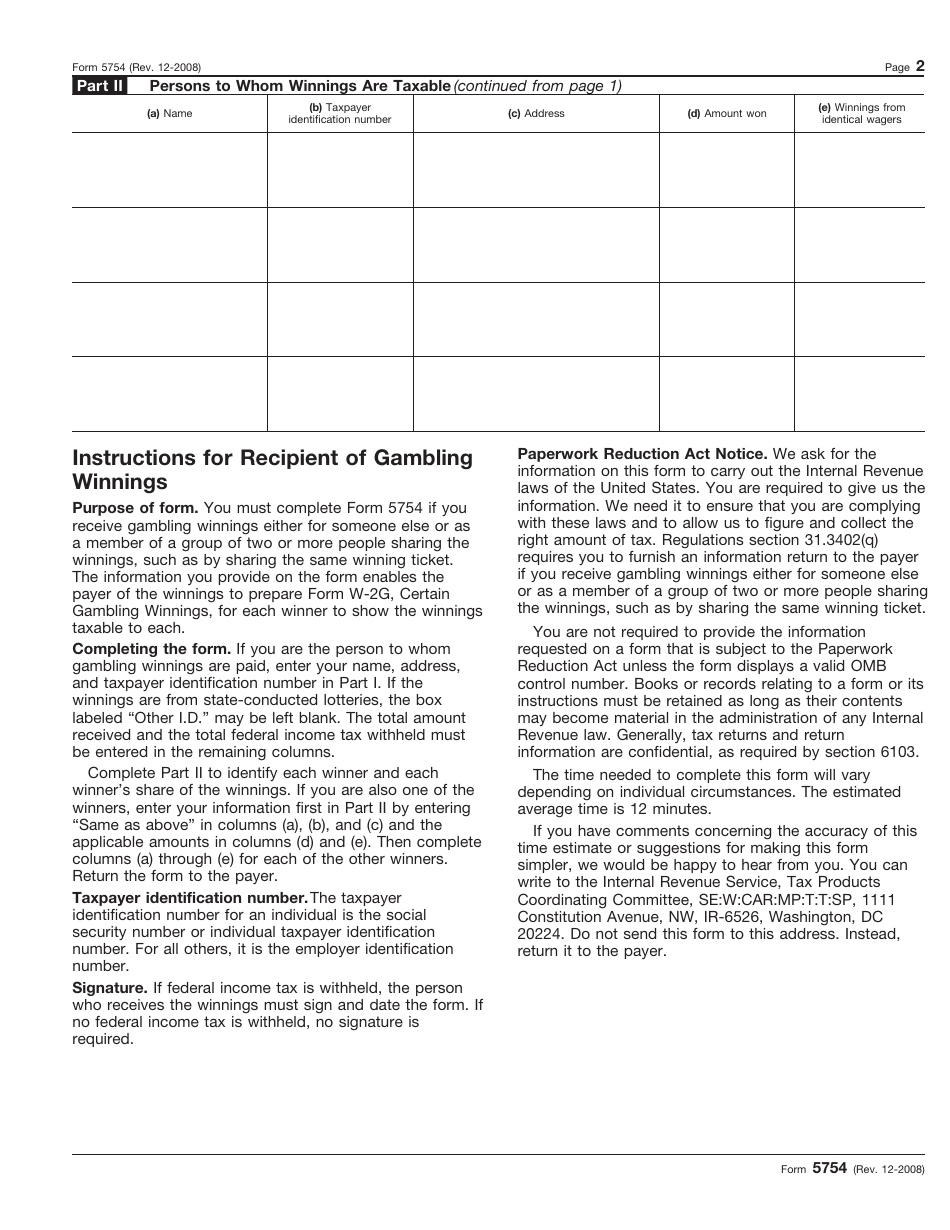

Form 5754 Irs

Form 5754 Irs - Information about developments affecting these instructions will be posted on both pages. Irs form 5754 is commonly used to document redistribution of income from winning wagers made in one players' account when the wager involved more than one player. You must complete form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people. Web the irs gets a copy, and the winner gets a copy. If multiple persons agree to split the prize winnings, they may need to complete a form 5754 to split the money and the reporting amounts on their. The person receiving the winnings must furnish all the information required by form 5754. Statement by person(s) receiving gambling winnings federal income tax you must complete form 5754 if you receive gambling. In order to redistribute the income, all individuals must have a wagering account. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated federal form 5754 in february 2023 from the federal internal revenue service.

