Form 7004 Due Date

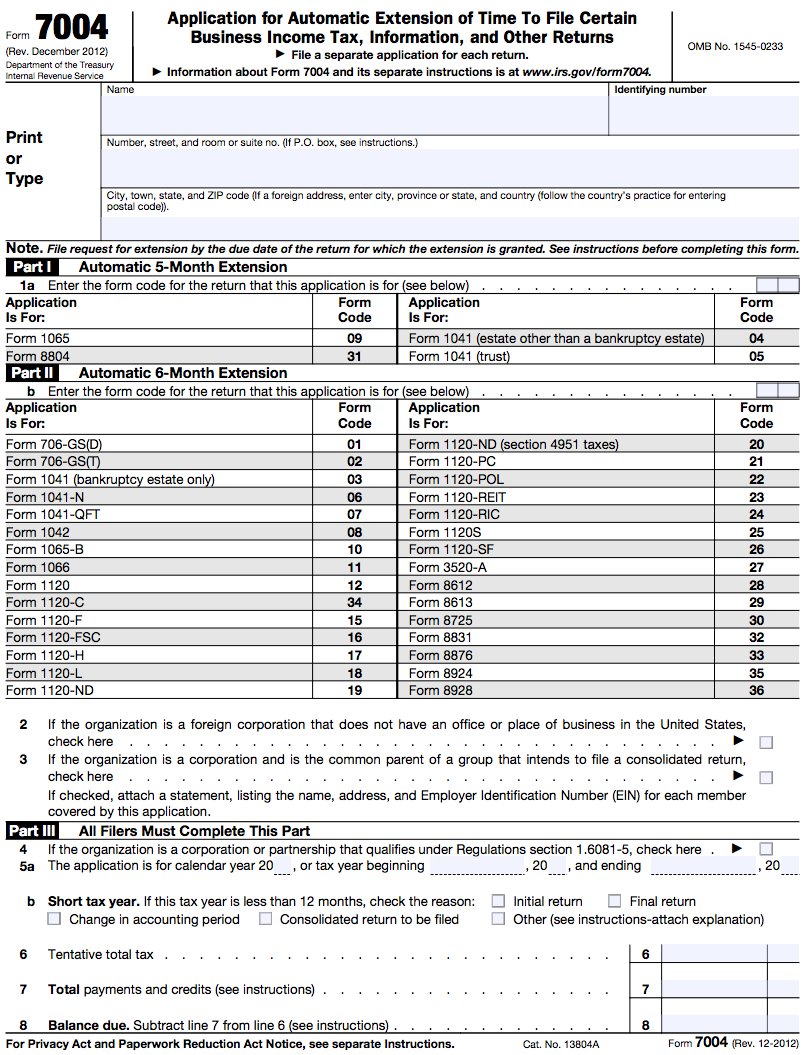

Form 7004 Due Date - Web if the year ends on december 31st, taxes must be filed and paid by april 15th. Complete irs tax forms online or print government tax documents. For all filers, the date that is entered on line 1a cannot be. Web form 7004 is an irs tax extension form. Usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year. Web the form lists the returns that can apply for automatic extensions. In the case of s corporations and partnerships, the tax returns are due by march 15th. See purpose of form above. When to file forms 8804. Web any 7004 form is due by the original due date for the form you’re requesting an extension on.

Web date to file form 7004. The due date to fill out irs form 7004 and submit is generally on or before the original deadline of the applicable tax return. Web general instructions purpose of forms taxpayer identification number (tin) applying for an ein who must file who must sign form 8804 paid preparer. This is the form that businesses should file to apply for an extension with the irs. See purpose of form above. Web the form lists the returns that can apply for automatic extensions. Web file this application on or before the original due date of the of the tax year. When to file forms 8804. Using our previous example, form 1065 is due by march 15th for partnerships that. Web when is form 7004 due?

Usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year. Web form 7004 is an irs tax extension form. Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march 15 and april 15, 2021, to june 15, 2021. This is the form that businesses should file to apply for an extension with the irs. Web any 7004 form is due by the original due date for the form you’re requesting an extension on. The due dates of the returns can be found in the instructions for. Web date to file form 7004. When to file forms 8804. Web file this application on or before the original due date of the of the tax year. See purpose of form above.

Form 7004 (Rev. July 1998)

And for the tax returns such as 1120, 1041 and others. In the case of s corporations and partnerships, the tax returns are due by march 15th. Web the table below shows the deadline for filing form 7004 for business tax returns. Web generally, form 7004 must be filed on or before the due date of the applicable tax return..

