Form 8283 Appraisal

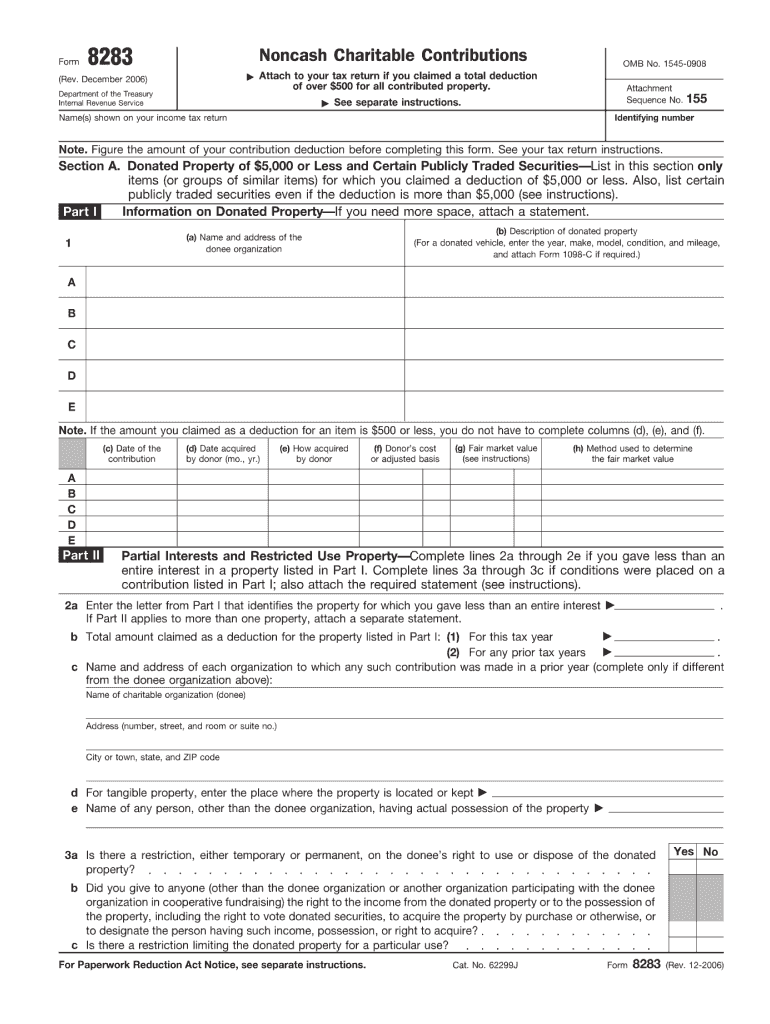

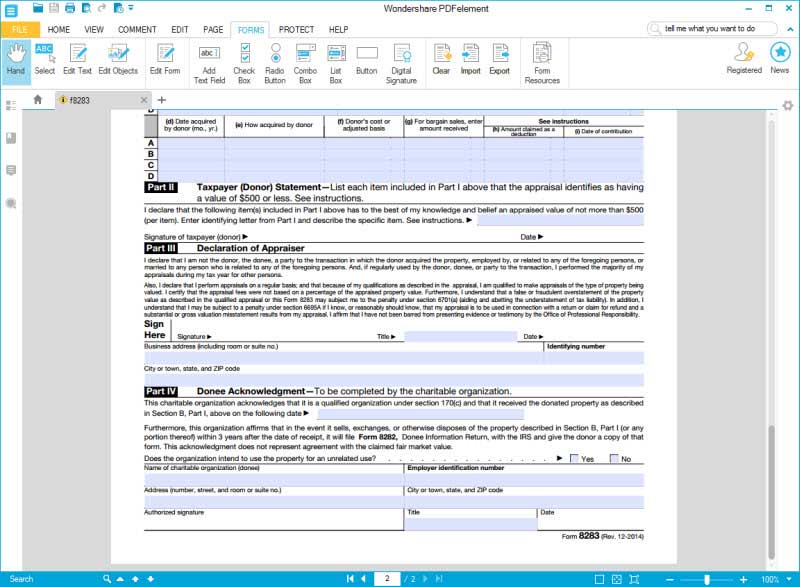

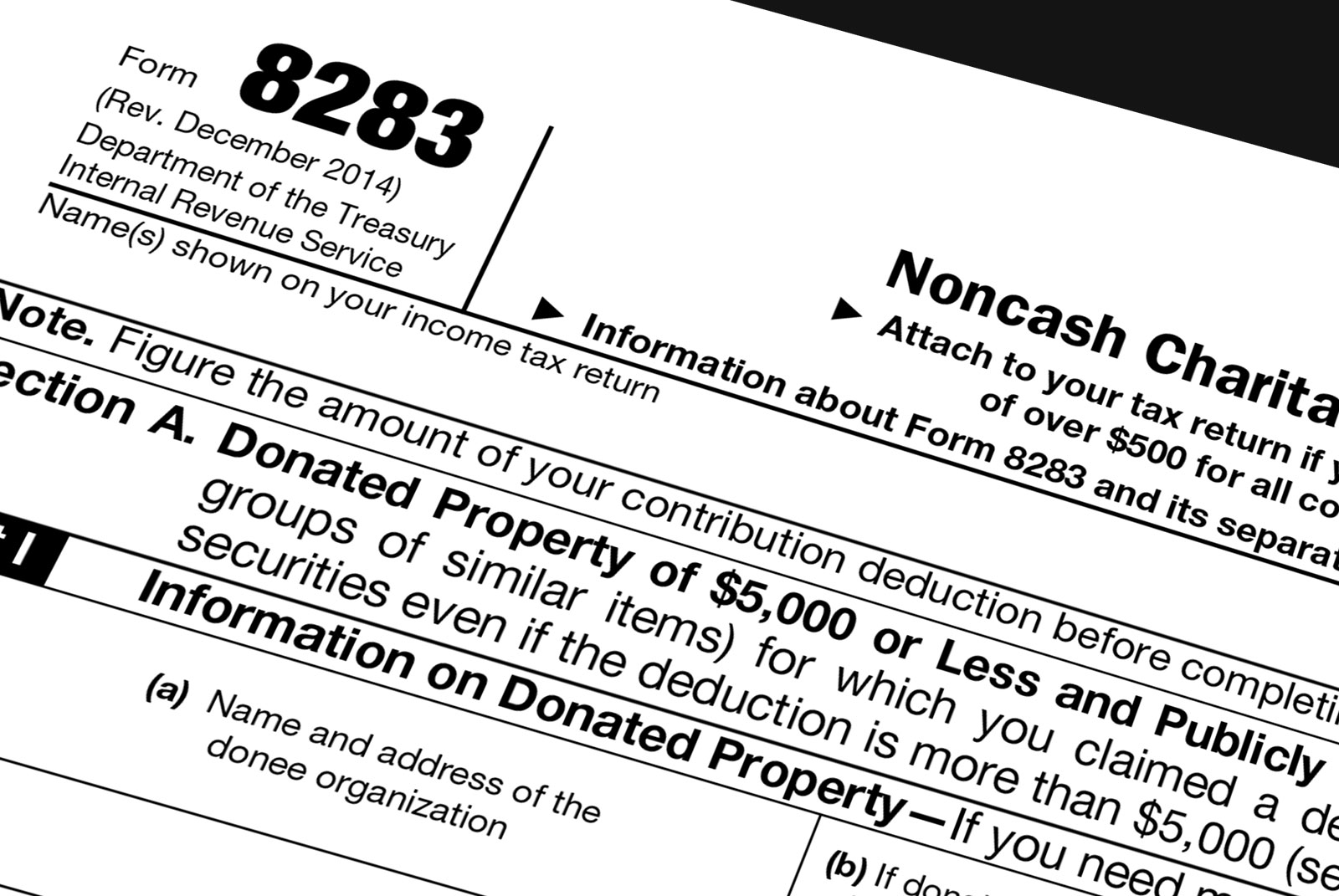

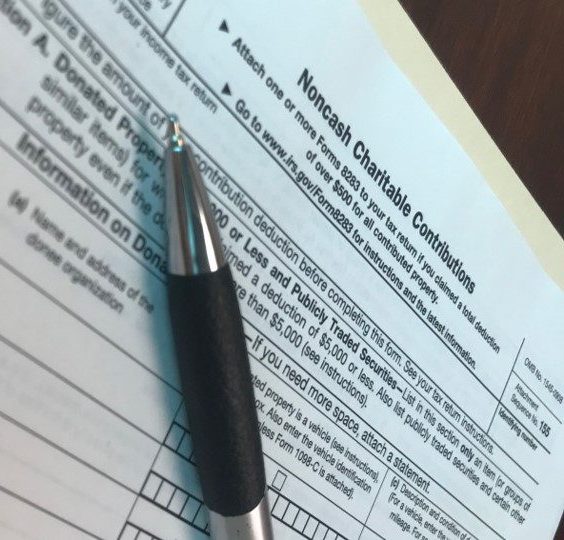

Form 8283 Appraisal - The donee must sign part iv. Web use form 8283 to report information about noncash charitable contributions. See what the nada says your. Web irs tax form 8283 / noncash charitable; While the land trust's signature on form 8283 does not represent agreement with. For noncash donations over $5,000, the donor must attach form 8283 to the tax return to support the charitable deduction. Web form 8283 is used to report noncash donations exceeding $500. Web identification our qualified appraisers will thoroughly research your donation, identify its characteristics, author, or origin, backstory and provenance. Web the appraisal must be done by someone who holds some expertise in the type of property and must be signed and dated no more than 60 days prior to making the. Figure the amount of your contribution deduction before completing this form.

