Form 8275 Example

Form 8275 Example - Web if form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Do not use this form to disclose items or positions that are. For example, when a taxpayer states that she is excluding a payment under section 104(a)(2), it might be sufficient to disclose in a footnote on a tax return. Web hence, if an allocation between deductible and nondeductible investment interest expense is needed, then form 8275 is required unless there is substantial. Web as provided by the irs: Any substantial or gross valuation misstatement (including. Taxpayers and tax return preparers use. Web for those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose items or positions that are not otherwise. This revenue procedure can be found on the internet at. If you are disclosing a position taken contrary to a regulation, use form 8275.

Web instructions for form 8275 internal revenue service (rev. Web information about form 8275, disclosure statement, including recent updates, related forms, and instructions on how to file. Any substantial or gross valuation misstatement (including. Web if form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Web hence, if an allocation between deductible and nondeductible investment interest expense is needed, then form 8275 is required unless there is substantial. Web as provided by the irs: Any substantial understatement of income tax on a tax shelter item. You do not have to file form 8275 for items that meet the requirements listed in this revenue procedure. Name of foreign entity employer identification number, if any reference id number. For example, when a taxpayer states that she is excluding a payment under section 104(a)(2), it might be sufficient to disclose in a footnote on a tax return.

This revenue procedure can be found on the internet at. For example, when a taxpayer states that she is excluding a payment under section 104(a)(2), it might be sufficient to disclose in a footnote on a tax return. Web information about form 8275, disclosure statement, including recent updates, related forms, and instructions on how to file. Web form 8275 was basically designed for that purpose. Web hence, if an allocation between deductible and nondeductible investment interest expense is needed, then form 8275 is required unless there is substantial. Web if form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Name of foreign entity employer identification number, if any reference id number. Web as provided by the irs: August 2013) department of the treasury internal revenue service. Web for those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose items or positions that are not otherwise.

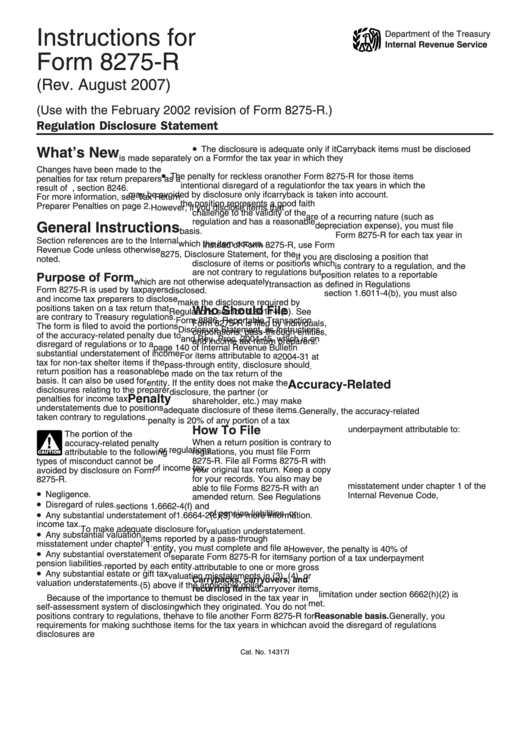

Instructions For Form 8275R Regulation Disclosure Statement 2007

February 2006) (use with the may 2001 revision of form 8275.) disclosure statement general instructions. Name of foreign entity employer identification number, if any reference id number. Do not use this form to disclose items or positions that are. Web going back to our deduction example, a disclosure on form 8275 generally would be adequate if it identifies the item.

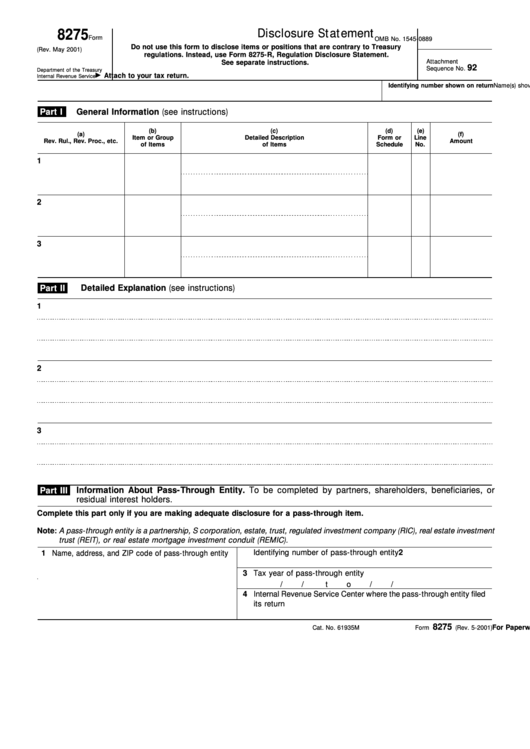

Fillable Form 8275 Disclosure Statement printable pdf download

Name of foreign entity employer identification number, if any reference id number. Web if form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: February 2006) (use with the may 2001 revision of form 8275.) disclosure statement general instructions. Web hence, if an allocation between deductible and nondeductible investment interest expense is needed, then.