Form 12 Extension Why You Should Not Go To Form 12 Extension AH

Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following the close of the tax year) to request an extension. And for the tax returns such as 1120, 1041 and others. The due dates of the returns can be found in the instructions for. Web date to file.

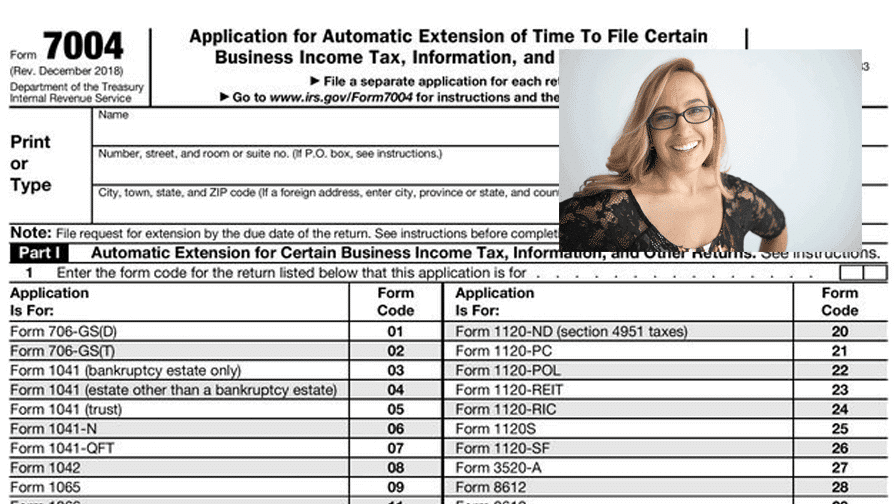

Form 7004 S Corporation Tax Extensions Bette Hochberger, CPA, CGMA

Web date to file form 7004. For most businesses, this falls. And for the tax returns such as 1120, 1041. Ad get ready for tax season deadlines by completing any required tax forms today. Web when is form 7004 due?

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

And for the tax returns such as 1120, 1041 and others. Web the form lists the returns that can apply for automatic extensions. The due dates of the returns can be found in the instructions for. Complete irs tax forms online or print government tax documents. The due date to fill out irs form 7004 and submit is generally on.

