at $1,500 for most small plans, $4,000 for large plans, and $750 for small 501 (c) (3) plans. We must receive a request for an extension of the time to file on or before the normal due date of your return. That means that, for a calendar plan year, the due date would be july 31. If a late filing is due to reasonable cause, you can make. Web further, penalties for small plans (generally under 100 participants) are capped at $750 for a single late form 5500 and $1,500 for multiple years per plan. See irc section 6652 (e).

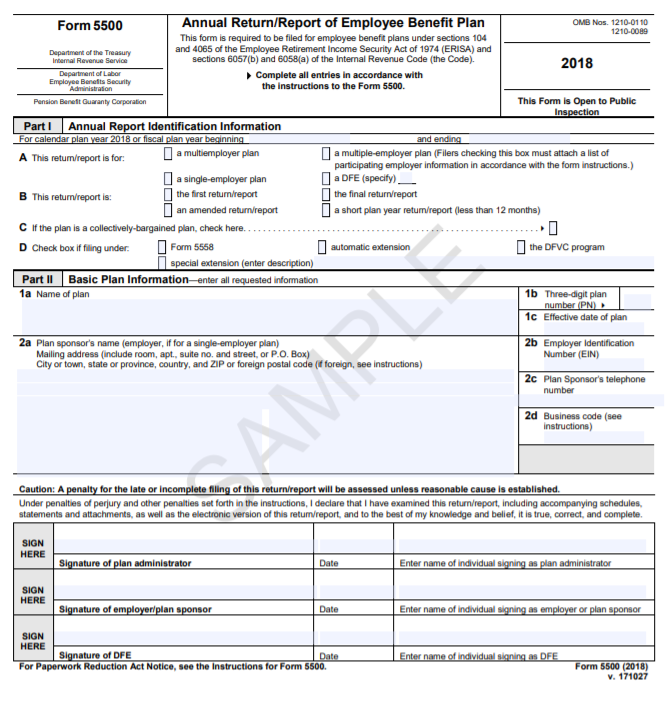

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

That means that, for a calendar plan year, the due date would be july 31. Department of labor is not responsible for any loss of calculations and data. Form 5500ez delinquent filing penalty relief. Web further, penalties for small plans (generally under 100 participants) are capped at $750 for a single late form 5500 and $1,500 for multiple years per.

Form 5500 Is Due by July 31 for Calendar Year Plans

This penalty is only for the filings entered on the calculator. Some plan sponsors, especially those that must have an audit performed, typically file a form 5558 to obtain an extension of that filing deadline. Department of labor is not responsible for any loss of calculations and data. We must receive a request for an extension of the time to.

Form 5500 Filing A Dangerous Compliance Trap BASIC

Disclaimer and limitations the u.s. The total penalty for all the filings entered on the calculator will be displayed below the chart. First, check to see if the information in your delinquency notice (cp 403 or cp 406 ) is correct. We must receive a request for an extension of the time to file on or before the normal due.