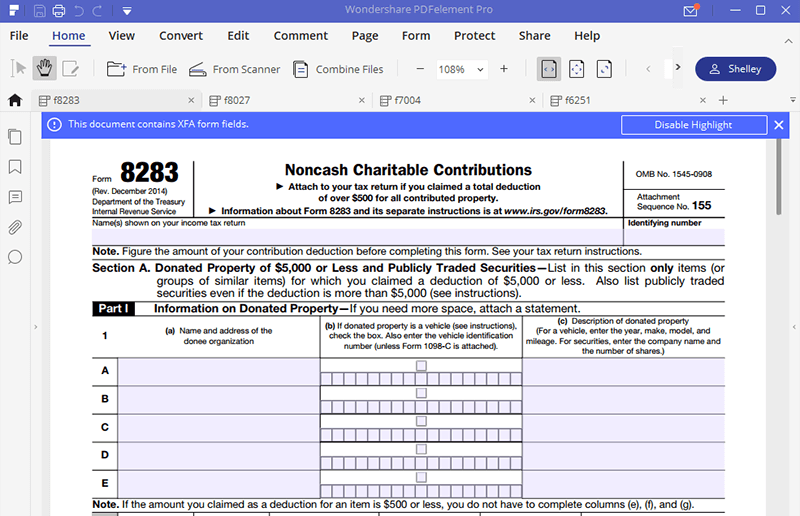

See your tax return instructions. For noncash donations over $5,000, the donor must attach form 8283 to the tax return to support the charitable deduction. Web to complete form 8283 for noncash charitable contributions in the taxslayer pro desktop program, from the main menu of the tax return (form 1040) select: Web irs tax form 8283 / noncash charitable; Figure the amount of your contribution deduction before completing this form. Web form 8283 is filed by individuals, partnerships, and corporations. Web use form 8283 to report information about noncash charitable contributions. The donee must sign part iv. Donated property of $5,000 or less and. Web irs form 8283 is a tax form that reports certain noncash charitable contributions to the irs.

The donee must sign part iv. Web form 8283 is used to report noncash donations exceeding $500. Web form 8283 is filed by individuals, partnerships, and corporations. Figure the amount of your contribution deduction before completing this form. While the land trust's signature on form 8283 does not represent agreement with. If you are claiming a deduction of more than $500,000 for an item (or group of similar items) donated to one or. For noncash donations over $5,000, the donor must attach form 8283 to the tax return to support the charitable deduction. Donated property of $5,000 or less and. Web use form 8283 to report information about noncash charitable contributions. Web irs tax form 8283 / noncash charitable;

Form 8283 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

Donated property of $5,000 or less and. If you are claiming a charitable contribution deduction and have a significant amount of noncash. Web form 8283 is filed by individuals, partnerships, and corporations. For noncash donations over $5,000, the donor must attach form 8283 to the tax return to support the charitable deduction. Web form 8283 is used to report noncash.

