Form 8027 Instructions 2022

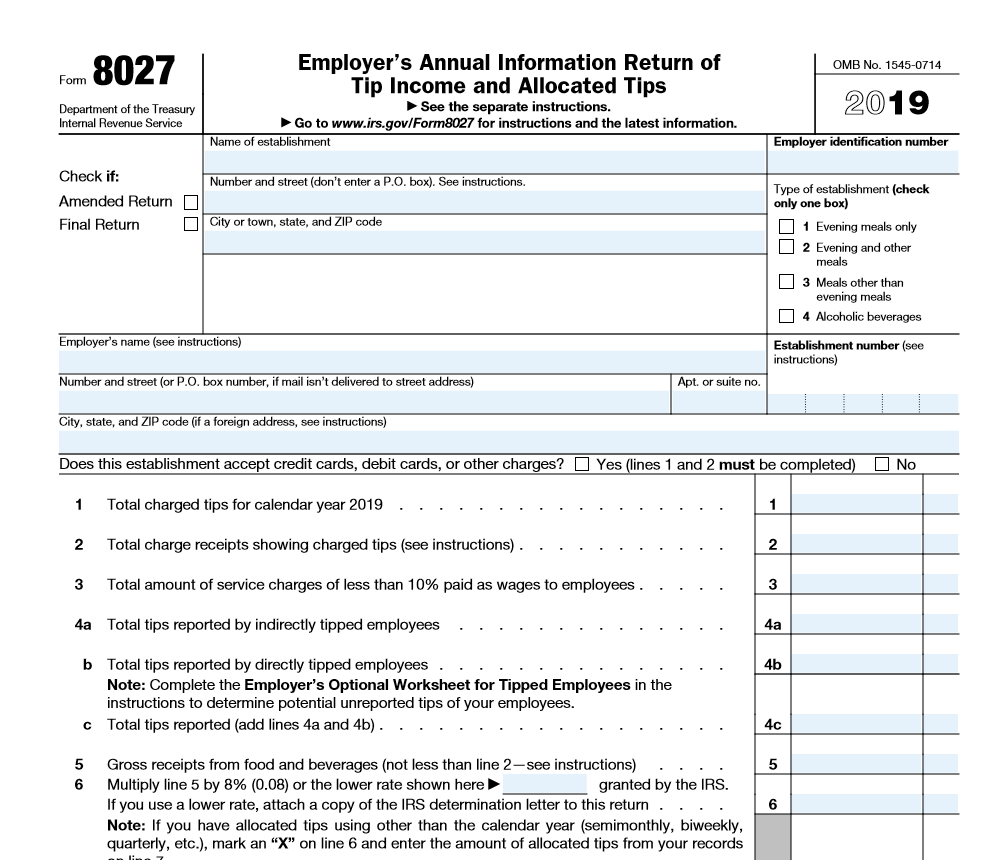

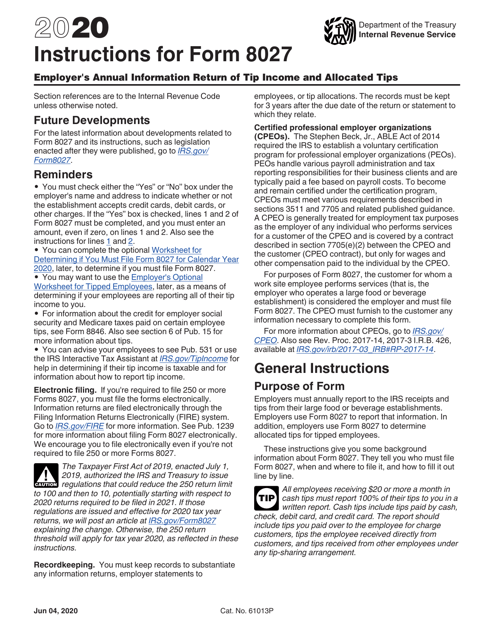

Form 8027 Instructions 2022 - Select the sign tool and create a. Web information about form 8027, employer's annual information return of tip income and allocated tips, including recent updates, related forms, and. Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information return of tip income and allocated tips—to track the. The form did not contain. Web complete every fillable area. Also see the instructions for lines 1 and 2. How to file 8027 instructions for easy reporting 8027 online. You’ll need to input your business’s name, address, and other relevant. October 2021) department of the treasury internal revenue service transmittal of employer’s annual information return of tip income and allocated tips. For the calendar year 2022 or tax year beginning, 2022, and ending, 20omb no.

