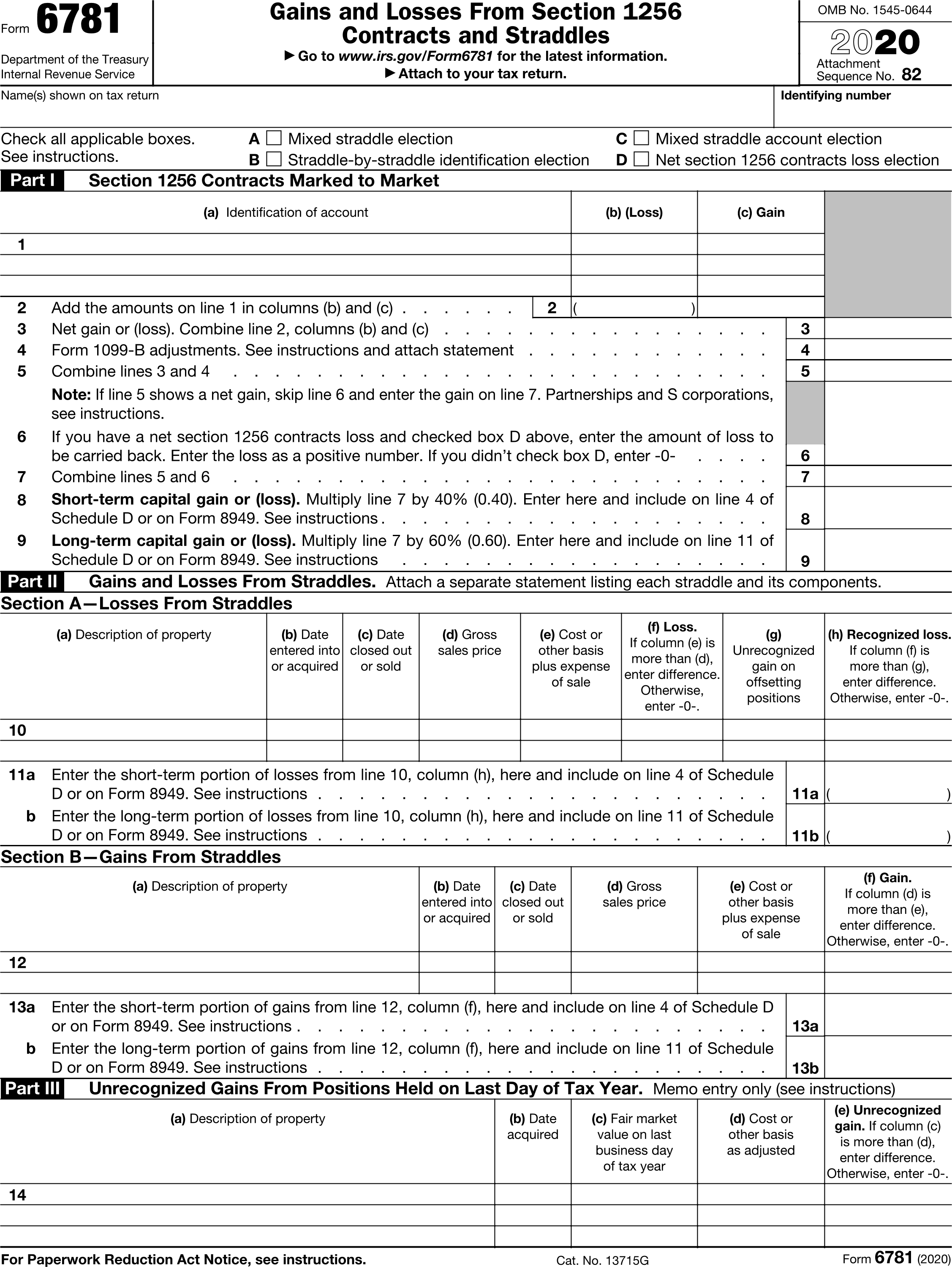

Form 6781 Example

Form 6781 Example - Web for example, assume a trader bought a regulated futures contract on may 5, 2019, for $25,000. Web enter the gain or loss in part i of form 6781 and identify the election. Let’s say john is a day trader specializing in the futures market. Tax, a form used for reporting income relevant to calculating one's capital gains tax liability. You might realize a loss when you sell part of a straddle position. The trader sells their long position in 2022 for $8,000 in profit. Web this is how to fill the 6781 section 1256 form for gains or losses. Web see the below example. This is very basic tutorial. Web how to generate form 6781 gains and losses in proconnect.