The person receiving the winnings must furnish all the information required by form 5754. Information about developments affecting these instructions will be posted on both pages. If multiple persons agree to split the prize winnings, they may need to complete a form 5754 to split the money and the reporting amounts on their. Web we last updated federal form 5754 in february 2023 from the federal internal revenue service. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web about form 5754, statement by person (s) receiving gambling winnings. You must complete form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people. This form is for income earned in tax year 2022, with tax returns due in april 2023. Statement by person(s) receiving gambling winnings federal income tax you must complete form 5754 if you receive gambling. Irs form 5754 is commonly used to document redistribution of income from winning wagers made in one players' account when the wager involved more than one player.

Web the irs gets a copy, and the winner gets a copy. Web about form 5754, statement by person (s) receiving gambling winnings. You must complete form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people. If multiple persons agree to split the prize winnings, they may need to complete a form 5754 to split the money and the reporting amounts on their. The person receiving the winnings must furnish all the information required by form 5754. In order to redistribute the income, all individuals must have a wagering account. Information about developments affecting these instructions will be posted on both pages. Irs form 5754 is commonly used to document redistribution of income from winning wagers made in one players' account when the wager involved more than one player. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web we last updated the statement by person(s) receiving gambling winnings in february 2023, so this is the latest version of form 5754, fully updated for tax year 2022.

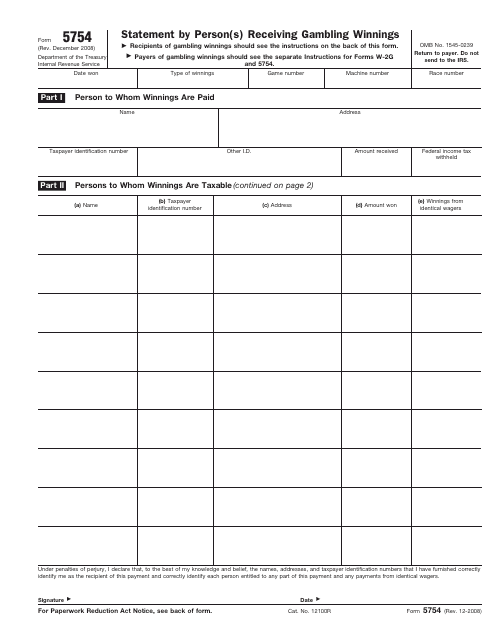

Form 5754 Statement by Person(s) Receiving Gambling Winnings (2008

Irs form 5754 is commonly used to document redistribution of income from winning wagers made in one players' account when the wager involved more than one player. Web about form 5754, statement by person (s) receiving gambling winnings. Information about developments affecting these instructions will be posted on both pages. You must complete form 5754 if you receive gambling winnings.

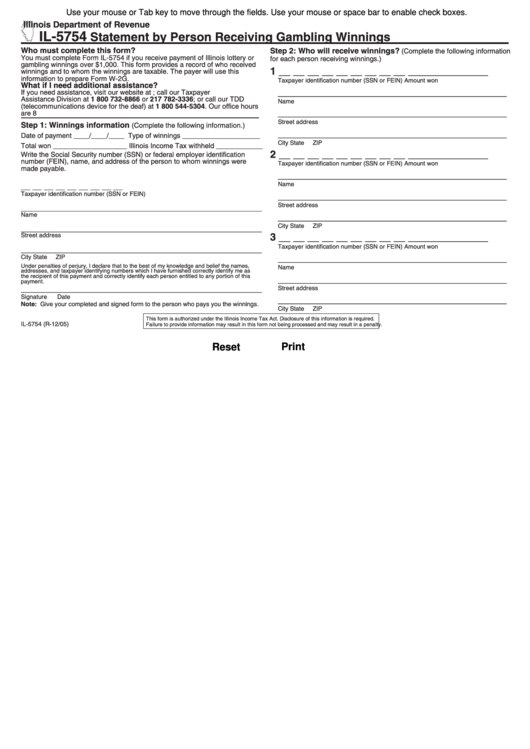

Fillable Form Il5754 Statement By Person Receiving Gambling Winnings

You must complete form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people. Statement by person(s) receiving gambling winnings federal income tax you must complete form 5754 if you receive gambling. Irs form 5754 is commonly used to document redistribution of income from winning wagers made in.

