Form 593 Instructions 2021

Form 593 Instructions 2021 - Web entering california real estate withholding on individual form 540 in proconnect. Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73. Web your california real estate withholding has to be entered on both the state and the federal return. Enjoy smart fillable fields and interactivity. Certify the seller/transferor qualifies for a full, partial, or no withholding exemption. • the transfer of this property is an installment sale where the buyer must withhold on the principal portion of each installment payment. Web see instructions for form 593, part iv. Web instructions for form 941 pdf. File your california and federal tax returns online with turbotax in minutes. We last updated the real estate.

Web as of january 1, 2020, california real estate withholding changed. Web real estate withholding statement california form 593 escrow or exchange no. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Certify the seller/transferor qualifies for a full, partial, or no withholding exemption. You simply need to follow these elementary. I will complete form 593 for the principal portion of each installment payment. Get your online template and fill it in using progressive features. Solved • by intuit • 4 • updated july 14, 2022. Web we last updated california 593 booklet from the franchise tax board in august 2021. Web instructions for form 941 pdf.

• the transfer of this property is an installment sale where the buyer must withhold on the principal portion of each installment payment. This form is for income earned in tax year 2022, with tax returns due in april. Web instructions for form 941 pdf. Solved • by intuit • 4 • updated july 14, 2022. Web see instructions for form 593, part iv. Enjoy smart fillable fields and interactivity. Web if you obtain an exemption due to a loss, zero gain, or if you elect an optional gain on sale withholding amount, then you must complete this form. Estimate the amount of the seller's/transferor's loss or zero gain for. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. Web for more information visit ftb.ca.gov

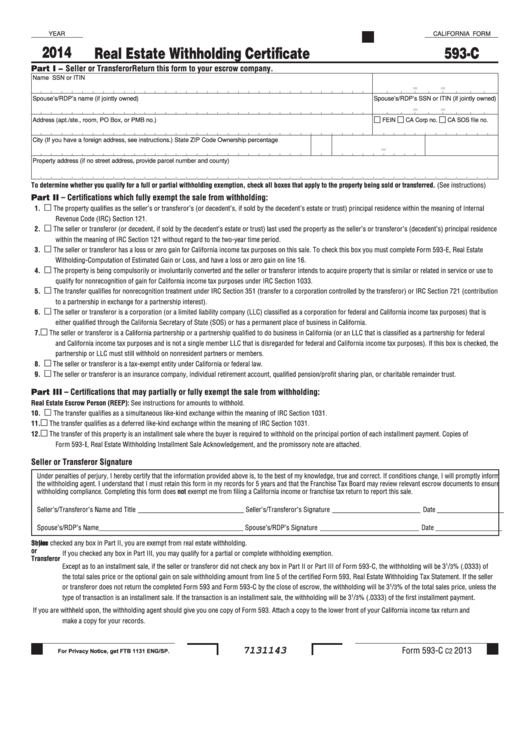

Fillable California Form 593C Real Estate Withholding Certificate

Certify the seller/transferor qualifies for a full, partial, or no withholding exemption. Solved • by intuit • 4 • updated july 14, 2022. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Inputs for ca form 593,. File your california and federal tax returns online with turbotax in minutes.

