Form 7202 Calculator

Form 7202 Calculator - Web up to 10% cash back claiming the credits. Web calculate detailed solution for 7202 expanded form expanded notation form: See other tax credits you may be. It is shown as a sum of each digit multiplied by its matching place value (ones, tens, hundreds, etc.). If you are filing a joint return,. Web to generate and complete form 7202. Web to complete form 7202 in the taxact program: From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen,. The form is obsolete after those years.** note:. Form 7202 is used by self.

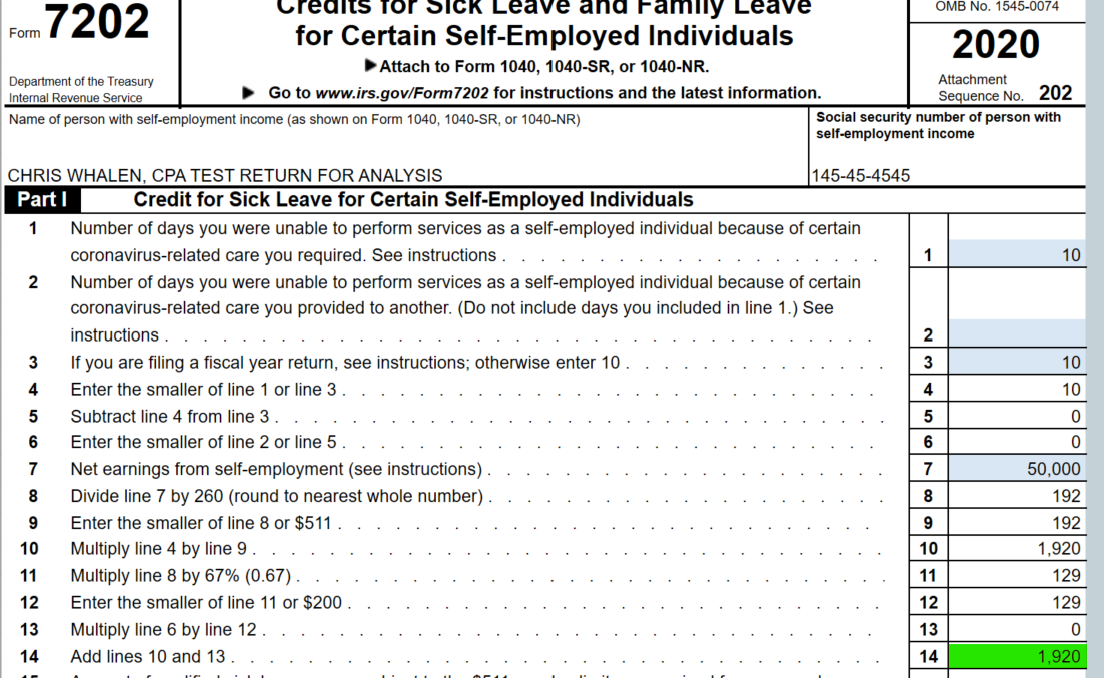

See other tax credits you may be. If you are filing a joint return,. Then, go to screen 38.4. Enter the smaller of line 1 or line 3. Web to generate and complete form 7202. Web recalculate the credit on the form 7202. Web calculate detailed solution for 7202 expanded form expanded notation form: Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Web use a 7202 2020 template to make your document workflow more streamlined. The form is obsolete after those years.** note:.

Then, go to screen 38.4. Web calculate detailed solution for 7202 expanded form expanded notation form: If you make $70,000 a year living in california you will be taxed $11,221. Web to generate and complete form 7202. Your average tax rate is 11.67% and your marginal tax rate is. See other tax credits you may be. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen,. It is shown as a sum of each digit multiplied by its matching place value (ones, tens, hundreds, etc.). Web use a 7202 2020 template to make your document workflow more streamlined. Subtract line 4 from line 3.