Fill Free fillable Form 5754 2008 Statement of Gambling Winnings PDF form

In order to redistribute the income, all individuals must have a wagering account. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated federal form 5754 in february 2023 from the federal internal revenue service. If multiple persons agree to split the prize winnings, they may need to complete.

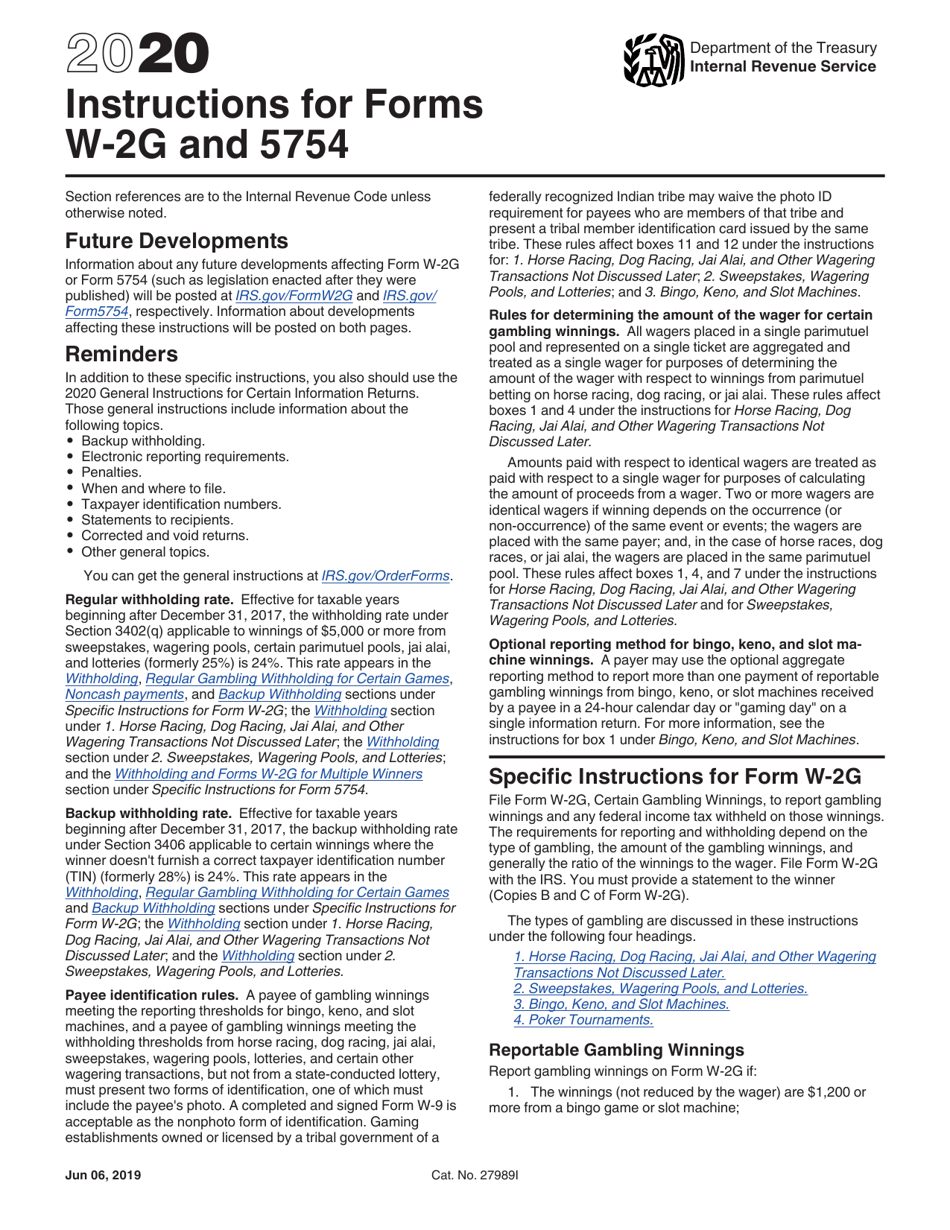

Download Instructions for IRS Form W2 G, 5754 PDF, 2020 Templateroller

Web about form 5754, statement by person (s) receiving gambling winnings. Web the irs gets a copy, and the winner gets a copy. Statement by person(s) receiving gambling winnings federal income tax you must complete form 5754 if you receive gambling. Web we last updated federal form 5754 in february 2023 from the federal internal revenue service. Web we last.