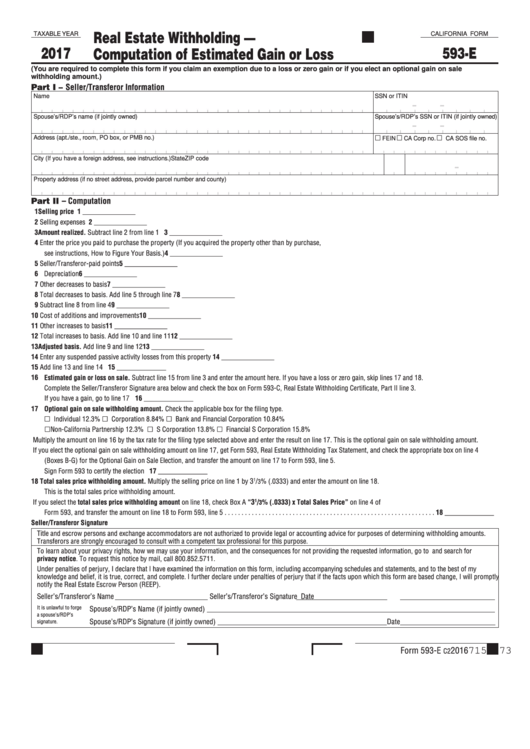

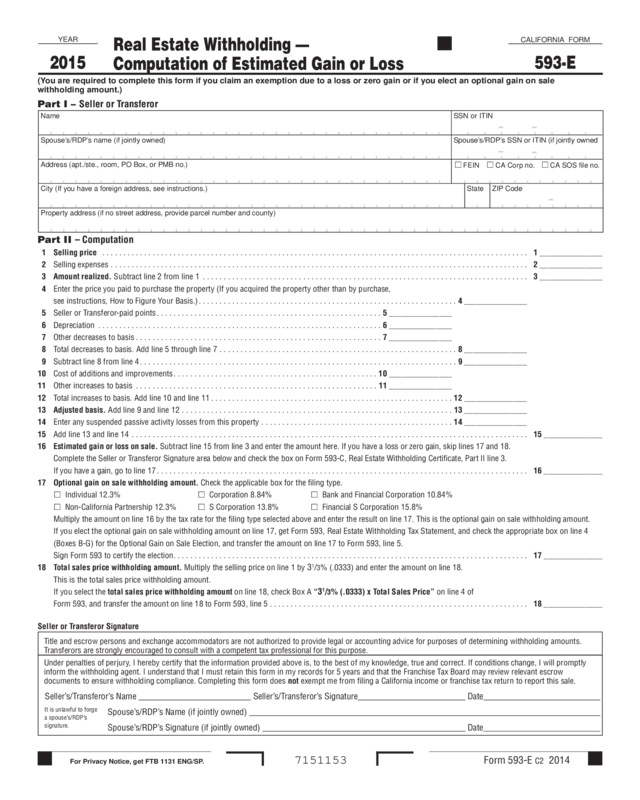

Fillable California Form 593E Real Estate Withholding Computation

Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web your california real estate withholding has to be entered on both the state and the federal return. Web see instructions for form 593, part iv. Web for more information visit ftb.ca.gov First, complete your state return.

