Form 8288 B Instructions

Form 8288 B Instructions - Web in 98 or 99 out of 100 instances , the withholding tax amount of 15% or 10% of the sales price will exceed (and maybe greatly exceed) the actual federal income tax. Realproperty interest, and a corporation,qualified investment entity, or fiduciarythat is required to withhold tax, must fileform 8288 to report. Web buyer or other transferee of a u.s. Web don’t be fooled; The second step is to determine the form,. As noted at the bottom of the slide, a tin is required for the buyer or transferee and the seller or transferor. The irs will normally act on an application by the 90th day after a complete application. Web the general instructions have been subdivided into three major sections: Format journal, periodical online resource Web we last updated the application for withholding certificate for dispositions by foreign persons of u.s.

Web developments related to form 8288 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8288. Web buyer or other transferee of a u.s. The irs will normally act on an application by the 90th day after a complete application. The second step is to determine the form,. Withholding tax return for dispositions by foreign persons of u.s. Real property interests in february 2023, so this is the latest version of. Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your document. Web part 1 the first step is to determine your tax status. Realproperty interest, and a corporation,qualified investment entity, or fiduciarythat is required to withhold tax, must fileform 8288 to report. If you are operating as a joint corporation in us then you need to.

Real property interests in february 2023, so this is the latest version of. The form is simple, but the trick is in the attachments. Web in 98 or 99 out of 100 instances , the withholding tax amount of 15% or 10% of the sales price will exceed (and maybe greatly exceed) the actual federal income tax. The foreign owner can be a. These instructions are generally to be. Withholding tax return for dispositions by foreign persons of u.s. Withholding tax return for dispositions by foreign persons of u.s. Web developments related to form 8288 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8288. The general instructions for section 1445 withholding, b. Realproperty interest, and a corporation,qualified investment entity, or fiduciarythat is required to withhold tax, must fileform 8288 to report.

