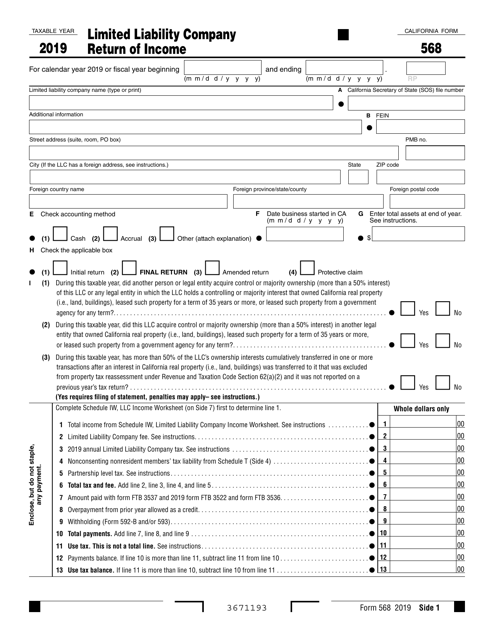

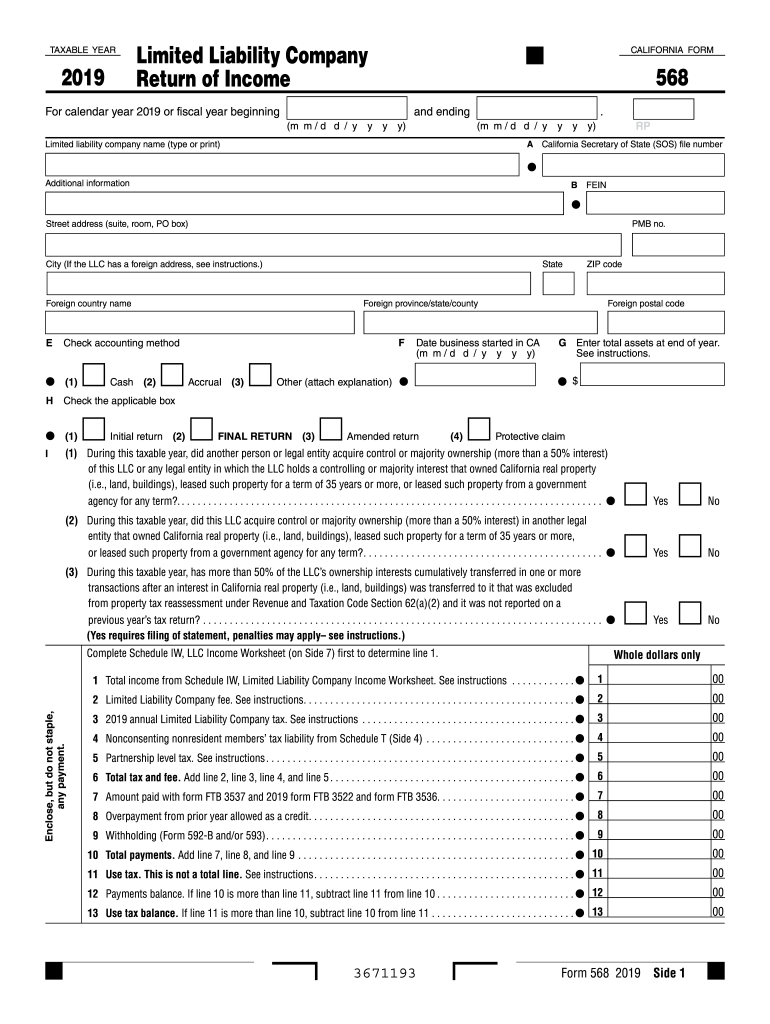

Form 568 2019

Form 568 2019 - Web limited liability companies are automatically assessed an $800 tax. You will need to upgrade from your current online version. Web california form 568 must be filed by the 15th day of the 3rd month after the close of the llc’s taxable year. 2021, form 568, limited liability company return of income: Web form 568 (2019) easily fill out and sign forms download blank or editable online current version: Fill in the blank fields; Open it using the online editor and begin adjusting. Involved parties names, addresses and phone numbers etc. To enter the information for form 568 in the 1040 taxact® program:. For example, if you're in lacerte 2019, the franchise tax payment paid with form 3522 is due april 15, 2019, but it’s paying for the.

While you can submit your state income tax return and federal income tax return by april 15,. Web form 568 due date. For calendar year 2018 or fiscal year beginning and ending. Web limited liability companies are automatically assessed an $800 tax. The llc is organized in. Web level 1 california form 568 is available in the turbotax business version. Use schedule d (568), capital gain or loss, to report the sale or exchange of capital assets, by the limited liability company (llc), except capital gains (losses) that. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: For example, the 2019 tax needs to be paid by the. Form 568 is due on march 31st following the end of the tax year.