Web information about form 6781, gains/losses from section 1256 contracts and straddles, including recent updates, related forms, and instructions on how to file. Web enter the gain or loss in part i of form 6781 and identify the election. Web attach to your tax return. 1099 b shown loss from line 8 , line 10 and line 11 ,. 1099 shown loss from line 8, i am filling out 6781 1st time. A section 1256 contract is (a) any. [a]ssume a trader bought a regulated futures contract on may 5, 2019, for $25,000. Web form 6781 in u.s. 82 name(s) shown on tax return identifying number check all applicable boxes. Tax, a form used for reporting income relevant to calculating one's capital gains tax liability.

Select your module below for instructions. Web form 6781, gains and losses from section 1256 contracts and straddles, is used to report: [a]ssume a trader bought a regulated futures contract on may 5, 2019, for $25,000. The trader will report a $1,000 loss on their 2022 tax return because they already recorded a $4,000 gain on their 2021 tax return. For this reason, investments that fall under section 1256 can result in huge gains or losses. Web use tax form 6781 for open section 1256 contracts. The irs form 6781 should be included with your u.s. I am filling out 6781 1st time. The form deals with the taxation of open positions under section 1256 of the u.s. 1099 b shown loss from line 8 , line 10 and line 11 ,.

IRS Form 6781

You need to manually enter it. At the end of the tax year, they still have the contract in their portfolio valued at $29,000. Instructions section references are to the internal revenue code unless otherwise noted. Select your module below for instructions. Web example of form 6781.

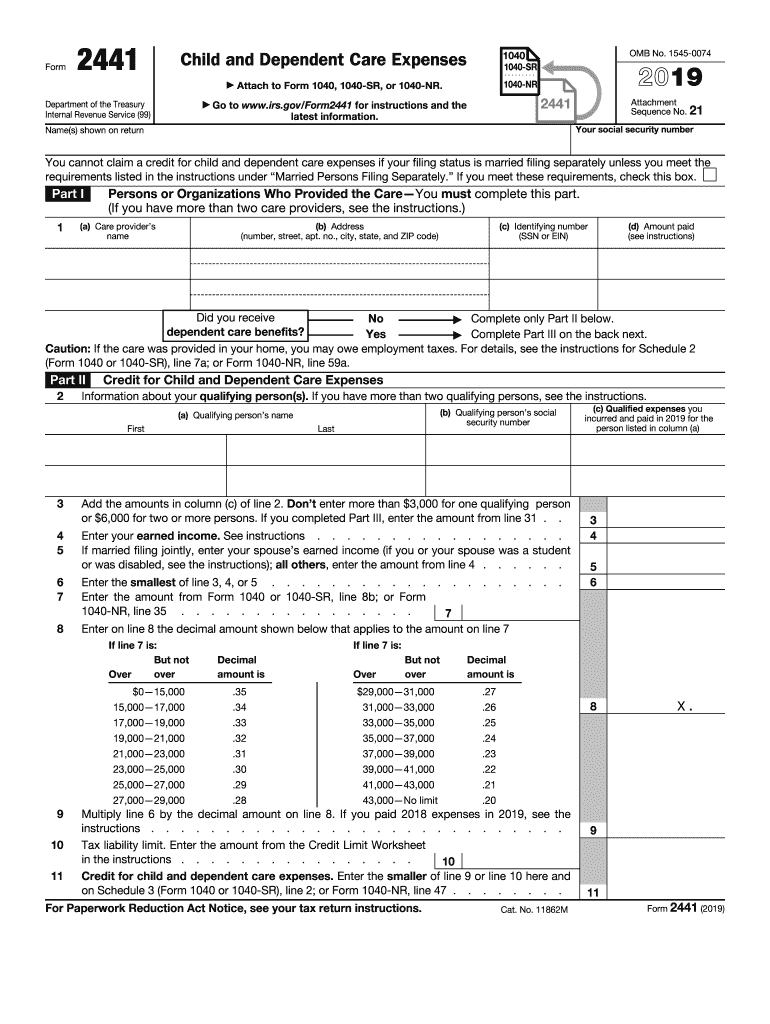

2019 Form IRS 2441 Fill Online, Printable, Fillable, Blank pdfFiller

You do not have to report the details, just the aggregate amount. Use tax form 6781, part i to report the gains and losses on open section 1256 contracts. Solved • by intuit • 573 • updated september 19, 2022. Select your module below for instructions. Web see the below example.