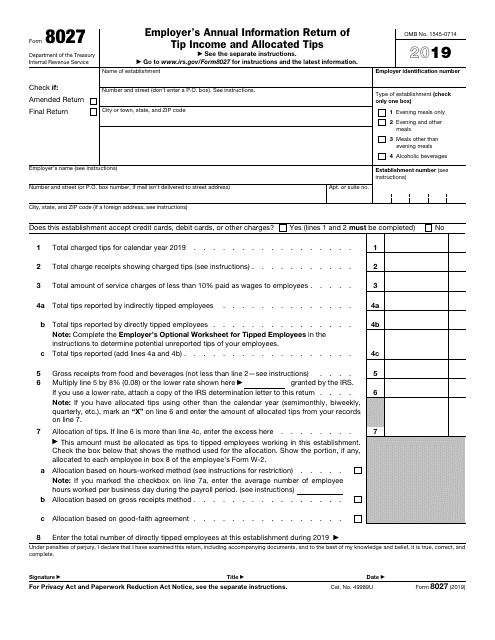

October 2021) department of the treasury internal revenue service transmittal of employer’s annual information return of tip income and allocated tips. Select the sign tool and create a. Employer information the top section of form 8027 is a typical irs form. For the calendar year 2022 or tax year beginning, 2022, and ending, 20omb no. Web the form 8027, employer's annual information report of tip income and allocated tips is an information return that is required by law to be filed annually by certain. Amended return final return name of establishment number and street. Also see the instructions for lines 1 and 2. Web definition form 8027 is an irs document certain food service businesses use to report their employees' tips to the irs each year. •you can complete the optional worksheet. Web do not enter social security numbers on this form (except on schedule a) as it may be made public.

For the calendar year 2022 or tax year beginning, 2022, and ending, 20omb no. You’ll need to input your business’s name, address, and other relevant. Web definition form 8027 is an irs document certain food service businesses use to report their employees' tips to the irs each year. Use a 2020 information return 2022 template to make your document workflow. Web the 2022 version of form 8027, which allows employers to report tips and receipts, was released oct. Also see the instructions for lines 1 and 2. Employer information the top section of form 8027 is a typical irs form. •you can complete the optional worksheet. How to file 8027 instructions for easy reporting 8027 online. Web the form 8027, employer's annual information report of tip income and allocated tips is an information return that is required by law to be filed annually by certain.