Irs Form 8283 Instructions

Web use form 8283 to report information about noncash charitable contributions. For noncash donations over $5,000, the donor must attach form 8283 to the tax return to support the charitable deduction. Web to complete form 8283 for noncash charitable contributions in the taxslayer pro desktop program, from the main menu of the tax return (form 1040) select: If you are.

Irs Form 8283 Instructions

If you are claiming a deduction of more than $500,000 for an item (or group of similar items) donated to one or. Web form 8283 is filed by individuals, partnerships, and corporations. For noncash donations over $5,000, the donor must attach form 8283 to the tax return to support the charitable deduction. Web irs tax form 8283 / noncash charitable;.

What Is a W9 Tax Form? LoveToKnow

While the land trust's signature on form 8283 does not represent agreement with. Web irs form 8283 is a tax form that reports certain noncash charitable contributions to the irs. Web identification our qualified appraisers will thoroughly research your donation, identify its characteristics, author, or origin, backstory and provenance. Bonded title appraisals / surety bonds; Web form 8283 is used.

Failure to File Form 8283 — 5 Drawbacks Appraisily

Web use form 8283 to report information about noncash charitable contributions. See your tax return instructions. Figure the amount of your contribution deduction before completing this form. Web the appraisal must be done by someone who holds some expertise in the type of property and must be signed and dated no more than 60 days prior to making the. Web.

IRS Form 8283 Sharpe Group blog

Web form 8283 is used to report noncash donations exceeding $500. Web the appraisal must be done by someone who holds some expertise in the type of property and must be signed and dated no more than 60 days prior to making the. While the land trust's signature on form 8283 does not represent agreement with. Web to complete form.

Download IRS Form 8283 for Free TidyTemplates

Figure the amount of your contribution deduction before completing this form. Web use form 8283 to report information about noncash charitable contributions. Web form 8283 is filed by individuals, partnerships, and corporations. The donee must sign part iv. Bonded title appraisals / surety bonds;

IRS Form 8283 Noncash Charitable Contributions

If you are claiming a charitable contribution deduction and have a significant amount of noncash. Web identification our qualified appraisers will thoroughly research your donation, identify its characteristics, author, or origin, backstory and provenance. Web form 8283 is used to report noncash donations exceeding $500. Web the appraisal must be done by someone who holds some expertise in the type.

Best Online Art Appraisal Service We value Artworks Appraisily

See what the nada says your. The donee must sign part iv. Bonded title appraisals / surety bonds; If you are claiming a deduction of more than $500,000 for an item (or group of similar items) donated to one or. Figure the amount of your contribution deduction before completing this form.

Form 8283 YouTube

The donee must sign part iv. Web irs form 8283 is a tax form that reports certain noncash charitable contributions to the irs. Donated property of $5,000 or less and. Web form 8283 is used to report noncash donations exceeding $500. Web the appraisal must be done by someone who holds some expertise in the type of property and must.

Donated Property Of $5,000 Or Less And.

The donee must sign part iv. Web form 8283 is filed by individuals, partnerships, and corporations. Web irs form 8283 is a tax form that reports certain noncash charitable contributions to the irs. Web the appraisal must be done by someone who holds some expertise in the type of property and must be signed and dated no more than 60 days prior to making the.

Web To Complete Form 8283 For Noncash Charitable Contributions In The Taxslayer Pro Desktop Program, From The Main Menu Of The Tax Return (Form 1040) Select:

Web form 8283 is used to report noncash donations exceeding $500. Figure the amount of your contribution deduction before completing this form. If you are claiming a deduction of more than $500,000 for an item (or group of similar items) donated to one or. Web irs tax form 8283 / noncash charitable;

See Your Tax Return Instructions.

While the land trust's signature on form 8283 does not represent agreement with. Web identification our qualified appraisers will thoroughly research your donation, identify its characteristics, author, or origin, backstory and provenance. Web use form 8283 to report information about noncash charitable contributions. For noncash donations over $5,000, the donor must attach form 8283 to the tax return to support the charitable deduction.

Bonded Title Appraisals / Surety Bonds;

See what the nada says your. If you are claiming a charitable contribution deduction and have a significant amount of noncash.