Form 6781 Gains and Losses From Section 1256 Contracts and Straddles

1099 b shown loss from line 8 , line 10 and line 11 ,. For this reason, investments that fall under section 1256 can result in huge gains or losses. You do not have to report the details, just the aggregate amount. Use form 6781 to report: Web example of form 6781.

Form 6781 Gains and Losses from Section 1256 Contracts and Straddles

Drake tax does not support the creation of form 1045 for a section 1256 loss carryback. Web form 6781 in u.s. This is very basic tutorial. Web for more information about entering gains and losses from section 1256 contracts and straddles, see form 6781 instructions, or publication 550. 1099 shown loss from line 8, i am filling out 6781 1st.

Form 6781 Gains and Losses from Section 1256 Contracts and Straddles

For this reason, investments that fall under section 1256 can result in huge gains or losses. [a]ssume a trader bought a regulated futures contract on may 5, 2019, for $25,000. The form deals with the taxation of open positions under section 1256 of the u.s. You cannot import this type of transaction in the taxact program; Web example of form.

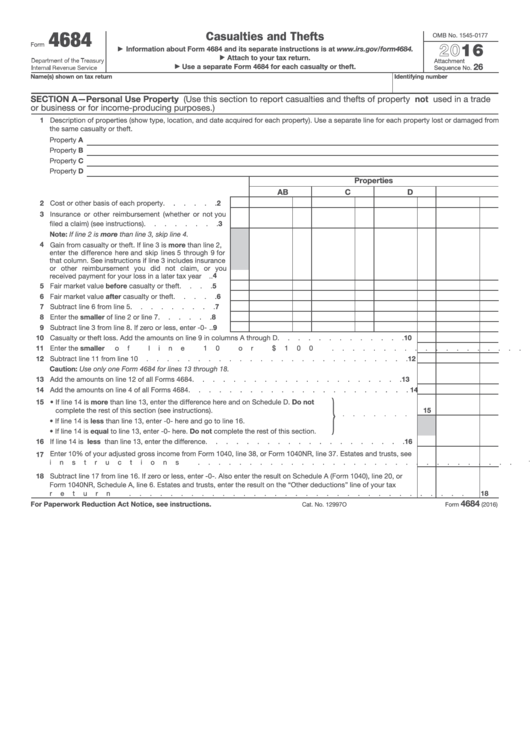

Form 4684 Casualties And Thefts 2016 printable pdf download

A section 1256 contract is (a) any. Select your module below for instructions. I am filling out 6781 1st time. 82 name(s) shown on tax return identifying number check all applicable boxes. Drake tax does not support the creation of form 1045 for a section 1256 loss carryback.

(FORM 6781 PAGE 4)

Web examples form 6781, or the gains and losses from section 1256 contracts and straddles, is a specific tax form used in the united states. I am filling out 6781 1st time. Web this is how to fill the 6781 section 1256 form for gains or losses. A fillable form 1045 is available from irs, if needed. Drake tax does.