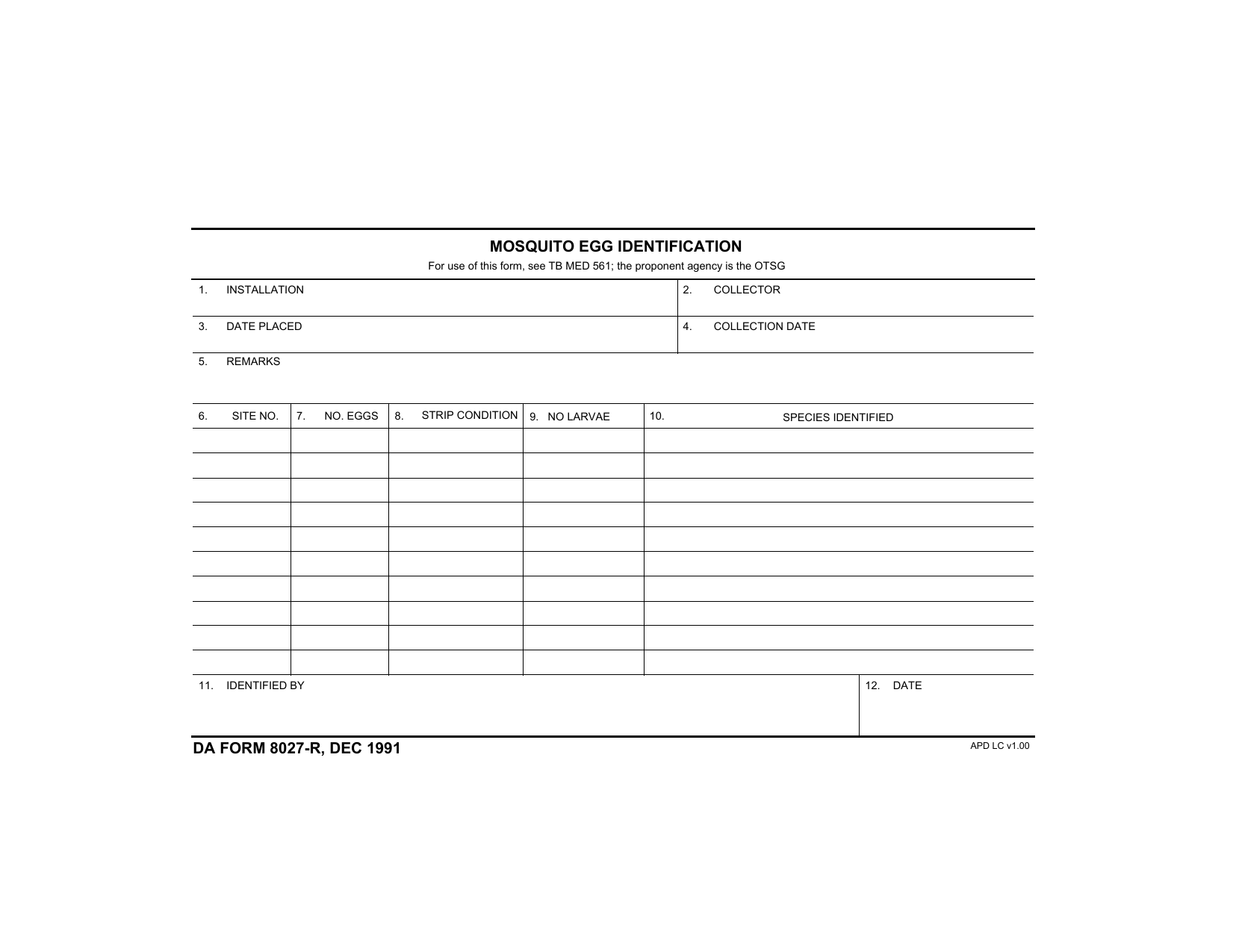

Download DA Form 8027R Mosquito Egg Identification PDF

You’ll need to input your business’s name, address, and other relevant. Include the date to the document with the date tool. The form did not contain. Employer information the top section of form 8027 is a typical irs form. Use a 2020 information return 2022 template to make your document workflow.

Payroll Forms Employers Need

October 2021) department of the treasury internal revenue service transmittal of employer’s annual information return of tip income and allocated tips. •you can complete the optional worksheet. Web complete every fillable area. You’ll need to input your business’s name, address, and other relevant. Use a 2020 information return 2022 template to make your document workflow.