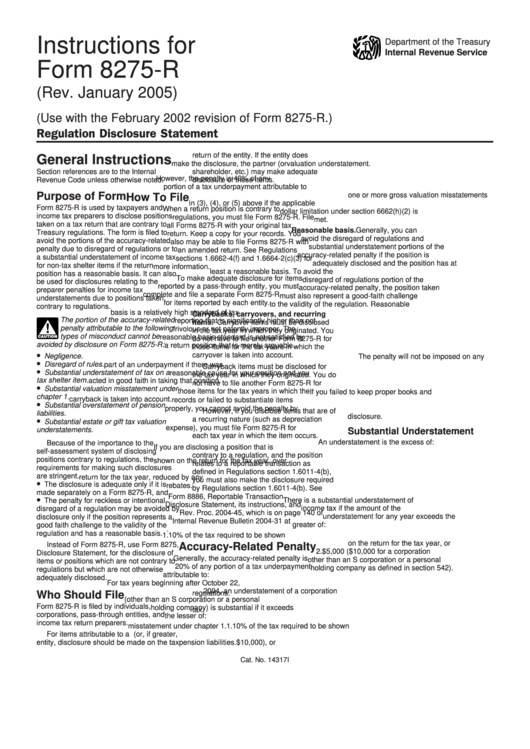

Form 8275R Regulation Disclosure Statement (2013) Free Download

Web hence, if an allocation between deductible and nondeductible investment interest expense is needed, then form 8275 is required unless there is substantial. Web instructions for form 8275 internal revenue service (rev. Web form 8275 was basically designed for that purpose. Any substantial or gross valuation misstatement (including. Taxpayers and tax return preparers use.

Fill Free fillable Regulation Disclosure Statement Form 8275R August

Quoting the instructions, “form 8275 is used by taxpayers and tax return preparers to disclose items or positions,. If you are disclosing a position taken contrary to a regulation, use form 8275. Web for those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose items or positions that are not.

Instructions For Form 8275R Regulation Disclosure Statement

August 2013) department of the treasury internal revenue service. You do not have to file form 8275 for items that meet the requirements listed in this revenue procedure. Any substantial or gross valuation misstatement (including. Any substantial understatement of income tax on a tax shelter item. Web form 8275 is used by taxpayers and tax return preparers to disclose items.

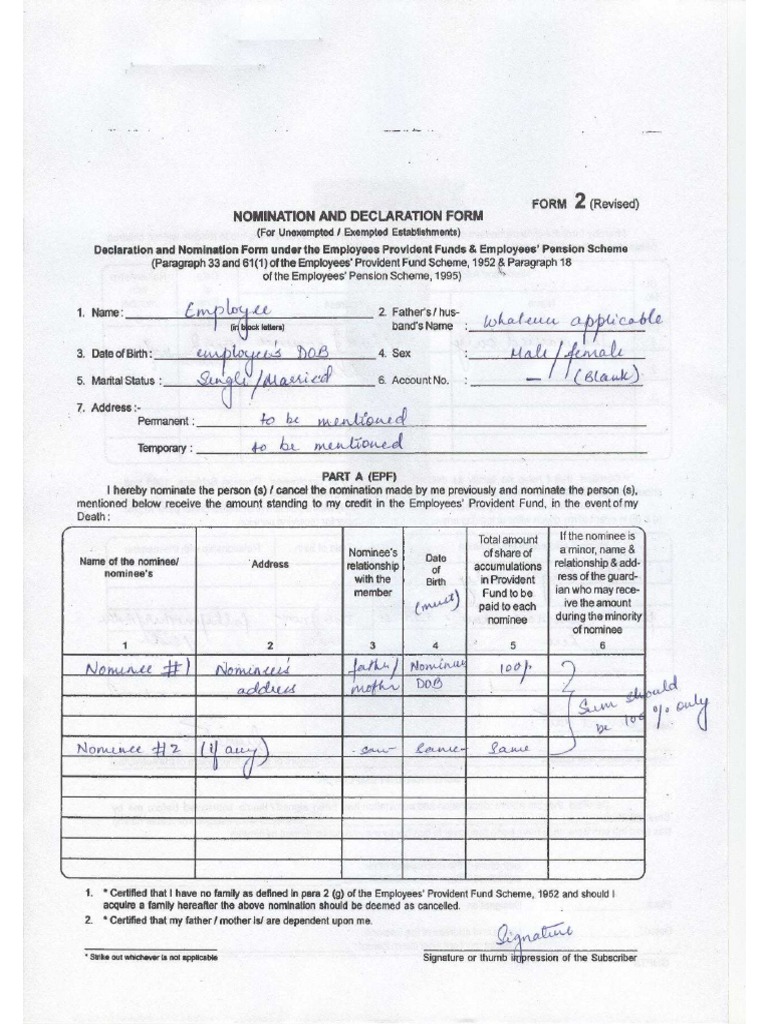

Sample Form 2 PDF

August 2013) department of the treasury internal revenue service. You do not have to file form 8275 for items that meet the requirements listed in this revenue procedure. Any substantial understatement of income tax on a tax shelter item. Web for those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to.

