Form 7203 Instructions

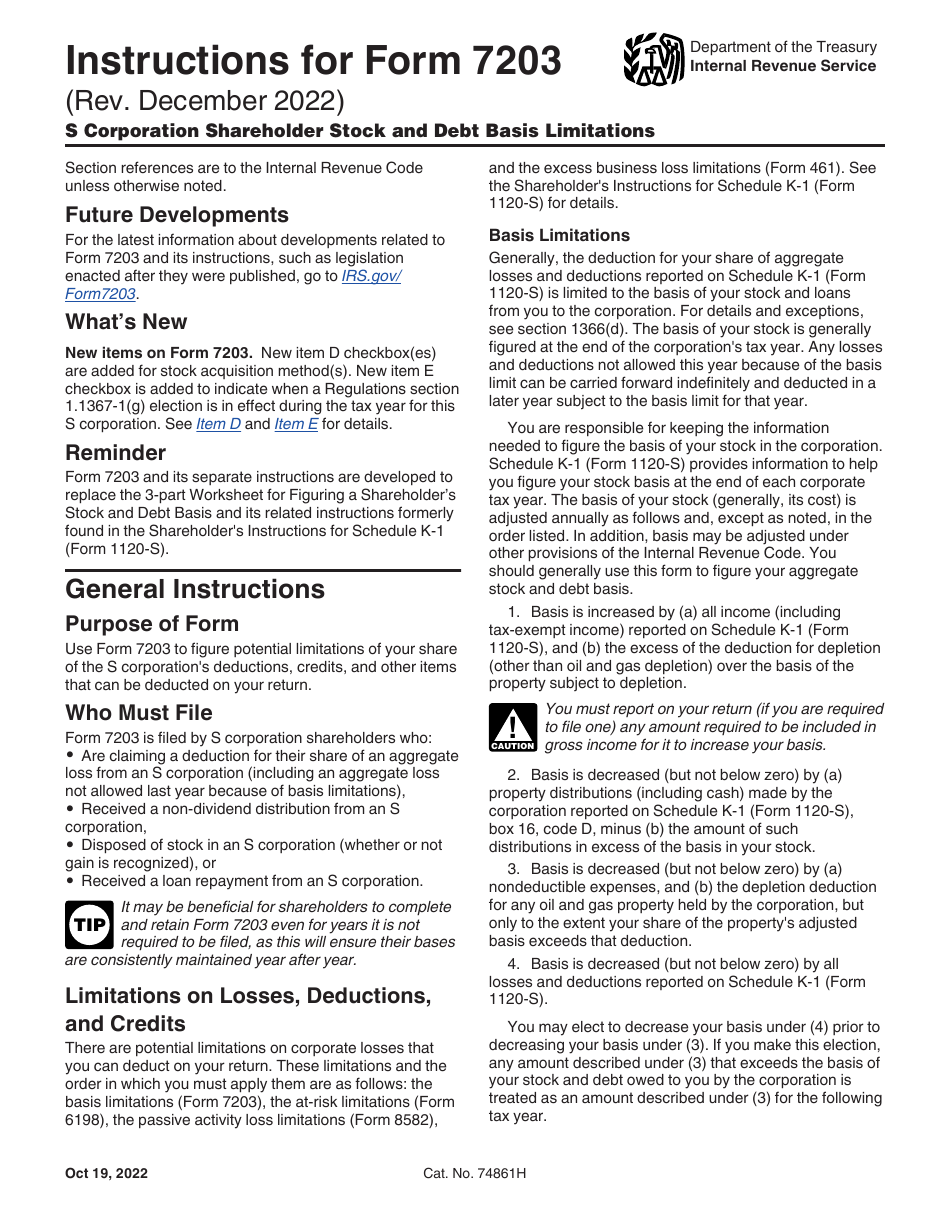

Form 7203 Instructions - Knott 11.4k subscribers join subscribe 17k views 1 year ago #irs #scorporation irs form 7203 was added in 2021 to. And form 461, limitation on business losses. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits,. Web go to www.irs.gov/form7203 for instructions and the latest information. Web general instructions purpose of form. 203 name(s) shown on return identifying number name of s corporation employer identification number stock block (see instructions) part i shareholder stock basis 1 Form 8582, passive activity loss limitations; Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Claims a deduction for their share of an aggregate loss from the s corporation (including an aggregate loss not allowed in a prior year due to a basis limitation); It may be beneficial for shareholders to complete and.

For example, your deductible loss generally can’t be greater than the cost of your investment (stock and loans) in. 203 name(s) shown on return identifying number name of s corporation employer identification number stock block (see instructions) part i shareholder stock basis 1 Go to www.irs.gov/form7203 for instructions and the latest information. And form 461, limitation on business losses. S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns. Knott 11.4k subscribers join subscribe 17k views 1 year ago #irs #scorporation irs form 7203 was added in 2021 to. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web about form 7203, s corporation shareholder stock and debt basis limitations. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits,. Form 8582, passive activity loss limitations;

And form 461, limitation on business losses. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. For example, your deductible loss generally can’t be greater than the cost of your investment (stock and loans) in. Web s corporation shareholders must include form 7203 (instructions can be found here) with their 2021 tax filing when the shareholder: Claims a deduction for their share of an aggregate loss from the s corporation (including an aggregate loss not allowed in a prior year due to a basis limitation); Form 8582, passive activity loss limitations; 203 name(s) shown on return identifying number name of s corporation employer identification number stock block (see instructions) part i shareholder stock basis 1 S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns. Received a loan repayment from an s corporation. It may be beneficial for shareholders to complete and.