IRS Form 5754 Download Fillable PDF or Fill Online Statement by Person

Information about developments affecting these instructions will be posted on both pages. In order to redistribute the income, all individuals must have a wagering account. Web the irs gets a copy, and the winner gets a copy. We will update this page with a new version of the form for 2024 as soon as it is made available by the.

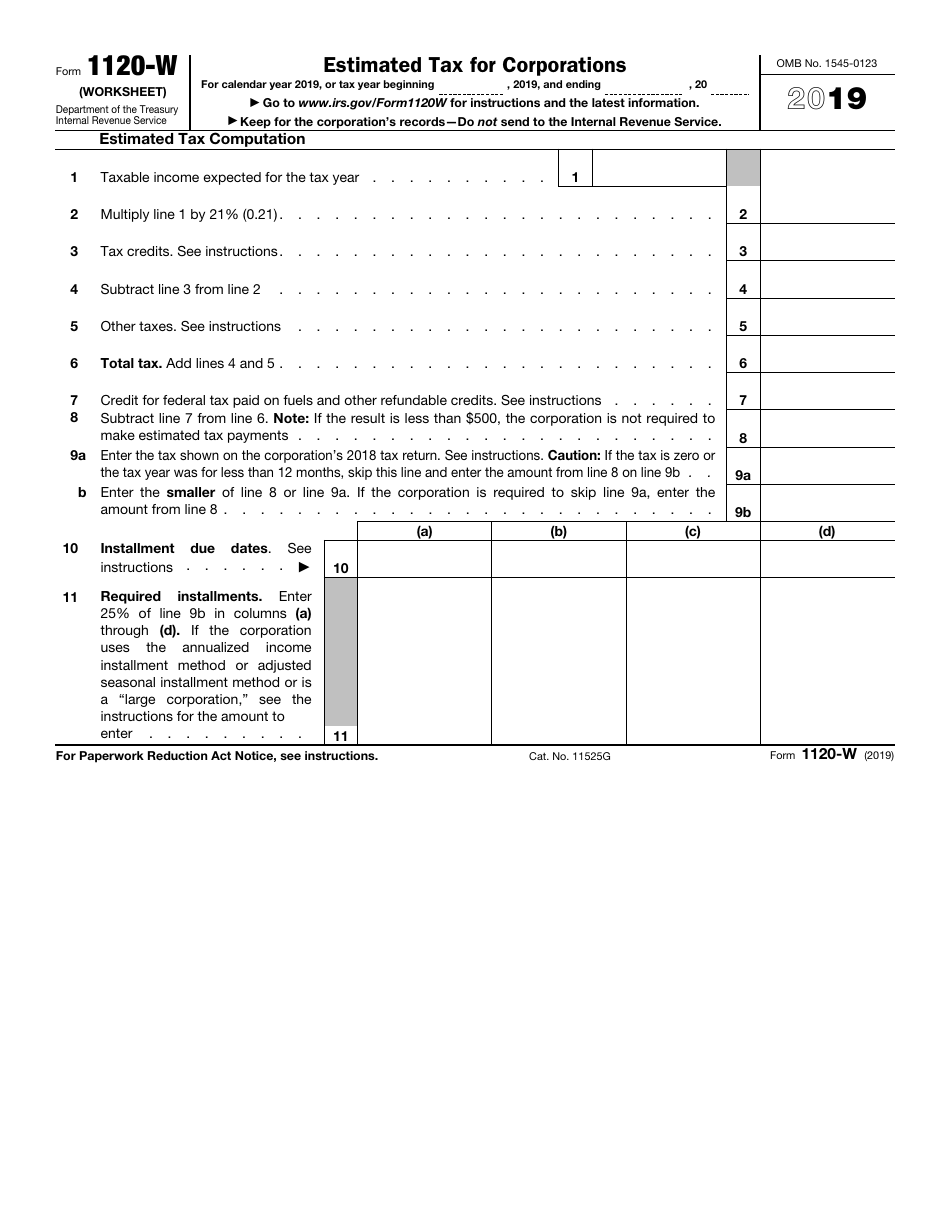

IRS Form 1120W Download Fillable PDF or Fill Online Estimated Tax for

Web we last updated federal form 5754 in february 2023 from the federal internal revenue service. In order to redistribute the income, all individuals must have a wagering account. Irs form 5754 is commonly used to document redistribution of income from winning wagers made in one players' account when the wager involved more than one player. If multiple persons agree.