Instructions For Form 8275 Disclosure Statement Department Of The

February 2006) (use with the may 2001 revision of form 8275.) disclosure statement general instructions. Web information about form 8275, disclosure statement, including recent updates, related forms, and instructions on how to file. Web form 8275 was basically designed for that purpose. Web going back to our deduction example, a disclosure on form 8275 generally would be adequate if it.

Wesley Snipes In Bizarre Tax Scheme The Smoking Gun

Any substantial understatement of income tax on a tax shelter item. August 2013) department of the treasury internal revenue service. If you are disclosing a position taken contrary to a regulation, use form 8275. Web form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are not.

Form 8275 Disclosure Statement (2013) Free Download

For example, when a taxpayer states that she is excluding a payment under section 104(a)(2), it might be sufficient to disclose in a footnote on a tax return. Taxpayers and tax return preparers use. Web hence, if an allocation between deductible and nondeductible investment interest expense is needed, then form 8275 is required unless there is substantial. Any substantial understatement.

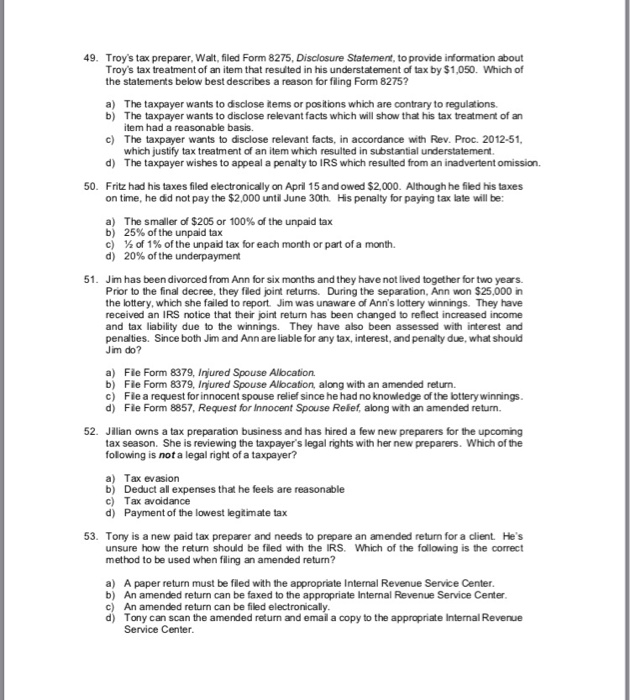

Solved 49. Troy's tax preparer, Walt, filed Form 8275,

Web going back to our deduction example, a disclosure on form 8275 generally would be adequate if it identifies the item being deducted, the amount of the deduction,. Web instructions for form 8275 internal revenue service (rev. For example, when a taxpayer states that she is excluding a payment under section 104(a)(2), it might be sufficient to disclose in a.

Web Going Back To Our Deduction Example, A Disclosure On Form 8275 Generally Would Be Adequate If It Identifies The Item Being Deducted, The Amount Of The Deduction,.

Quoting the instructions, “form 8275 is used by taxpayers and tax return preparers to disclose items or positions,. Web information about form 8275, disclosure statement, including recent updates, related forms, and instructions on how to file. You do not have to file form 8275 for items that meet the requirements listed in this revenue procedure. This revenue procedure can be found on the internet at.

February 2006) (Use With The May 2001 Revision Of Form 8275.) Disclosure Statement General Instructions.

August 2013) department of the treasury internal revenue service. Web form 8275 was basically designed for that purpose. Taxpayers and tax return preparers use. Any substantial or gross valuation misstatement (including.

Name Of Foreign Entity Employer Identification Number, If Any Reference Id Number.

Do not use this form to disclose items or positions that are. Web instructions for form 8275 internal revenue service (rev. Web as provided by the irs: Web for those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose items or positions that are not otherwise.

Web If Form 8275 Relates To An Information Return For A Foreign Entity (For Example, Form 5471), Enter:

Web hence, if an allocation between deductible and nondeductible investment interest expense is needed, then form 8275 is required unless there is substantial. If you are disclosing a position taken contrary to a regulation, use form 8275. Web form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are not otherwise adequately disclosed. For example, when a taxpayer states that she is excluding a payment under section 104(a)(2), it might be sufficient to disclose in a footnote on a tax return.