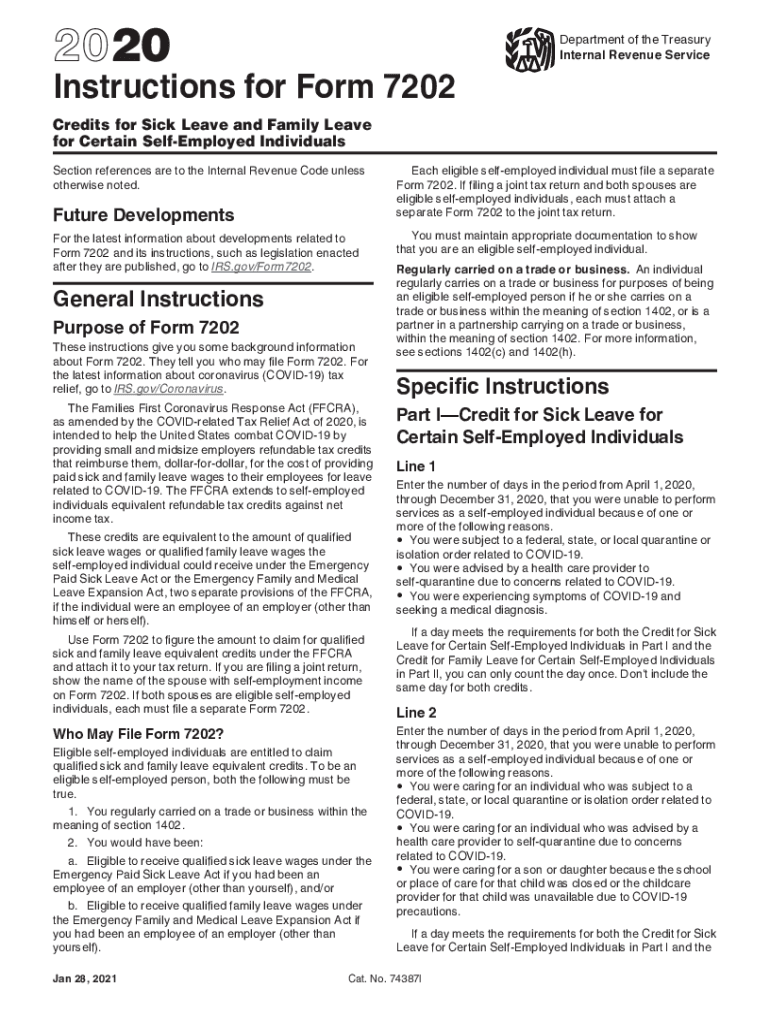

2020 Form IRS Instructions 7202 Fill Online, Printable, Fillable, Blank

Maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. See other tax credits you may be. Then, go to screen 38.4. Web recalculate the credit on the form 7202. Your average tax rate is 11.67% and your marginal tax rate is.

IRS Form 7202 LinebyLine Instructions 2022 Sick Leave and Family

If you are filing a joint return,. Web recalculate the credit on the form 7202. Web calculate detailed solution for 7202 expanded form expanded notation form: If the amount of the qualified leave equivalent credit has changed from the amount claimed on the individual's 2021 form 1040, u.s. It is shown as a sum of each digit multiplied by its.