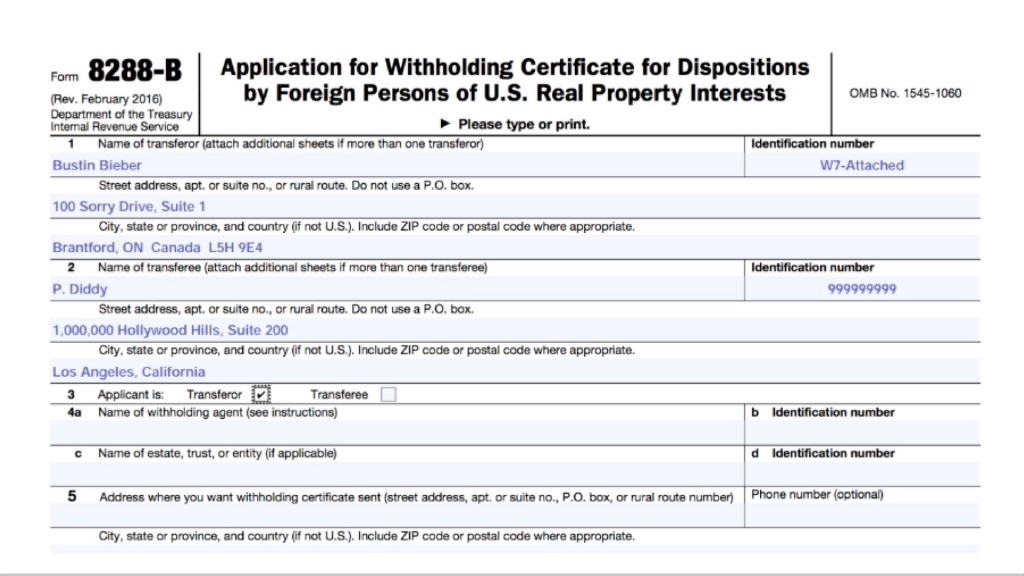

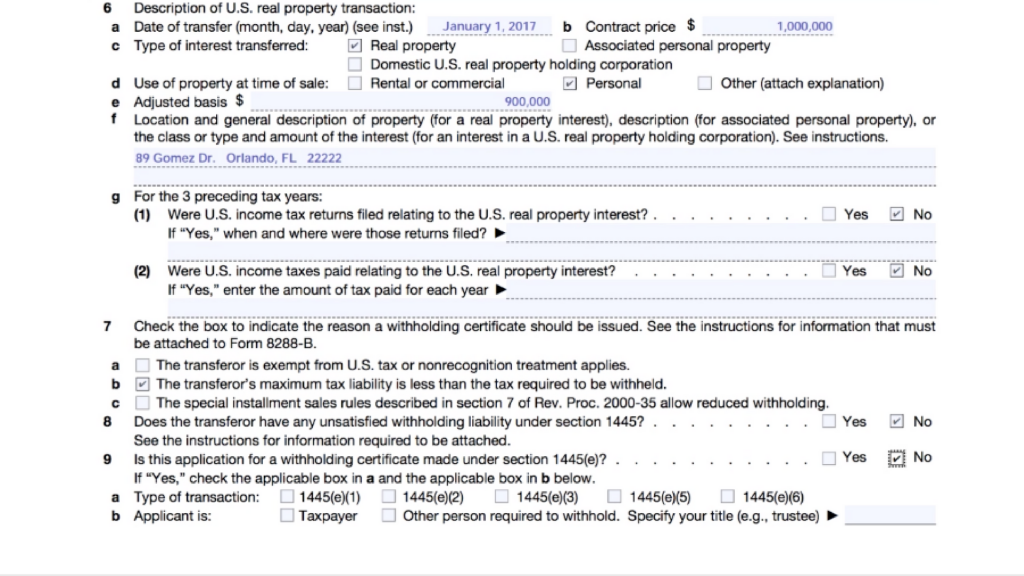

How to Reduce Withholding Taxes on the Sale of U.S. Property Madan CA

Withholding tax return for dispositions by foreign persons of u.s. Web buyer or other transferee of a u.s. Web part 1 the first step is to determine your tax status. Withholding tax return for dispositions by foreign persons of u.s. Web edit form 8288 b.

Irs form 8288 b instructions

Web edit form 8288 b. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in the usa from a foreign owner. If you are operating as a joint corporation in us then you need to. Web instructions for form 8288 u.s. The general.

FIRPTA Lawyers IRS Form 8288B Foreign Investment in Real Property Act

Format journal, periodical online resource Web the general instructions have been subdivided into three major sections: Web buyer or other transferee of a u.s. Web in 98 or 99 out of 100 instances , the withholding tax amount of 15% or 10% of the sales price will exceed (and maybe greatly exceed) the actual federal income tax. The general instructions.

Form 8288B Application for Withholding Certificate for Dispositions

Web developments related to form 8288 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8288. Withholding tax return for dispositions by foreign persons of u.s. Withholding tax return for dispositions by foreign persons of u.s. Real property interests in february 2023, so this is the latest version of. Web instructions for form 8288 u.s.

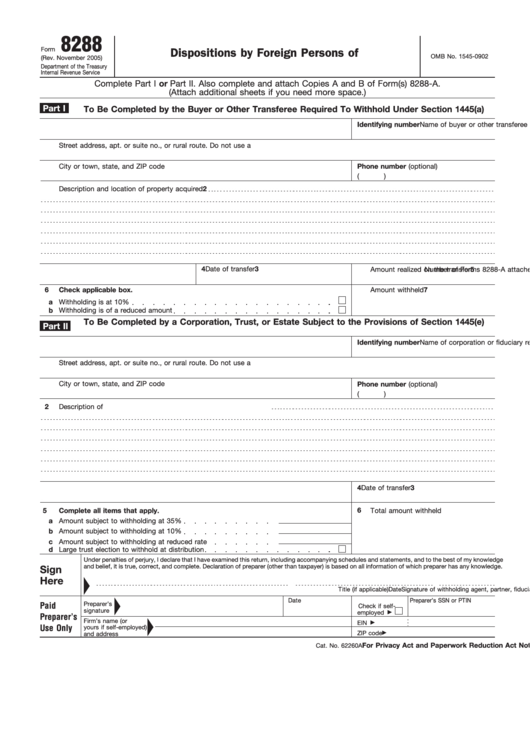

Fillable Form 8288 U.s. Withholding Tax Return For Dispositions By

The general instructions for section 1445 withholding, b. Web the general instructions have been subdivided into three major sections: Real property interests to met your witholding, payment, notice 2018. Web buyer or other transferee of a u.s. The form is simple, but the trick is in the attachments.