IRS Issues New Form 7203 for Farmers and Fishermen

Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits,. Received a loan repayment from an s corporation. And form 461, limitation on business losses. 203 name(s) shown on return identifying number name of s corporation employer identification number stock block (see instructions) part i shareholder stock basis 1 Web s corporation shareholders must.

More Basis Disclosures This Year for S corporation Shareholders Need

Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web general instructions purpose of form. Claims a deduction for their share of an aggregate loss from the s corporation (including an aggregate loss not allowed in a prior year due to a.

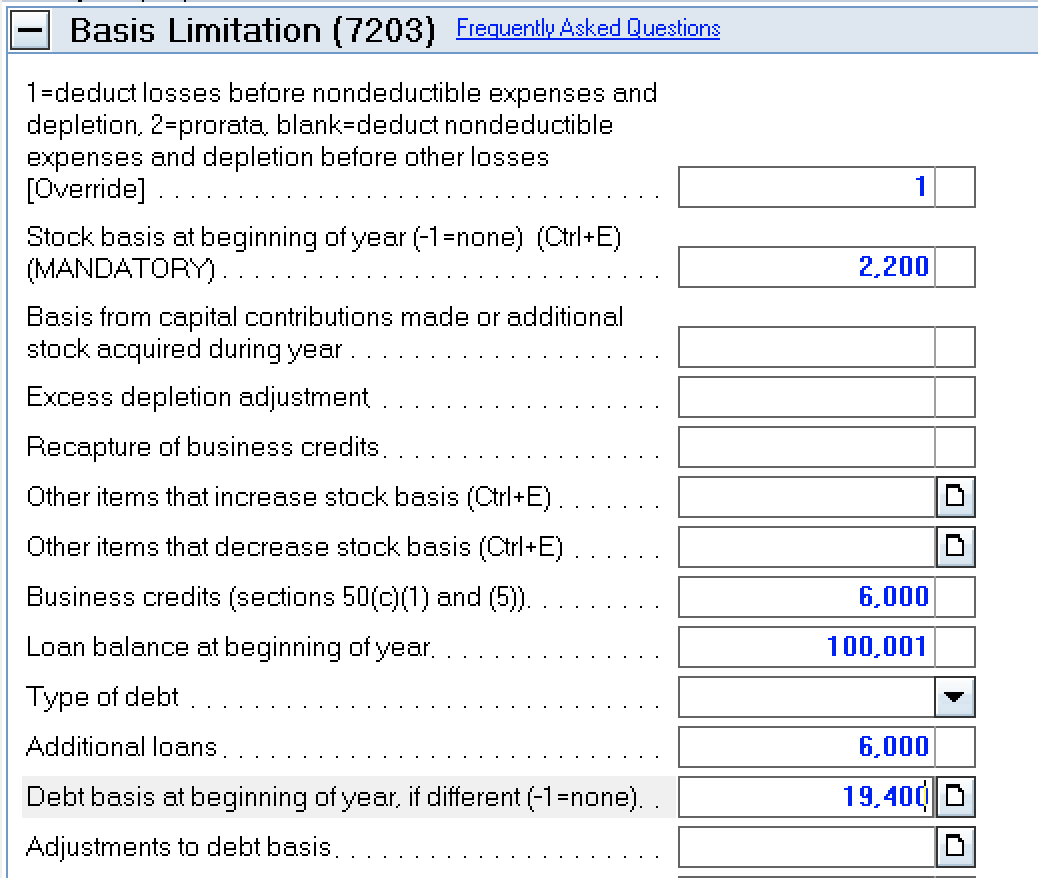

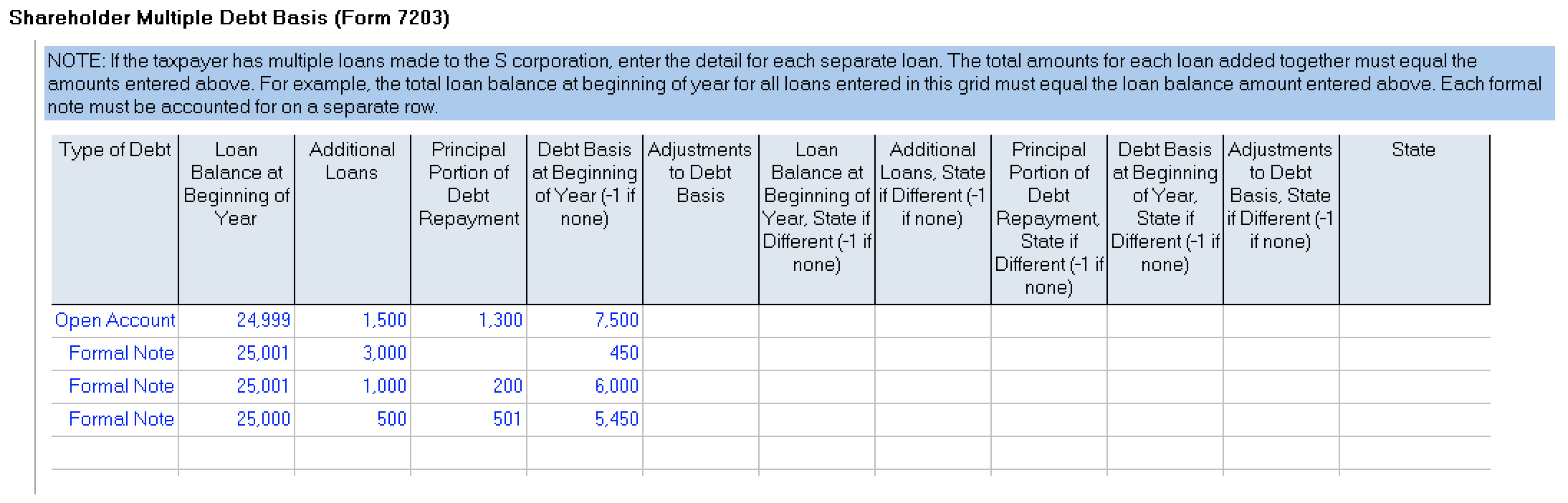

How to complete Form 7203 in Lacerte

203 name(s) shown on return identifying number name of s corporation employer identification number stock block (see instructions) part i shareholder stock basis 1 Go to www.irs.gov/form7203 for instructions and the latest information. Form 8582, passive activity loss limitations; Web go to www.irs.gov/form7203 for instructions and the latest information. Web s corporation shareholders must include form 7203 (instructions can be.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

And form 461, limitation on business losses. Knott 11.4k subscribers join subscribe 17k views 1 year ago #irs #scorporation irs form 7203 was added in 2021 to. 203 name(s) shown on return identifying number name of s corporation employer identification number stock block (see instructions) part i shareholder stock basis 1 For example, your deductible loss generally can’t be greater.

How to complete Form 7203 in Lacerte

It may be beneficial for shareholders to complete and. Web about form 7203, s corporation shareholder stock and debt basis limitations. The new form is required to be filed by an s corporation shareholder to report shareholder basis. Claims a deduction for their share of an aggregate loss from the s corporation (including an aggregate loss not allowed in a.

National Association of Tax Professionals Blog

203 name(s) shown on return identifying number name of s corporation employer identification number stock block (see instructions) part i shareholder stock basis 1 Web general instructions purpose of form. Web go to www.irs.gov/form7203 for instructions and the latest information. Web s corporation shareholders must include form 7203 (instructions can be found here) with their 2021 tax filing when the.

Form7203PartI PBMares