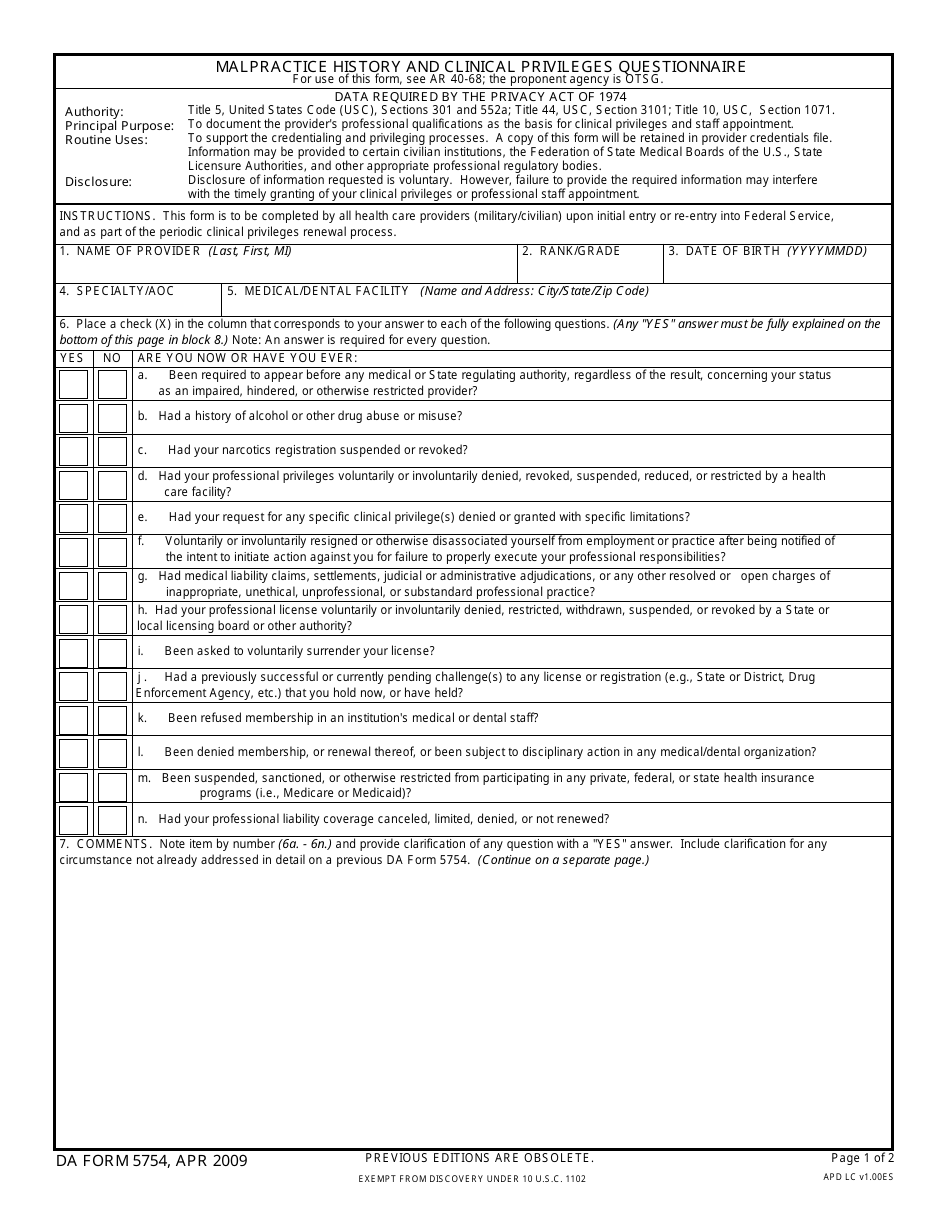

DA Form 5754 Download Fillable PDF or Fill Online Malpractice History

Web we last updated the statement by person(s) receiving gambling winnings in february 2023, so this is the latest version of form 5754, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax returns due in april 2023. Statement by person(s) receiving gambling winnings federal income tax you must complete form 5754.