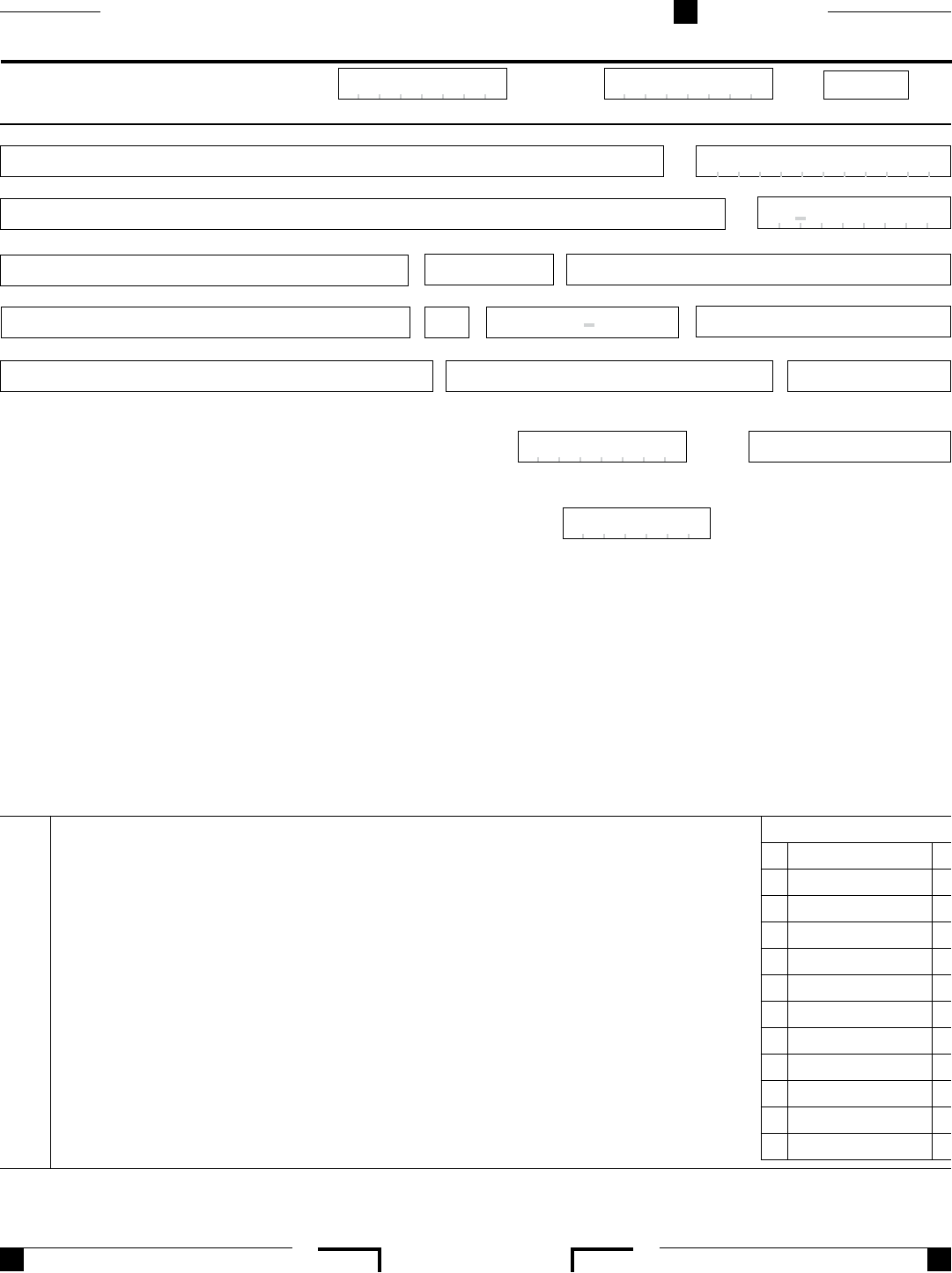

Llcs classified as a disregarded entity or. Web limited liability companies are automatically assessed an $800 tax. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. For calendar year 2018 or fiscal year beginning and ending. Limited liability company return of income finding a california accountant california franchise tax board contact info deal alert! Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. Web 2018 limited liability company return of income. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal.