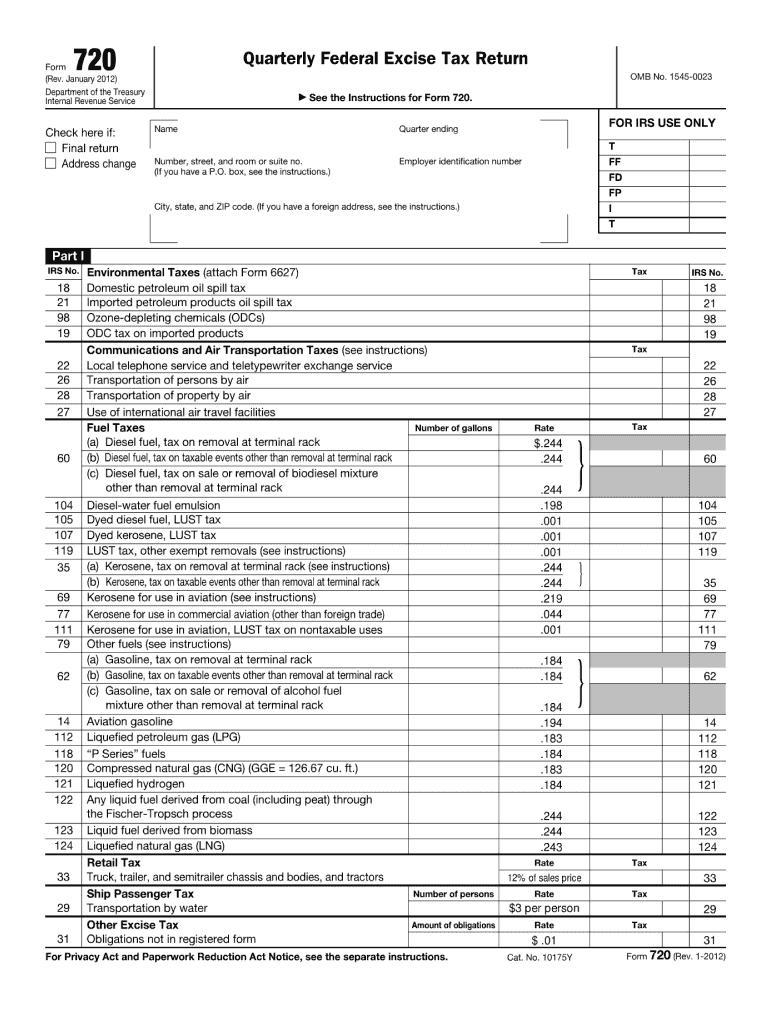

Form 720 Fill Out and Sign Printable PDF Template signNow

The form is obsolete after those years.** note:. It is shown as a sum of each digit multiplied by its matching place value (ones, tens, hundreds, etc.). Web calculate detailed solution for 7202 expanded form expanded notation form: It must be attached to your tax return and mailed to the irs. Web up to 10% cash back claiming the credits.

How to Complete Form 720 Quarterly Federal Excise Tax Return

The form is obsolete after those years.** note:. Web to complete form 7202 in the taxact program: Enter the smaller of line 1 or line 3. Maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. If you make $70,000 a year living in california you will be taxed $11,221.

Printable Fileable IRS Form 7202 Self Employed Sick Leave and Family

Maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. It is shown as a sum of each digit multiplied by its matching place value (ones, tens, hundreds, etc.). Web recalculate the credit on the form 7202. Web to complete form 7202 in the taxact program: If you make $70,000 a year living in california you will.

Memo SelfEmployed People, Don't Miss Your 2020 Coronavirus Tax

Form 7202 is used by self. If you are filing a joint return,. See other tax credits you may be. It must be attached to your tax return and mailed to the irs. If you make $70,000 a year living in california you will be taxed $11,221.

Form 7202 Pdf Fill and Sign Printable Template Online US Legal Forms

Web use a 7202 2020 template to make your document workflow more streamlined. The form is obsolete after those years.** note:. Web recalculate the credit on the form 7202. Form 7202 is used by self. Web to generate and complete form 7202.

Form 7202 Instructions Fill Online, Printable, Fillable, Blank

Subtract line 4 from line 3. Maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. See other tax credits you may be. Form 7202 is used by self. Web recalculate the credit on the form 7202.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

Enter the smaller of line 1 or line 3. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. If you are filing a joint return,. Web to generate and complete form 7202. Your average tax rate is 11.67% and your marginal.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

Form 7202 is used by self. It is shown as a sum of each digit multiplied by its matching place value (ones, tens, hundreds, etc.). Web to complete form 7202 in the taxact program: Enter the smaller of line 1 or line 3. The form is obsolete after those years.** note:.

It Must Be Attached To Your Tax Return And Mailed To The Irs.

If you make $70,000 a year living in california you will be taxed $11,221. Then, go to screen 38.4. Enter the smaller of line 1 or line 3. Web calculate detailed solution for 7202 expanded form expanded notation form:

If The Amount Of The Qualified Leave Equivalent Credit Has Changed From The Amount Claimed On The Individual's 2021 Form 1040, U.s.

Form 7202 is used by self. If you are filing a joint return,. Web use a 7202 2020 template to make your document workflow more streamlined. The form is obsolete after those years.** note:.

It Is Shown As A Sum Of Each Digit Multiplied By Its Matching Place Value (Ones, Tens, Hundreds, Etc.).

See other tax credits you may be. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen,. Web up to 10% cash back claiming the credits. Web to complete form 7202 in the taxact program:

Web To Generate And Complete Form 7202.

Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. Web recalculate the credit on the form 7202. Subtract line 4 from line 3.