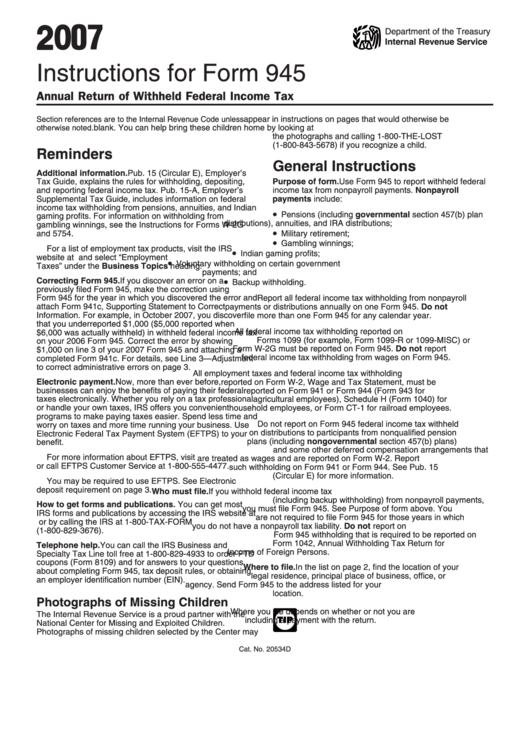

Instructions For Form 945 Annual Return Of Withheld Federal

Information about developments affecting these instructions will be posted on both pages. Web about form 5754, statement by person (s) receiving gambling winnings. If multiple persons agree to split the prize winnings, they may need to complete a form 5754 to split the money and the reporting amounts on their. Web we last updated the statement by person(s) receiving gambling.

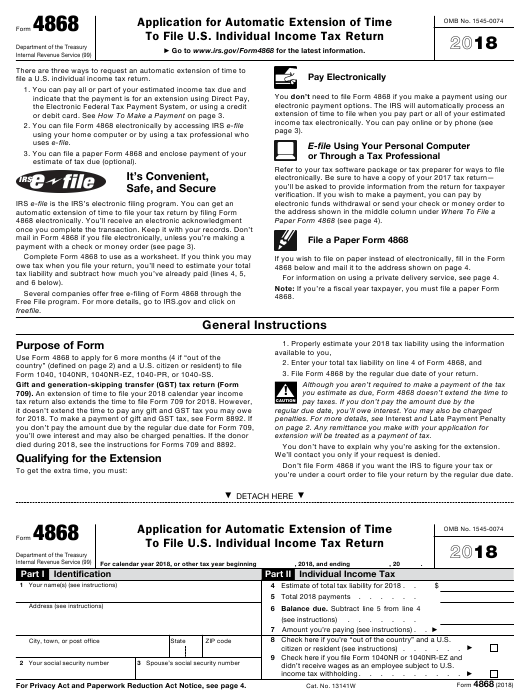

Free Printable Irs Form 4868 Printable Form 2022

You must complete form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people. Irs form 5754 is commonly used to document redistribution of income from winning wagers made in one players' account when the wager involved more than one player. Web we last updated federal form 5754.

IRS Form 5754 Download Fillable PDF or Fill Online Statement by Person

Web the irs gets a copy, and the winner gets a copy. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated the statement by person(s) receiving gambling winnings in february 2023, so this is the latest version of form 5754, fully updated for tax year 2022. In order.

Irs Form 5754 Is Commonly Used To Document Redistribution Of Income From Winning Wagers Made In One Players' Account When The Wager Involved More Than One Player.

Web the irs gets a copy, and the winner gets a copy. The person receiving the winnings must furnish all the information required by form 5754. This form is for income earned in tax year 2022, with tax returns due in april 2023. You must complete form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The Federal Government.

If multiple persons agree to split the prize winnings, they may need to complete a form 5754 to split the money and the reporting amounts on their. Web about form 5754, statement by person (s) receiving gambling winnings. In order to redistribute the income, all individuals must have a wagering account. Statement by person(s) receiving gambling winnings federal income tax you must complete form 5754 if you receive gambling.

Web We Last Updated Federal Form 5754 In February 2023 From The Federal Internal Revenue Service.

Web we last updated the statement by person(s) receiving gambling winnings in february 2023, so this is the latest version of form 5754, fully updated for tax year 2022. Information about developments affecting these instructions will be posted on both pages.