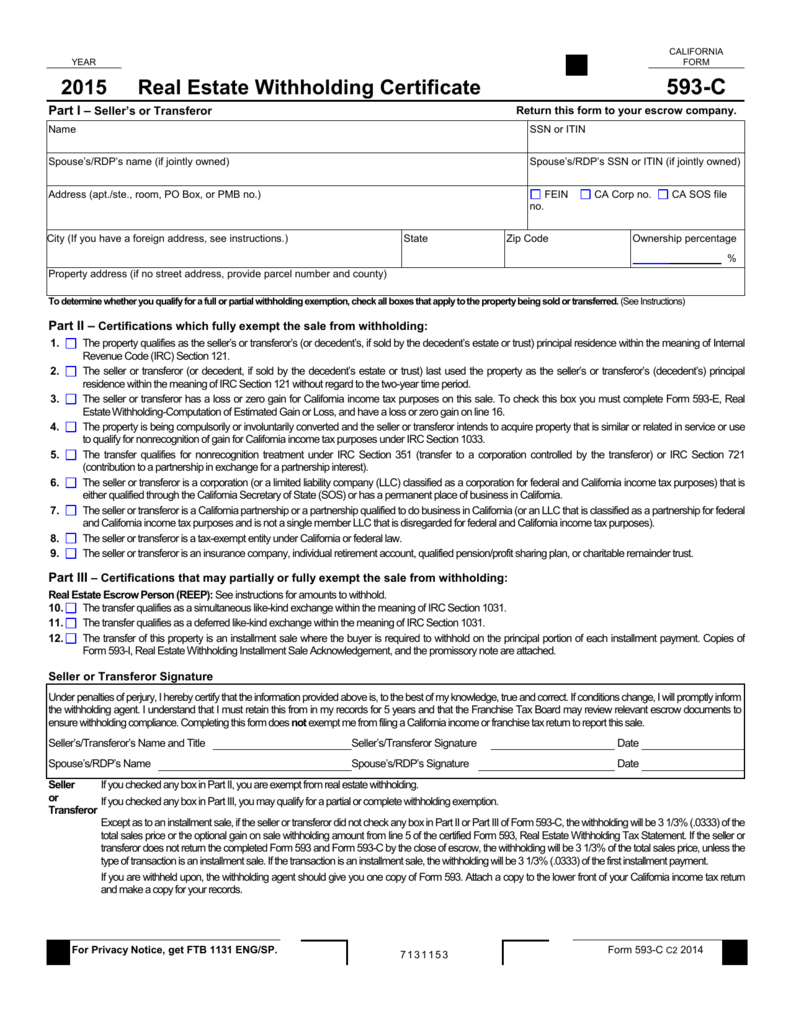

Form 593 C slidesharetrick

• the transfer of this property is an installment sale where the buyer must withhold on the principal portion of each installment payment. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. Certify the seller/transferor qualifies for a full, partial, or no withholding exemption. Estimate the amount of the seller's/transferor's.

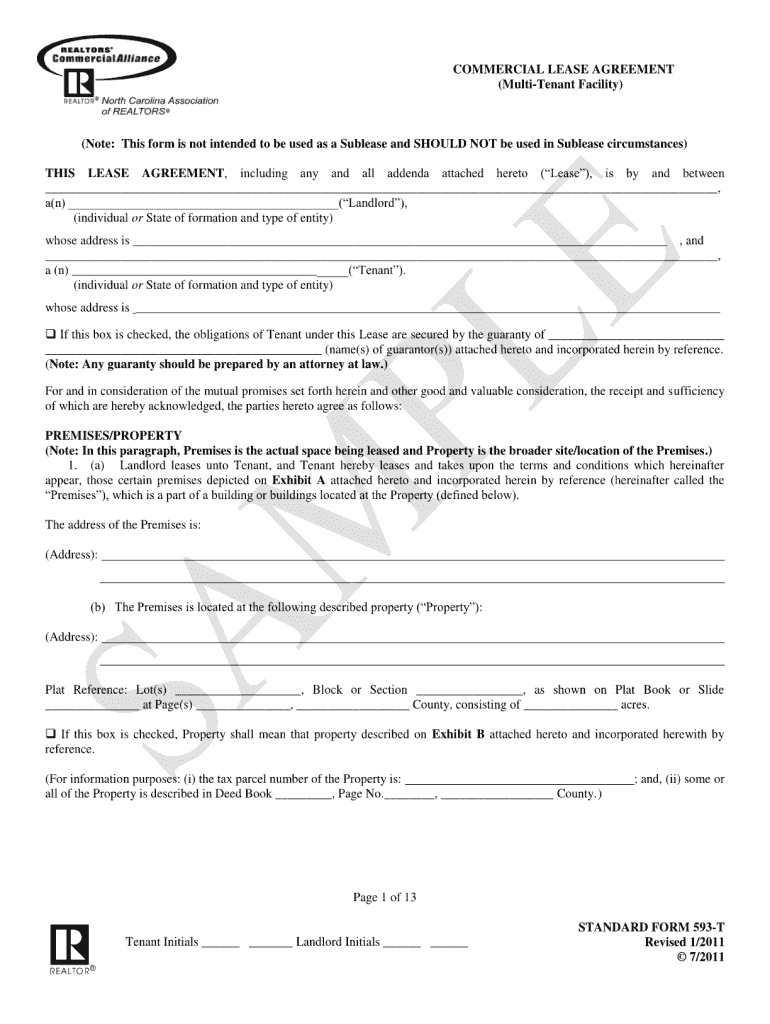

593 Withholding Form Fill Out and Sign Printable PDF Template signNow

This form is for income earned in tax year 2022, with tax returns due in april. We last updated the real estate. I will complete form 593 for the principal portion of each installment payment. Web for more information visit ftb.ca.gov Certify the seller/transferor qualifies for a full, partial, or no withholding exemption.