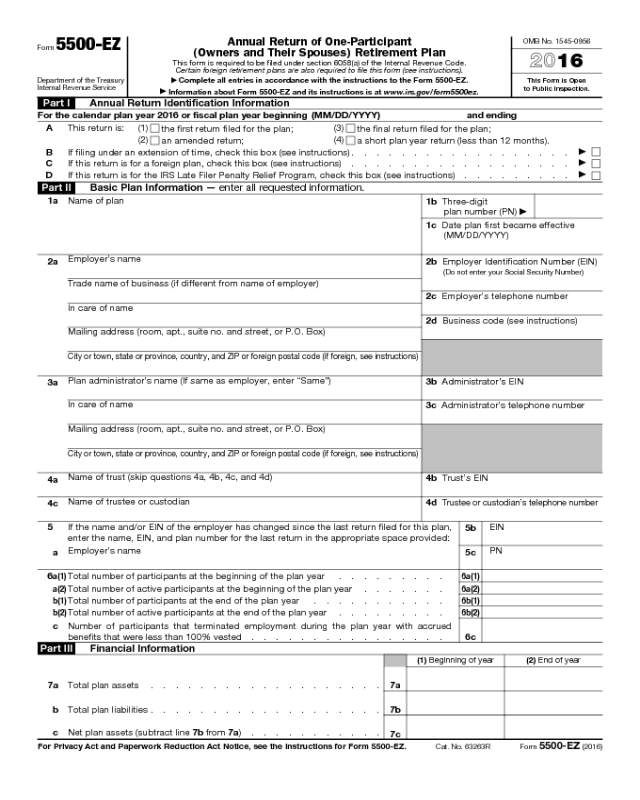

Form 5500EZ Edit, Fill, Sign Online Handypdf

Some plan sponsors, especially those that must have an audit performed, typically file a form 5558 to obtain an extension of that filing deadline. Web the penalty notice is cp 283, penalty charged on your form 5500 return. Each plan must be submitted separately. Web further, penalties for small plans (generally under 100 participants) are capped at $750 for a.

Penalty for Late Filing Form 2290 Computer Tech Reviews

For returns required to be filed after december 31, 2019, the penalty for failure to file is increased to $250 a day (up to (150,000). Web further, penalties for small plans (generally under 100 participants) are capped at $750 for a single late form 5500 and $1,500 for multiple years per plan. Each plan must be submitted separately. Web the.

Letter To Waive Penalty Charge Request To Waive Penalty Letter

Web generally the dfvcp penalty is capped at $1,500 for most small plans, $4,000 for large plans, and $750 for small 501 (c) (3) plans. For returns required to be filed after december 31, 2019, the penalty for failure to file is increased to $250 a day (up to (150,000). The total penalty for all the filings entered on the.

Filed Form 5500 Late? Here's How to Avoid Penalties

That means that, for a calendar plan year, the due date would be july 31. See irc section 6652 (e). If a late filing is due to reasonable cause, you can make. Each plan must be submitted separately. If you can resolve an issue in your notice, there may be no penalty.

Form 5500 Instructions 5 Steps to Filing Correctly

First, check to see if the information in your delinquency notice (cp 403 or cp 406 ) is correct. That means that, for a calendar plan year, the due date would be july 31. Some plan sponsors, especially those that must have an audit performed, typically file a form 5558 to obtain an extension of that filing deadline. Penalties for.

DOL 2022 Penalty Fees Wrangle 5500 ERISA Reporting and Disclosure

Web a form 5500 is typically due seven months following the end of the plan year, without extension. Department of labor is not responsible for any loss of calculations and data. That means that, for a calendar plan year, the due date would be july 31. Form 5500ez delinquent filing penalty relief. The total penalty for all the filings entered.

How To File The Form 5500EZ For Your Solo 401k in 2022 Good Money Sense

Disclaimer and limitations the u.s. First, check to see if the information in your delinquency notice (cp 403 or cp 406 ) is correct. Web further, penalties for small plans (generally under 100 participants) are capped at $750 for a single late form 5500 and $1,500 for multiple years per plan. Each plan must be submitted separately. Some plan sponsors,.

For Returns Required To Be Filed After December 31, 2019, The Penalty For Failure To File Is Increased To $250 A Day (Up To (150,000).

This penalty is only for the filings entered on the calculator. Web the calculator will determine the number of days late and the penalty for each filing. Some plan sponsors, especially those that must have an audit performed, typically file a form 5558 to obtain an extension of that filing deadline. Web the penalty notice is cp 283, penalty charged on your form 5500 return.

Web A Form 5500 Is Typically Due Seven Months Following The End Of The Plan Year, Without Extension.

Web further, penalties for small plans (generally under 100 participants) are capped at $750 for a single late form 5500 and $1,500 for multiple years per plan. Each plan must be submitted separately. First, check to see if the information in your delinquency notice (cp 403 or cp 406 ) is correct. See irc section 6652 (e).

Form 5500Ez Delinquent Filing Penalty Relief.

If a late filing is due to reasonable cause, you can make. The total penalty for all the filings entered on the calculator will be displayed below the chart. Department of labor is not responsible for any loss of calculations and data. We must receive a request for an extension of the time to file on or before the normal due date of your return.

If You Can Resolve An Issue In Your Notice, There May Be No Penalty.

Web generally the dfvcp penalty is capped at $1,500 for most small plans, $4,000 for large plans, and $750 for small 501 (c) (3) plans. Disclaimer and limitations the u.s. Penalties for large plans (generally 100 employees and over) are capped at $2,000 for a single late form 5500 and $4,000 for multiple years per plan. That means that, for a calendar plan year, the due date would be july 31.