For example, your deductible loss generally can’t be greater than the cost of your investment (stock and loans) in. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Web go to www.irs.gov/form7203 for instructions and the latest information. Go to www.irs.gov/form7203 for instructions and the latest information..

National Association of Tax Professionals Blog

For example, your deductible loss generally can’t be greater than the cost of your investment (stock and loans) in. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Web form 7203 is used to calculate any limits on the deductions you can take for your share of.

Download Instructions for IRS Form 7203 S Corporation Shareholder Stock

Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits,. For example, your deductible loss generally can’t be greater than the cost of your investment (stock and loans) in. Form 8582, passive activity loss limitations; Web about form 7203, s corporation shareholder stock and debt basis limitations. It may be beneficial for shareholders to.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Claims a deduction for their share of an aggregate loss from the s corporation (including an aggregate loss not allowed in a prior year due to a basis limitation); S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns..

Knott 11.4K Subscribers Join Subscribe 17K Views 1 Year Ago #Irs #Scorporation Irs Form 7203 Was Added In 2021 To.

S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Web go to www.irs.gov/form7203 for instructions and the latest information. 203 name(s) shown on return identifying number name of s corporation employer identification number stock block (see instructions) part i shareholder stock basis 1

It May Be Beneficial For Shareholders To Complete And.

For example, your deductible loss generally can’t be greater than the cost of your investment (stock and loans) in. Claims a deduction for their share of an aggregate loss from the s corporation (including an aggregate loss not allowed in a prior year due to a basis limitation); Received a loan repayment from an s corporation. Web about form 7203, s corporation shareholder stock and debt basis limitations.

Web S Corporation Shareholders Must Include Form 7203 (Instructions Can Be Found Here) With Their 2021 Tax Filing When The Shareholder:

Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits,. Form 8582, passive activity loss limitations; Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. And form 461, limitation on business losses.

Web General Instructions Purpose Of Form.

The new form is required to be filed by an s corporation shareholder to report shareholder basis. Go to www.irs.gov/form7203 for instructions and the latest information.