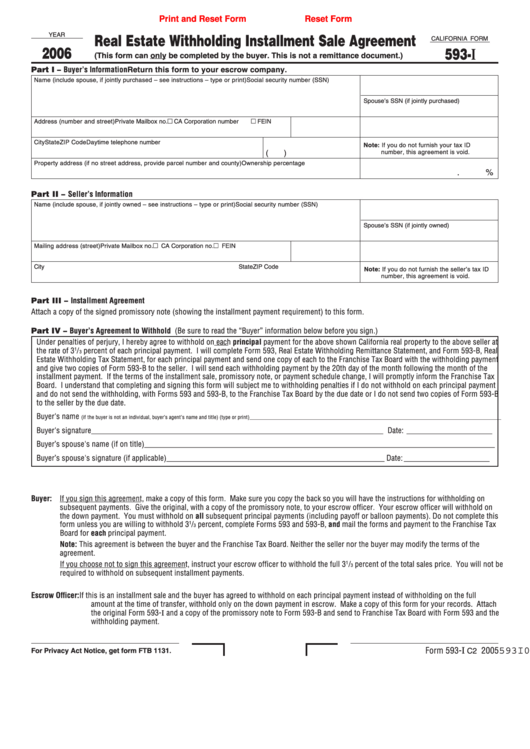

Fillable Form 593I Real Estate Withholding Installment Sale

File your california and federal tax returns online with turbotax in minutes. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web for more information visit ftb.ca.gov Solved • by intuit • 4 • updated july 14, 2022. Enjoy smart fillable fields and interactivity.

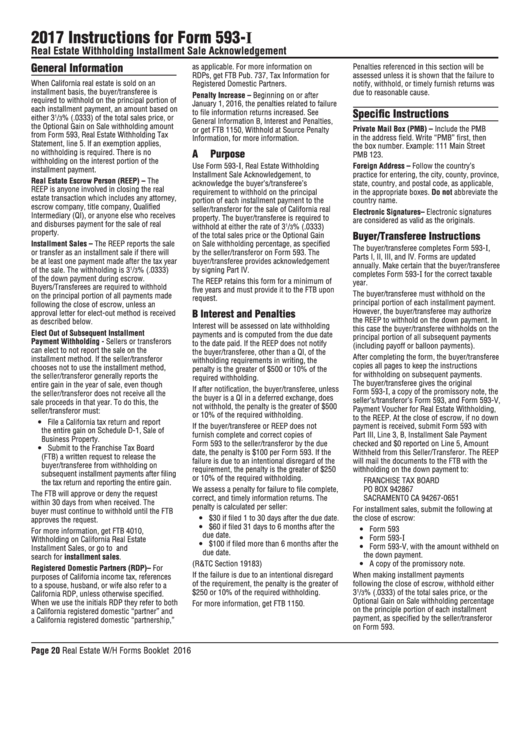

Instructions For Form 593I Real Estate Withholding Installment Sale

Web instructions for form 941 pdf. Web see instructions for form 593, part iv. • the transfer of this property is an installment sale where the buyer must withhold on the principal portion of each installment payment. First, complete your state return. Web how to fill out and sign 2021 form 593 online?