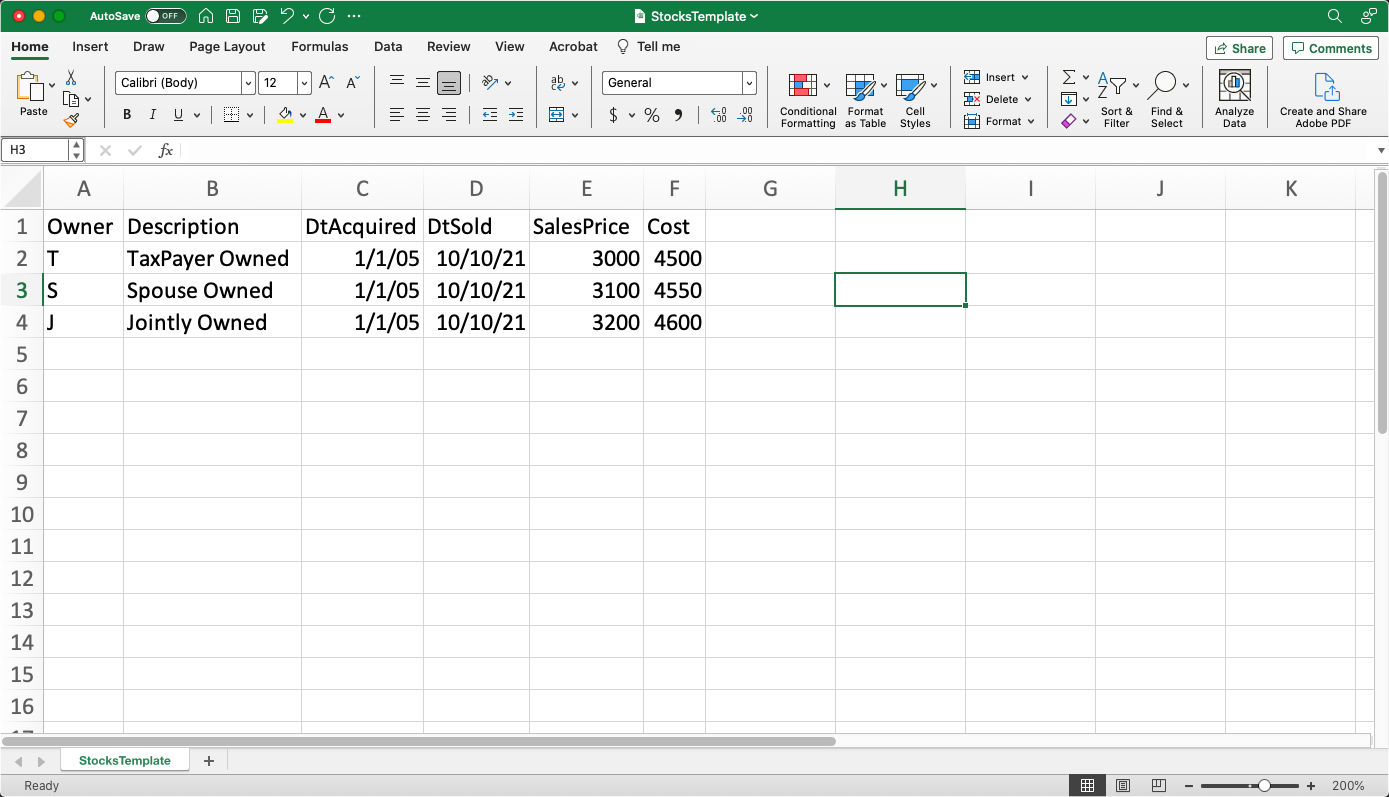

TaxSlayer Form 1099B Import

Tax, a form used for reporting income relevant to calculating one's capital gains tax liability. The trader sells their long position in 2022 for $8,000 in profit. The total is shown on form 6781, line 1. Web for example, assume a trader bought a regulated futures contract on may 5, 2019, for $25,000. Web enter the gain or loss in.

Sample Forms For Authorized Drivers Form I 9 Examples Related To

Web use tax form 6781 for open section 1256 contracts. The irs form 6781 should be included with your u.s. Let’s say john is a day trader specializing in the futures market. You then report the gains or losses on your tax return each year. Drake tax does not support the creation of form 1045 for a section 1256 loss.

Form 6781 Gains and Losses From Section 1256 Contracts and Straddles

I am filling out 6781 1st time. Web example of form 6781. Let’s say john is a day trader specializing in the futures market. Web for example, with a futures contract, an investor could control $100,000 of a commodity, such as silver, with only a $5,000 deposit, known as a margin deposit. The trader sells their long position in 2022.

Let’s Say John Is A Day Trader Specializing In The Futures Market.

For this reason, investments that fall under section 1256 can result in huge gains or losses. Web example of form 6781. Web examples form 6781, or the gains and losses from section 1256 contracts and straddles, is a specific tax form used in the united states. Select your module below for instructions.

[A]Ssume A Trader Bought A Regulated Futures Contract On May 5, 2019, For $25,000.

A section 1256 contract is (a) any. You need to complete part i for futures contracts. Select your module below for instructions. A straddle is when you hold contracts that offset the risk of loss from each other.

Drake Tax Does Not Support The Creation Of Form 1045 For A Section 1256 Loss Carryback.

Web this is how to fill the 6781 section 1256 form for gains or losses. Web use tax form 6781 for open section 1256 contracts. 82 name(s) shown on tax return identifying number check all applicable boxes. You then report the gains or losses on your tax return each year.

Use Tax Form 6781, Part I To Report The Gains And Losses On Open Section 1256 Contracts.

Web form 6781 in u.s. You cannot import this type of transaction in the taxact program; Web generating form 6781 in lacerte. Web enter the gain or loss in part i of form 6781 and identify the election.