Fillable California Form 568 Limited Liability Company Return Of

Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web 2018 limited liability company return of income. For example, if you're in lacerte 2019, the franchise tax payment paid with form 3522 is due april 15, 2019, but it’s paying for the. 2021, form 568, limited.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

Form 568 is due on march 31st following the end of the tax year. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web level 1 california form 568 is available in the turbotax business version. Web 2018 limited liability company return of income. The llc.

Download Instructions for Form 568 Schedule EO PassThrough Entity

Open it using the online editor and begin adjusting. Web limited liability companies are automatically assessed an $800 tax. To enter the information for form 568 in the 1040 taxact® program:. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. California.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. Web level 1 california form 568 is available in the turbotax business version. You will need to upgrade from your current online version. For example, the 2019 tax needs to be.

2019 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Limited liability company return of income finding a california accountant california franchise tax board contact info deal alert! Web limited liability companies are automatically assessed an $800 tax. For calendar year 2018 or fiscal year beginning and ending. Web 2018 limited liability company return of income. To enter the information for form 568 in the 1040 taxact® program:.

California 568 Booklet

Llcs classified as a disregarded entity or. The llc is doing business in california. Use schedule d (568), capital gain or loss, to report the sale or exchange of capital assets, by the limited liability company (llc), except capital gains (losses) that. Limited liability company return of income finding a california accountant california franchise tax board contact info deal alert!.

Form 568 instructions 2013

Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Use schedule d (568), capital gain or loss, to report the sale or exchange of capital assets, by the limited liability company (llc), except capital gains (losses) that. Web we last updated the limited liability company return of.

Form Ca 568 Fill Out and Sign Printable PDF Template signNow

Form 568 is due on march 31st following the end of the tax year. Fill in the blank fields; California defines a single member llc as a disregarded entity because the single owner's income is. Web to generate the ca 568 instead of the ca 565: Web up to $40 cash back do whatever you want with a 2021 form.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

The llc is doing business in california. Click here about the product. Web form 568 (2019) easily fill out and sign forms download blank or editable online current version: Use schedule d (568), capital gain or loss, to report the sale or exchange of capital assets, by the limited liability company (llc), except capital gains (losses) that. The llc is.

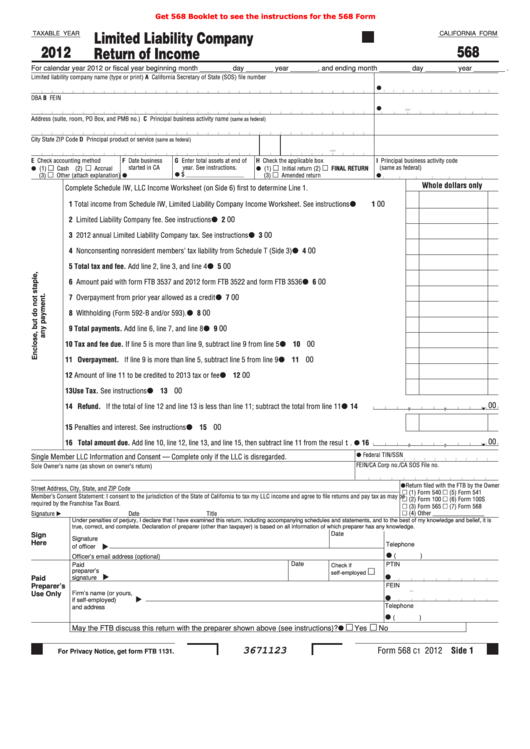

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Involved parties names, addresses and phone numbers etc. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. Limited liability company return of income finding a california accountant california franchise tax board contact info deal alert! California defines a single member llc.

Limited Liability Company Return Of Income Finding A California Accountant California Franchise Tax Board Contact Info Deal Alert!

Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. Involved parties names, addresses and phone numbers etc. The llc is doing business in california. California defines a single member llc as a disregarded entity because the single owner's income is.

Web Up To $40 Cash Back Do Whatever You Want With A 2021 Form 568 Limited Liability Company Return Of Income.

For example, if you're in lacerte 2019, the franchise tax payment paid with form 3522 is due april 15, 2019, but it’s paying for the. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. For example, the 2019 tax needs to be paid by the. The llc is organized in.

For Calendar Year 2018 Or Fiscal Year Beginning And Ending.

You will need to upgrade from your current online version. Click here about the product. Web 2018 limited liability company return of income. Web form 568 (2019) easily fill out and sign forms download blank or editable online current version:

Web California Form 568 Must Be Filed By The 15Th Day Of The 3Rd Month After The Close Of The Llc’s Taxable Year.

Fill in the blank fields; While you can submit your state income tax return and federal income tax return by april 15,. Web to generate the ca 568 instead of the ca 565: Web form 568 due date.