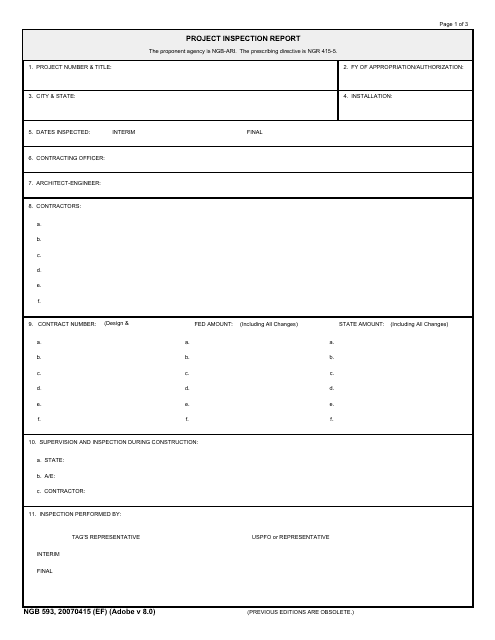

NGB Form 593 Download Fillable PDF or Fill Online Project Inspection

Web see instructions for form 593, part iv. Web instructions for form 941 pdf. Inputs for ca form 593,. Certify the seller/transferor qualifies for a full, partial, or no withholding exemption. Web we last updated california 593 booklet from the franchise tax board in august 2021.

Form 5695 2021 2022 IRS Forms TaxUni

Web if you obtain an exemption due to a loss, zero gain, or if you elect an optional gain on sale withholding amount, then you must complete this form. Web we last updated california 593 booklet from the franchise tax board in august 2021. We last updated the real estate. Certify the seller/transferor qualifies for a full, partial, or no.

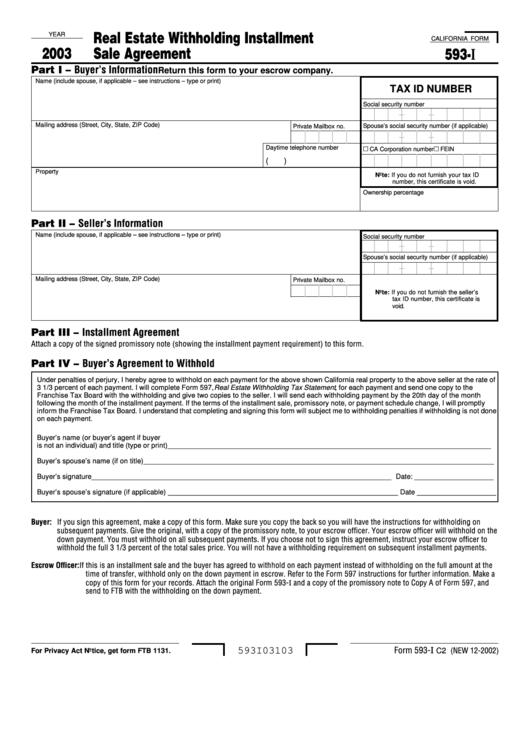

Form 593I Real Estate Withholding Installment Sale Agreement

File your california and federal tax returns online with turbotax in minutes. When you reach take a. This article will assist you. Certify the seller/transferor qualifies for a full, partial, or no withholding exemption. Web real estate withholding statement california form 593 escrow or exchange no.

2015 Form 593E Real Estate Withholding Edit, Fill, Sign Online

This form is for income earned in tax year 2022, with tax returns due in april. Web as of january 1, 2020, california real estate withholding changed. Web see instructions for form 593, part iv. Certify the seller/transferor qualifies for a full, partial, or no withholding exemption. Estimate the amount of the seller's/transferor's loss or zero gain for.

Enjoy Smart Fillable Fields And Interactivity.

Web your california real estate withholding has to be entered on both the state and the federal return. Web entering california real estate withholding on individual form 540 in proconnect. Web as of january 1, 2020, california real estate withholding changed. Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73.

Solved • By Intuit • 4 • Updated July 14, 2022.

When you reach take a. Web form 593, real estate withholding statement, of the principal portion of each installment payment. Web real estate withholding statement california form 593 escrow or exchange no. Get your online template and fill it in using progressive features.

Web We Last Updated California 593 Booklet From The Franchise Tax Board In August 2021.

Inputs for ca form 593,. Web for more information visit ftb.ca.gov This form is for income earned in tax year 2022, with tax returns due in april. This article will assist you.

_________________________ Part I Remitter Information • Reep • Qualified.

Web instructions for form 941 pdf. Web if you obtain an exemption due to a loss, zero gain, or if you elect an optional gain on sale withholding amount, then you must complete this form. Estimate the amount of the seller's/transferor's loss or zero gain for. We last updated the real estate.