How to Reduce Withholding Taxes on the Sale of U.S. Property Madan CA

Withholding tax return for dispositions by foreign persons of u.s. Web part 1 the first step is to determine your tax status. If you are operating as a joint corporation in us then you need to. Web the general instructions have been subdivided into three major sections: Web we last updated the application for withholding certificate for dispositions by foreign.

form 1120 schedule b instructions 2017 Fill Online, Printable

Web developments related to form 8288 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8288. Web we last updated the application for withholding certificate for dispositions by foreign persons of u.s. If you are operating as a joint corporation in us then you need to. The second step is to determine the form,. Web don’t.

Irs form 8288 b instructions

Withholding tax return for dispositions by foreign persons of u.s. Web buyer or other transferee of a u.s. Web developments related to form 8288 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8288. Web edit form 8288 b. Format journal, periodical online resource

Form 8288B Where to File?

Web don’t be fooled; Web instructions for form 8288 u.s. Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your document. If you are operating as a joint corporation in us then you need to. Real property interests to met your witholding, payment, notice 2018.

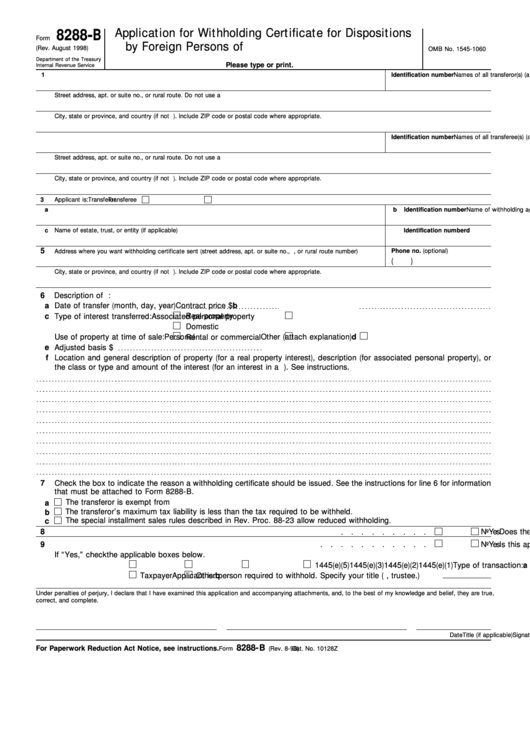

Fillable Form 8288B (Rev. August 1998) Application For Withholding

Withholding tax return for dispositions by foreign persons of u.s. Web developments related to form 8288 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8288. Web in 98 or 99 out of 100 instances , the withholding tax amount of 15% or 10% of the sales price will exceed (and maybe greatly exceed) the actual.

Realproperty Interest, And A Corporation,Qualified Investment Entity, Or Fiduciarythat Is Required To Withhold Tax, Must Fileform 8288 To Report.

Web don’t be fooled; Real property interests in february 2023, so this is the latest version of. The second step is to determine the form,. The foreign owner can be a.

Web Instructions For Form 8288 U.s.

The form is simple, but the trick is in the attachments. These instructions are generally to be. Web the general instructions have been subdivided into three major sections: Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your document.

Web We Last Updated The Application For Withholding Certificate For Dispositions By Foreign Persons Of U.s.

Web edit form 8288 b. As noted at the bottom of the slide, a tin is required for the buyer or transferee and the seller or transferor. If you are operating as a joint corporation in us then you need to. Web developments related to form 8288 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8288.

The General Instructions For Section.

Real property interests to met your witholding, payment, notice 2018. Withholding tax return for dispositions by foreign persons of u.s. The irs will normally act on an application by the 90th day after a complete application. Withholding tax return for dispositions by foreign persons of u.s.