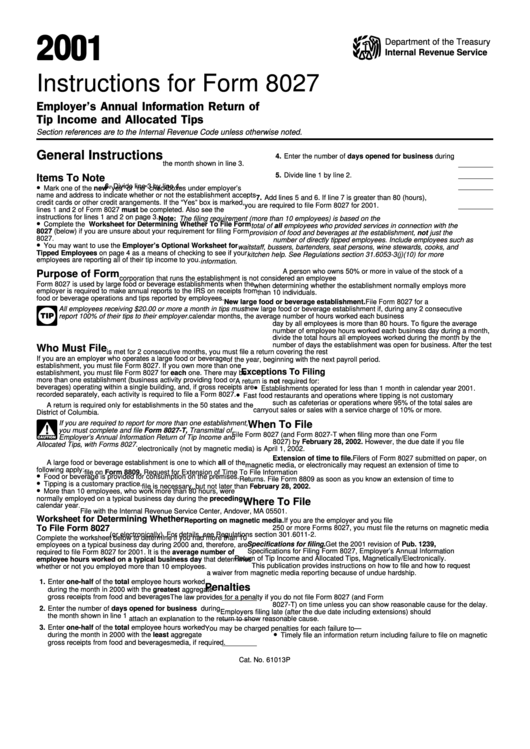

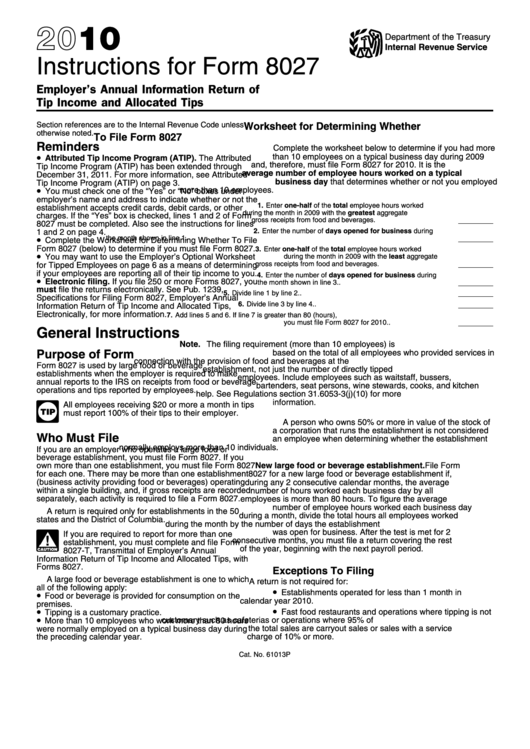

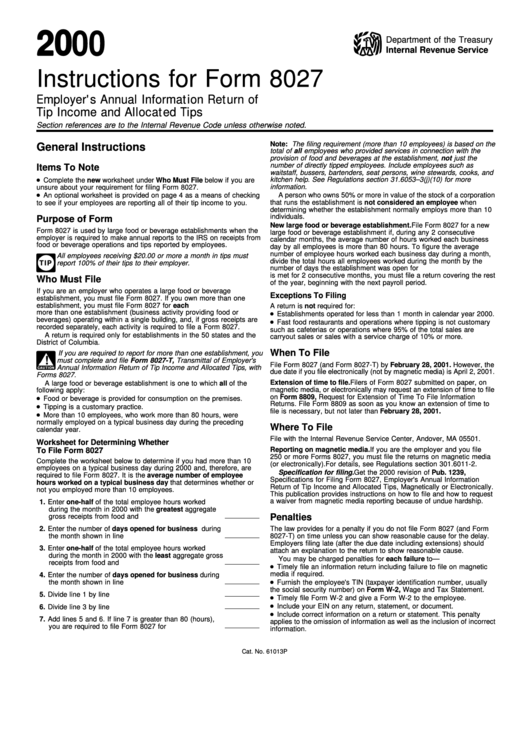

Instructions For Form 8027 printable pdf download

Be sure the data you fill in irs 8027 is updated and accurate. Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information return of tip income and allocated tips—to track the. October 2021) department of the treasury internal revenue service transmittal of employer’s annual information return of tip income and allocated tips. •you can.

Form 8027 Employer's Annual Information Return of Tip and

Also see the instructions for lines 1 and 2. Web the 2022 version of form 8027, which allows employers to report tips and receipts, was released oct. You’ll need to input your business’s name, address, and other relevant. 27 by the internal revenue service. Employer information the top section of form 8027 is a typical irs form.

Form 8027 Your Guide to Reporting Tip FreshBooks Blog

Web do not enter social security numbers on this form (except on schedule a) as it may be made public. Web definition form 8027 is an irs document certain food service businesses use to report their employees' tips to the irs each year. Use a 2020 information return 2022 template to make your document workflow. You’ll need to input your.

Instructions For Form 8027 printable pdf download

27 by the internal revenue service. The form did not contain. Web do not enter social security numbers on this form (except on schedule a) as it may be made public. For the calendar year 2022 or tax year beginning, 2022, and ending, 20omb no. Web the 2022 version of form 8027, which allows employers to report tips and receipts,.

Instructions For Form 8027 printable pdf download

Web go to www.irs.gov/form8027 for instructions and the latest information. Web form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2. The form did not contain. Use a 2020 information return 2022 template to make your document workflow. Web the form 8027, employer's annual information report of tip income and allocated.

IRS Form 8027 Download Fillable PDF or Fill Online Employer's Annual

The form did not contain. Web do not enter social security numbers on this form (except on schedule a) as it may be made public. Be sure the data you fill in irs 8027 is updated and accurate. You’ll need to input your business’s name, address, and other relevant. Web the 2022 version of form 8027, which allows employers to.

Form 8027 Worksheet

•you can complete the optional worksheet. Employer information the top section of form 8027 is a typical irs form. Be sure the data you fill in irs 8027 is updated and accurate. Web the form 8027, employer's annual information report of tip income and allocated tips is an information return that is required by law to be filed annually by.

Download Instructions for IRS Form 8027 Employer's Annual Information

27 by the internal revenue service. Web information about form 8027, employer's annual information return of tip income and allocated tips, including recent updates, related forms, and. You’ll need to input your business’s name, address, and other relevant. Web do not enter social security numbers on this form (except on schedule a) as it may be made public. For the.

You’ll Need To Input Your Business’s Name, Address, And Other Relevant.

Be sure the data you fill in irs 8027 is updated and accurate. Include the date to the document with the date tool. Web the 2022 version of form 8027, which allows employers to report tips and receipts, was released oct. Web form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2.

Web We Last Updated The Employer's Annual Information Return Of Tip Income And Allocated Tips In December 2022, So This Is The Latest Version Of Form 8027, Fully Updated For Tax Year.

27 by the internal revenue service. Select the sign tool and create a. Web definition form 8027 is an irs document certain food service businesses use to report their employees' tips to the irs each year. For the calendar year 2022 or tax year beginning, 2022, and ending, 20omb no.

Web The Internal Revenue Service (Irs) Uses Form 8027 —Also Known As Employer’s Annual Information Return Of Tip Income And Allocated Tips—To Track The.

Web do not enter social security numbers on this form (except on schedule a) as it may be made public. Web go to www.irs.gov/form8027 for instructions and the latest information. How to file 8027 instructions for easy reporting 8027 online. Web complete every fillable area.

The Form Did Not Contain.

•you can complete the optional worksheet. Employer information the top section of form 8027 is a typical irs form. Also see the instructions for lines 1 and 2. Web information about form 8027, employer's annual information return of tip income and allocated tips, including recent updates, related forms, and.