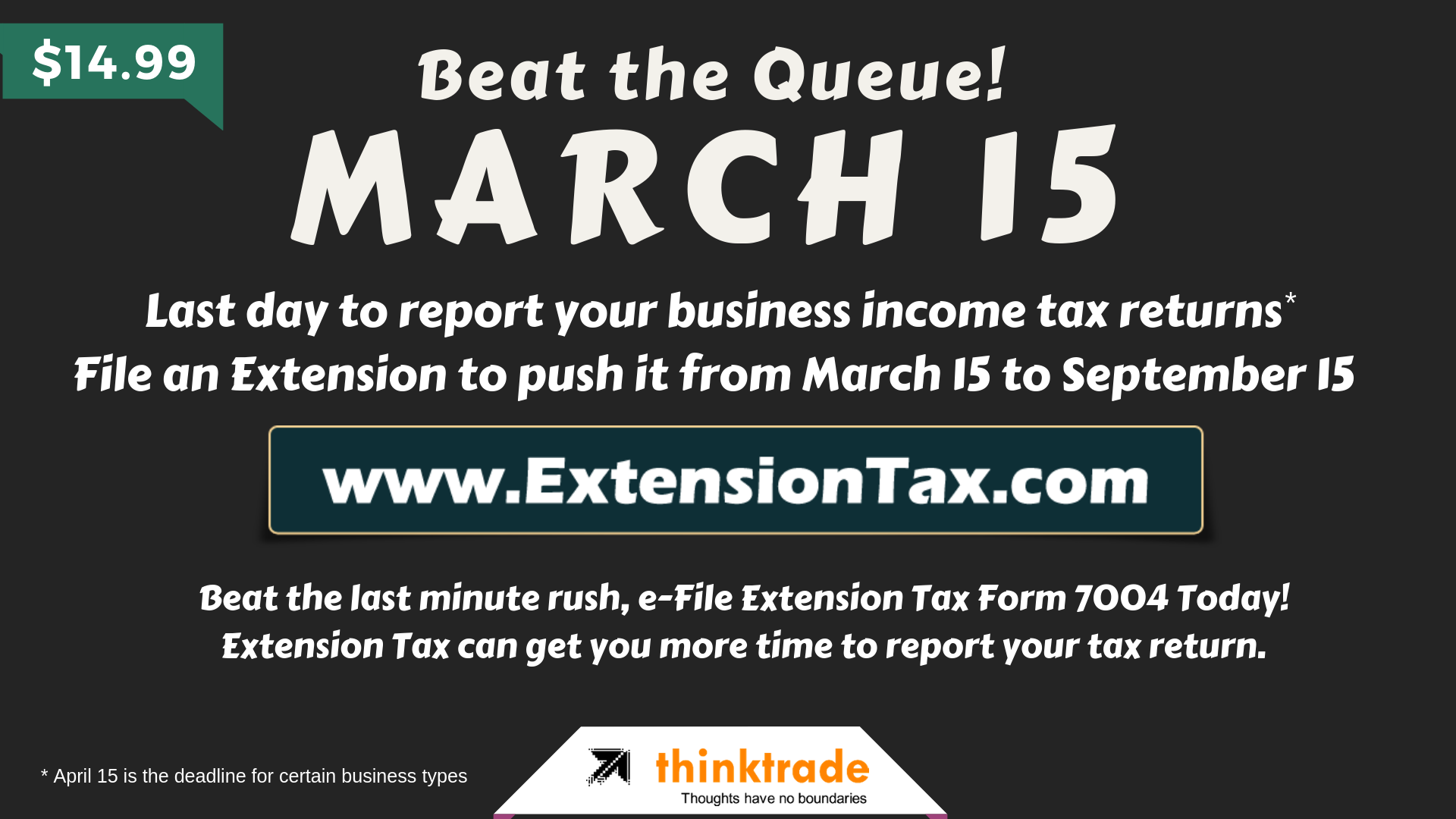

Form 7004 deadline is around the corner, March 15 is the Due Date

The due date to fill out irs form 7004 and submit is generally on or before the original deadline of the applicable tax return. Web when is form 7004 due? In the case of s corporations and partnerships, the tax returns are due by march 15th. Web the entity must file form 7004 by the due date of the return.

Form 7004 Automatically Extend Your 1120 Filing Due date IRSForm7004

Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march 15 and april 15, 2021, to june 15, 2021. As long as the business files their. Web if the year ends on december 31st, taxes must be filed and paid by april 15th. Web date to file form 7004. Web when to.

Irs Form 7004 amulette

When to file forms 8804. Ad get ready for tax season deadlines by completing any required tax forms today. Web the table below shows the deadline for filing form 7004 for business tax returns. Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following the close of the.

When is Tax Extension Form 7004 Due? Tax Extension Online

Web generally, form 7004 must be filed on or before the due date of the applicable tax return. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. In the case of s corporations and partnerships, the tax returns are due by march 15th. The due dates of the.

How to Fill Out Tax Form 7004 tax department of india

The due date to fill out irs form 7004 and submit is generally on or before the original deadline of the applicable tax return. The due dates of the returns can be found in the instructions for. Web if the year ends on december 31st, taxes must be filed and paid by april 15th. Web the form lists the returns.

Where to file Form 7004 Federal Tax TaxUni

Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. To file online go to www.floridarevenue.com if you are required to pay tax with this application, failure to. Web any 7004 form is due by the original due date for the form you’re requesting an extension on. Ad get.

Web Any 7004 Form Is Due By The Original Due Date For The Form You’re Requesting An Extension On.

In the case of s corporations and partnerships, the tax returns are due by march 15th. Web generally, form 7004 must be filed on or before the due date of the applicable tax return. And for the tax returns such as 1120, 1041. Ad get ready for tax season deadlines by completing any required tax forms today.

This Is The Form That Businesses Should File To Apply For An Extension With The Irs.

For all filers, the date that is entered on line 1a cannot be. And for the tax returns such as 1120, 1041 and others. The due dates of the returns can be found in the instructions for. Usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year.

Web Date To File Form 7004.

Complete irs tax forms online or print government tax documents. When to file forms 8804. Web the table below shows the deadline for filing form 7004 for business tax returns. The due date to fill out irs form 7004 and submit is generally on or before the original deadline of the applicable tax return.

Using Our Previous Example, Form 1065 Is Due By March 15Th For Partnerships That.

Web file this application on or before the original due date of the of the tax year. Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march 15 and april 15, 2021, to june 15, 2021. As long as the business files their. Web form 7004 is an irs tax extension form.